Fill a Valid Mortgage Statement Form

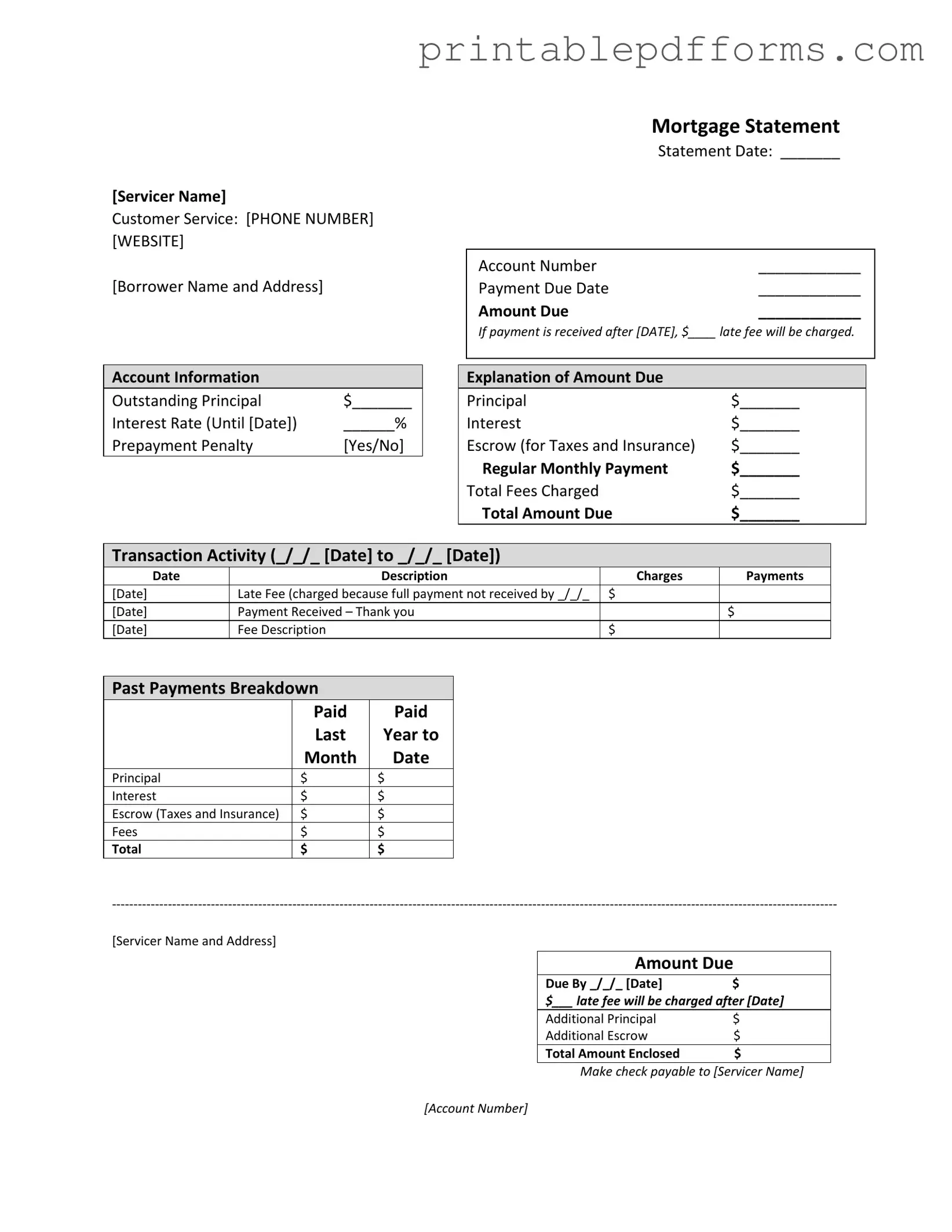

A Mortgage Statement is an essential document for homeowners, providing a detailed snapshot of their mortgage account. This statement typically includes vital information such as the servicer's name and contact details, the borrower's name and address, and the account number. Homeowners can find the statement date and payment due date prominently displayed, along with the total amount due and any applicable late fees. The form breaks down the account information, showing the outstanding principal, interest rate, and whether a prepayment penalty applies. It also explains the amount due, detailing the principal, interest, escrow for taxes and insurance, and any total fees charged. Transaction activity is listed chronologically, allowing borrowers to track charges and payments over a specified period. Additionally, a past payments breakdown helps homeowners understand their payment history. Important messages about partial payments and delinquency notices are included, emphasizing the consequences of late payments. For those facing financial difficulties, the statement often provides resources for mortgage counseling or assistance, ensuring that borrowers are informed and supported throughout their mortgage journey.

Additional PDF Templates

Panel Schedule - Helps identify circuits that may require upgrades.

Bill Lading - Timely completion of this form helps maintain operational efficiency within shipping logistics.

The USCIS I-864 form, also known as the Affidavit of Support, is a crucial document used in the immigration process. It serves to demonstrate that a sponsor can financially support a family member seeking permanent residency in the United States. For those needing assistance with this form, resources can be found at freebusinessforms.org. By signing this form, the sponsor commits to ensuring that the immigrant will not rely on government assistance.

Form I 864 - Be prepared to respond to further requests from USCIS.

Similar forms

- Billing Statement: A billing statement provides an overview of the amounts owed for various services, much like a mortgage statement outlines the payments due for a mortgage loan. Both documents detail the total amount due, payment history, and any applicable fees.

- Loan Statement: Similar to a mortgage statement, a loan statement summarizes the current status of a loan, including outstanding balance, interest rates, and payment due dates. Both documents serve to inform borrowers about their financial obligations.

- Trailer Bill of Sale: This document, necessary for the sale of a trailer, ensures both the buyer and seller are protected and informed throughout the transaction process. To facilitate this, you can download a blank document for your use.

