New York Promissory Note Document

When it comes to borrowing or lending money in New York, understanding the Promissory Note form is crucial. This document serves as a written promise from the borrower to repay a specific amount of money to the lender within a defined timeframe. Key elements of the form include the loan amount, interest rate, repayment schedule, and any applicable late fees. Additionally, it outlines the rights and obligations of both parties, ensuring that everyone is on the same page. The Promissory Note can also specify whether the loan is secured or unsecured, which can significantly impact the lender's recourse in case of default. Given the importance of clarity and legality in financial transactions, having a well-drafted Promissory Note can protect both the lender's investment and the borrower's interests. As financial relationships can often become complicated, utilizing this form effectively can help prevent misunderstandings and disputes down the line. Understanding the nuances of the New York Promissory Note form is essential for anyone involved in a lending agreement, whether you are a seasoned investor or someone borrowing for the first time.

Discover More Promissory Note Forms for Different States

Florida Promissory Note Requirements - The lender often retains the original note while the borrower keeps a copy.

By utilizing the Washington Divorce Settlement Agreement form, you can create a comprehensive outline that addresses critical issues in your divorce, such as asset division, child support, and alimony. This document serves as a clear reference for both parties, reducing misunderstandings and ensuring compliance with agreed terms. For additional resources that can assist you in this process, visit All Washington Forms.

Create a Promissory Note - A well-structured note can enhance trust between lenders and borrowers.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing money, including the repayment schedule and interest rates. However, it typically includes more detailed clauses regarding the rights and responsibilities of both parties.

- Mortgage: A mortgage is a type of promissory note secured by real property. It involves a borrower agreeing to repay a loan while giving the lender a claim to the property if the borrower defaults.

- Credit Agreement: This document specifies the terms under which credit is extended to a borrower. Like a promissory note, it includes repayment terms but often covers a broader range of financial products.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in scheduled payments over time. It shares similarities with a promissory note in its repayment structure.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While less formal than a promissory note, it serves a similar purpose by indicating that one party owes money to another.

- Personal Loan Agreement: This document outlines the terms of a personal loan between individuals. It resembles a promissory note in its focus on repayment terms and obligations.

- Ohio IT AR Form: This document is crucial for taxpayers seeking refunds on state income tax or school district income tax. It requires detailed information on withheld taxes and payment history, aligning with the principles of financial obligation shared by other documents. For more details, you can refer to All Ohio Forms.

- Business Loan Agreement: This is a formal contract between a lender and a business borrower. It includes specific terms for repayment and interest, similar to a promissory note but tailored for business transactions.

- Lease Agreement: A lease agreement may include a promissory note as part of its terms when payments are made over time for rental property. Both documents involve payment obligations.

- Sales Agreement: In some cases, a sales agreement may include a promissory note if the buyer agrees to pay for goods or services over time. It outlines payment terms similar to those in a promissory note.

- Settlement Agreement: A settlement agreement may involve a promissory note when one party agrees to pay a sum to another as part of resolving a dispute. It contains similar repayment terms.

