New York Deed in Lieu of Foreclosure Document

When facing financial difficulties, homeowners in New York may consider a Deed in Lieu of Foreclosure as a viable option to avoid the lengthy and stressful foreclosure process. This legal document allows a homeowner to voluntarily transfer the ownership of their property back to the lender, effectively settling the mortgage debt. By doing so, the homeowner can prevent the negative impact of foreclosure on their credit score and may even negotiate more favorable terms with the lender. The Deed in Lieu of Foreclosure form includes essential information such as the property address, the names of the parties involved, and a clear statement of intent to convey the property. Additionally, it may outline any agreements regarding the release of liability for the remaining mortgage balance. Understanding the major aspects of this form can help homeowners make informed decisions and navigate the complexities of their financial situation with greater ease.

Discover More Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Mortgage - In many situations, the deed in lieu is a more dignified exit strategy for homeowners facing foreclosure.

The Ohio Motor Vehicle Bill of Sale form is a critical document that records the essential details of the sale of a vehicle between two parties in Ohio. It serves as a proof of transaction and establishes the transfer of ownership from the seller to the buyer. For those looking to create or obtain this document, resources like All Ohio Forms can be invaluable, as the importance of this document cannot be overstated, being often required for vehicle registration and legal protection.

California Voluntary Foreclosure Deed - Can potentially allow homeowners to avoid the repercussions of a formal foreclosure filing.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Follow-up actions after execution may be necessary to ensure all obligations have been met.

Similar forms

- Short Sale Agreement: A short sale allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, it aims to avoid foreclosure, but involves selling the home rather than transferring it back to the lender.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable for the borrower. Both aim to prevent foreclosure, but a loan modification keeps the borrower in the home rather than transferring ownership.

- Forbearance Agreement: In a forbearance agreement, the lender allows the borrower to temporarily pause or reduce mortgage payments. This document provides a temporary solution, while a deed in lieu of foreclosure results in the transfer of property ownership.

- Repayment Plan: A repayment plan outlines how a borrower will pay back missed payments over time. Similar to a deed in lieu of foreclosure, it addresses financial distress but does not involve surrendering the property.

- Tractor Bill of Sale Form: When documenting the sale of agricultural equipment, refer to our reliable Tractor Bill of Sale template to ensure all legal requirements are met.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a fresh start. While both options involve financial distress, bankruptcy may allow the borrower to retain ownership under certain conditions.

- Mortgage Release or Satisfaction: This document indicates that a mortgage has been paid off or released. It is similar in that it resolves the mortgage obligation, but differs as it typically follows a sale or refinance rather than a voluntary transfer of the property.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any guarantees. While it can be used to transfer property to a lender, it does not necessarily address the mortgage obligation like a deed in lieu of foreclosure.

