New York Power of Attorney Document

In the realm of personal and financial planning, the New York Power of Attorney form plays a crucial role in enabling individuals to designate someone they trust to make decisions on their behalf. This legal document empowers an agent, often referred to as an attorney-in-fact, to handle a variety of matters, including financial transactions, real estate decisions, and even healthcare choices, depending on the authority granted. It is essential to understand that this form can be tailored to fit specific needs; individuals can choose to grant broad powers or limit the agent's authority to particular tasks. Furthermore, the form must be signed in the presence of a notary public to ensure its validity, and it is advisable to discuss the implications of this decision with a trusted advisor. The New York Power of Attorney form not only facilitates the management of affairs during times of incapacity but also provides peace of mind, knowing that your interests will be safeguarded by someone you trust. As you navigate the intricacies of this document, consider the responsibilities it entails and the importance of selecting the right person for this significant role.

Discover More Power of Attorney Forms for Different States

Does a Power of Attorney Need to Be Recorded in Pennsylvania - A Power of Attorney may include provisions for its amendment or revocation as needed.

California Durable Power of Attorney - With a Power of Attorney, you can manage finances, property, and other important responsibilities.

A Georgia Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Georgia. This form ensures that the transaction is properly documented and is essential for establishing and proving property ownership. For those looking to navigate the real estate landscape in Georgia, it is important to familiarize oneself with the necessary components and requirements, and a great place to start is by referring to the Deed form.

Simple Power of Attorney Form Florida - A Power of Attorney can simplify the management of your estate upon your passing.

Power of Attorney Form -- Pdf - The form can be revoked, allowing you to regain control anytime you choose.

Similar forms

The Power of Attorney (POA) form is a crucial legal document that allows one individual to act on behalf of another in various matters. Several other documents share similarities with the Power of Attorney, each serving specific purposes while empowering individuals to make decisions for others. Below is a list of ten such documents, along with brief explanations of their similarities to the Power of Attorney.

- Living Will: A living will allows individuals to outline their preferences regarding medical treatment in the event they become incapacitated. Like a POA, it provides guidance to others about the individual's wishes.

- Healthcare Proxy: This document designates a person to make medical decisions on behalf of another. Similar to a POA, it grants authority to act in specific situations, particularly concerning health care.

- Durable Power of Attorney: This variant of the standard POA remains effective even if the principal becomes incapacitated. It shares the same fundamental purpose of granting authority to manage affairs.

- Financial Power of Attorney: This document specifically focuses on financial matters, allowing one person to manage another's financial affairs. It operates under the same principles as a general POA.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Both documents involve the delegation of authority and management of assets.

- Guardianship Agreement: This legal arrangement appoints a guardian to make decisions for a minor or incapacitated adult. Like a POA, it involves granting decision-making authority to another individual.

- Assignment of Benefits: This document allows one person to assign their benefits, such as insurance or retirement benefits, to another. It shares the concept of transferring authority to manage certain rights or benefits.

-

Residential Lease Agreement: The Ohio Residential Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for the rental of residential property. This agreement is crucial for both parties to ensure rights and responsibilities are clearly defined. It serves as a foundation for a secure and mutually beneficial relationship throughout the lease term. For more details, visit All Ohio Forms.

- Advance Healthcare Directive: This document combines elements of a living will and healthcare proxy, providing instructions for medical care and appointing a decision-maker. It parallels the POA in terms of decision-making authority.

- Release of Liability Form: This form allows individuals to waive certain rights or claims against another party. It reflects the concept of granting authority to act in specific contexts, similar to a POA.

- Employment Authorization Document: This document permits an individual to work in the United States. It involves the delegation of authority to manage employment-related matters, akin to the powers granted in a POA.

Each of these documents plays a vital role in facilitating decision-making and managing affairs on behalf of others, highlighting the importance of clear communication and trust in personal and legal relationships.

