New York Last Will and Testament Document

Creating a Last Will and Testament is an essential step in planning for the future and ensuring that your wishes are honored after your passing. In New York, this legal document outlines how your assets will be distributed and who will manage your estate. The form typically includes important sections such as the designation of beneficiaries, the appointment of an executor, and provisions for guardianship of minor children, if applicable. It is crucial to clearly state your intentions to avoid potential disputes among family members. Additionally, the New York Last Will and Testament must meet specific requirements to be considered valid, including being signed in the presence of witnesses. Understanding these key elements helps ensure that your will reflects your desires and complies with state laws, providing peace of mind for you and your loved ones.

Discover More Last Will and Testament Forms for Different States

Free Will Kit Ohio - Allows the testator to express any special requests regarding their estate.

When navigating the complexities of divorce, it is crucial to have a well-prepared settlement agreement that reflects the unique circumstances of your situation. This document not only addresses the division of assets and responsibilities but also serves to protect the rights of both parties involved. For a comprehensive resource, you can access All Washington Forms to ensure that you have the appropriate paperwork in order.

Lawyer to Write a Will - A legal document that specifies how a person's assets should be distributed after their death.

Florida Will Pdf Free - A formal plan for managing an individual's estate and affairs posthumously.

Similar forms

- Living Will: A living will outlines your medical preferences in case you become incapacitated. While a Last Will and Testament deals with asset distribution after death, a living will addresses healthcare decisions while you are still alive.

- Durable Power of Attorney: This document allows you to designate someone to make financial decisions on your behalf if you are unable to do so. Unlike a Last Will, which takes effect after death, a durable power of attorney is effective during your lifetime.

- Trust: A trust holds assets for beneficiaries and can provide more control over how and when those assets are distributed. While a Last Will transfers assets after death, a trust can manage assets during your lifetime and beyond.

Ohio Payoff Form: The Ohio Payoff Form is a crucial document for realtors and title companies to obtain payoff details concerning debts to the State of Ohio. It requires consent to release information related to certified debts and liens, streamlining debt resolution and lien releases ahead of transactions. For more information, visit All Ohio Forms.

- Health Care Proxy: This document appoints someone to make medical decisions for you if you are unable to communicate. Similar to a living will, it focuses on healthcare, whereas a Last Will addresses asset distribution.

- Beneficiary Designation: This document specifies who will receive certain assets, such as life insurance or retirement accounts, upon your death. Unlike a Last Will, which covers all assets, beneficiary designations are specific to certain accounts.

- Letter of Instruction: This informal document provides guidance on your wishes regarding your funeral, burial, and distribution of personal items. It complements a Last Will by offering additional personal insights that may not be legally binding.

