New York Quitclaim Deed Document

The New York Quitclaim Deed is a vital legal instrument that facilitates the transfer of property ownership between parties. Often used in situations where the seller's title may not be fully guaranteed, this form allows one party, known as the grantor, to convey their interest in a property to another party, the grantee, without making any warranties about the title's validity. This means that the grantee receives whatever interest the grantor holds, which could range from full ownership to a mere partial interest. The Quitclaim Deed is particularly useful in family transactions, such as transferring property between relatives or during divorce proceedings, where the parties may trust each other to handle the transfer without the need for extensive title searches or guarantees. However, it is essential for both parties to understand that this type of deed does not provide the same level of protection as other deed forms, such as warranty deeds, which offer assurances regarding the title's clear status. Therefore, careful consideration should be given before proceeding with a Quitclaim Deed, as it can have significant implications for property rights and future ownership disputes.

Discover More Quitclaim Deed Forms for Different States

Pennsylvania Quit Claim Deed Form - A Quitclaim Deed does not provide protection against claims by third parties, highlighting the need for clear communication among parties.

How Do I File a Quit Claim Deed - The Quitclaim Deed can be utilized for both residential and commercial properties.

For more information on the WC-240 form and its importance in the workers' compensation process in Georgia, you can visit https://georgiapdf.com/wc-240-georgia/, where you'll find resources that can help clarify the procedures and requirements involved.

Florida Quit Claim Deed Filled Out - A Quitclaim Deed can make the process of inheritance easier.

Similar forms

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it offers more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed provides some assurance that the property hasn’t been sold to someone else and that it is free from encumbrances, except those disclosed.

- Deed of Trust: This document secures a loan on the property. It involves three parties: the borrower, the lender, and a trustee, who holds the title until the loan is paid off.

- Mortgage: A mortgage creates a lien on the property in favor of the lender. While a quitclaim deed transfers ownership, a mortgage secures a loan against the property.

- Lease Agreement: This document allows a tenant to occupy property owned by someone else for a specified time. Unlike a quitclaim deed, it does not transfer ownership but grants use rights.

- Affidavit of Title: This sworn statement affirms that the seller has legal ownership of the property and outlines any liens or claims against it. It is often used in conjunction with other deeds.

- Ohio IT AR Form: This form can be critical for individuals looking to reclaim funds from their state income tax or school district income tax, similar to how certain deeds facilitate the transfer of property rights. For more information, visit All Ohio Forms.

- Bill of Sale: This document transfers ownership of personal property, similar to how a quitclaim deed transfers real property. It provides proof of sale and ownership change.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. It can be used to execute a quitclaim deed.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer ownership itself, it sets the stage for a quitclaim deed to be executed.

- Trust Agreement: This document establishes a trust to hold property for the benefit of another. It can involve quitclaim deeds to transfer property into the trust.

