Fill a Valid Louisiana act of donation Form

The Louisiana Act of Donation form is an essential legal document that facilitates the transfer of ownership of property from one person to another without any exchange of money. This form is particularly significant in Louisiana, where community property laws and specific regulations govern property rights. It outlines the details of the donation, including the names of the donor and the recipient, a clear description of the property being donated, and any conditions or restrictions that may apply. The form also requires the signatures of both parties, ensuring that the donation is made voluntarily and with full consent. Additionally, it may need to be notarized to provide further validation, especially if the property in question includes real estate. Understanding the components and requirements of the Act of Donation form is crucial for anyone looking to make a gift of property in Louisiana, as it helps to ensure that the transaction is legally binding and protects the interests of both the donor and the recipient.

Additional PDF Templates

Geico Supplement Request Form - Ensure all sections are filled out completely for faster processing.

The ST-12B Georgia form is a crucial resource for individuals and businesses aiming to reclaim overpaid sales tax. By completing this Purchaser’s Claim for Sales Tax Refund Affidavit, applicants ensure that all pertinent details regarding the purchaser, dealer, and transaction are meticulously documented. To avoid any confusion and streamline the refund process, it is vital to provide accurate information. For further guidance on how to properly fill out the form, visit georgiapdf.com/st-12b-georgia and get started on your refund request.

Ca Marriage Certificate - In some states, there is a waiting period from form submission to certificate issuance.

Notice of Intent to Lien Letter Sample - Utilized to promote amicable resolution of payment disputes before filing a lien.

Similar forms

- Gift Deed: A gift deed is a legal document that transfers ownership of property from one person to another without any exchange of money. Similar to the Louisiana act of donation form, it requires the consent of both parties and must be executed in writing to be valid.

Mobile Home Bill of Sale: The Ohio Mobile Home Bill of Sale is essential for documenting the sale of a mobile home, ensuring legal proof of ownership transfer. For more details, refer to All Ohio Forms.

- Last Will and Testament: A last will and testament outlines how a person's assets will be distributed upon their death. Like the act of donation, it involves the transfer of property, although the will takes effect after the individual's passing, while the act of donation is immediate.

- Power of Attorney: A power of attorney allows one person to make decisions on behalf of another. This document can be similar to the act of donation in that it can grant authority to transfer property. However, the act of donation specifically pertains to the gift of property rather than general decision-making.

- Trust Agreement: A trust agreement establishes a trust to manage assets for the benefit of a beneficiary. Similar to the Louisiana act of donation, it involves the transfer of property, but a trust can continue to manage that property over time, while a donation is a one-time transfer.

- Sales Agreement: A sales agreement is a contract between a buyer and seller outlining the terms of a property sale. While a sales agreement involves a financial transaction, it shares similarities with the act of donation in that both documents facilitate the transfer of ownership from one party to another.

