New York Durable Power of Attorney Document

In New York, a Durable Power of Attorney (DPOA) is a vital legal tool that empowers an individual, known as the principal, to designate another person, referred to as the agent, to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. The DPOA covers a broad range of powers, from managing bank accounts and paying bills to handling real estate transactions and making investment decisions. Importantly, the principal can tailor the authority granted to the agent, specifying exactly what powers are included or excluded. Additionally, the DPOA must be signed in the presence of a notary public and can be revoked at any time, as long as the principal is still capable of making decisions. Understanding the nuances of this form is essential for anyone looking to secure their financial future and ensure their wishes are honored during times of incapacity.

Discover More Durable Power of Attorney Forms for Different States

Durable Power of Attorney Paperwork - A Durable Power of Attorney provides peace of mind by outlining your wishes clearly.

Understanding the importance of a well-crafted lease is vital for any landlord or tenant, as it not only delineates all crucial aspects of the rental arrangement but also protects the interests of both parties. For those looking to create a legally sound document, resources like All Ohio Forms can provide templates and guidelines that assist in drafting the perfect Ohio Residential Lease Agreement.

Is Power of Attorney Public Record - Can be customized to grant specific powers, ensuring tailored support during incapacity.

How to Get Power of Attorney in Ohio - Some states require specific language to be included in a Durable Power of Attorney to ensure its validity.

Durable Power of Attorney Pa - It can prevent disputes or misunderstandings regarding your financial affairs.

Similar forms

- General Power of Attorney: Similar to the Durable Power of Attorney, this document allows someone to act on your behalf in financial matters. However, it becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This document specifically gives someone the authority to make medical decisions for you if you are unable to do so yourself.

- Living Will: A living will outlines your wishes regarding medical treatment in case you become terminally ill or incapacitated. It complements a Healthcare Power of Attorney.

- Financial Power of Attorney: This document grants authority over financial decisions but does not cover healthcare choices. It can be durable or non-durable.

- Ohio Mobile Home Bill of Sale: For those looking to finalize ownership transfers, the efficient Mobile Home Bill of Sale documentation ensures that all necessary legal details are addressed properly.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specifies what happens to them after your death. It can be altered while you are alive.

- Irrevocable Trust: Unlike a revocable trust, this document cannot be changed once established. It can protect assets from creditors and may have tax benefits.

- Advance Healthcare Directive: This combines a living will and a Healthcare Power of Attorney. It outlines your healthcare preferences and designates someone to make decisions for you.

- Guardianship Documents: These documents appoint someone to make decisions for a minor or an incapacitated adult. They are similar in that they grant authority but focus on personal care rather than finances.

- Will: A will dictates how your assets will be distributed after your death. While it does not grant authority during your lifetime, it is a key document in estate planning.