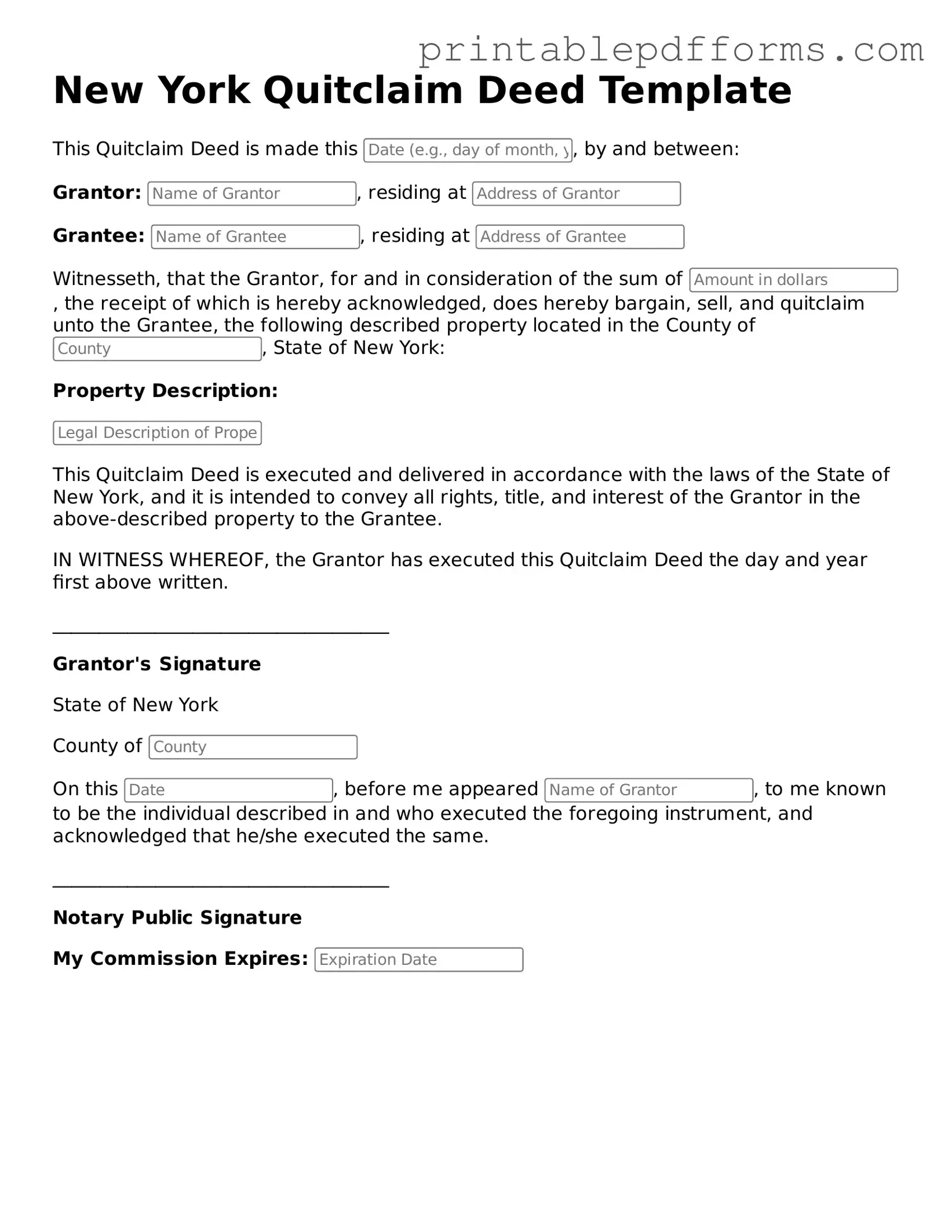

Document Example

New York Quitclaim Deed Template

This Quitclaim Deed is made this , by and between:

Grantor: , residing at

Grantee: , residing at

Witnesseth, that the Grantor, for and in consideration of the sum of , the receipt of which is hereby acknowledged, does hereby bargain, sell, and quitclaim unto the Grantee, the following described property located in the County of , State of New York:

Property Description:

This Quitclaim Deed is executed and delivered in accordance with the laws of the State of New York, and it is intended to convey all rights, title, and interest of the Grantor in the above-described property to the Grantee.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed the day and year first above written.

____________________________________

Grantor's Signature

State of New York

County of

On this , before me appeared , to me known to be the individual described in and who executed the foregoing instrument, and acknowledged that he/she executed the same.

____________________________________

Notary Public Signature

My Commission Expires:

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any guarantees regarding the title. |

| Governing Law | The New York Quitclaim Deed is governed by the New York Real Property Law, specifically Section 258. |

| Use Cases | Commonly used in situations like transferring property between family members, clearing title issues, or during divorce settlements. |

| Limitations | This type of deed does not provide any warranties or assurances about the property's title, meaning the buyer assumes all risks. |

Crucial Questions on This Form

- Transferring property between family members, like parents to children.

- Clearing up title issues or disputes.

- Adding or removing someone from the title.

- Transferring property in a divorce settlement.

- The names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property, which can usually be found on the property’s tax records.

- The date of the transfer.

- The signature of the grantor, which must be notarized.

What is a Quitclaim Deed?

A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title. It simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim deeds are commonly used in specific situations, such as:

How do I fill out a Quitclaim Deed in New York?

To fill out a quitclaim deed in New York, you will need to provide the following information:

Is a Quitclaim Deed the same as a Warranty Deed?

