Blank Loan Agreement Form

When individuals or businesses seek financial assistance, a Loan Agreement form becomes an essential tool in outlining the terms of the loan. This document serves as a written contract between the lender and the borrower, detailing critical aspects such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of both parties, ensuring that everyone is on the same page regarding expectations. Key elements often included in the form are the duration of the loan, late payment penalties, and provisions for default, which help protect the lender's interests while also providing clarity to the borrower. By clearly defining these terms, the Loan Agreement form fosters transparency and trust, making it a vital component of the borrowing process. Understanding its structure and contents can empower borrowers to make informed decisions and navigate their financial commitments with confidence.

State-specific Guidelines for Loan Agreement Forms

Loan Agreement Document Categories

Other Templates:

Eviction Papers - It serves as a first step in the eviction process when necessary.

When selling a mobile home, it's crucial to have the right documentation in place. A well-prepared mobile home bill of sale is vital for ensuring a smooth transaction. For detailed guidance on this process, refer to our informative resource about the Ohio mobile home bill of sale requirements.

Family Law Financial Affidavit Short Form Florida - Filling out this form is a practical step for managing marital finances.

Similar forms

-

Promissory Note: This document outlines the borrower's promise to repay a specified amount of money to the lender. Similar to a Loan Agreement, it includes terms such as the loan amount, interest rate, and repayment schedule.

- Articles of Incorporation: Essential for establishing a corporation in New York, this form lays out important details about the business. To get started, fill out the Articles of Incorporation form accurately.

-

Mortgage Agreement: A Mortgage Agreement secures a loan with the property being purchased. Like a Loan Agreement, it details the terms of the loan and the responsibilities of both the borrower and lender.

-

Credit Agreement: This document governs the terms of a credit facility, similar to a Loan Agreement. It specifies the amount of credit, interest rates, and repayment terms, making it essential for both parties.

-

Lease Agreement: A Lease Agreement outlines the terms under which one party rents property from another. While it primarily focuses on rental terms, it shares similarities with a Loan Agreement in that both documents establish obligations and expectations between parties.

-

Secured Loan Agreement: This type of agreement involves a loan backed by collateral. Like a standard Loan Agreement, it details the loan amount, interest rate, and repayment terms, while also specifying the collateral involved.