Document Example

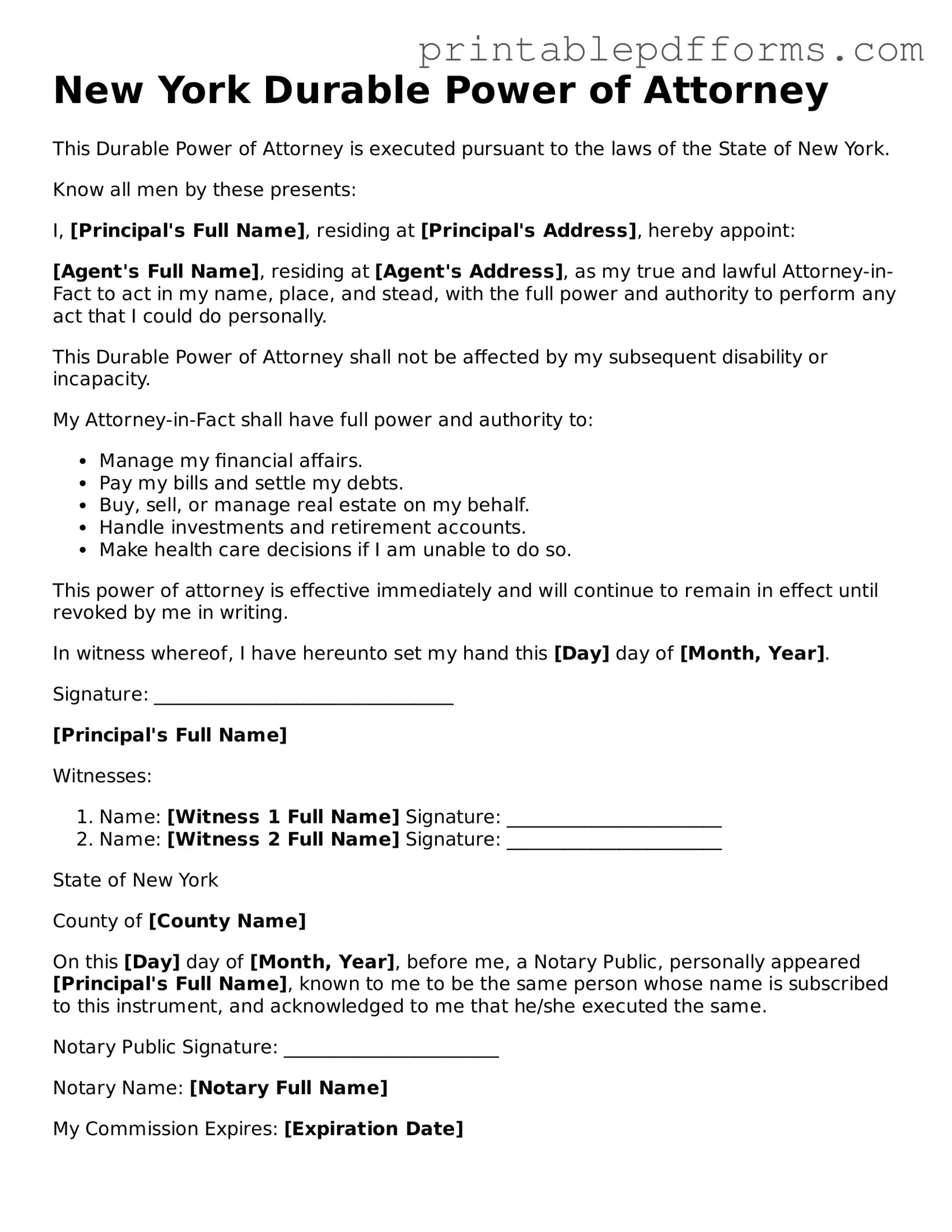

New York Durable Power of Attorney

This Durable Power of Attorney is executed pursuant to the laws of the State of New York.

Know all men by these presents:

I, [Principal's Full Name], residing at [Principal's Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address], as my true and lawful Attorney-in-Fact to act in my name, place, and stead, with the full power and authority to perform any act that I could do personally.

This Durable Power of Attorney shall not be affected by my subsequent disability or incapacity.

My Attorney-in-Fact shall have full power and authority to:

- Manage my financial affairs.

- Pay my bills and settle my debts.

- Buy, sell, or manage real estate on my behalf.

- Handle investments and retirement accounts.

- Make health care decisions if I am unable to do so.

This power of attorney is effective immediately and will continue to remain in effect until revoked by me in writing.

In witness whereof, I have hereunto set my hand this [Day] day of [Month, Year].

Signature: ________________________________

[Principal's Full Name]

Witnesses:

- Name: [Witness 1 Full Name] Signature: _______________________

- Name: [Witness 2 Full Name] Signature: _______________________

State of New York

County of [County Name]

On this [Day] day of [Month, Year], before me, a Notary Public, personally appeared [Principal's Full Name], known to me to be the same person whose name is subscribed to this instrument, and acknowledged to me that he/she executed the same.

Notary Public Signature: _______________________

Notary Name: [Notary Full Name]

My Commission Expires: [Expiration Date]

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone else to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | New York Consolidated Laws, General Obligations Law, Article 5, Title 15. |

| Durability | This type of power of attorney remains effective even after the principal is no longer able to make decisions. |

| Principal and Agent | The person granting the power is called the principal, while the person receiving the authority is known as the agent or attorney-in-fact. |

| Execution Requirements | The form must be signed by the principal and acknowledged before a notary public or signed in the presence of two witnesses. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

Crucial Questions on This Form

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This document remains effective even if you become incapacitated. It can cover financial matters, healthcare decisions, or both, depending on how it is structured.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose any competent adult to be your agent. This person should be someone you trust, as they will have significant authority over your financial and legal matters. Common choices include family members, close friends, or professionals such as attorneys or financial advisors.