Document Example

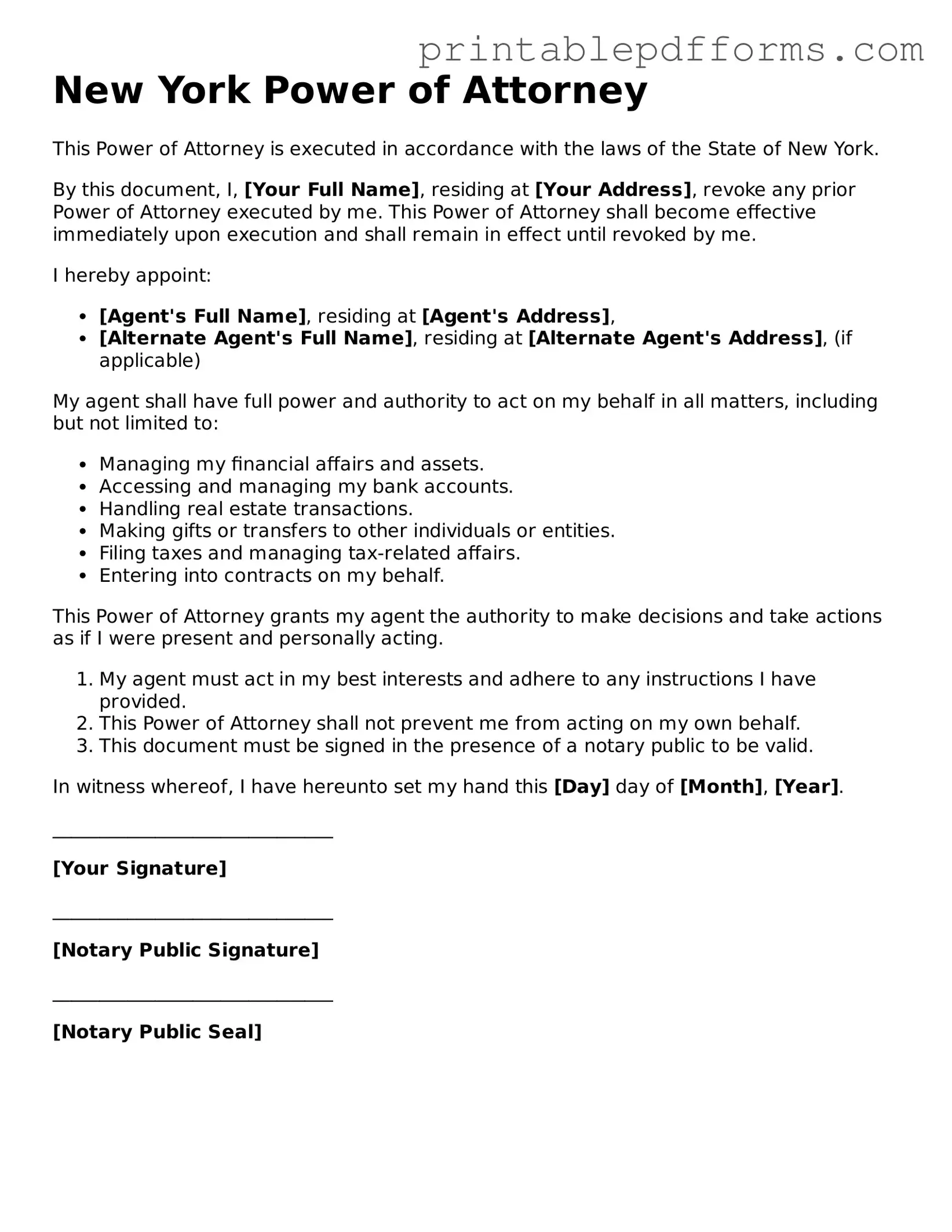

New York Power of Attorney

This Power of Attorney is executed in accordance with the laws of the State of New York.

By this document, I, [Your Full Name], residing at [Your Address], revoke any prior Power of Attorney executed by me. This Power of Attorney shall become effective immediately upon execution and shall remain in effect until revoked by me.

