Fill a Valid Netspend Dispute Form

The Netspend Dispute Notification Form serves as a crucial tool for cardholders who need to address unauthorized credit or debit transactions. This form must be completed and submitted to Netspend within 60 days of the disputed transaction to ensure timely processing. Upon receipt of the completed form, Netspend will review the information and make a decision regarding the disputed funds within 10 business days. To facilitate this process, cardholders are encouraged to provide supporting documentation, which can significantly aid in the determination of the dispute. It is important to note that if a card is lost or stolen, cardholders may still be liable for unauthorized transactions that occurred before they reported the loss. However, any unauthorized use after reporting the card as lost or stolen will not incur liability. The form requires essential details, including the cardholder's name, contact information, and specifics about the disputed transactions, such as amounts, dates, and merchant names. Cardholders must also indicate whether they have contacted the merchant regarding the dispute and provide a detailed explanation of the incident. Additionally, attaching a police report and other relevant documents is recommended to strengthen the claim. By following the outlined steps and submitting the necessary information, cardholders can effectively initiate a dispute and seek resolution for unauthorized transactions.

Additional PDF Templates

Ms Word Chart Examples - Use for project planning and task allocation.

Understanding the significance of a well-drafted Lease Agreement form is crucial for both landlords and tenants in Ohio. By accessing a comprehensive guide on lease agreements, you can ensure that all terms are thoroughly outlined to prevent future disputes. For more information, you can explore this detailed Lease Agreement template for Ohio.

Asylum Form - It is essential to adhere to deadlines associated with the I-589 process.

Similar forms

The Netspend Dispute form shares similarities with several other documents commonly used in financial and consumer contexts. Each serves a unique purpose but follows a comparable structure and intent.

- Chargeback Request Form: This document is used by consumers to dispute a transaction with their bank or credit card issuer. Like the Netspend form, it requires details about the transaction, including the amount, date, and merchant information. Both forms aim to initiate a review process for unauthorized charges.

- Fraud Report Form: Often utilized by financial institutions, this form allows individuals to report suspected fraud on their accounts. Similar to the Netspend Dispute form, it asks for specific transaction details and a narrative of the events leading to the fraud claim. Both documents seek to protect consumers from financial loss.

-

Power of Attorney Form: The Ohio Power of Attorney form is essential for granting someone the ability to act in your best interest during legal or financial circumstances. This legal document is customizable to suit various situations, ensuring trusted individuals can make decisions for you when necessary. For more information, visit All Ohio Forms.

- Consumer Complaint Form: This form is typically submitted to regulatory agencies or consumer protection organizations. It outlines grievances related to financial transactions or services. Like the Netspend Dispute form, it requires personal information and details about the disputed transaction, aiming to resolve issues between consumers and service providers.

- Identity Theft Affidavit: Used when an individual’s personal information has been compromised, this affidavit helps victims report identity theft. It parallels the Netspend Dispute form in that it collects detailed information about unauthorized transactions and the circumstances surrounding the theft, facilitating the investigation and resolution process.

