New York Operating Agreement Document

The New York Operating Agreement form serves as a foundational document for Limited Liability Companies (LLCs) operating within the state. This form outlines the internal structure and management of the LLC, detailing the rights and responsibilities of its members. Key components typically included are the management structure, voting procedures, profit distribution, and procedures for adding or removing members. Furthermore, the agreement addresses dispute resolution methods and outlines the process for amending the document itself. By establishing clear guidelines, the Operating Agreement helps prevent misunderstandings among members and provides a roadmap for the LLC's operations. Its importance cannot be overstated, as it not only complies with state requirements but also protects the interests of all parties involved.

Discover More Operating Agreement Forms for Different States

Is an Operating Agreement Required for an Llc in California - The Operating Agreement can help establish trust among members.

To ensure a smooth transaction when buying or selling a vehicle, it’s important to utilize the California Motor Vehicle Bill of Sale form, which you can find detailed information for, including instructions on how to properly fill it out by visiting Automotive Bill of Sale.

How to Make an Operating Agreement - It creates a formal structure that can alleviate tensions among members.

Similar forms

- Partnership Agreement: This document outlines the relationship between partners in a business. Like an Operating Agreement, it details roles, responsibilities, and profit sharing.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they define how decisions are made and the roles of directors and officers.

-

Bill of Sale: The Bill of Sale form is crucial for documenting the transfer of ownership of personal property, ensuring both buyer and seller are protected and have a clear record of the transaction.

- Shareholder Agreement: This agreement is for corporations and outlines the rights and obligations of shareholders. It’s akin to an Operating Agreement in that it addresses ownership and management issues.

- Limited Partnership Agreement: This document is used for limited partnerships and specifies the roles of general and limited partners. It shares similarities with an Operating Agreement in defining the management structure.

- Joint Venture Agreement: This outlines the terms of a partnership between two or more parties for a specific project. Like an Operating Agreement, it clarifies contributions, management, and profit sharing.

- Nonprofit Bylaws: These govern the operations of a nonprofit organization. Similar to an Operating Agreement, they set rules for governance and decision-making.

- Membership Agreement: Used in cooperatives or LLCs, this document details the rights and responsibilities of members. It parallels an Operating Agreement in its focus on member roles.

- Franchise Agreement: This contract outlines the terms between a franchisor and franchisee. It shares similarities with an Operating Agreement by detailing operational guidelines and responsibilities.

- Operating Plan: This document outlines the operational strategies for a business. It is similar to an Operating Agreement in that it provides a roadmap for management and operations.

