Ohio Deed Document

The Ohio Deed form is a crucial document in real estate transactions, serving as a legal instrument for transferring property ownership. It outlines essential details such as the names of the grantor and grantee, a clear description of the property being transferred, and the consideration involved in the transaction. This form must be executed with precision to ensure the validity of the transfer. It also requires notarization, which adds a layer of authenticity to the document. Various types of deeds exist in Ohio, including warranty deeds and quitclaim deeds, each serving different purposes and offering varying levels of protection to the parties involved. Understanding the specific requirements and implications of the Ohio Deed form is vital for anyone engaged in buying or selling property in the state, as it lays the foundation for a legally binding agreement and protects the rights of all parties. Proper completion and filing of this form can prevent future disputes and complications regarding property ownership.

Discover More Deed Forms for Different States

Nys Deed Form - Deeds can be used for various types of property, including real estate and personal property.

When engaging in transactions that require a Washington Bill of Sale form, it is important to understand its significance in providing a formal record of ownership transfer and ensuring all parties are protected. To access the necessary documentation and facilitate your sale, you can explore All Washington Forms which offer a collection of essential resources for buyers and sellers alike.

Who Has the Deed to My House - After recording, a copy of the Deed is often provided to the new property owner.

Texas Deed Forms - This document outlines the details of the property being conveyed.

How Long Does It Take to Record a Deed in Florida - Understanding your rights as a grantee is vital once the deed is signed.

Similar forms

Title Transfer Document: Like a deed, this document transfers ownership of property from one party to another. It typically includes details about the property and the parties involved.

Bill of Sale: This document serves as proof of sale for personal property. It outlines the buyer and seller's details and describes the item being sold, similar to how a deed describes real estate.

Lease Agreement: A lease agreement grants a tenant the right to use a property for a specified time. It shares similarities with a deed in that it outlines the rights and responsibilities of both parties.

Mortgage Agreement: This document secures a loan with property as collateral. It functions similarly to a deed by establishing ownership rights and obligations related to the property.

Power of Attorney: This document allows one person to act on behalf of another in legal matters. Like a deed, it requires signatures and can transfer rights or responsibilities.

Trust Agreement: A trust agreement creates a legal entity to hold property for beneficiaries. It parallels a deed by defining ownership and management of the property.

Quitclaim Deed: This type of deed transfers any interest the grantor has in the property without guaranteeing that interest. It is similar to a standard deed but offers less protection to the grantee.

Warranty Deed: A warranty deed guarantees that the grantor holds clear title to the property. It provides more assurances than a quitclaim deed, but both serve to transfer property ownership.

- Motorcycle Bill of Sale: This form is vital for recording the sale of a motorcycle in Ohio, ensuring a clear transfer of ownership, and can be found at All Ohio Forms.

Affidavit of Title: This document certifies that the seller has the right to sell the property. It is akin to a deed in that it conveys ownership information and legal standing.

Release of Lien: This document removes a lien from a property, confirming that the debt has been satisfied. It shares a purpose with a deed in establishing clear ownership of the property.

