New York Transfer-on-Death Deed Document

The New York Transfer-on-Death Deed (TOD) is a powerful estate planning tool that allows property owners to designate beneficiaries who will automatically receive their real estate upon the owner's death, bypassing the often lengthy and costly probate process. This form offers a straightforward way to ensure that your property is transferred according to your wishes without the complications that can arise from traditional wills. One of its key features is that the owner retains full control over the property during their lifetime, meaning they can sell, mortgage, or change the beneficiaries at any time. The deed must be executed properly, including being signed and notarized, and it must be filed with the county clerk's office to take effect. Importantly, the TOD deed can only be used for real property and does not apply to personal assets like bank accounts or vehicles. Understanding the implications of this form is essential for anyone looking to streamline the transfer of their property and provide clarity for their heirs, making it a vital consideration in estate planning discussions.

Discover More Transfer-on-Death Deed Forms for Different States

How Much Does a Beneficiary Deed Cost - A Transfer-on-Death Deed does not require the beneficiary to be present at the time of signing.

A Lease Agreement is a legally binding document that outlines the terms and conditions under which one party agrees to rent property owned by another party. This essential form protects the rights of both landlords and tenants and ensures clarity regarding rent, duration of tenancy, and obligations. For those seeking a template or more information about lease agreements, resources such as freebusinessforms.org/ can be invaluable. Understanding the key components of a lease agreement can help both parties uphold their responsibilities and maintain a harmonious relationship.

Transfer on Death Deed Ohio Pdf - It is a legal document that enables property owners to leave their real estate to a named beneficiary.

Similar forms

- Will: A will specifies how a person's assets will be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries, but it typically requires probate to transfer assets, while the Transfer-on-Death Deed does not.

- Living Trust: A living trust holds a person's assets during their lifetime and specifies how they should be distributed after death. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of property without going through probate, providing a smoother transition for beneficiaries.

- Beneficiary Designation: Commonly used for financial accounts, a beneficiary designation allows individuals to name who will receive assets upon their death. This document functions similarly to a Transfer-on-Death Deed by enabling direct transfer of assets without probate.

- Power of Attorney Form: Essential for delegating decision-making authority, the comprehensive Power of Attorney documentation prepares you for times when you need someone to act on your behalf.

- Joint Tenancy: Joint tenancy is a form of property ownership where two or more people hold title to the property together. Upon the death of one owner, the property automatically passes to the surviving owner(s), much like a Transfer-on-Death Deed facilitates the transfer of property to designated beneficiaries.

Document Example

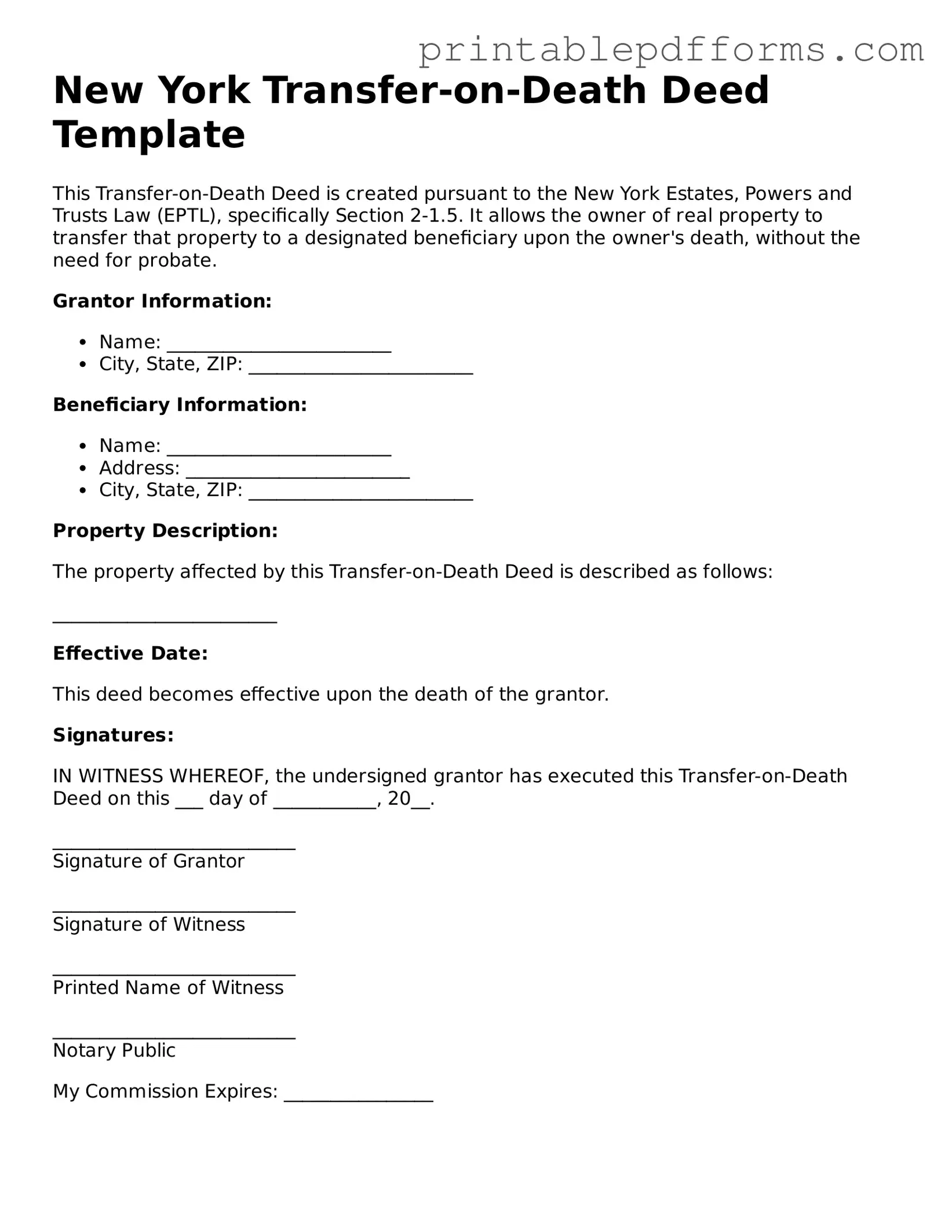

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to the New York Estates, Powers and Trusts Law (EPTL), specifically Section 2-1.5. It allows the owner of real property to transfer that property to a designated beneficiary upon the owner's death, without the need for probate.