What powers can I grant to my agent?

The powers you grant can be broad or limited. Common powers include:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Handling investments

- Making healthcare decisions (if included)

You can specify exactly what powers your agent will have in the document.

How do I create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, you must fill out the official form. The form must be signed by you and notarized. Additionally, you may need witnesses depending on the specifics of the document. It's advisable to consult with a legal professional to ensure everything is completed correctly.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions or individuals who may have relied on the original document.

What happens if I become incapacitated and don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, your family may need to go through a court process to appoint a guardian or conservator to manage your affairs. This can be time-consuming and may not align with your wishes.

Is a Durable Power of Attorney the same as a Health Care Proxy?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Health Care Proxy specifically allows someone to make medical decisions on your behalf. You can have both documents in place to cover different aspects of your life.

Documents used along the form

A Durable Power of Attorney is a vital document that allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. However, several other documents often accompany this form to ensure comprehensive planning. Below is a list of related forms and documents that can enhance your estate planning strategy.

- Health Care Proxy: This document allows you to designate someone to make medical decisions on your behalf if you are unable to do so. It ensures that your health care preferences are respected.

- Residential Lease Agreement: This document is essential for establishing the terms and conditions between a landlord and tenant, and you can find the necessary form Residential Lease Agreement form to ensure clarity and legality in your rental agreements.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. It serves as a guide for your health care proxy and medical providers.

- Last Will and Testament: This document specifies how your assets will be distributed upon your death. It can also appoint guardians for minor children, ensuring your wishes are followed.

- Revocable Living Trust: A trust allows you to manage your assets during your lifetime and specify how they will be distributed after your death. It can help avoid probate and provide privacy.

- Beneficiary Designations: Certain accounts, like life insurance policies and retirement accounts, require you to name beneficiaries. These designations override your will and can simplify asset transfer.

- HIPAA Authorization: This document allows designated individuals to access your medical records and communicate with health care providers. It ensures that your health care proxy can make informed decisions.

- Financial Power of Attorney: While similar to a Durable Power of Attorney, this document specifically focuses on financial matters. It grants authority to manage your finances, pay bills, and handle investments.

- Declaration of Guardian: This document allows you to nominate a guardian for yourself in case of incapacity. It can guide the court in appointing someone who aligns with your wishes.

Understanding these documents is essential for effective estate planning. Each serves a specific purpose and can work together to ensure your wishes are honored and your affairs are managed according to your preferences.

Misconceptions

Understanding the New York Durable Power of Attorney form is essential for anyone considering this important legal document. Here are nine common misconceptions about the form:

- It only applies to financial matters. Many people believe the Durable Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions if specified in the document.

- It becomes invalid if I become incapacitated. This is not true. The "durable" aspect means it remains in effect even if you become incapacitated.

- Anyone can act as my agent. While you can choose anyone you trust, they must be at least 18 years old and mentally competent to act on your behalf.

- I can only create a Durable Power of Attorney when I'm healthy. You can create this document at any time, even if you are facing health challenges, as long as you are still mentally competent.

- It is permanent and cannot be revoked. This is a misconception. You can revoke a Durable Power of Attorney at any time, as long as you are mentally competent.

- It must be notarized to be valid. While notarization is recommended, it is not strictly required. However, having it notarized can help avoid disputes later.

- My agent can do anything they want with my money. Your agent must act in your best interest and follow the instructions outlined in the document. They cannot act outside of those guidelines.

- Once signed, I can't change my Durable Power of Attorney. You can change or update your Durable Power of Attorney whenever you wish, provided you are competent to do so.

- It is the same as a living will. A Durable Power of Attorney is not the same as a living will. A living will outlines your wishes for medical treatment, while a Durable Power of Attorney allows someone to make decisions on your behalf.

Being informed about these misconceptions can help you make better decisions regarding your Durable Power of Attorney in New York.