Document Example

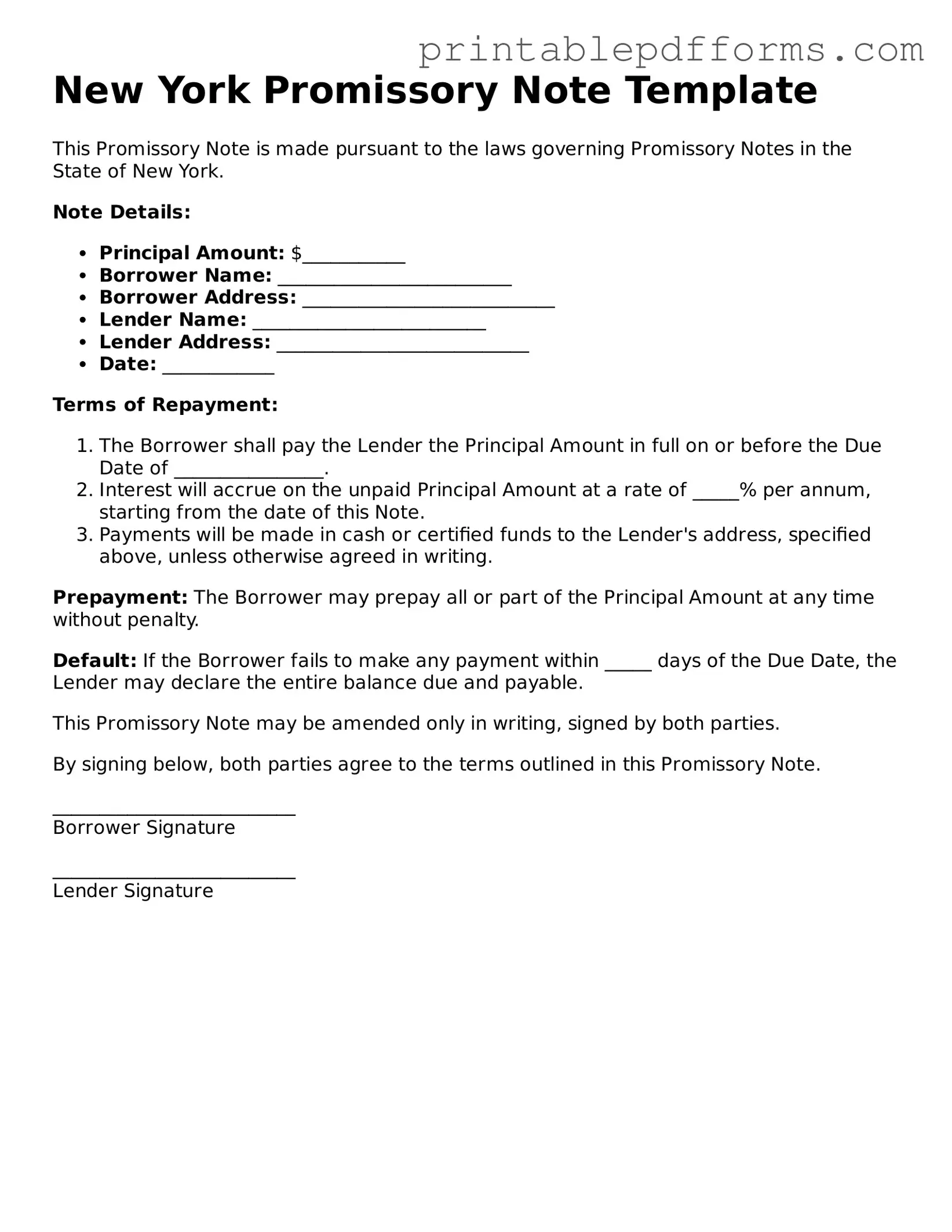

New York Promissory Note Template

This Promissory Note is made pursuant to the laws governing Promissory Notes in the State of New York.

Note Details:

- Principal Amount: $___________

- Borrower Name: _________________________

- Borrower Address: ___________________________

- Lender Name: _________________________

- Lender Address: ___________________________

- Date: ____________

Terms of Repayment:

- The Borrower shall pay the Lender the Principal Amount in full on or before the Due Date of ________________.

- Interest will accrue on the unpaid Principal Amount at a rate of _____% per annum, starting from the date of this Note.

- Payments will be made in cash or certified funds to the Lender's address, specified above, unless otherwise agreed in writing.

Prepayment: The Borrower may prepay all or part of the Principal Amount at any time without penalty.

Default: If the Borrower fails to make any payment within _____ days of the Due Date, the Lender may declare the entire balance due and payable.

This Promissory Note may be amended only in writing, signed by both parties.

By signing below, both parties agree to the terms outlined in this Promissory Note.

__________________________

Borrower Signature

__________________________

Lender Signature

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Parties Involved | The note typically involves a maker (the borrower) and a payee (the lender). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the note. |

| Payment Terms | Payment terms must specify when and how payments will be made, including any grace periods. |

| Default Clause | A default clause outlines the consequences if the maker fails to make payments. |

| Transferability | Promissory notes are generally negotiable, allowing the payee to transfer rights to another party. |

| Signature Requirement | The maker's signature is essential for the note to be enforceable. |

| Legal Recourse | If the maker defaults, the payee can pursue legal action to recover the owed amount. |

Crucial Questions on This Form

What is a New York Promissory Note?