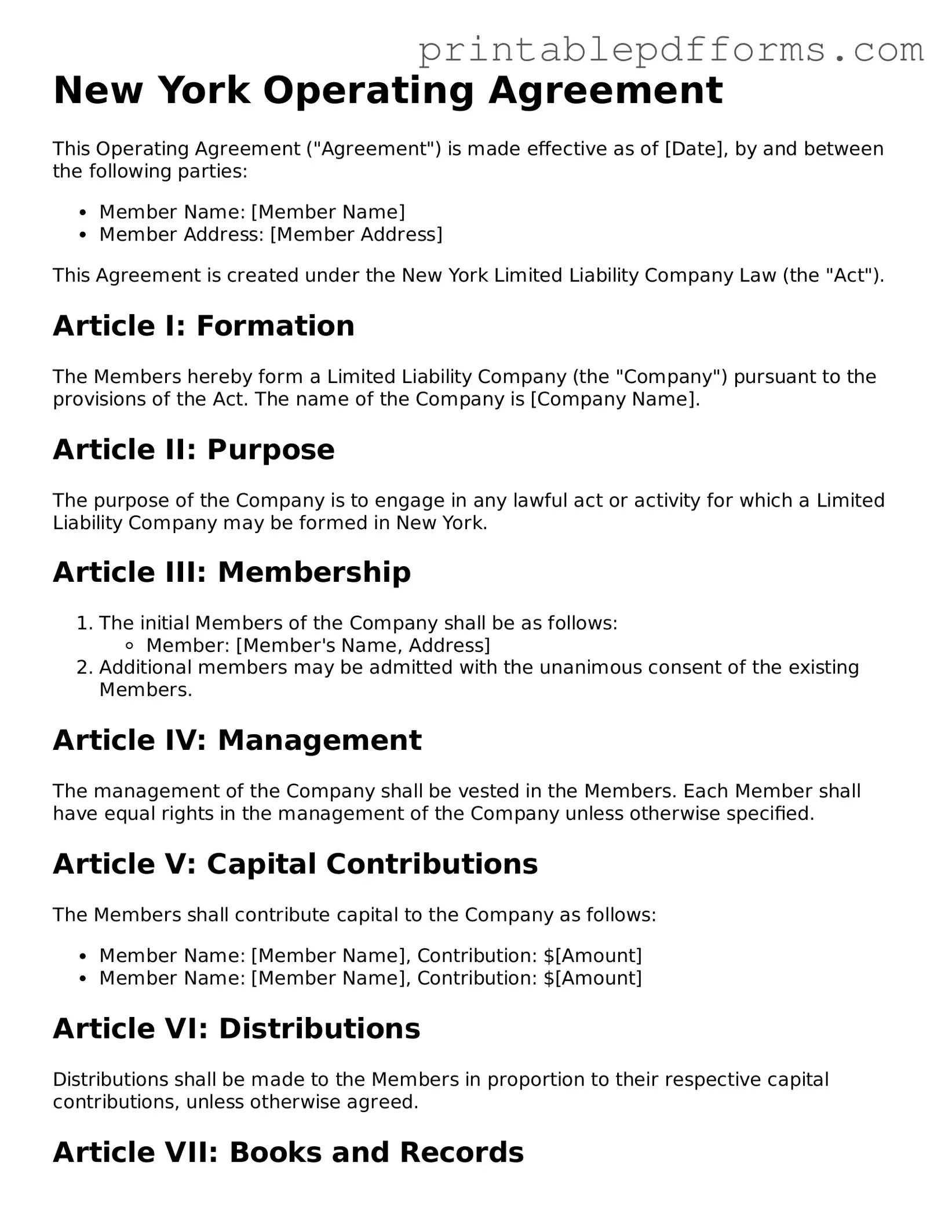

Document Example

New York Operating Agreement

This Operating Agreement ("Agreement") is made effective as of [Date], by and between the following parties:

- Member Name: [Member Name]

- Member Address: [Member Address]

This Agreement is created under the New York Limited Liability Company Law (the "Act").

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") pursuant to the provisions of the Act. The name of the Company is [Company Name].

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be formed in New York.

Article III: Membership

- The initial Members of the Company shall be as follows:

- Member: [Member's Name, Address]

- Additional members may be admitted with the unanimous consent of the existing Members.

Article IV: Management

The management of the Company shall be vested in the Members. Each Member shall have equal rights in the management of the Company unless otherwise specified.

Article V: Capital Contributions

The Members shall contribute capital to the Company as follows:

- Member Name: [Member Name], Contribution: $[Amount]

- Member Name: [Member Name], Contribution: $[Amount]

Article VI: Distributions

Distributions shall be made to the Members in proportion to their respective capital contributions, unless otherwise agreed.

Article VII: Books and Records

The Company shall maintain complete and accurate books and records of the Company's business and affairs as required by the Act.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article IX: Indemnification

The Company shall indemnify any Member to the fullest extent permitted by law against any and all expenses and liabilities incurred in connection with the Company's affairs.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

- _________________________ (Signature of Member)

- _________________________ (Date)

- _________________________ (Signature of Member)

- _________________________ (Date)

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | The New York Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the New York Limited Liability Company Law. |

| Mandatory Requirement | While not required to be filed with the state, having an Operating Agreement is crucial for LLCs in New York. |

| Members' Rights | The agreement specifies the rights and responsibilities of the members, ensuring clarity in operations. |

| Management Structure | It can outline whether the LLC is member-managed or manager-managed, affecting decision-making processes. |

| Profit Distribution | The Operating Agreement details how profits and losses will be distributed among members. |

| Amendments | It provides a process for making amendments, allowing flexibility as the business evolves. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, promoting harmony. |

| Duration | It can specify the duration of the LLC, whether it is perpetual or for a set term. |

| Compliance | Having a well-drafted Operating Agreement helps ensure compliance with state regulations and protects member interests. |

Crucial Questions on This Form

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in New York. It details the rights and responsibilities of members, how profits and losses are distributed, and the procedures for decision-making. While not required by law, having an Operating Agreement is highly recommended as it helps prevent disputes and provides clarity on the LLC's operations.