Document Example

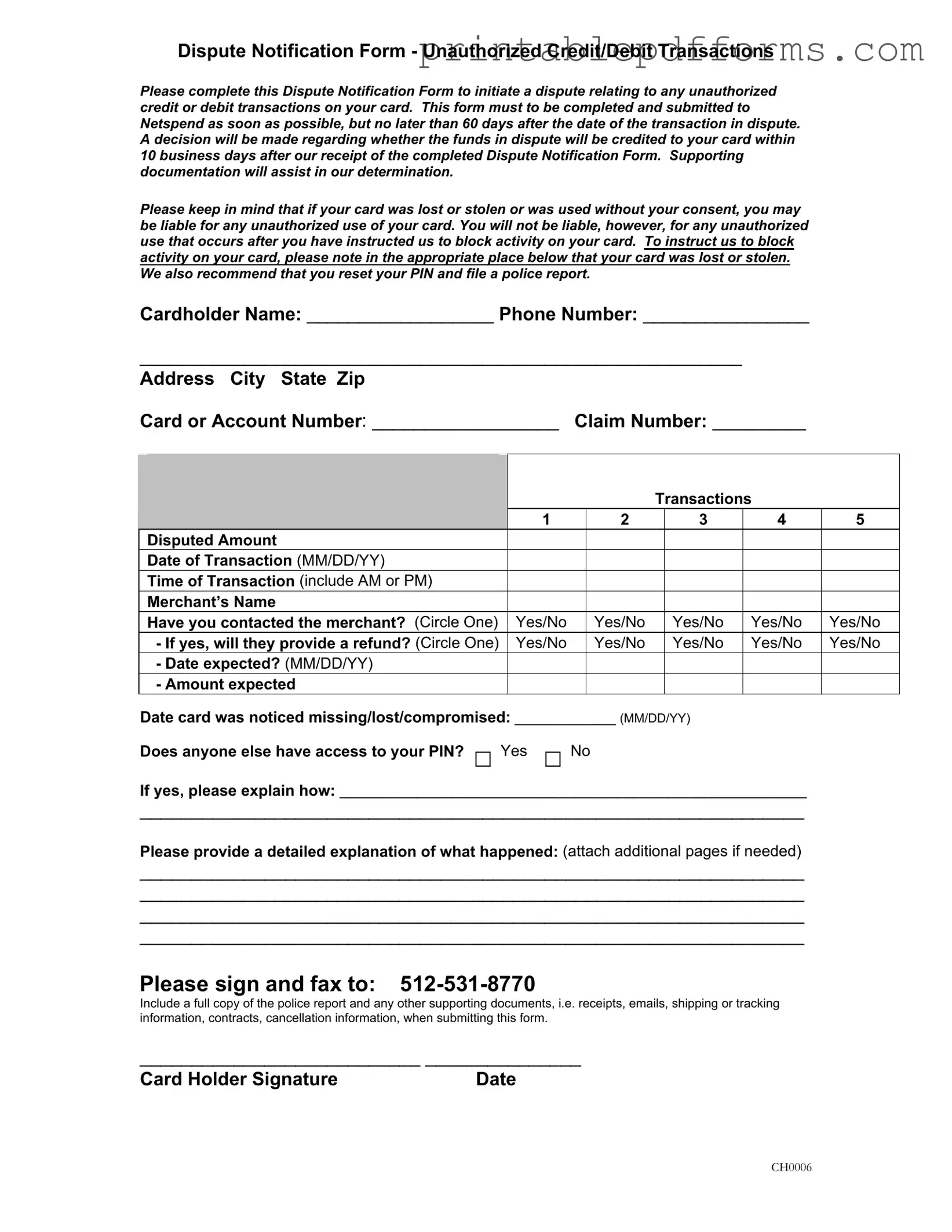

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Netspend Dispute Notification Form is used to report unauthorized credit or debit transactions on a card. |

| Submission Deadline | The form must be submitted within 60 days of the disputed transaction date. |

| Response Time | Netspend will make a decision regarding the dispute within 10 business days of receiving the completed form. |

| Supporting Documentation | Providing supporting documents can help in the determination of the dispute. |

| Liability Conditions | If a card is lost or stolen, the cardholder may be liable for unauthorized transactions unless they report it promptly. |

| Blocking Activity | Cardholders can block activity on their card by indicating that it was lost or stolen on the form. |

| PIN Security | Cardholders must disclose if anyone else has access to their PIN, which could affect liability. |

| Additional Instructions | Cardholders are advised to reset their PIN and file a police report in cases of loss or theft. |

Crucial Questions on This Form

What is the purpose of the Netspend Dispute Form?

The Netspend Dispute Form is designed to help you report any unauthorized credit or debit transactions on your card. If you notice a transaction that you did not authorize, completing this form allows you to initiate a dispute with Netspend. It’s important to act quickly, as you must submit the form within 60 days of the transaction date.

How do I submit the Dispute Notification Form?

Once you have filled out the Dispute Notification Form, you need to sign it and fax it to Netspend at 512-531-8770. Ensure that you include any supporting documents, such as a police report, receipts, or emails, that may help your case. This additional information can be crucial in resolving your dispute.

What happens after I submit the form?