Document Example

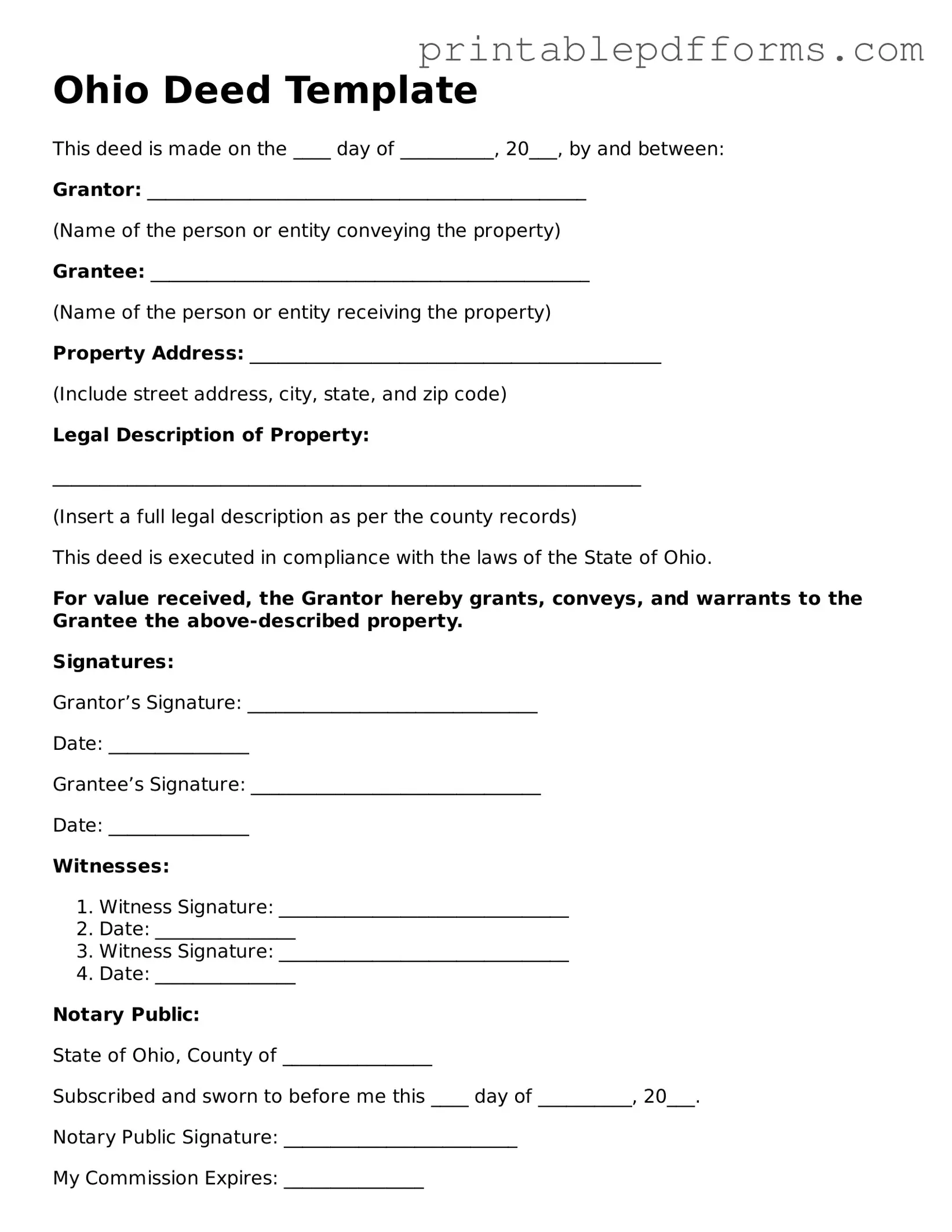

Ohio Deed Template

This deed is made on the ____ day of __________, 20___, by and between:

Grantor: _______________________________________________

(Name of the person or entity conveying the property)

Grantee: _______________________________________________

(Name of the person or entity receiving the property)

Property Address: ____________________________________________

(Include street address, city, state, and zip code)

Legal Description of Property:

_______________________________________________________________

(Insert a full legal description as per the county records)

This deed is executed in compliance with the laws of the State of Ohio.

For value received, the Grantor hereby grants, conveys, and warrants to the Grantee the above-described property.

Signatures:

Grantor’s Signature: _______________________________

Date: _______________

Grantee’s Signature: _______________________________

Date: _______________

Witnesses:

- Witness Signature: _______________________________

- Date: _______________

- Witness Signature: _______________________________

- Date: _______________

Notary Public:

State of Ohio, County of ________________

Subscribed and sworn to before me this ____ day of __________, 20___.

Notary Public Signature: _________________________

My Commission Expires: _______________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Law | The transfer of property through deeds in Ohio is governed by the Ohio Revised Code, specifically Chapter 5301. |

| Signatures Required | Both the grantor (seller) and the grantee (buyer) must sign the deed for it to be valid. |

| Notarization | A notary public must witness the signatures on the deed to ensure its authenticity. |

| Recording | To protect the interests of the new owner, the deed should be recorded at the county recorder’s office where the property is located. |

| Property Description | A legal description of the property must be included in the deed to clearly identify it. |

| Consideration | The deed should state the consideration, or payment, involved in the transfer of property. |

| Tax Implications | Ohio may impose a conveyance fee on property transfers, which must be paid at the time of recording. |

| Effective Date | The effective date of the deed is typically the date it is signed, unless otherwise specified. |

Crucial Questions on This Form

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Ohio. This form serves as a record of the transaction and outlines the details of the property being transferred, including its legal description, the names of the parties involved, and any specific terms of the transfer. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving distinct purposes in property transactions.

What types of deeds are available in Ohio?

Ohio recognizes several types of deeds, each with unique characteristics:

- Warranty Deed: This type guarantees that the grantor holds clear title to the property and has the right to transfer it. It also protects the grantee against any future claims on the property.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in the property without any warranties. It is often used among family members or in situations where the parties trust each other.