No, a quitclaim deed is not the same as a warranty deed. A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a quitclaim deed offers no such guarantees, making it riskier for the grantee.

Do I need to file a Quitclaim Deed with the county?

Yes, in New York, you must file the quitclaim deed with the county clerk’s office where the property is located. This step is crucial to ensure the transfer is legally recognized and recorded in public records.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees for filing a quitclaim deed. These fees vary by county, so it is advisable to check with your local county clerk’s office for the exact amount.

Can a Quitclaim Deed be revoked?

Once a quitclaim deed is executed and recorded, it cannot be revoked unilaterally. However, the parties involved can create a new document to reverse the transfer if both agree to do so.

What happens if the grantor has no ownership interest?

If the grantor has no ownership interest in the property, the quitclaim deed will still transfer whatever interest they may have, which could be nothing. The grantee should be cautious and conduct a title search to ensure they are aware of the property’s status.

Can I use a Quitclaim Deed for commercial property?

Yes, quitclaim deeds can be used for commercial property as well as residential property. However, it is essential to understand the implications of such a transfer, particularly regarding title and ownership rights.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a quitclaim deed, it is often advisable. An attorney can help ensure that the deed is properly drafted and that all necessary legal requirements are met.

Documents used along the form

When completing a real estate transaction in New York, the Quitclaim Deed is often accompanied by several other important documents. Each of these forms plays a crucial role in ensuring the transfer of property is clear and legally binding. Below is a list of commonly used forms and documents.

- Property Transfer Tax Form: This form is required to report the transfer of real property and calculate any applicable taxes.

- Ohio Bill of Sale Form: To document personal property transactions, refer to the essential Ohio bill of sale form guide for comprehensive details on the transfer process.

- Affidavit of Title: This document provides a sworn statement confirming the seller's ownership and the absence of any liens or claims against the property.

- Title Search Report: A report that reveals the history of ownership and any existing liens, ensuring the buyer is aware of any potential issues.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price and any fees or adjustments.

- Mortgage Documents: If the buyer is financing the purchase, these documents outline the terms of the loan and the lender's rights.

- Transfer of Ownership Form: This form officially records the change of ownership with the local government or municipality.

- Homeowner's Insurance Policy: Proof of insurance is often required to protect the property against potential damages or losses.

- Power of Attorney: If the seller cannot be present at closing, this document allows someone else to act on their behalf.

These documents work together to ensure a smooth and legally sound property transfer process. It’s important to gather and complete all necessary forms to avoid complications down the line.

Misconceptions

When it comes to the New York Quitclaim Deed form, there are several misconceptions that can lead to confusion. Here’s a clear breakdown of some common misunderstandings:

- A Quitclaim Deed transfers ownership without warranties. Many believe that a quitclaim deed guarantees the property is free of liens or claims. In reality, it simply transfers whatever interest the grantor has, if any.

- It can be used for any type of property transfer. Some think that quitclaim deeds are suitable for all property transfers. However, they are primarily used among family members or in situations where the parties know each other well.

- A Quitclaim Deed is only for transferring property between family members. While often used in family transactions, quitclaim deeds can also be used in other situations, such as divorce settlements or when clearing up title issues.

- Once a Quitclaim Deed is signed, the transaction is final. Some people assume that signing a quitclaim deed means the transaction cannot be reversed. However, it can be contested in certain situations, such as fraud or lack of capacity.

- Quitclaim Deeds are not legally binding. There is a misconception that quitclaim deeds lack legal weight. In fact, when properly executed and recorded, they are legally binding documents.

- You don’t need to record a Quitclaim Deed. Many think that recording the deed is unnecessary. However, recording protects the new owner’s rights and provides public notice of the ownership change.

- A Quitclaim Deed eliminates all future claims on the property. Some believe that by using a quitclaim deed, all future claims are eliminated. This is not true; it only transfers the interest that the grantor has at the time of the deed.

- You don’t need legal advice when using a Quitclaim Deed. Some people think they can handle the process without professional help. However, seeking legal advice can help avoid potential pitfalls and ensure the deed is properly executed.

Understanding these misconceptions can help you navigate property transactions more effectively. Always consider consulting with a legal professional to clarify any doubts you may have.