- Account Statement: An account statement, often used for bank accounts, lists transactions over a specific period. Like a mortgage statement, it includes information on charges, payments, and account balances, helping individuals track their financial activities.

- Property Tax Statement: A property tax statement details the taxes owed on real estate, similar to how a mortgage statement provides information on payments related to the property. Both documents are essential for homeowners to understand their financial responsibilities regarding their property.

- Credit Card Statement: A credit card statement summarizes the charges made on a credit card, including payment due dates and interest rates. Much like a mortgage statement, it helps individuals manage their debt and understand their payment obligations.

- Utility Bill: A utility bill provides a summary of charges for services such as water, electricity, or gas. It shares similarities with a mortgage statement in that both documents specify amounts due, payment deadlines, and any late fees that may apply if payments are not made on time.

Document Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Form Specs

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy access to assistance. |

| Payment Details | It specifies the payment due date, amount due, and any applicable late fees, ensuring borrowers are aware of their obligations. |

| Account Information | The statement provides details about the outstanding principal, interest rate, and whether a prepayment penalty applies, giving borrowers a clear picture of their mortgage status. |

| Delinquency Notice | A notice alerts borrowers if they are late on payments, emphasizing the potential consequences of continued delinquency, including fees and foreclosure. |

Crucial Questions on This Form

What is a Mortgage Statement?

A mortgage statement is a document provided by your mortgage servicer that outlines the details of your loan. It includes important information such as your account number, payment due date, amount due, and a breakdown of your outstanding principal and interest. This statement helps you understand your financial obligations and track your payment history.

How can I read my Mortgage Statement?

Your mortgage statement is organized into several sections. Key components include:

- Account Information: This section shows your outstanding principal, interest rate, and any prepayment penalties.

- Explanation of Amount Due: Here, you will find a detailed breakdown of the principal, interest, escrow for taxes and insurance, and total fees charged.

- Transaction Activity: This lists all transactions related to your mortgage, including payments made and any late fees incurred.

By reviewing each section carefully, you can gain a clear understanding of your mortgage status.

What happens if I miss a payment?