- Special Warranty Deed: Similar to a warranty deed, this type only guarantees the title against claims that arose during the grantor's ownership.

How do I complete an Ohio Deed form?

Completing an Ohio Deed form involves several steps:

- Identify the parties involved: Clearly state the names of the grantor (seller) and grantee (buyer).

- Provide a legal description of the property: This description should be precise and can usually be found on the property’s tax records or previous deed.

- Specify the type of deed: Indicate whether it is a warranty deed, quitclaim deed, or another type.

- Sign the deed: The grantor must sign the deed in the presence of a notary public.

- Record the deed: After signing, the deed should be filed with the county recorder’s office where the property is located.

Do I need a lawyer to prepare an Ohio Deed form?

While it is not legally required to have a lawyer prepare an Ohio Deed form, it is often advisable. A lawyer can ensure that the deed is correctly drafted and meets all legal requirements. They can also provide guidance on the implications of the transfer and help avoid potential disputes in the future. If the transaction is straightforward, some individuals choose to complete the deed themselves using templates available online.

Are there any fees associated with filing an Ohio Deed?

Yes, there are typically fees associated with filing an Ohio Deed. These fees can vary by county but generally include:

- A recording fee, which is charged for the actual filing of the deed.

- Transfer taxes, which may apply depending on the value of the property being transferred.

It is important to check with the local county recorder's office for specific fee amounts and any additional costs that may apply.

What happens after I file the Ohio Deed?

Once the Ohio Deed is filed with the county recorder’s office, it becomes a public record. This means that anyone can access the information contained in the deed. The grantee should receive a copy of the recorded deed, which serves as proof of ownership. It is essential to keep this document in a safe place, as it may be needed for future transactions, such as selling the property or obtaining financing.

Can an Ohio Deed be contested?

Yes, an Ohio Deed can be contested under certain circumstances. If there are claims of fraud, undue influence, or if the grantor lacked the capacity to sign the deed, a party may challenge the validity of the deed in court. It is crucial for all parties involved in a property transaction to ensure that the deed is executed properly and that all legal requirements are met to minimize the risk of disputes.

Documents used along the form

When preparing to execute a property transfer in Ohio, several forms and documents may accompany the Ohio Deed form. Each of these documents serves a specific purpose in ensuring the transaction is legally sound and properly recorded. Below is a list of commonly used forms that may be required during the process.

- Property Transfer Tax Affidavit: This form is used to report the sale of real estate and to calculate any transfer taxes owed to the state or local government.

- Title Search Report: A title search report provides a detailed history of the property, including previous ownership, liens, and any encumbrances that may affect the title.

- Trailer Bill of Sale: This form is crucial for documenting the sale of a trailer in Georgia, serving as proof of ownership transfer and protecting both the seller and buyer during the transaction. For more information, visit georgiapdf.com/trailer-bill-of-sale/.

- Real Estate Purchase Agreement: This document outlines the terms and conditions agreed upon by the buyer and seller regarding the sale of the property.

- Affidavit of Title: This is a sworn statement from the seller confirming their ownership of the property and disclosing any claims or liens against it.

- Closing Statement: Also known as a HUD-1 statement, this document itemizes all the costs and fees associated with the closing of the property sale.

- Power of Attorney: In cases where one party cannot be present for the signing, a power of attorney allows another individual to act on their behalf during the transaction.

- Certificate of Occupancy: This document certifies that the property meets local building codes and is safe for occupancy, often required for residential properties.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents provide information about the association's rules, fees, and regulations that govern the property.

Understanding these accompanying forms is essential for anyone involved in a property transaction in Ohio. Each document plays a vital role in protecting the interests of all parties involved and ensuring a smooth transfer of ownership.

Misconceptions

Understanding the Ohio Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

All deeds are the same. Many people think that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with specific legal implications and protections.

-

Filing a deed is optional. Some believe that filing a deed is not necessary. However, to ensure legal ownership and protect your rights, it is crucial to file the deed with the county recorder's office.

-

Only lawyers can prepare a deed. While it is advisable to consult a lawyer for complex transactions, individuals can prepare a deed themselves if they understand the requirements and legal language involved.

-

Deeds do not need to be notarized. This is a common myth. In Ohio, most deeds must be signed in the presence of a notary public to be valid.

-

Once a deed is signed, it cannot be changed. Many people assume that a signed deed is final and unchangeable. However, it is possible to create a new deed to correct or modify the original, provided the proper legal procedures are followed.

By clarifying these misconceptions, individuals can navigate the process of property transfer more effectively and confidently.