Document Example

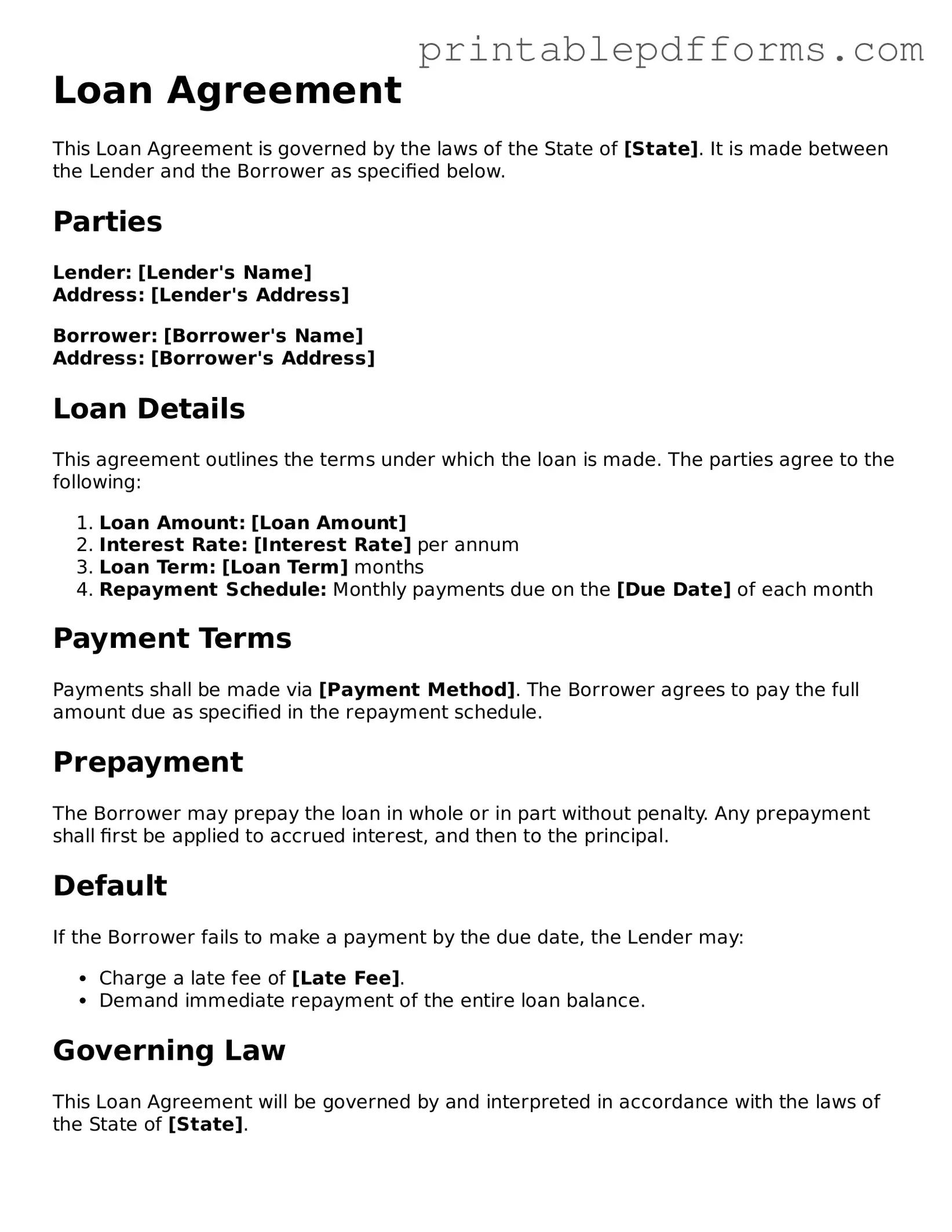

Loan Agreement

This Loan Agreement is governed by the laws of the State of [State]. It is made between the Lender and the Borrower as specified below.

Parties

Lender: [Lender's Name]

Address: [Lender's Address]

Borrower: [Borrower's Name]

Address: [Borrower's Address]

Loan Details

This agreement outlines the terms under which the loan is made. The parties agree to the following:

- Loan Amount: [Loan Amount]

- Interest Rate: [Interest Rate] per annum

- Loan Term: [Loan Term] months

- Repayment Schedule: Monthly payments due on the [Due Date] of each month

Payment Terms

Payments shall be made via [Payment Method]. The Borrower agrees to pay the full amount due as specified in the repayment schedule.

Prepayment

The Borrower may prepay the loan in whole or in part without penalty. Any prepayment shall first be applied to accrued interest, and then to the principal.

Default

If the Borrower fails to make a payment by the due date, the Lender may:

- Charge a late fee of [Late Fee].

- Demand immediate repayment of the entire loan balance.

Governing Law

This Loan Agreement will be governed by and interpreted in accordance with the laws of the State of [State].

Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Lender's Signature: ______________________ Date: _______________

Borrower's Signature: ______________________ Date: _______________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | The governing law varies by state; for example, California law applies to agreements made in California. |

| Key Components | Essential components include the loan amount, interest rate, repayment schedule, and default terms. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Crucial Questions on This Form

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to receive funds from a lender. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly stating their rights and obligations.

Who needs to sign the Loan Agreement?

Both the borrower and the lender must sign the Loan Agreement. If the borrower is an individual, that person will sign. If the borrower is a business entity, an authorized representative of the business will need to sign on behalf of the organization. Additionally, witnesses may be required in some cases to validate the agreement.

What information is typically included in a Loan Agreement form?

A Loan Agreement form generally includes the following key information:

- Names and addresses of both the borrower and lender.

- The principal amount of the loan.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates and payment amounts.

- Any collateral that secures the loan.

- Default terms and conditions, outlining what happens if the borrower fails to repay.