Why do I need an Operating Agreement for my LLC?

An Operating Agreement is essential for several reasons:

- It establishes the rules and guidelines for running the LLC.

- It protects the limited liability status of the members by showing that the LLC is a separate entity.

- It helps prevent misunderstandings among members by clearly defining roles and responsibilities.

- It can serve as a reference in case of disputes or legal issues.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC. However, it is advisable to seek legal assistance to ensure that the document complies with New York laws and accurately reflects the intentions of the members. A lawyer can help tailor the agreement to your specific needs and address any potential issues that may arise in the future.

What should be included in the Operating Agreement?

An effective Operating Agreement should cover the following key elements:

- Basic information about the LLC, including its name, purpose, and principal office address.

- Details about the members, including their ownership percentages and capital contributions.

- Management structure, specifying whether the LLC is member-managed or manager-managed.

- Procedures for voting, meetings, and decision-making.

- Distribution of profits and losses among members.

- Guidelines for adding or removing members.

- Procedures for resolving disputes among members.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members can agree to changes at any time, provided they follow the amendment procedures outlined in the original agreement. It is important to document any amendments in writing and have all members sign the updated agreement to ensure that everyone is in agreement and to maintain clarity regarding the LLC's operations.

Documents used along the form

The New York Operating Agreement is a crucial document for limited liability companies (LLCs), outlining the management structure and operational guidelines. However, several other forms and documents often accompany this agreement to ensure comprehensive legal compliance and clarity among members. Below is a list of these essential documents.

- Articles of Organization: This document is filed with the New York Department of State to officially create the LLC. It includes basic information such as the company name, address, and the name of the registered agent.

- Membership Certificates: These certificates serve as proof of ownership for each member of the LLC. They outline the member’s stake in the company and can be important for transferring ownership interests.

- Operating Procedures: This document details the day-to-day operational procedures of the LLC. It can address topics like decision-making processes, voting rights, and member responsibilities.

- Bill of Sale Form: To secure your sales transactions, refer to our comprehensive bill of sale form resources that ensure all legal aspects are addressed.

- Bylaws: While not always required for LLCs, bylaws can provide additional governance rules. They may include guidelines on meetings, member rights, and other operational matters.

- Initial Capital Contributions Agreement: This agreement outlines the initial financial contributions made by each member. It specifies the amount contributed and the ownership percentage each member holds in the LLC.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover various topics, including the approval of major business decisions or changes in membership.

- Tax Forms: LLCs must also complete various tax forms to comply with federal and state tax regulations. This may include forms for income tax, sales tax, and employment tax, depending on the nature of the business.

These documents, when used in conjunction with the New York Operating Agreement, help establish a clear framework for the LLC's operations and governance. Properly preparing and maintaining these forms can contribute to a well-functioning business and provide legal protections for all members involved.

Misconceptions

When it comes to the New York Operating Agreement form, several misconceptions often arise. Understanding these can help individuals and businesses navigate the process more effectively.

- Misconception 1: An Operating Agreement is only necessary for large businesses.

- Misconception 2: The Operating Agreement is a public document.

- Misconception 3: An Operating Agreement is not legally binding.

- Misconception 4: The Operating Agreement cannot be changed once established.

Many believe that only large corporations need an Operating Agreement. In reality, any Limited Liability Company (LLC) in New York, regardless of size, benefits from having this document. It outlines the management structure and operational procedures, providing clarity for all members.

Some people think that the Operating Agreement must be filed with the state and is therefore public. However, this is not the case. The Operating Agreement is an internal document and does not need to be submitted to the New York Secretary of State, ensuring privacy for the members.

There is a common belief that the Operating Agreement lacks legal weight. On the contrary, it is a legally binding contract among the members of the LLC. If disputes arise, the agreement can be enforced in court, making it a crucial document for all members.

Some individuals think that once an Operating Agreement is created, it cannot be modified. This is incorrect. Members can amend the agreement as needed, provided they follow the procedures outlined within the document itself. Flexibility is one of the key advantages of having an Operating Agreement.