A New York Promissory Note is a legal document in which one party, known as the borrower, agrees to pay a specified amount of money to another party, known as the lender, at a predetermined date or on demand. This document serves as a written promise to repay the borrowed amount, often with interest. It is essential for establishing clear terms and protecting the interests of both parties involved in the transaction.

What information is typically included in a New York Promissory Note?

A New York Promissory Note generally includes the following key components:

- Borrower and Lender Information: Names and contact details of both parties.

- Loan Amount: The principal amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Payment Terms: Details on how and when payments will be made, including any grace periods.

- Maturity Date: The date by which the loan must be fully repaid.

- Signatures: Both parties must sign to validate the agreement.

Is a New York Promissory Note legally binding?

Yes, a New York Promissory Note is legally binding as long as it meets certain criteria. Both parties must agree to the terms, and the document must be signed. It is advisable for both parties to keep a copy of the signed note for their records. In case of a dispute, this document can be presented in court as evidence of the agreement.

Can a New York Promissory Note be modified after it is signed?

Yes, a New York Promissory Note can be modified, but both parties must agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note. This ensures that everyone is on the same page and protects against misunderstandings in the future.

What should I do if the borrower fails to make payments?

If the borrower fails to make payments as agreed, the lender has several options. First, review the terms of the Promissory Note to understand the remedies available. The lender may choose to contact the borrower to discuss the missed payments and seek a resolution. If the situation does not improve, legal action may be necessary. Consulting with a legal professional can provide guidance on the best course of action based on the specific circumstances.

Documents used along the form

A New York Promissory Note is a critical document used to outline the terms of a loan between a borrower and a lender. Along with this note, several other forms and documents are commonly utilized to ensure clarity and legal compliance in the lending process. Here is a list of some of these important documents.

- Loan Agreement: This document details the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Bill of Sale Form: For the transfer of personal property ownership, refer to our essential Ohio bill of sale documentation guide to ensure all legal requirements are met.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged to guarantee repayment. It outlines the rights of the lender in the event of default.

- Disclosure Statement: This document provides essential information about the loan, including the total cost, interest rates, and any fees. It ensures that the borrower fully understands the financial obligations before signing.

- Personal Guarantee: In some cases, a personal guarantee may be required, where an individual agrees to be personally responsible for the loan if the borrower defaults. This adds an extra layer of security for the lender.

- Amortization Schedule: This schedule outlines the repayment plan, showing how much of each payment goes toward principal and interest over the life of the loan. It helps borrowers plan their finances accordingly.

These documents work together to create a clear framework for the lending process, protecting the interests of both the borrower and the lender. Understanding each of these forms is essential for anyone involved in a loan transaction in New York.

Misconceptions

Misconceptions about the New York Promissory Note form can lead to confusion and potential legal issues. Below are seven common misconceptions along with clarifications.

- All Promissory Notes Must Be Notarized: Many believe that notarization is a requirement for all promissory notes. However, in New York, notarization is not mandatory for a promissory note to be legally binding.

- Only Banks Can Issue Promissory Notes: Some individuals think that only financial institutions can create promissory notes. In reality, any person or business can issue a promissory note as long as the terms are clear and agreed upon.

- Promissory Notes Are Only for Loans: It is a common misconception that promissory notes are exclusively used for loans. They can also be used in various transactions where one party agrees to pay another party a specific amount of money.

- Verbal Agreements Are Sufficient: Some believe that a verbal agreement is enough to constitute a promissory note. However, having a written document is essential for clarity and enforceability.

- Interest Rates Are Always Required: Many think that a promissory note must include an interest rate. While including an interest rate is common, it is not a legal requirement. A note can be interest-free.

- Promissory Notes Are the Same as Contracts: There is a misconception that promissory notes are identical to contracts. While both are legal documents, a promissory note specifically outlines a promise to pay a certain amount, whereas contracts can cover a broader range of agreements.

- They Cannot Be Transferred: Some people believe that once a promissory note is created, it cannot be transferred to another party. In fact, promissory notes can often be assigned or sold to another individual or entity, unless otherwise stated in the document.