Document Example

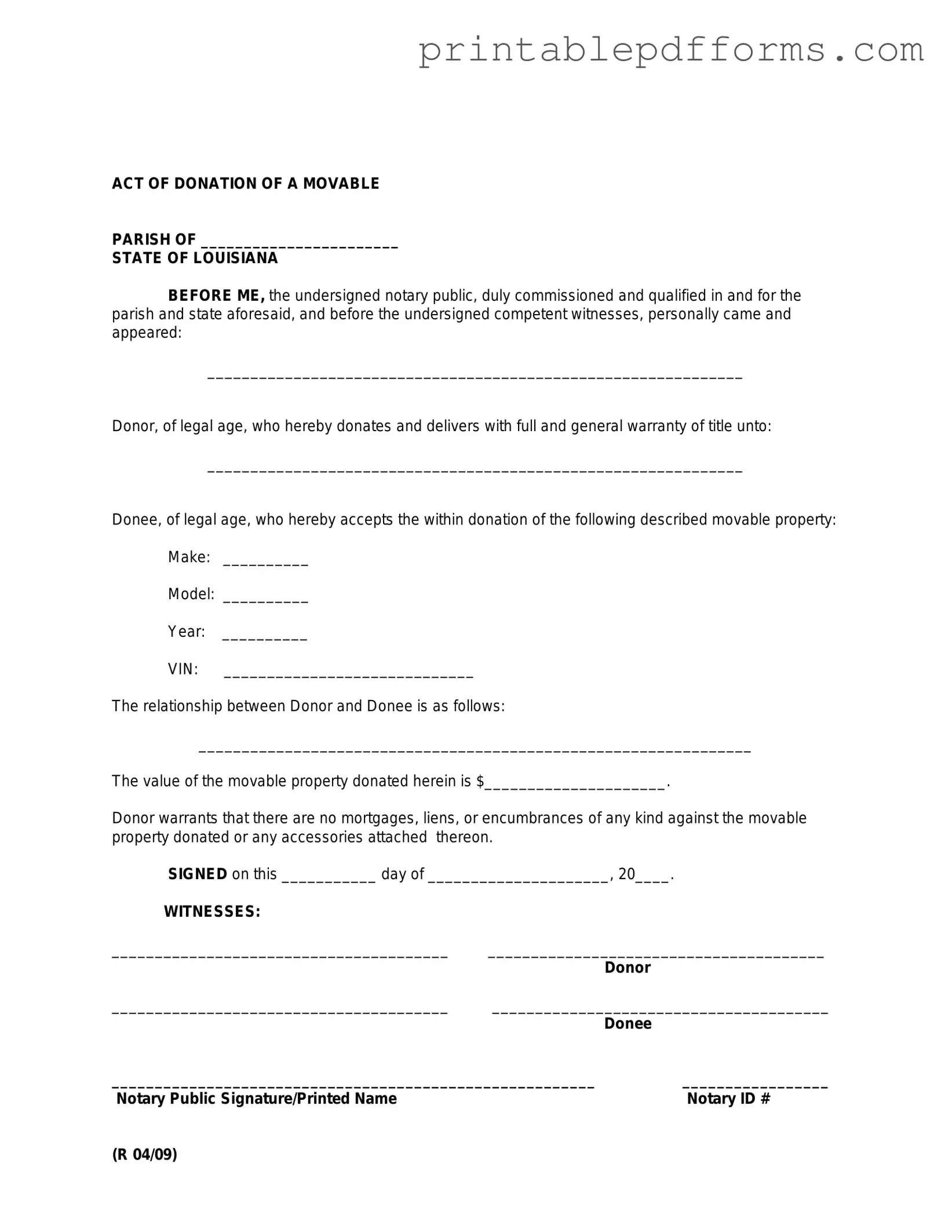

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468-1473. |

| Types of Donations | Donations can include movable property, immovable property, or a combination of both. |

| Requirements | The form must be signed by the donor and accepted by the donee for the donation to be valid. |

| Notarization | While notarization is not always required, it is recommended to ensure the document's validity. |

| Revocation | Donations can be revoked under certain conditions, such as ingratitude or failure to fulfill obligations. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, including gift tax considerations. |

| Record Keeping | It is advisable to keep a copy of the signed form for personal records and future reference. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with all relevant laws and regulations. |

Crucial Questions on This Form

What is the Louisiana Act of Donation form?

The Louisiana Act of Donation form is a legal document used to transfer ownership of property or assets from one person (the donor) to another (the donee) without any exchange of money. This form is essential in Louisiana, where specific laws govern the donation of property, ensuring that the process is clear and legally binding.

Who can use the Act of Donation form?

Any individual who wishes to donate property or assets can use the Act of Donation form. This includes family members, friends, or even charitable organizations. It is important that both the donor and the donee are of legal age and have the capacity to enter into a contract. Additionally, the property being donated must be legally owned by the donor.

What types of property can be donated using this form?

The Act of Donation form can be used to donate various types of property, including:

- Real estate, such as land or homes

- Personal property, including vehicles, jewelry, and artwork

- Financial assets, such as bank accounts or stocks

However, certain restrictions may apply, particularly regarding the donation of community property between spouses.

Is the Act of Donation form required to be notarized?

