New York Deed Document

When it comes to transferring property ownership in New York, understanding the New York Deed form is essential for both buyers and sellers. This legal document serves as the official record of the transaction, detailing vital information such as the names of the parties involved, the property's description, and the type of deed being used—be it a warranty deed, quitclaim deed, or another variation. Each type has its own implications for the rights and responsibilities of the parties, influencing everything from liability for existing liens to the level of protection offered to the buyer. Additionally, the New York Deed form must be properly executed, which includes signatures, notarization, and, in some cases, the payment of transfer taxes. Understanding these components not only ensures compliance with state laws but also protects your interests in the property transfer process. Whether you are a first-time homebuyer or an experienced real estate investor, knowing how to navigate this form can make a significant difference in your real estate transactions.

Discover More Deed Forms for Different States

House Deed Template - The homestead designation on a deed can offer certain protections and tax exemptions for a homeowner's primary residence.

How Long Does It Take to Record a Deed in Florida - Understanding the differences between deed types can influence property decisions.

Having a properly executed Georgia Tractor Bill of Sale form is essential for both buyers and sellers, as it not only records the transfer of ownership but also protects all parties involved. For more information and to obtain the necessary documentation, you can visit georgiapdf.com/tractor-bill-of-sale to ensure a seamless transaction.

Ohio Deed Transfer Form - This document specifies the parties involved in the property transfer.

Texas Deed Forms - Review your Deed carefully before signing to ensure completeness.

Similar forms

- Title Transfer Document: This document transfers ownership of property from one person to another, similar to a deed.

- Quitclaim Deed: A type of deed that transfers whatever interest the grantor has in the property without guaranteeing that the title is clear.

- Warranty Deed: This deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it.

- Lease Agreement: This document outlines the terms under which one party rents property from another, establishing rights and responsibilities.

- Mortgage Agreement: This document secures a loan with real property as collateral, similar to how a deed secures ownership.

- Motor Vehicle Bill of Sale: As a vital document for vehicle transactions, it certifies the sale and ownership transfer between parties in Ohio. For further details, visit All Ohio Forms.

- Bill of Sale: This document transfers ownership of personal property, akin to how a deed transfers real property ownership.

- Property Settlement Agreement: This document is often used in divorce cases to outline the division of property between spouses.

- Easement Agreement: This document grants one party the right to use another party's property for a specific purpose, similar to how a deed establishes property rights.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including the signing of deeds.

- Affidavit of Title: This document is a sworn statement confirming the ownership and status of a property, which can accompany a deed.

