New York Loan Agreement Document

The New York Loan Agreement form serves as a vital document in the lending process, outlining the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral required to secure the loan. It also addresses the rights and responsibilities of both parties, ensuring clarity and mutual understanding. Key provisions often cover late payment penalties, default consequences, and dispute resolution methods, providing a framework for resolving potential issues. By clearly stating these aspects, the Loan Agreement helps protect the interests of both lenders and borrowers, fostering a transparent and trustworthy lending environment. Understanding this form is crucial for anyone involved in borrowing or lending in New York, as it lays the groundwork for a successful financial transaction.

Discover More Loan Agreement Forms for Different States

Free Promissory Note Template Florida - Includes a section on confidentiality of the agreement's terms.

To ensure that your medical preferences are respected, it is essential to complete the necessary documentation, such as the Ohio Living Will form. This legal instrument empowers individuals to specify their treatment desires during critical health situations, alleviating ambiguity for both family and medical professionals. For more information on this important document, you can visit All Ohio Forms, which provides invaluable resources for those considering these life-altering decisions.

Similar forms

Promissory Note: This document outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. Like a loan agreement, it details the repayment schedule and interest rates.

-

RV Bill of Sale: This form is essential for the transfer of RV ownership, capturing vital details about the vehicle and transaction. To learn more about this form, visit georgiapdf.com/rv-bill-of-sale.

Mortgage Agreement: A mortgage agreement secures a loan with real estate. It shares similarities with a loan agreement, as both documents specify the loan amount, interest rate, and repayment terms.

Security Agreement: This document establishes a lender's rights to specific collateral in case of default. Both agreements outline the obligations of the borrower and the rights of the lender.

Lease Agreement: A lease agreement involves renting property and includes payment terms and conditions. Similar to a loan agreement, it defines the responsibilities of both parties and the duration of the agreement.

Credit Agreement: This document governs the terms of a line of credit. Like a loan agreement, it specifies the amount of credit available, interest rates, and repayment obligations.

Personal Loan Agreement: A personal loan agreement is a contract between an individual and a lender. It includes details about the loan amount, interest rate, and repayment schedule, much like a standard loan agreement.

Business Loan Agreement: This type of agreement is specifically for business financing. It outlines terms similar to a personal loan agreement, including repayment schedules and interest rates, but tailored for business needs.

Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares commonalities with a loan agreement in defining the obligations of both parties.

Installment Sale Agreement: In this agreement, a buyer pays for a product over time. Similar to a loan agreement, it details the payment schedule and terms of sale.

Line of Credit Agreement: This document allows borrowers to access funds up to a specified limit. It shares characteristics with a loan agreement, particularly in outlining terms, interest rates, and repayment conditions.