How is the interest rate determined?

The interest rate can vary based on several factors, including the borrower’s creditworthiness, the lender’s policies, and current market conditions. Lenders may offer fixed or variable rates, and it is essential for borrowers to understand how these rates will affect their total repayment amount over time.

What happens if the borrower cannot repay the loan?

If the borrower fails to make payments as outlined in the Loan Agreement, the lender may take several actions. These can include charging late fees, reporting the delinquency to credit bureaus, or initiating legal proceedings to recover the owed amount. In cases where collateral is involved, the lender may also have the right to seize the collateral to cover the unpaid debt.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified, but both parties must agree to any changes. It is advisable to document any amendments in writing and have both parties sign the revised agreement. This ensures that all modifications are legally binding and clear to both the borrower and lender.

Is it necessary to have a lawyer review the Loan Agreement?

While it is not mandatory to have a lawyer review a Loan Agreement, it is often a wise decision. A legal professional can help ensure that the terms are fair and that the document complies with applicable laws. This can provide peace of mind and help prevent potential disputes in the future.

Documents used along the form

When entering into a loan agreement, several other documents often accompany it to ensure clarity and legal protection for all parties involved. These documents serve various purposes, from outlining the terms of the loan to providing necessary disclosures and guarantees. Below is a list of common forms and documents that may be used alongside a Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, and repayment schedule.

- Loan Disclosure Statement: This statement provides essential information about the loan, including terms, fees, and the total cost of borrowing, ensuring transparency for the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral and the lender's rights in case of default.

- Personal Guarantee: A personal guarantee may be required from the borrower or a third party, ensuring that the lender can pursue personal assets if the loan is not repaid.

- Credit Application: This document collects information about the borrower's financial history and creditworthiness, helping the lender assess risk.

- Amortization Schedule: This schedule breaks down each payment into principal and interest, showing how the loan balance will decrease over time.

- Quitclaim Deed: This document is essential for transferring ownership and protecting the interests of parties involved; it can be accessed at All Ohio Forms.

- Loan Closing Statement: At the closing of the loan, this statement summarizes all financial transactions, fees, and adjustments made during the loan process.

Understanding these documents can significantly impact the borrowing experience. Each serves a unique purpose, ensuring that both the lender and borrower are well-informed and protected throughout the loan process.

Misconceptions

Understanding a Loan Agreement can be challenging, and several misconceptions often arise. Here are ten common misunderstandings about Loan Agreements that need clarification:

-

All Loan Agreements are the same.

This is not true. Loan Agreements can vary significantly based on the lender, the type of loan, and the specific terms negotiated between the borrower and lender.

-

Signing a Loan Agreement means you will automatically receive the funds.

Not necessarily. Signing the agreement is just one step in the process. The lender may still need to complete additional checks or processes before disbursing the funds.

-

You can change the terms of the agreement anytime.

Once signed, the terms of a Loan Agreement are legally binding. Any changes typically require the consent of both parties and may need to be documented in writing.

-

Loan Agreements are only for large amounts.

This is a misconception. Loan Agreements can be used for both small and large loans, depending on the needs of the borrower.

-

All Loan Agreements come with the same interest rates.

Interest rates can differ widely based on factors such as the lender's policies, the borrower's credit history, and market conditions.

-

Only banks can issue Loan Agreements.

Many financial institutions, including credit unions and online lenders, can issue Loan Agreements.

-

Once you default, there’s no way to recover.

While defaulting on a loan can have serious consequences, there may be options for negotiation or restructuring with the lender.

-

You don’t need to read the Loan Agreement.

This is a dangerous assumption. It’s crucial to read and understand all terms and conditions before signing to avoid unexpected surprises.

-

Loan Agreements are only for personal loans.

Loan Agreements can also apply to business loans, mortgages, and other types of financing.

-

Once the loan is paid off, the agreement is irrelevant.

Even after repayment, the agreement may still hold legal significance, especially if there were any disputes or issues during the loan term.

Being aware of these misconceptions can help borrowers navigate the lending process more effectively and make informed decisions.