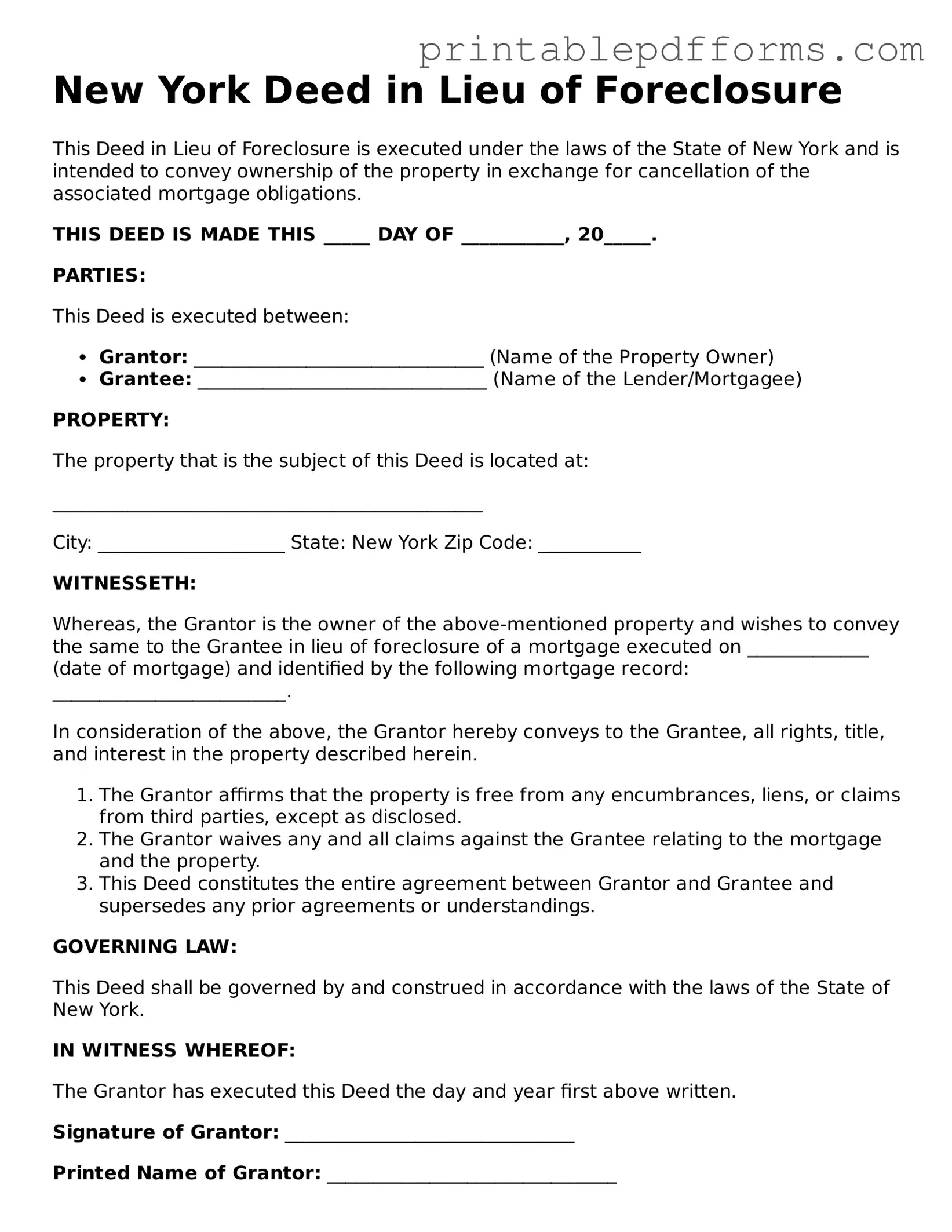

Document Example

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed under the laws of the State of New York and is intended to convey ownership of the property in exchange for cancellation of the associated mortgage obligations.

THIS DEED IS MADE THIS _____ DAY OF ___________, 20_____.

PARTIES:

This Deed is executed between:

- Grantor: _______________________________ (Name of the Property Owner)

- Grantee: _______________________________ (Name of the Lender/Mortgagee)

PROPERTY:

The property that is the subject of this Deed is located at:

______________________________________________

City: ____________________ State: New York Zip Code: ___________

WITNESSETH:

Whereas, the Grantor is the owner of the above-mentioned property and wishes to convey the same to the Grantee in lieu of foreclosure of a mortgage executed on _____________ (date of mortgage) and identified by the following mortgage record: _________________________.

In consideration of the above, the Grantor hereby conveys to the Grantee, all rights, title, and interest in the property described herein.

- The Grantor affirms that the property is free from any encumbrances, liens, or claims from third parties, except as disclosed.

- The Grantor waives any and all claims against the Grantee relating to the mortgage and the property.

- This Deed constitutes the entire agreement between Grantor and Grantee and supersedes any prior agreements or understandings.

GOVERNING LAW:

This Deed shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF:

The Grantor has executed this Deed the day and year first above written.

Signature of Grantor: _______________________________

Printed Name of Grantor: _______________________________

Signature of Grantee: _______________________________

Printed Name of Grantee: _______________________________

Witnessed by:

_____________________________ (Name of Witness)

_____________________________ (Signature of Witness)

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | In New York, the deed in lieu of foreclosure is governed by state laws related to real property and mortgages, specifically New York Real Property Actions and Proceedings Law. |

| Advantages | This process can help borrowers avoid the lengthy and costly foreclosure process, allowing for a quicker resolution of their mortgage default. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively affect the borrower’s credit score. |

| Eligibility Criteria | To qualify, borrowers typically need to demonstrate financial hardship and show that they cannot continue making mortgage payments. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option can be beneficial for both parties. The homeowner can escape the lengthy and often damaging foreclosure process, while the lender can quickly take possession of the property without the need for a court process.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners facing financial difficulties, such as job loss or medical expenses, may qualify. Key factors include:

- Ownership of the property must be clear, meaning there should be no other liens or claims against it.

- The homeowner must demonstrate that they are unable to keep up with mortgage payments.

- Most lenders require that the homeowner is in default or at risk of defaulting on their mortgage.