Document Example

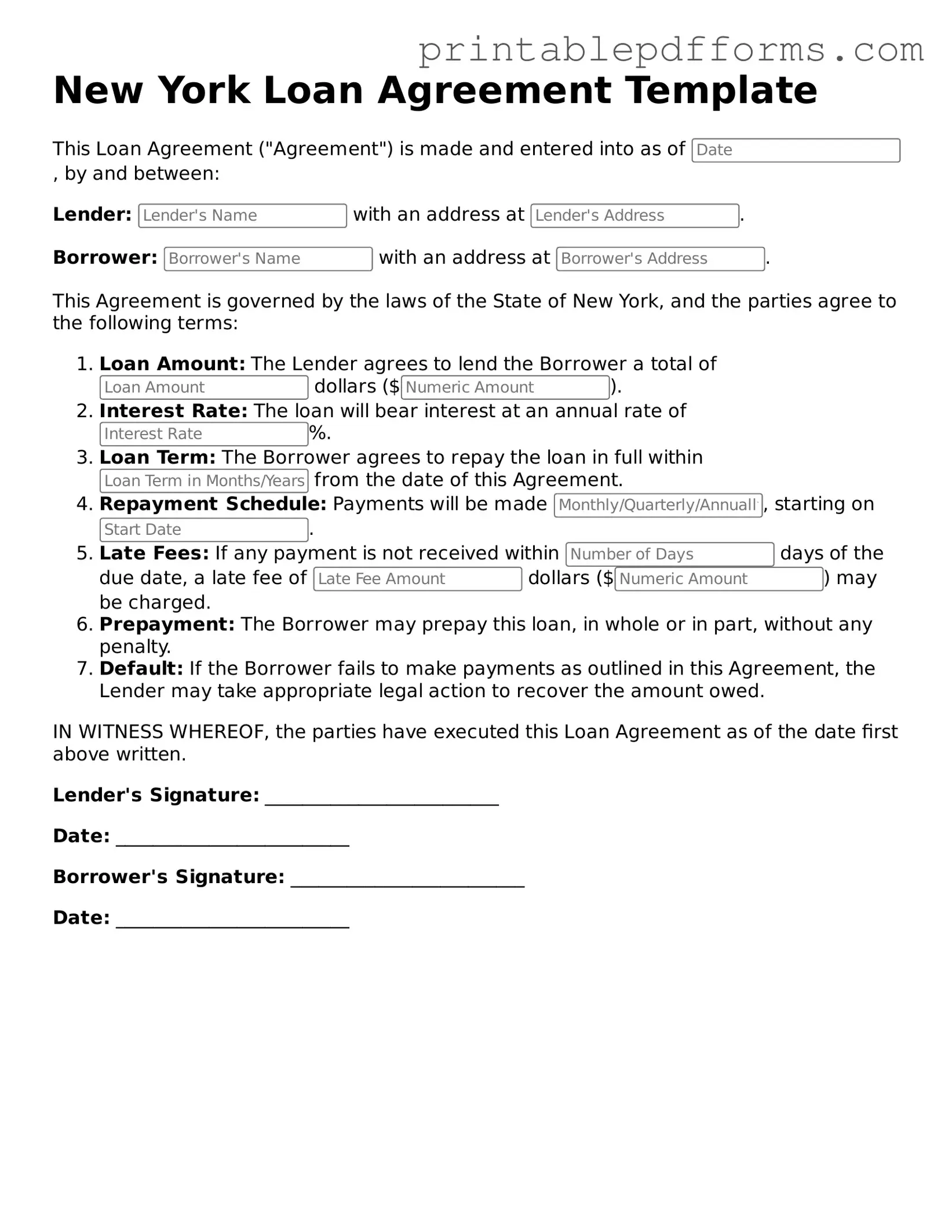

New York Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of , by and between:

Lender: with an address at .

Borrower: with an address at .

This Agreement is governed by the laws of the State of New York, and the parties agree to the following terms:

- Loan Amount: The Lender agrees to lend the Borrower a total of dollars ($).

- Interest Rate: The loan will bear interest at an annual rate of %.

- Loan Term: The Borrower agrees to repay the loan in full within from the date of this Agreement.

- Repayment Schedule: Payments will be made , starting on .

- Late Fees: If any payment is not received within days of the due date, a late fee of dollars ($) may be charged.

- Prepayment: The Borrower may prepay this loan, in whole or in part, without any penalty.

- Default: If the Borrower fails to make payments as outlined in this Agreement, the Lender may take appropriate legal action to recover the amount owed.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Lender's Signature: _________________________

Date: _________________________

Borrower's Signature: _________________________

Date: _________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement is governed by the laws of the State of New York. |

| Parties Involved | The agreement typically includes a lender and a borrower. |

| Loan Amount | The document specifies the total amount of money being loaned. |

| Interest Rate | The agreement outlines the interest rate applied to the loan. |

| Repayment Terms | It details how and when the borrower will repay the loan. |

| Default Conditions | The agreement includes conditions under which the borrower would be considered in default. |

| Collateral | If applicable, the document describes any collateral securing the loan. |

| Governing Language | The agreement is typically written in English, as it is the primary language of New York. |

| Signatures Required | Both parties must sign the agreement for it to be legally binding. |

| Amendment Clause | The agreement may include a clause on how it can be amended in the future. |

Crucial Questions on This Form

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form specifies important details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations under the agreement.

Who should use a New York Loan Agreement form?

This form is suitable for anyone entering into a loan arrangement in New York. Individuals, businesses, or organizations looking to borrow or lend money can benefit from using this agreement. It is particularly useful for private loans, business financing, or personal loans among friends or family. Having a formal agreement helps prevent misunderstandings and provides a clear record of the transaction.

What are the key components of a New York Loan Agreement form?