Document Example

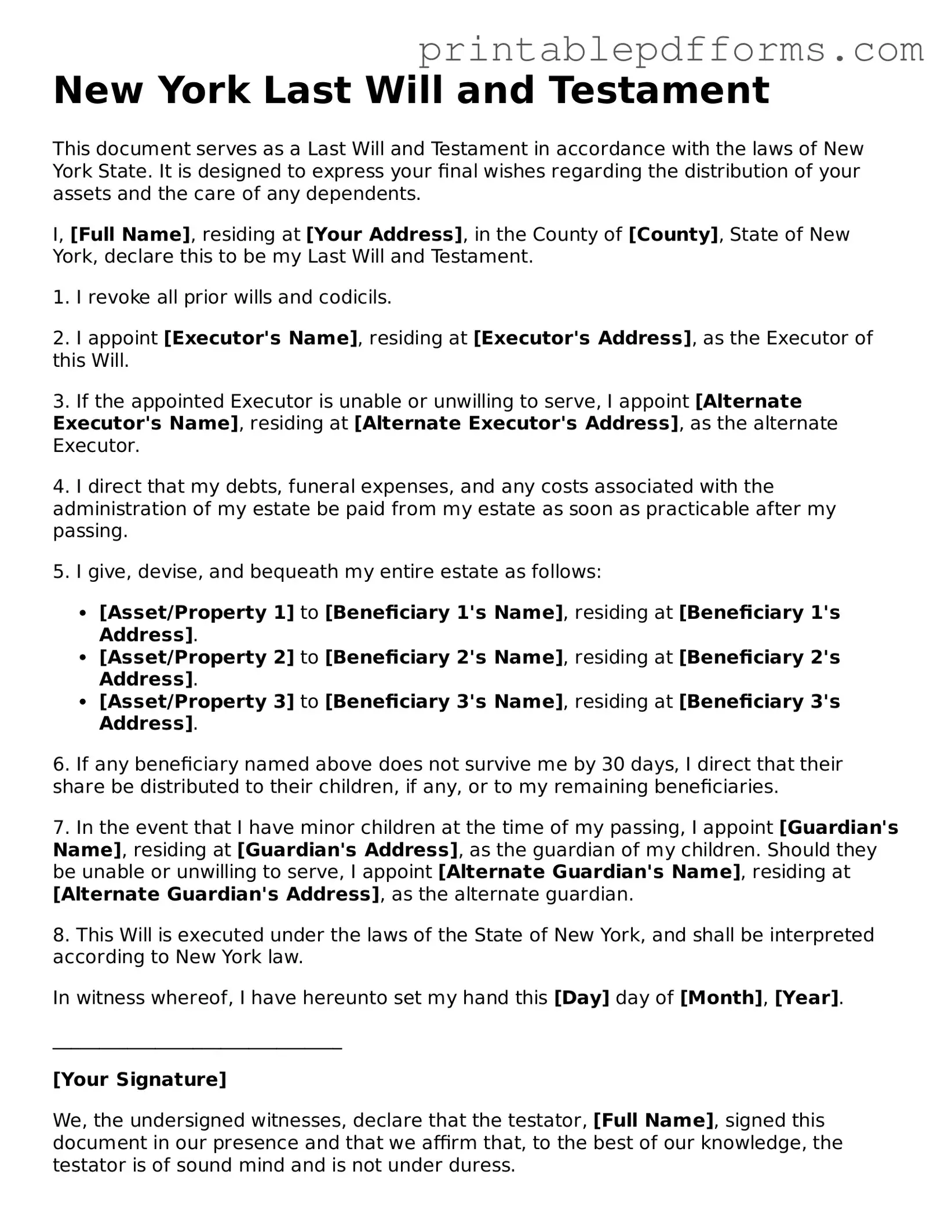

New York Last Will and Testament

This document serves as a Last Will and Testament in accordance with the laws of New York State. It is designed to express your final wishes regarding the distribution of your assets and the care of any dependents.

I, [Full Name], residing at [Your Address], in the County of [County], State of New York, declare this to be my Last Will and Testament.

1. I revoke all prior wills and codicils.

2. I appoint [Executor's Name], residing at [Executor's Address], as the Executor of this Will.

3. If the appointed Executor is unable or unwilling to serve, I appoint [Alternate Executor's Name], residing at [Alternate Executor's Address], as the alternate Executor.

4. I direct that my debts, funeral expenses, and any costs associated with the administration of my estate be paid from my estate as soon as practicable after my passing.

5. I give, devise, and bequeath my entire estate as follows:

- [Asset/Property 1] to [Beneficiary 1's Name], residing at [Beneficiary 1's Address].

- [Asset/Property 2] to [Beneficiary 2's Name], residing at [Beneficiary 2's Address].

- [Asset/Property 3] to [Beneficiary 3's Name], residing at [Beneficiary 3's Address].

6. If any beneficiary named above does not survive me by 30 days, I direct that their share be distributed to their children, if any, or to my remaining beneficiaries.

7. In the event that I have minor children at the time of my passing, I appoint [Guardian's Name], residing at [Guardian's Address], as the guardian of my children. Should they be unable or unwilling to serve, I appoint [Alternate Guardian's Name], residing at [Alternate Guardian's Address], as the alternate guardian.

8. This Will is executed under the laws of the State of New York, and shall be interpreted according to New York law.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_______________________________

[Your Signature]

We, the undersigned witnesses, declare that the testator, [Full Name], signed this document in our presence and that we affirm that, to the best of our knowledge, the testator is of sound mind and is not under duress.

1. Witness Signature: ___________________ Date: _______________

Printed Name: [Witness 1's Name]

Address: [Witness 1's Address]

2. Witness Signature: ___________________ Date: _______________

Printed Name: [Witness 2's Name]

Address: [Witness 2's Address]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Legal Requirement | In New York, a Last Will and Testament must be in writing and signed by the testator, who must be at least 18 years old. |

| Witnesses | The will must be signed in the presence of at least two witnesses, who must also sign the document. This ensures its validity. |

| Revocation | A will can be revoked by the testator at any time, either by creating a new will or by physically destroying the existing one. |

| Probate Process | After the testator's death, the will must go through probate, a legal process to validate the will and distribute the estate according to its terms. |

| Governing Law | The New York Estates, Powers and Trusts Law governs the creation and execution of Last Wills and Testaments in New York. |

Crucial Questions on This Form

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify who will inherit their property, appoint guardians for minor children, and designate an executor to carry out their wishes. This document serves as a crucial part of estate planning, ensuring that your desires are honored and that your loved ones are taken care of according to your wishes.

Who can create a Last Will and Testament in New York?