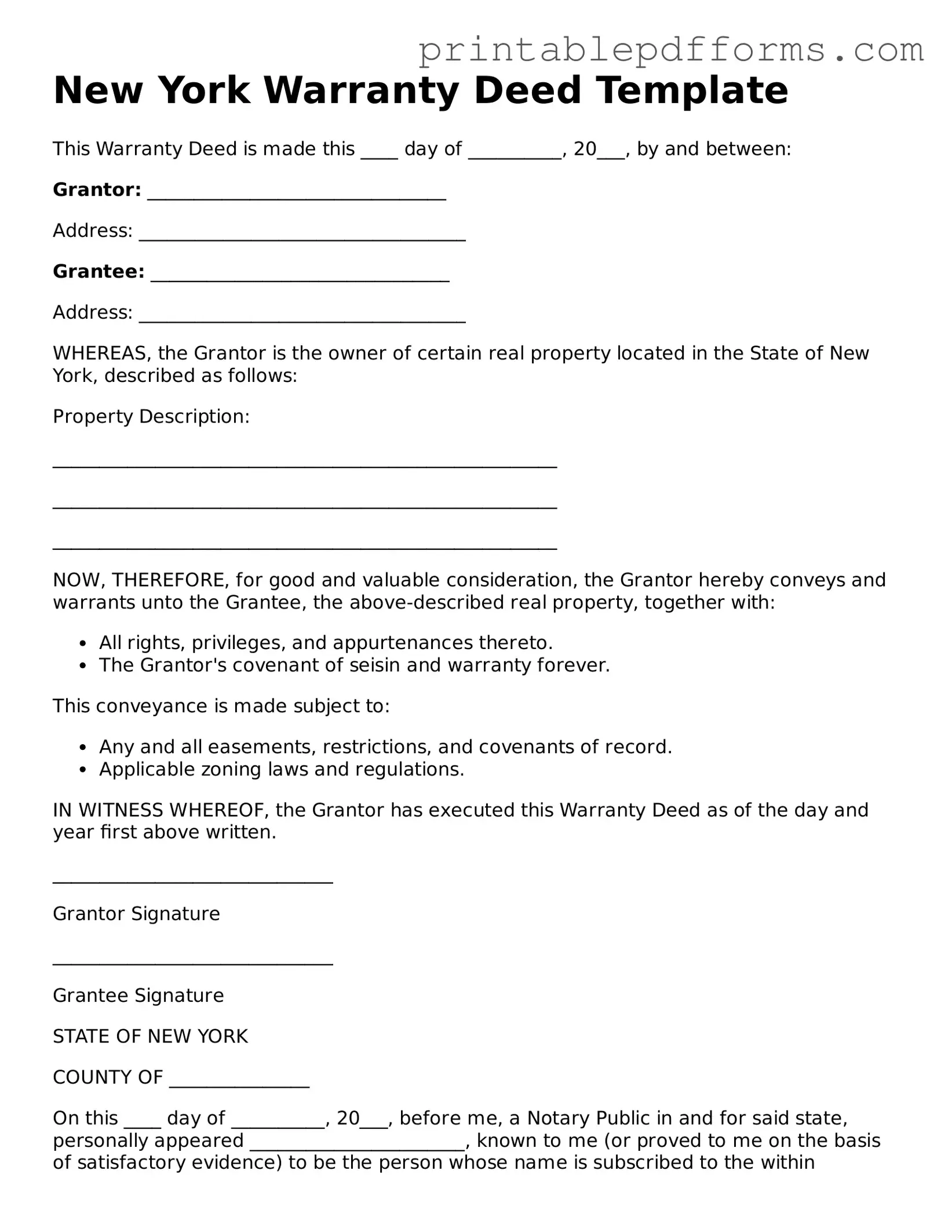

Document Example

New York Warranty Deed Template

This Warranty Deed is made this ____ day of __________, 20___, by and between:

Grantor: ________________________________

Address: ___________________________________

Grantee: ________________________________

Address: ___________________________________

WHEREAS, the Grantor is the owner of certain real property located in the State of New York, described as follows:

Property Description:

______________________________________________________

______________________________________________________

______________________________________________________

NOW, THEREFORE, for good and valuable consideration, the Grantor hereby conveys and warrants unto the Grantee, the above-described real property, together with:

- All rights, privileges, and appurtenances thereto.

- The Grantor's covenant of seisin and warranty forever.

This conveyance is made subject to:

- Any and all easements, restrictions, and covenants of record.

- Applicable zoning laws and regulations.

IN WITNESS WHEREOF, the Grantor has executed this Warranty Deed as of the day and year first above written.

______________________________

Grantor Signature

______________________________

Grantee Signature

STATE OF NEW YORK

COUNTY OF _______________

On this ____ day of __________, 20___, before me, a Notary Public in and for said state, personally appeared _______________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged to me that he/she executed the same in his/her capacity, and that by his/her signature on the instrument, the person executed the instrument.

__________________________________

Notary Public

My commission expires: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A New York Deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Bargain and Sale Deeds, each serving different purposes in property transfer. |

| Governing Laws | The New York Real Property Law governs the execution and recording of deeds in the state. |

| Signature Requirements | In New York, the deed must be signed by the grantor (the person transferring the property) and acknowledged before a notary public. |

| Recording | To protect the new owner’s rights, the deed should be recorded in the county where the property is located. |

| Consideration | The deed must state the consideration, or value exchanged, for the property, although this can be nominal in certain cases. |

| Tax Implications | New York imposes a transfer tax on the sale of real property, which must be paid at the time of recording the deed. |

| Legal Description | A precise legal description of the property must be included in the deed to clearly identify the real estate being transferred. |

Crucial Questions on This Form

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another within the state of New York. This form outlines the details of the transaction, including the names of the parties involved, the property description, and any conditions of the transfer.

What types of deeds are available in New York?

In New York, there are several types of deeds, including:

- Warranty Deed: Provides a guarantee that the grantor holds clear title to the property and has the right to sell it.

- Quitclaim Deed: Transfers whatever interest the grantor has in the property without any warranties.