I hereby appoint:

- [Agent's Full Name], residing at [Agent's Address],

- [Alternate Agent's Full Name], residing at [Alternate Agent's Address], (if applicable)

My agent shall have full power and authority to act on my behalf in all matters, including but not limited to:

- Managing my financial affairs and assets.

- Accessing and managing my bank accounts.

- Handling real estate transactions.

- Making gifts or transfers to other individuals or entities.

- Filing taxes and managing tax-related affairs.

- Entering into contracts on my behalf.

This Power of Attorney grants my agent the authority to make decisions and take actions as if I were present and personally acting.

- My agent must act in my best interests and adhere to any instructions I have provided.

- This Power of Attorney shall not prevent me from acting on my own behalf.

- This document must be signed in the presence of a notary public to be valid.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

______________________________

[Your Signature]

______________________________

[Notary Public Signature]

______________________________

[Notary Public Seal]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | The New York Power of Attorney form is governed by New York General Obligations Law, Article 5, Title 15. |

| Types of POA | In New York, there are two main types: Durable and Non-Durable Power of Attorney. Durable remains effective even if the principal becomes incapacitated. |

| Execution Requirements | The form must be signed by the principal and acknowledged before a notary public or signed in the presence of two witnesses. |

| Agent's Authority | The agent can be granted broad or limited powers, which must be clearly specified in the document. |

| Revocation | A Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and must keep accurate records of all transactions made on their behalf. |

| Validity | A properly executed Power of Attorney remains valid until revoked by the principal or until the principal's death. |

| Common Uses | POAs are commonly used for managing financial affairs, real estate transactions, and healthcare decisions. |

Crucial Questions on This Form

What is a Power of Attorney in New York?

A Power of Attorney (POA) in New York is a legal document that allows one person (the principal) to appoint another person (the agent) to make decisions on their behalf. This can include financial matters, legal decisions, or health care choices. The principal retains the right to revoke the POA at any time, as long as they are mentally competent.

What types of Power of Attorney are available in New York?

New York recognizes several types of Power of Attorney, including:

- General Power of Attorney: Grants broad authority to the agent to handle a wide range of financial and legal matters.

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

- Health Care Proxy: Specifically allows the agent to make medical decisions for the principal if they are unable to do so.

- Limited Power of Attorney: Grants the agent authority to act in specific situations or for a limited time.

How do I create a Power of Attorney in New York?

To create a Power of Attorney in New York, follow these steps:

- Choose a trusted individual to act as your agent.

- Obtain the New York State Power of Attorney form, which is available online or at legal offices.

- Fill out the form, specifying the powers you wish to grant your agent.

- Sign the document in the presence of a notary public.

- Consider having the document witnessed, although it is not required.

Do I need a lawyer to create a Power of Attorney?

While it is not legally required to have a lawyer to create a Power of Attorney in New York, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. This is particularly important if you have complex financial situations or specific concerns regarding your health care decisions.

Can I revoke a Power of Attorney in New York?

Yes, you can revoke a Power of Attorney in New York at any time, as long as you are mentally competent. To revoke it, you should create a written notice of revocation, sign it, and provide copies to your agent and any institutions or individuals that may have relied on the original POA. It is advisable to destroy any copies of the original document to prevent confusion.

What happens if I become incapacitated and have a Power of Attorney?

If you become incapacitated and have a Durable Power of Attorney in place, your agent can continue to act on your behalf. They will have the authority to make decisions regarding your finances and health care, as specified in the document. If you do not have a Durable Power of Attorney, the POA may become invalid, and a court may need to appoint a guardian to manage your affairs.

Is a Power of Attorney valid if I move to another state?

A Power of Attorney created in New York is generally valid in other states, but this can vary depending on the laws of the new state. It is advisable to check the requirements in the new state to ensure that your POA remains effective. Some states may require a new POA to be drafted according to their specific laws.