If you miss a payment, your mortgage servicer will typically charge a late fee after a specified date. This fee will be outlined in your mortgage statement. Additionally, missing payments can lead to your account being marked as delinquent, which may result in further fees and the risk of foreclosure if the situation is not addressed promptly. It is essential to communicate with your servicer if you are having trouble making payments.

What should I do if I am experiencing financial difficulty?

If you find yourself in financial trouble, it is crucial to take action as soon as possible. Your mortgage statement often includes information about mortgage counseling or assistance programs. Contact your servicer directly for guidance on available options. They may offer solutions such as loan modifications, repayment plans, or other assistance to help you manage your payments.

Can I make partial payments on my mortgage?

While you can make partial payments, it is important to note that these payments are not applied directly to your mortgage. Instead, they are held in a separate suspense account. To ensure that your mortgage is credited appropriately, you must pay the full amount due. Once the balance of a partial payment is received, those funds will then be applied to your mortgage.

Where can I find help if I have questions about my Mortgage Statement?

If you have questions or need assistance with your mortgage statement, reach out to your mortgage servicer's customer service. Their contact information, including phone number and website, is typically listed on the statement itself. They can provide clarification on any charges, payment history, or other concerns you may have.

Documents used along the form

When managing a mortgage, several documents complement the Mortgage Statement form. Each of these documents serves a specific purpose, providing essential information related to the mortgage account. Below is a list of commonly used forms and documents.

- Loan Agreement: This document outlines the terms of the mortgage, including the loan amount, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Amortization Schedule: This schedule details each payment over the life of the loan, breaking down how much goes toward principal and interest, and shows the remaining balance after each payment.

- Referral Letter: This form is essential for individuals seeking endorsements from qualified sources, providing a streamlined approach to collecting necessary recommendations, which is crucial in various applications such as job references or academic admissions. For more details, you can check out this Referral Letter.

- Escrow Account Statement: This statement provides information about the funds held in escrow for property taxes and insurance, detailing deposits and disbursements throughout the year.

- Payment History: A record of all payments made on the mortgage, including dates, amounts, and any late fees incurred, helping borrowers track their payment performance.

- Delinquency Notice: This document alerts the borrower to missed payments and outlines the potential consequences, including late fees and the risk of foreclosure.

- Mortgage Payoff Statement: This statement indicates the total amount needed to pay off the mortgage in full, including principal, interest, and any fees, providing clarity for borrowers considering refinancing or selling their home.

- Loan Modification Agreement: If a borrower is struggling to make payments, this document outlines the revised terms of the loan, which may include changes to the interest rate or payment schedule.

Understanding these documents can help borrowers navigate their mortgage responsibilities more effectively. Keeping track of this information is crucial for managing financial obligations and ensuring timely payments.

Misconceptions

Here are eight misconceptions about the Mortgage Statement form:

- All payments are applied immediately. Many people think that once they make a payment, it is applied right away. In reality, partial payments are held in a suspense account until the full amount is received.

- The amount due is only the principal. Some borrowers believe that the amount due only includes the principal. However, the total amount due also includes interest, escrow for taxes and insurance, and any fees charged.

- Late fees are charged automatically. It's a common belief that late fees are always applied. While late fees can occur, they are only charged if payment is not received by the specified due date.

- All servicers provide the same information. Many assume that all mortgage servicers offer identical statements. This is not true; the format and details can vary significantly between servicers.

- You can ignore the delinquency notice. Some borrowers think they can overlook the delinquency notice. Ignoring it can lead to serious consequences, including foreclosure.

- Escrow payments are optional. There is a misconception that escrow payments for taxes and insurance are optional. In many cases, they are required as part of the mortgage agreement.

- You can pay any amount you want. Some believe they can pay any amount toward their mortgage. However, only the full payment amount specified in the statement will bring the loan current.

- Mortgage counseling is unnecessary. Many think that seeking mortgage counseling is not needed. However, if you are experiencing financial difficulty, reaching out for assistance can provide valuable support.

Understanding these misconceptions can help borrowers manage their mortgage more effectively.