- Special Warranty Deed: Similar to a warranty deed but only covers the period during which the grantor owned the property.

- Grant Deed: Implies that the property has not been sold to anyone else and that it is free from encumbrances.

How do I fill out a New York Deed form?

Filling out a New York Deed form involves several key steps:

- Identify the parties involved: Include the full names and addresses of the grantor (seller) and grantee (buyer).

- Provide a legal description of the property: This should include the address and a detailed description of the land.

- Specify the type of deed: Clearly indicate whether it is a warranty, quitclaim, or another type of deed.

- Sign and date the form: The grantor must sign the deed in front of a notary public.

Is notarization required for a New York Deed?

Yes, notarization is required for a New York Deed. The grantor must sign the deed in the presence of a notary public, who will then affix their seal to the document. This step is essential to ensure the authenticity of the signatures and the validity of the deed.

Do I need to file the New York Deed with the county clerk?

Yes, after completing the deed, it must be filed with the county clerk's office in the county where the property is located. Filing the deed provides public notice of the ownership transfer and is necessary to protect the rights of the new owner.

Are there any fees associated with filing a New York Deed?

Yes, there are typically fees associated with filing a New York Deed. The fees can vary by county, so it's a good idea to check with your local county clerk's office for the specific amounts. Additionally, there may be transfer taxes that apply to the transaction.

What happens if I don’t file the Deed?

If you do not file the deed, the transfer of ownership may not be recognized legally. This can lead to complications in proving ownership, affecting your ability to sell or mortgage the property in the future. Filing is crucial for establishing your rights as the new owner.

Can I create my own New York Deed form?

While it is possible to create your own New York Deed form, it is advisable to use a standard template or consult with a legal professional. Ensuring that all necessary information is included and that the document complies with state laws is essential for a valid transfer.

Where can I find a New York Deed form?

New York Deed forms can be found online through various legal websites, at local county clerk offices, or through legal stationery stores. It's important to ensure that the form you choose is appropriate for your specific needs and complies with New York state requirements.

Documents used along the form

When engaging in real estate transactions in New York, several documents complement the New York Deed form. Each of these documents serves a specific purpose and helps ensure that the transfer of property is legally sound and transparent.

- Title Search Report: This document outlines the history of ownership for the property. It helps identify any liens, encumbrances, or claims against the property that could affect the new owner's rights.

- Affidavit of Title: This sworn statement by the seller confirms that they are the rightful owner of the property and that there are no undisclosed claims or liens. It provides assurance to the buyer regarding the title's integrity.

- Purchase Agreement: This is a legally binding contract between the buyer and seller that outlines the terms of the sale. It includes details such as the purchase price, closing date, and any contingencies that must be met.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document summarizes the financial aspects of the transaction. It details the costs and fees associated with the sale, ensuring transparency for both parties.

- Operating Agreement: This essential document outlines the management structure and operational procedures of an LLC in New York, ensuring clarity and compliance. For further assistance, you can access the freebusinessforms.org/ for resources related to this form.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It must be filed with the appropriate government agency to comply with tax obligations.

- Deed of Trust: In some cases, a Deed of Trust may be used to secure a loan. This document allows a lender to hold a security interest in the property until the borrower repays the loan in full.

Understanding these accompanying documents is crucial for anyone involved in real estate transactions in New York. Each document plays a vital role in ensuring a smooth transfer of property ownership and protecting the interests of all parties involved.

Misconceptions

When it comes to the New York Deed form, there are several misconceptions that can lead to confusion. Here are four common misunderstandings:

- All Deeds are the Same: Many people believe that all deed forms serve the same purpose. In reality, different types of deeds exist, such as warranty deeds and quitclaim deeds, each with unique legal implications and protections.

- Only Lawyers Can Prepare a Deed: While it’s true that legal professionals can assist with deed preparation, individuals can also fill out the form themselves. As long as you follow the guidelines and provide accurate information, you can complete a deed without legal assistance.

- A Deed is Only Necessary for Property Sales: Some think that deeds are only required during a sale. However, deeds are also needed for transfers between family members, gifts, or when changing the title of a property.

- Once a Deed is Signed, It Cannot Be Changed: Many assume that a signed deed is permanent. In fact, deeds can be modified or revoked under certain conditions, but this often requires a new deed to be drafted and executed.

Understanding these misconceptions can help you navigate the process of handling deeds in New York more effectively.