Ohio Articles of Incorporation Document

The Ohio Articles of Incorporation form serves as a crucial document for individuals and groups looking to establish a corporation within the state. This form outlines essential information about the corporation, including its name, purpose, and the address of its principal office. Additionally, it requires details about the registered agent, who acts as the official point of contact for legal documents and notices. The form also addresses the structure of the corporation, specifying the number of shares the corporation is authorized to issue. Understanding the requirements and implications of the Articles of Incorporation is vital for ensuring compliance with state regulations and for laying a solid foundation for the corporation’s operations. By accurately completing this form, founders can facilitate the legal recognition of their business entity, which is a critical step in the journey of entrepreneurship in Ohio.

Discover More Articles of Incorporation Forms for Different States

New York Department of State Business Search - It's essential to be aware of the deadlines for filing.

Registration Certificate - Financing can be influenced by the structure laid out in the Articles.

How Much Is an Llc in Texas - Awareness of local and state laws is essential when drafting the Articles.

To ensure a smooth verification process, employers often rely on the resources provided by All Washington Forms, which offer easy access to the necessary employment verification documentation and guidance for proper completion.

How to Obtain an Llc - Incorporation can provide credibility to your business.

Similar forms

- Bylaws: Bylaws outline the internal rules and regulations governing the management of a corporation. Like the Articles of Incorporation, they are essential for establishing how the organization operates, including the roles of directors and officers.

Prenuptial Agreement: A legal document for couples in Ohio that establishes ownership and division of current and future assets and debts before marriage. It helps clarify financial matters in case of divorce or death, much like how guidelines in business agreements secure interests. For more details, visit All Ohio Forms.

- Operating Agreement: This document is similar for limited liability companies (LLCs). It details the management structure and operational procedures, akin to how Articles of Incorporation define the structure of a corporation.

- Certificate of Formation: In some states, this document serves a similar purpose to Articles of Incorporation. It officially creates a corporation and includes basic information about the business, such as its name and registered agent.

- Partnership Agreement: This document outlines the terms of a partnership, including responsibilities and profit-sharing. Like Articles of Incorporation, it formalizes the relationship between parties involved.

- Business License: While not a governance document, a business license is required to operate legally. It is similar in that it provides official recognition of the business entity, much like how Articles of Incorporation establish a corporation’s existence.

- Shareholder Agreement: This document governs the relationship between shareholders and the corporation. It is similar to Articles of Incorporation as it addresses ownership structure and shareholder rights within the corporation.