A comprehensive New York Loan Agreement typically includes the following components:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan, which may be fixed or variable.

- Repayment Terms: This section outlines how and when the borrower will repay the loan, including payment frequency and due dates.

- Default Clause: Details the consequences if the borrower fails to make payments as agreed.

- Signatures: Both parties must sign the agreement to make it legally binding.

Is it necessary to have a lawyer review the New York Loan Agreement form?

While it is not legally required to have a lawyer review the agreement, it is highly recommended. A legal professional can ensure that the document complies with New York laws and adequately protects your interests. They can also help clarify any complex terms and address potential issues before they arise. Taking this precaution can save both parties time and money in the long run.

Documents used along the form

When entering into a loan agreement in New York, several other forms and documents may accompany the primary agreement. Each of these documents serves a specific purpose and helps clarify the terms and conditions of the loan. Below is a list of commonly used forms that often accompany a New York Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Loan Disclosure Statement: This statement provides borrowers with key information about the loan, including fees, interest rates, and the total cost of the loan over its term.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are pledged to guarantee repayment.

- Personal Guarantee: This document is signed by an individual who agrees to be personally responsible for the loan if the borrowing entity defaults.

- Closing Statement: This statement summarizes the financial details of the loan transaction, including all costs and fees involved in closing the loan.

- UCC Financing Statement: This form is filed to publicly record the lender's interest in the collateral, providing notice to other creditors.

- Motor Vehicle Bill of Sale: This document provides a record of the transfer of ownership of a vehicle and is vital for both buyer and seller. For more information, visit freebusinessforms.org.

- Credit Application: Borrowers typically complete this form to provide lenders with their financial history and creditworthiness before the loan is approved.

- Loan Servicing Agreement: This document outlines the responsibilities of the lender or a third-party servicer in managing the loan after it has been disbursed.

- Amortization Schedule: This schedule details each payment over the life of the loan, breaking down principal and interest amounts.

Understanding these documents can help borrowers navigate the loan process more effectively. Each form plays a crucial role in ensuring that both parties are clear on their rights and obligations, ultimately leading to a smoother lending experience.

Misconceptions

Understanding the New York Loan Agreement form can be challenging, and several misconceptions often arise. Here are ten common misunderstandings, along with clarifications to help demystify the form.

-

Misconception: The New York Loan Agreement is a one-size-fits-all document.

In reality, this form can be tailored to meet the specific needs of the parties involved. It is essential to customize the agreement to reflect the terms and conditions agreed upon by both the lender and the borrower.

-

Misconception: Only banks can use the New York Loan Agreement form.

This is not true. While banks frequently utilize this form, any individual or entity that lends money can use it, provided they follow the legal requirements.

-

Misconception: The New York Loan Agreement does not require signatures.

Actually, signatures from both parties are essential for the agreement to be legally binding. Without them, the document lacks enforceability.

-

Misconception: The agreement is only about repayment terms.

While repayment terms are a crucial part of the agreement, it also includes provisions regarding interest rates, default conditions, and collateral, among other elements.

-

Misconception: Once signed, the terms of the agreement cannot be changed.

This is misleading. Parties can amend the agreement if both sides agree to the changes, but it is advisable to document any amendments formally.

-

Misconception: The New York Loan Agreement is only for large loans.

This form can be used for loans of any size. Whether the loan is small or large, the agreement helps clarify the terms and protect both parties.

-

Misconception: The agreement is automatically enforceable in court.

While the agreement can be enforceable, it must comply with all relevant laws and regulations. If it does not, a court may refuse to enforce it.

-

Misconception: All loan agreements in New York must be notarized.

Notarization is not a requirement for all loan agreements. However, having a notary can add an extra layer of authenticity and may be required for certain types of loans.

-

Misconception: The New York Loan Agreement form is the same as a promissory note.

These are distinct documents. A promissory note is a promise to pay back a loan, while the loan agreement outlines the terms of the loan itself.

-

Misconception: Once the loan is paid off, the agreement is no longer relevant.

Even after repayment, the agreement may still hold significance, especially if there are disputes or if the parties need to refer back to the original terms.

By addressing these misconceptions, individuals can better navigate the complexities of the New York Loan Agreement and ensure that their financial dealings are clear and legally sound.