In New York, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. Sound mind means that the person understands the nature of the document they are signing, the extent of their assets, and the consequences of their decisions. It’s important to note that individuals who are mentally incapacitated or under undue influence may not be able to create a valid will.

What are the requirements for a valid will in New York?

To ensure that a will is valid in New York, several key requirements must be met:

- The will must be in writing.

- The person creating the will (the testator) must sign it at the end.

- The signature must be witnessed by at least two individuals who are present at the same time.

- Witnesses must be at least 18 years old and should not be beneficiaries of the will to avoid potential conflicts of interest.

Failure to meet these requirements may result in the will being deemed invalid, which could complicate the distribution of assets.

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive and mentally competent. To make changes, you can either create a new will that explicitly revokes the previous one or add a codicil, which is a legal document that modifies an existing will. If you wish to revoke the will entirely, you can do so by destroying it or stating your intention to revoke it in writing. Always ensure that any changes are executed in accordance with New York law to maintain their validity.

What happens if I die without a will in New York?

If you pass away without a will, you are considered to have died "intestate." In this case, New York's intestacy laws will dictate how your assets are distributed. Generally, your property will be divided among your closest relatives, such as your spouse, children, or parents, depending on the circumstances. Dying without a will can lead to complications, delays, and potential disputes among family members. Therefore, having a Last Will and Testament is a proactive way to ensure that your wishes are followed and to minimize family conflicts.

Documents used along the form

When preparing a Last Will and Testament in New York, several other documents may be necessary to ensure that your estate is managed according to your wishes. Each of these documents serves a specific purpose and can help facilitate the probate process or address other aspects of estate planning.

- Living Will: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It specifies what types of life-sustaining treatments you do or do not want.

- Health Care Proxy: A health care proxy allows you to designate someone to make medical decisions on your behalf if you are unable to do so. This ensures that your health care preferences are honored.

- Articles of Incorporation: This legal document establishes a corporation in New York, outlining essential details about its name, purpose, and structure. It is crucial for anyone looking to start a business in New York, as detailed in the https://nypdfforms.com/articles-of-incorporation-form/.

- Durable Power of Attorney: This document grants someone the authority to manage your financial affairs if you become incapacitated. It can be tailored to be effective immediately or only under specific circumstances.

- Trust Agreement: A trust can hold and manage your assets for the benefit of your beneficiaries. It can help avoid probate and provide more control over how your assets are distributed.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. These designations can override your will, so it’s essential to keep them updated.

- Affidavit of Heirship: This document can help establish the rightful heirs of an estate when there is no will. It is often used in situations where the deceased did not leave clear instructions.

- Pet Trust: If you have pets, a pet trust ensures that they are cared for after your passing. It specifies how funds should be used for their care and designates a caregiver.

- Letter of Instruction: This informal document provides additional guidance to your loved ones about your wishes. It can include details about funeral arrangements, personal messages, and other important information.

By considering these documents alongside your Last Will and Testament, you can create a comprehensive estate plan that reflects your wishes and protects your loved ones. It is always advisable to consult with a legal professional to ensure that all documents are properly prepared and executed.

Misconceptions

Many people hold misconceptions about the New York Last Will and Testament form. Understanding the facts can help ensure that your estate planning is effective and meets your wishes. Here are ten common misconceptions:

- A handwritten will is not valid in New York. This is incorrect. New York recognizes handwritten wills, known as holographic wills, as long as they meet certain criteria.

- You must have a lawyer to create a valid will. While having legal assistance can be beneficial, it is not a requirement. Individuals can create their own wills as long as they follow the state's guidelines.

- Wills can only be changed through a formal process. This is a misconception. A will can be amended or revoked by creating a new will or a codicil, which is a legal document that modifies the original will.

- All assets must be included in a will. Not necessarily. Some assets, like those held in a trust or accounts with designated beneficiaries, may not need to be included in the will.

- Once a will is created, it cannot be changed. This is false. Individuals have the right to update or change their will at any time, as long as they are of sound mind.

- Only wealthy individuals need a will. This is a misconception. Anyone with assets, regardless of their value, should consider having a will to ensure their wishes are carried out.

- Wills are only for after death. While a will does take effect upon death, it can also serve to outline preferences for guardianship and other matters while the individual is still alive.

- Wills are public documents once filed. This is true, but only after the individual's death. Until then, the will remains private.

- Verbal wills are legally binding. In New York, verbal wills are generally not recognized. A will must be written and signed to be valid.

- All wills must be notarized. While notarization can add an extra layer of validity, it is not a requirement for a will to be legally binding in New York.

By addressing these misconceptions, individuals can make informed decisions about their estate planning and ensure their wishes are honored.