Document Example

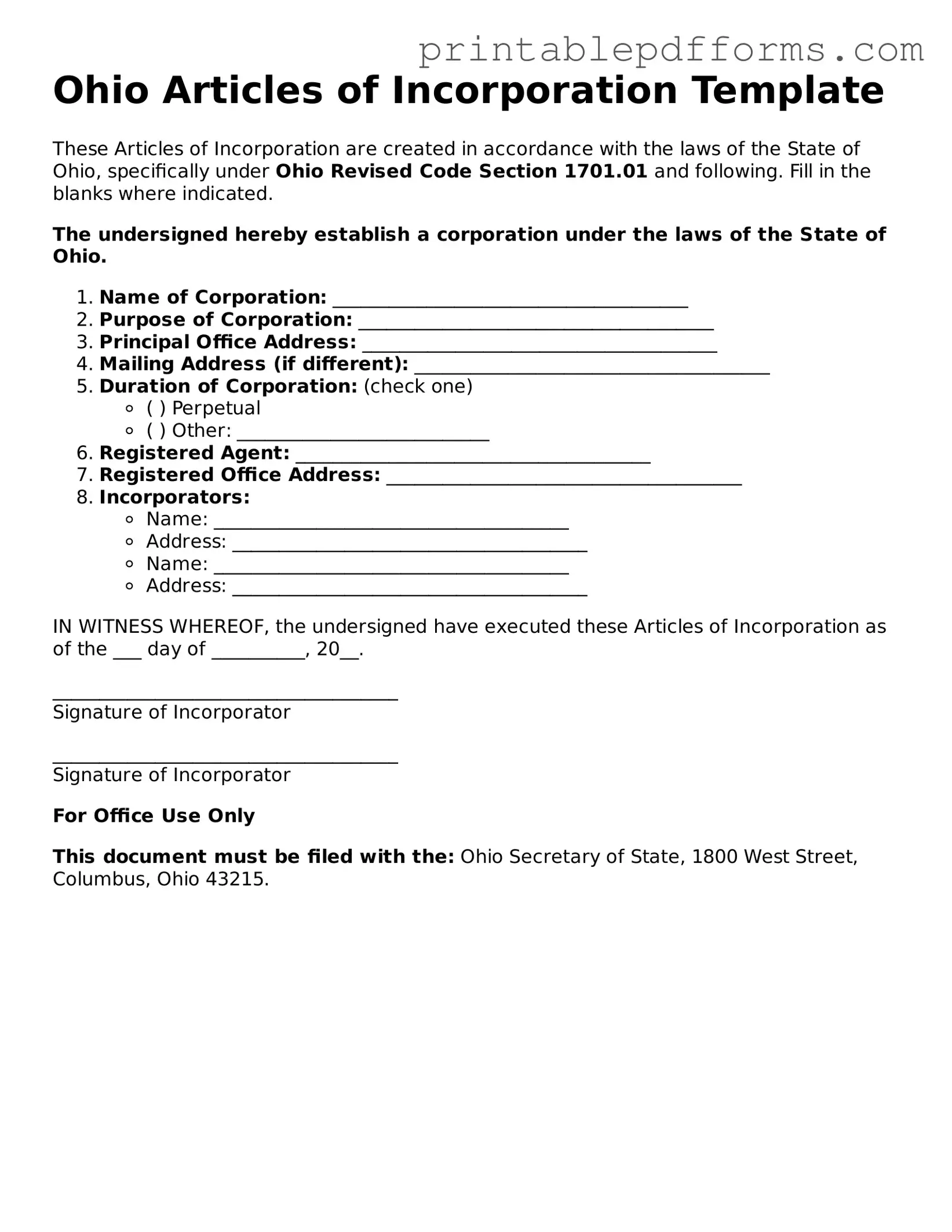

Ohio Articles of Incorporation Template

These Articles of Incorporation are created in accordance with the laws of the State of Ohio, specifically under Ohio Revised Code Section 1701.01 and following. Fill in the blanks where indicated.

The undersigned hereby establish a corporation under the laws of the State of Ohio.

- Name of Corporation: ______________________________________

- Purpose of Corporation: ______________________________________

- Principal Office Address: ______________________________________

- Mailing Address (if different): ______________________________________

- Duration of Corporation: (check one)

- ( ) Perpetual

- ( ) Other: ___________________________

- Registered Agent: ______________________________________

- Registered Office Address: ______________________________________

- Incorporators:

- Name: ______________________________________

- Address: ______________________________________

- Name: ______________________________________

- Address: ______________________________________

IN WITNESS WHEREOF, the undersigned have executed these Articles of Incorporation as of the ___ day of __________, 20__.

_____________________________________

Signature of Incorporator

_____________________________________

Signature of Incorporator

For Office Use Only

This document must be filed with the: Ohio Secretary of State, 1800 West Street, Columbus, Ohio 43215.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Articles of Incorporation form is used to legally create a corporation in Ohio. |

| Governing Law | This form is governed by the Ohio Revised Code, specifically Chapter 1701. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for establishing a corporation in Ohio. |

| Information Needed | Key information includes the corporation's name, purpose, and registered agent details. |

| Fees | A filing fee is required when submitting the Articles of Incorporation to the state. |

| Processing Time | Processing can take several business days, depending on the volume of applications received. |

| Amendments | Changes to the Articles can be made by filing an amendment with the state. |

| Public Record | Once filed, the Articles of Incorporation become a public record accessible to anyone. |

| Annual Reports | Corporations must file annual reports to maintain good standing after incorporation. |

Crucial Questions on This Form

What are the Articles of Incorporation in Ohio?

The Articles of Incorporation is a legal document that establishes a corporation in Ohio. It outlines the basic information about the corporation, such as its name, purpose, and structure. Filing this document with the Ohio Secretary of State is essential for a corporation to be recognized as a legal entity.

What information do I need to include in the Articles of Incorporation?

You will need to provide several key pieces of information, including:

- The name of the corporation, which must be unique and not already in use.

- The purpose of the corporation, which describes what the business will do.

- The address of the corporation's principal office.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, if applicable.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Ohio, you can do so online or by mail. If filing online, visit the Ohio Secretary of State's website and follow the instructions. For mail submissions, print the form, complete it, and send it to the appropriate address along with the required filing fee.