After you submit the completed Dispute Notification Form, Netspend will review your claim. You can expect a decision regarding the disputed funds within 10 business days. If your claim is approved, the funds will be credited back to your card.

What if my card was lost or stolen?

If your card was lost or stolen, you should indicate this on the form. It’s essential to notify Netspend immediately to block any further transactions on your card. Additionally, you should reset your PIN and consider filing a police report for your protection.

Am I liable for unauthorized transactions?

Generally, you are not liable for unauthorized transactions that occur after you report your card as lost or stolen. However, if you fail to report the loss in a timely manner, you may be held responsible for transactions made before you notified Netspend. Always act quickly to minimize your liability.

What kind of documentation should I include?

When submitting your dispute form, include any relevant supporting documentation. This can consist of:

- A full copy of the police report

- Receipts or proof of purchase

- Emails or correspondence with the merchant

- Shipping or tracking information

- Any cancellation information related to the transaction

Providing thorough documentation can significantly aid in the resolution of your dispute.

Can I dispute multiple transactions on one form?

Yes, you can dispute up to five transactions on a single Dispute Notification Form. Be sure to provide all the required details for each transaction you are disputing, including the amount, date, time, and merchant’s name. This will help streamline the process for you and Netspend.

Documents used along the form

When dealing with disputes related to unauthorized transactions on your Netspend card, several forms and documents may be necessary to support your claim. Each of these documents plays a crucial role in ensuring that your dispute is handled effectively and efficiently. Below is a list of commonly used forms that can accompany the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report can provide essential evidence of the incident. It is often required for disputes involving unauthorized transactions.

- Transaction Receipts: Keeping receipts for transactions can help verify legitimate purchases. They serve as proof that a transaction was authorized and can clarify disputes.

- Email Correspondence: Any emails exchanged with merchants regarding the disputed transactions can support your claim. They may show attempts to resolve the issue directly with the merchant.

- Shipping or Tracking Information: For disputes related to online purchases, providing shipping or tracking details can demonstrate whether the item was received or not.

- Cancellation Confirmation: If you canceled a service or transaction, including confirmation of that cancellation can bolster your case, showing that the charge should not have occurred.

- Identity Theft Affidavit: In cases of identity theft, this document can help establish that the unauthorized transactions were not made by you. It is often used in conjunction with a police report.

- Bank Statements: Recent bank statements can provide a comprehensive view of your account activity. They help identify unauthorized charges and can serve as additional proof.

- Written Explanation: A detailed letter explaining the circumstances of the dispute can clarify your position. This letter should outline the timeline of events and any relevant details.

- Articles of Incorporation Form: When establishing a corporation, refer to the legal requirements for Articles of Incorporation documentation to ensure compliance with state regulations.

- Authorization Letters: If someone else was authorized to use your card, a letter from you stating this can help clarify the situation and determine liability.

- Affidavit of Fraud: This sworn statement can declare that you did not authorize the transactions in question. It may be required for certain types of disputes.

Gathering these documents can significantly enhance the chances of a favorable outcome for your dispute. Each piece of evidence provides context and support for your claim, helping to clarify any misunderstandings and ensuring that your case is thoroughly reviewed.

Misconceptions

Misconception 1: The Netspend Dispute Form must be submitted immediately.

While it is important to act quickly, you have up to 60 days from the date of the disputed transaction to submit the form. This timeframe allows you to gather necessary information and documentation to support your claim.

Misconception 2: All disputes will be resolved within a few days.

The review process takes time. After submitting the completed Dispute Notification Form, a decision regarding the disputed funds will be made within 10 business days. However, this does not guarantee that the funds will be credited back to your account within that period.

Misconception 3: You are always liable for unauthorized transactions.

If your card was lost or stolen, you may be liable for unauthorized transactions. However, you will not be held responsible for any unauthorized use that occurs after you have reported the card as lost or stolen and requested to block activity on it.

Misconception 4: Supporting documentation is optional.

In fact, providing supporting documentation is highly recommended. It can significantly assist in the determination of your dispute. Include any relevant documents such as police reports, receipts, or emails when submitting your dispute.