Ohio Deed in Lieu of Foreclosure Document

In Ohio, homeowners facing the possibility of foreclosure have an alternative option known as a Deed in Lieu of Foreclosure. This legal instrument allows property owners to voluntarily transfer the title of their property to the lender in exchange for the cancellation of their mortgage debt. By choosing this route, homeowners can avoid the lengthy and often stressful foreclosure process, while also mitigating the negative impact on their credit scores. The Deed in Lieu of Foreclosure form requires specific information, including the names of the parties involved, a description of the property, and the terms of the transfer. It is essential for homeowners to understand that while this option can provide a quicker resolution, it may not be suitable for everyone. Legal advice is highly recommended to navigate the implications of this decision. Additionally, the lender must agree to the deed transfer, making communication with the financial institution a critical step in the process. Overall, this form serves as a practical solution for some, offering a path to financial relief and property resolution.

Discover More Deed in Lieu of Foreclosure Forms for Different States

California Voluntary Foreclosure Deed - Facilitates a clean break for a homeowner ready to move on from an unaffordable mortgage.

Deed in Lieu of Foreclosure Sample - A Deed in Lieu can improve a borrower’s chance of future loan acceptance.

Deed in Lieu of Foreclosure Texas - Legal advice is often recommended before a homeowner signs this document.

The Georgia Tractor Bill of Sale form not only records the transfer of ownership of a tractor but also serves to clarify any potential ambiguities that may arise during the transaction process. To assist you further, more information and the necessary form can be found at georgiapdf.com/tractor-bill-of-sale/, providing a seamless experience for both buyers and sellers alike.

Foreclosure Vs Deed in Lieu - Homeowners may still owe taxes or other costs after the transfer is complete.

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale agreement allows a homeowner to sell their property for less than the amount owed on the mortgage. The lender must approve this sale, and it can help avoid foreclosure.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make it more manageable for the borrower. Like a deed in lieu, it aims to prevent foreclosure by adjusting payment terms or interest rates.

- Forbearance Agreement: In this agreement, a lender allows a borrower to temporarily reduce or pause mortgage payments. This can help the borrower regain financial stability and avoid foreclosure, similar to the intention behind a deed in lieu.

- Mortgage Release or Satisfaction: This document indicates that a mortgage has been paid in full or released. A deed in lieu effectively serves the same purpose by transferring property ownership to the lender and relieving the borrower of mortgage obligations.

- Repayment Plan: A repayment plan outlines how a borrower can catch up on missed payments over time. This option can prevent foreclosure, much like a deed in lieu, by providing a structured path to resolve outstanding debts.

-

New York Mobile Home Bill of Sale: This form is essential for legal transactions involving mobile homes, detailing the transfer of ownership. It is important for both parties to understand its content fully to avoid any disputes. Additional information and a sample can be found at https://freebusinessforms.org/.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide the borrower with a chance to reorganize debts. While a deed in lieu involves voluntarily transferring property, bankruptcy offers a legal route to manage financial difficulties.

- Property Deed Transfer: A property deed transfer involves changing the ownership of a property. A deed in lieu of foreclosure is a specific type of transfer that occurs to avoid foreclosure, but both processes involve the transfer of property rights.