Is there a fee for filing the Articles of Incorporation?

Yes, there is a filing fee associated with the Articles of Incorporation in Ohio. The amount may vary depending on the type of corporation you are forming. It's important to check the Ohio Secretary of State's website for the most current fee schedule.

How long does it take for the Articles of Incorporation to be processed?

The processing time can vary. Typically, online submissions are processed more quickly than those sent by mail. You can expect a processing time of anywhere from a few days to a couple of weeks. For the most accurate estimate, check with the Ohio Secretary of State's office.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, you will receive a certificate of incorporation. This document confirms that your corporation is officially recognized by the state of Ohio. You can then proceed with other necessary steps, such as obtaining an Employer Identification Number (EIN) and setting up a corporate bank account.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are needed, you will need to file an amendment with the Ohio Secretary of State. This process also requires a fee, and the amendment must be approved to take effect.

Do I need a lawyer to file the Articles of Incorporation?

While it is not required to have a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that all information is accurate and that you comply with state regulations. This can save you time and potential issues down the road.

What is the difference between a corporation and an LLC?

A corporation and a Limited Liability Company (LLC) are both types of business structures, but they differ in several ways. A corporation is a separate legal entity that provides limited liability to its owners (shareholders) and can issue stock. An LLC, on the other hand, offers flexibility in management and taxation while also providing limited liability. The choice between the two depends on your business goals and needs.

Where can I find the Articles of Incorporation form?

You can find the Articles of Incorporation form on the Ohio Secretary of State's website. They provide downloadable forms and online filing options. Make sure to use the most current version of the form to ensure compliance with state requirements.

Documents used along the form

When forming a corporation in Ohio, the Articles of Incorporation is a crucial document. However, several other forms and documents may be necessary to complete the incorporation process effectively. Below is a list of commonly used documents that complement the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and regulations governing the corporation. Bylaws cover topics such as the structure of the board, the roles of officers, and procedures for meetings.

- Initial Resolution: This is a formal decision made by the board of directors to approve the corporation's formation and set forth initial actions, such as appointing officers and adopting bylaws.

- Employer Identification Number (EIN) Application: To operate legally, corporations must obtain an EIN from the IRS. This number is essential for tax purposes and is often required to open a business bank account.

- State Business License: Depending on the nature of the business, additional licenses or permits may be required at the state or local level. These licenses ensure compliance with local regulations.

- Shareholder Agreements: If there are multiple shareholders, this agreement outlines the rights and obligations of each party. It can cover topics like profit distribution, decision-making processes, and the sale of shares.

- Dirt Bike Bill of Sale: This form is essential for transferring ownership of a dirt bike and can be found at nypdfforms.com/dirt-bike-bill-of-sale-form/, ensuring that both the buyer and seller have a clear legal record of the transaction.

- Annual Reports: Corporations in Ohio are required to file annual reports with the state. This document provides updated information about the corporation's activities and financial status.

- Meeting Minutes: Keeping detailed records of meetings is essential for corporate governance. Meeting minutes document discussions and decisions made during board and shareholder meetings.

Each of these documents plays a vital role in ensuring that your corporation operates smoothly and in compliance with legal requirements. By preparing them alongside the Articles of Incorporation, you can set a solid foundation for your new business venture.

Misconceptions

When it comes to filing the Articles of Incorporation in Ohio, several misconceptions can lead to confusion. Understanding the facts can help streamline the process and ensure compliance with state regulations.

- Misconception 1: Anyone can file Articles of Incorporation without any prior knowledge.

- Misconception 2: The Articles of Incorporation are the only documents needed to start a business.

- Misconception 3: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 4: Filing the Articles of Incorporation guarantees business success.

While technically anyone can submit the form, it's crucial to understand the implications of incorporation. Knowledge of business structure, tax obligations, and compliance requirements is essential for making informed decisions.

This is not entirely true. While the Articles of Incorporation are a foundational document, businesses often require additional filings, such as operating agreements, licenses, and permits, depending on their industry and location.

In reality, amendments can be made after the initial filing. If the business structure or purpose changes, it’s possible to submit amendments to update the Articles of Incorporation as needed.

Incorporating a business does not automatically lead to success. Factors such as market research, business planning, and effective management play significant roles in a company's performance and sustainability.