What are the benefits of a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several advantages:

- Less Damage to Credit: A Deed in Lieu may have a lesser impact on your credit score compared to a foreclosure.

- Quick Resolution: The process is typically faster than going through foreclosure, allowing homeowners to move on more quickly.

- Relief from Debt: Homeowners can walk away from their mortgage obligation, which can be a significant relief.

What are the potential downsides of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides to consider:

- Homeowners may still be liable for any deficiency judgment if the property sells for less than the mortgage balance.

- It may be challenging to find a lender willing to accept a Deed in Lieu if there are multiple mortgages on the property.

- Some lenders may require homeowners to provide financial documentation, which can be a lengthy process.

How does the process work?

The process typically involves several steps:

- The homeowner contacts the lender to express interest in a Deed in Lieu.

- After reviewing the homeowner's financial situation, the lender may agree to the arrangement.

- Legal documents are prepared, including the Deed in Lieu of Foreclosure form.

- Both parties sign the documents, and the homeowner transfers the property title to the lender.

Can a Deed in Lieu of Foreclosure affect my ability to buy a home in the future?

Yes, a Deed in Lieu of Foreclosure can impact your future home buying prospects. While it may be less damaging than a foreclosure, it can still affect your credit score and your ability to secure a mortgage. Typically, lenders may require a waiting period before approving a new mortgage, which can range from two to four years depending on the lender's policies.

Documents used along the form

A Deed in Lieu of Foreclosure is a significant step in the process of resolving a mortgage default. Several other forms and documents are often used alongside this form to ensure a smooth transition and protect the interests of all parties involved. Below is a list of commonly associated documents.

- Mortgage Satisfaction Document: This document confirms that the mortgage has been fully paid off and releases the borrower from any further obligations to the lender.

- Property Transfer Agreement: This agreement outlines the terms and conditions under which the property is transferred from the borrower to the lender.

- Notice of Default: This notice informs the borrower that they have defaulted on their mortgage payments and outlines the potential consequences.

- Release of Liability: This document releases the borrower from any further liability associated with the mortgage after the deed is executed.

- Title Search Report: A report that verifies the legal ownership of the property and ensures there are no outstanding liens or claims against it.

- Tractor Bill of Sale: To ensure a successful transfer of ownership, it is important to have a documented agreement, which can be found at georgiapdf.com/tractor-bill-of-sale/.

- Affidavit of Title: A sworn statement by the seller confirming their ownership of the property and the absence of any undisclosed claims or encumbrances.

- Closing Statement: A summary of the financial transactions involved in the property transfer, including any fees or costs associated with the deed in lieu process.

- Escrow Agreement: This agreement outlines the terms under which funds or documents will be held by a neutral third party until all conditions are met.

Understanding these documents can help facilitate the deed in lieu process and ensure that all legal requirements are met. Proper documentation is essential for protecting both the borrower and lender throughout this transition.

Misconceptions

Many homeowners and real estate professionals hold misconceptions about the New York Deed in Lieu of Foreclosure form. Understanding the facts can help clarify this important legal tool. Here are ten common misconceptions:

- It eliminates all debt obligations. A deed in lieu of foreclosure may not release you from all debts associated with the mortgage. You might still owe other debts related to the property.

- It is a quick process. While it can be faster than foreclosure, the process may still take time. Lenders need to review the situation and approve the deed.

- It is the same as a short sale. A deed in lieu of foreclosure transfers ownership back to the lender, while a short sale involves selling the property for less than the mortgage balance with lender approval.

- All lenders accept it. Not all lenders will agree to a deed in lieu of foreclosure. Each lender has its own policies and may prefer other options.

- It affects your credit score the same way as foreclosure. A deed in lieu may impact your credit score, but it might be less damaging than a full foreclosure.

- It relieves you of all liabilities. You may still be liable for any deficiencies if the property sells for less than the mortgage balance, depending on state laws.

- It is only for homeowners in dire financial situations. While often used by those facing financial hardship, it can also be an option for homeowners looking to avoid foreclosure for other reasons.

- Legal representation is not necessary. While it is possible to navigate the process without a lawyer, having legal assistance can help protect your interests.

- It guarantees a smooth transition. Even with a deed in lieu, you may face challenges, including negotiations with the lender and potential tax implications.

- Once signed, it cannot be reversed. While it is difficult to reverse a deed in lieu, there may be limited circumstances under which it can be contested or renegotiated.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing foreclosure.