Yes, the Act of Donation form must be notarized to be legally valid. This means that a notary public must witness the signing of the document. Notarization helps to prevent fraud and ensures that both parties understand the terms of the donation.

Are there any tax implications associated with donating property?

Yes, there can be tax implications when donating property. The donor may be eligible for a tax deduction based on the fair market value of the donated property. However, the donee may also face tax responsibilities, such as capital gains tax if the property is sold in the future. It is advisable to consult with a tax professional to understand the specific implications of a donation.

Can the donor change their mind after completing the Act of Donation form?

Once the Act of Donation form is executed and notarized, it typically becomes a binding agreement. However, if the donation was made under certain conditions, such as coercion or lack of capacity, the donor may have grounds to contest the donation. It is best to discuss any concerns with a legal professional before proceeding with the donation.

What should be included in the Act of Donation form?

The Act of Donation form should include several key elements:

- The names and addresses of both the donor and the donee

- A detailed description of the property being donated

- The date of the donation

- A statement indicating that the donation is made voluntarily and without compensation

- The signatures of both parties and the notary public

Including these elements ensures that the donation is clear and legally enforceable.

Where can I obtain a Louisiana Act of Donation form?

The Louisiana Act of Donation form can be obtained from various sources. Many legal stationery stores offer pre-printed forms. Additionally, online legal service providers often have templates available for download. It is crucial to ensure that the form used complies with Louisiana law, so seeking a reputable source is advisable.

Documents used along the form

The Louisiana Act of Donation Form serves as a critical document for individuals wishing to make a gift of property or assets to another party. However, several other forms and documents often accompany this act to ensure that the donation process is legally sound and clear. Below is a list of these related documents, each playing a unique role in the donation process.

- Donation Agreement: This document outlines the terms and conditions of the donation, including the specifics of what is being donated and any obligations of the donor or recipient.

- Quitclaim Deed Form: To facilitate the transfer of property ownership, consult our essential Quitclaim Deed form resources for proper documentation.

- Title Transfer Document: When real property is involved, a title transfer document is necessary to formally transfer ownership from the donor to the recipient.

- Affidavit of Donation: This sworn statement serves to confirm the details of the donation and can provide additional legal backing if disputes arise later.

- Gift Tax Return (Form 709): If the value of the donation exceeds a certain threshold, the donor may be required to file this form with the IRS to report the gift for tax purposes.

- Property Deed: In cases of real estate donations, a property deed is essential to document the change in ownership and ensure that the recipient has clear title to the property.

- Letter of Intent: This informal document expresses the donor's intention to make a gift and can serve as a preliminary agreement before the formal donation is executed.

- Power of Attorney: If the donor is unable to complete the donation in person, a power of attorney allows another person to act on their behalf in executing the donation documents.

- Estate Planning Documents: These may include wills or trusts that address how the donated property fits into the donor's overall estate plan, ensuring that their wishes are honored.

- Tax Exemption Certificates: If the donation is to a nonprofit organization, these certificates may be required to confirm the recipient's tax-exempt status.

Each of these documents plays a vital role in the process of making a donation in Louisiana. Understanding their purposes can help ensure that both donors and recipients navigate the complexities of property transfer smoothly and in compliance with legal requirements.

Misconceptions

The Louisiana act of donation form is a vital legal document used to transfer ownership of property without any compensation. However, several misconceptions surround this form that can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The act of donation is only for family members.

- Misconception 2: An act of donation is the same as a will.

- Misconception 3: No formalities are required for an act of donation.

- Misconception 4: The donor can revoke the donation at any time without consequences.

While many people use the act of donation to transfer property to relatives, it is not limited to family. Friends, charities, and other organizations can also be recipients of a donation.

This is not accurate. An act of donation transfers ownership immediately, while a will only takes effect after the donor's death. A will can include various assets, but a donation is a direct transfer.

In reality, certain formalities must be followed. The act of donation must be in writing and typically requires notarization to be legally binding.

This is misleading. Once an act of donation is executed and delivered, it can be difficult to revoke. There are specific legal processes to follow if a donor wishes to reclaim their property.