What should I consider when choosing an agent for my Power of Attorney?

Choosing an agent for your Power of Attorney is a significant decision. Consider the following factors:

- Trustworthiness: Select someone you trust to act in your best interest.

- Availability: Ensure that the person is willing and able to take on the responsibilities involved.

- Financial acumen: If your POA involves financial decisions, consider someone who is knowledgeable about financial matters.

- Willingness to communicate: Choose someone who will keep you informed and consult with you when possible.

Documents used along the form

When creating a Power of Attorney in New York, several other documents may be necessary to ensure your legal and financial matters are properly managed. Each of these forms serves a unique purpose, complementing the Power of Attorney and providing additional clarity or authority. Below is a list of commonly used documents alongside the New York Power of Attorney form.

- Health Care Proxy: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are respected.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate your preferences. It specifically addresses end-of-life care and other critical health decisions.

- Advance Directive: This combines both a Health Care Proxy and a Living Will, providing comprehensive instructions regarding your medical care and appointing a decision-maker.

- Durable Power of Attorney: While similar to a standard Power of Attorney, this version remains effective even if you become incapacitated. It ensures continuous management of your affairs.

- Financial Power of Attorney: This document specifically focuses on financial matters, allowing someone to handle your financial transactions, pay bills, and manage investments on your behalf.

- Will: A Will outlines how you want your assets distributed after your death. It also allows you to name guardians for any minor children.

- Trust Agreement: A Trust Agreement can help manage your assets during your lifetime and after your death. It provides specific instructions on how your assets should be handled and distributed.

- Mobile Home Bill of Sale: For accurate transfers of ownership, refer to the reliable Mobile Home Bill of Sale template to ensure all legal details are correctly handled.

- Beneficiary Designation Forms: These forms are used for life insurance policies, retirement accounts, and bank accounts. They specify who will receive these assets upon your death.

- Real Estate Transfer Documents: If you plan to transfer property, these documents are necessary to legally transfer ownership of real estate assets.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person, particularly when there is no Will. It helps clarify who is entitled to inherit property.

Using these documents in conjunction with the New York Power of Attorney can help ensure that your wishes are honored and your affairs are managed according to your preferences. It is advisable to consult with a legal professional to tailor these documents to your specific needs and circumstances.

Misconceptions

Understanding the New York Power of Attorney form can be challenging. Here are nine common misconceptions that people often have about this important legal document:

- It only applies to financial matters. Many believe that a Power of Attorney is solely for financial decisions. In reality, it can also be used for health care decisions and other personal matters, depending on how it is drafted.

- Once signed, it cannot be revoked. Some think that signing a Power of Attorney is a permanent decision. However, you can revoke it at any time, as long as you are mentally competent.

- All Powers of Attorney are the same. Not all Power of Attorney forms are identical. Each can be tailored to fit specific needs, whether for broad authority or limited purposes.

- It must be notarized to be valid. While notarization is often recommended, it is not always required. A Power of Attorney can be valid with just the signatures of the principal and the agent, depending on the circumstances.

- My agent can do anything I can do. Some assume that their appointed agent has unlimited powers. However, the extent of authority granted is defined within the document itself, and certain actions may require explicit permission.

- It expires after a certain period. Many people think that a Power of Attorney has a set expiration date. In fact, it remains effective until revoked or until the principal becomes incapacitated, unless otherwise specified.

- Only lawyers can prepare a Power of Attorney. While legal assistance can be beneficial, individuals can prepare their own Power of Attorney using state-approved forms, provided they understand the requirements.

- It is only necessary for the elderly or sick. Some believe that only older adults or those with health issues need a Power of Attorney. In truth, anyone can benefit from having one, as life is unpredictable.

- My family can make decisions for me without a Power of Attorney. While family members may wish to help, they may not have the legal authority to make decisions on your behalf without a Power of Attorney in place.

By clarifying these misconceptions, individuals can better understand the importance and functionality of the New York Power of Attorney form.