Grantor Information:

- Name: ________________________

- City, State, ZIP: ________________________

Beneficiary Information:

- Name: ________________________

- Address: ________________________

- City, State, ZIP: ________________________

Property Description:

The property affected by this Transfer-on-Death Deed is described as follows:

________________________

Effective Date:

This deed becomes effective upon the death of the grantor.

Signatures:

IN WITNESS WHEREOF, the undersigned grantor has executed this Transfer-on-Death Deed on this ___ day of ___________, 20__.

__________________________

Signature of Grantor

__________________________

Signature of Witness

__________________________

Printed Name of Witness

__________________________

Notary Public

My Commission Expires: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows a property owner to designate a beneficiary who will receive the property upon the owner's death, avoiding probate. |

| Governing Law | The TOD deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 13-4.1. |

| Revocation | The property owner can revoke or change the beneficiary at any time during their lifetime without the beneficiary's consent. |

| Filing Requirements | The deed must be recorded with the county clerk's office where the property is located to be effective. |

Crucial Questions on This Form

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD Deed) allows property owners in New York to designate a beneficiary who will receive the property upon the owner's death. This deed bypasses probate, simplifying the transfer process. It ensures that the property goes directly to the chosen beneficiary without the need for court involvement.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in New York can utilize a Transfer-on-Death Deed. This includes homeowners, individuals holding property in their name, and even joint owners, provided they comply with the necessary requirements. However, it is essential to ensure that the property is not subject to other legal claims or restrictions that could complicate the transfer.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

- Obtain the official form from a reliable source, such as the New York State government website.

- Fill out the form with accurate information, including the property description and the beneficiary's details.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk's office where the property is located.

Once recorded, the deed becomes effective, and the property will transfer to the beneficiary upon your death.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or simply record a revocation document with the county clerk. Ensure that the new deed is properly executed and recorded to avoid any confusion regarding your wishes.

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the property will not automatically transfer to them. Instead, the property will become part of your estate. You may want to consider naming an alternate beneficiary in the deed to avoid complications in such situations.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax implications. The property may be subject to estate taxes if your estate exceeds the federal or state exemption limits. However, it is advisable to consult a tax professional to understand the specific implications based on your situation and the value of your estate.

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting an attorney can provide clarity and ensure that all legal requirements are met. An attorney can help you understand the implications of the deed, assist with the paperwork, and address any unique circumstances related to your property or estate.

Documents used along the form

The New York Transfer-on-Death Deed form is a useful document for transferring property upon the owner's death without the need for probate. However, several other forms and documents are often used in conjunction with this deed to ensure a smooth transfer process and proper estate planning. Below are four common documents that may accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after their death. It can provide instructions for assets not covered by the Transfer-on-Death Deed.

- Durable Power of Attorney: This form allows an individual to designate someone to make financial decisions on their behalf if they become incapacitated. It is important for managing assets before death.

- Last Will and Testament: This essential legal document articulates a person's final wishes regarding the distribution of their estate, ensuring adherence to their directives. More information can be found at All Ohio Forms.

- Living Will: A living will specifies a person's wishes regarding medical treatment in case they become unable to communicate their preferences. It ensures that healthcare decisions align with the individual’s values.

- Beneficiary Designation Forms: These forms are used to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. They work in tandem with the Transfer-on-Death Deed to ensure all assets are properly directed.

Using these documents together can help create a comprehensive estate plan. Each form plays a critical role in ensuring that your wishes are honored and that your loved ones are taken care of after your passing.

Misconceptions

Understanding the Transfer-on-Death Deed form in New York can be challenging, leading to several misconceptions. Here are five common misunderstandings that individuals often have regarding this important legal document.

-

Misconception 1: The Transfer-on-Death Deed automatically transfers property upon the owner's death.

This is not entirely accurate. The deed allows for the transfer of property to a designated beneficiary upon the owner's death, but it does not take effect until that moment. Until then, the owner retains full control over the property.

-

Misconception 2: A Transfer-on-Death Deed avoids probate entirely.

While the deed does allow property to pass outside of probate, it does not eliminate the need for probate in all cases. Other assets may still require probate, and any debts owed by the deceased could complicate the process.

-

Misconception 3: The Transfer-on-Death Deed is only for real estate.

This is a common misunderstanding. The deed is specifically designed for real property, but it does not apply to personal property or bank accounts. Individuals should consider other estate planning tools for those assets.

-

Misconception 4: A Transfer-on-Death Deed can be revoked at any time without formalities.

While it is true that the deed can be revoked, doing so requires a formal process. The owner must execute a new deed or a revocation document and file it appropriately to ensure that the change is legally recognized.

-

Misconception 5: All beneficiaries named in the deed will receive equal shares of the property.

This is not always the case. The deed can specify how the property is divided among multiple beneficiaries. If no specific instructions are provided, state laws regarding intestacy may apply, which can lead to unintended distributions.

Addressing these misconceptions is crucial for anyone considering a Transfer-on-Death Deed in New York. Understanding the nuances of this document can lead to better estate planning and help ensure that wishes are honored after one's passing.