Document Example

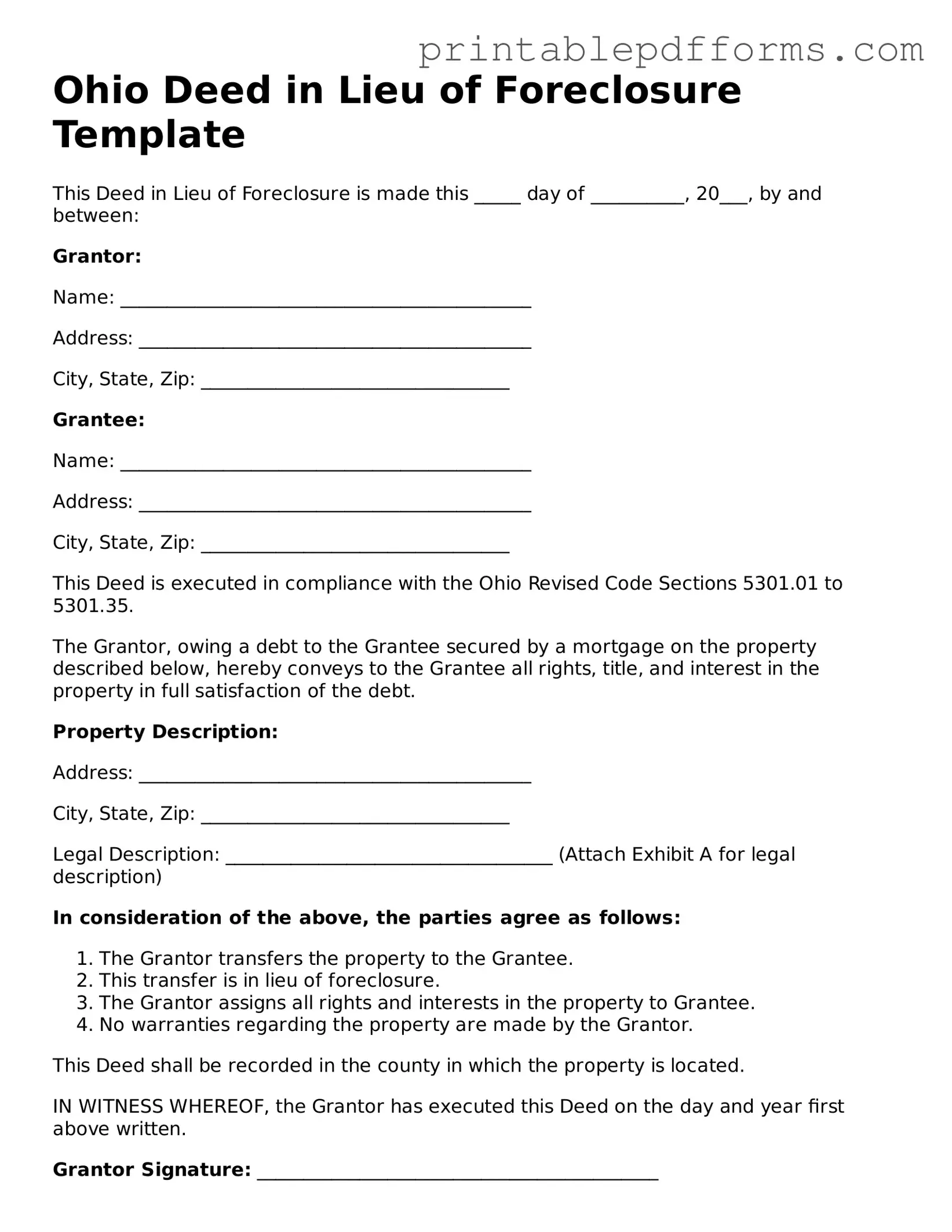

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this _____ day of __________, 20___, by and between:

Grantor:

Name: ____________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

Grantee:

Name: ____________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

This Deed is executed in compliance with the Ohio Revised Code Sections 5301.01 to 5301.35.

The Grantor, owing a debt to the Grantee secured by a mortgage on the property described below, hereby conveys to the Grantee all rights, title, and interest in the property in full satisfaction of the debt.

Property Description:

Address: __________________________________________

City, State, Zip: _________________________________

Legal Description: ___________________________________ (Attach Exhibit A for legal description)

In consideration of the above, the parties agree as follows:

- The Grantor transfers the property to the Grantee.

- This transfer is in lieu of foreclosure.

- The Grantor assigns all rights and interests in the property to Grantee.

- No warranties regarding the property are made by the Grantor.

This Deed shall be recorded in the county in which the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Deed on the day and year first above written.

Grantor Signature: ___________________________________________

Date: _____________________

Grantee Signature: ___________________________________________

Date: _____________________

Notary Public:

State of Ohio

County of _______________________________

Subscribed and sworn to before me this _____ day of __________, 20___.

Notary Public Signature: ___________________________________

My Commission Expires: _______________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | Ohio Revised Code Section 5301.01 governs the execution and recording of deeds in lieu of foreclosure in Ohio. |

| Purpose | The primary purpose is to resolve a mortgage default without going through the lengthy foreclosure process. |

| Eligibility | Borrowers facing financial difficulties may qualify, but they must typically demonstrate that they cannot continue making mortgage payments. |

| Process | The borrower must submit a request to the lender, who will review the situation and determine if they will accept the deed. |

| Impact on Credit | A deed in lieu of foreclosure can negatively affect a borrower's credit score, but it may be less damaging than a foreclosure. |

| Tax Implications | Borrowers should be aware of potential tax consequences, as forgiven debt may be considered taxable income. |

| Legal Assistance | It is advisable for borrowers to seek legal advice before entering into a deed in lieu of foreclosure agreement. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid the foreclosure process. This option can be beneficial for both the homeowner and the lender. The homeowner can avoid the negative consequences of foreclosure, while the lender can recover the property without going through lengthy legal proceedings.

Who is eligible for a Deed in Lieu of Foreclosure in Ohio?

Eligibility for a Deed in Lieu of Foreclosure typically depends on several factors, including:

- The homeowner must be experiencing financial hardship.

- The mortgage must be in default or at risk of default.

- The homeowner must not have any other liens on the property that would complicate the transfer.

- The property must be owner-occupied or a primary residence.

It's essential for homeowners to discuss their specific situation with their lender to determine if they qualify for this option.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to opting for a Deed in Lieu of Foreclosure, including:

- Less damage to credit score compared to a foreclosure.

- Quicker resolution of the mortgage obligation.

- Possibility of receiving relocation assistance from the lender.

- Reduction of stress associated with the foreclosure process.

These benefits can make a Deed in Lieu of Foreclosure an appealing option for homeowners facing financial difficulties.

What steps are involved in the Deed in Lieu of Foreclosure process?

The process generally involves the following steps:

- Contact the lender to discuss the option of a Deed in Lieu of Foreclosure.

- Submit a formal request along with any required documentation, such as financial statements.

- Negotiate the terms with the lender, including any potential forgiveness of debt.

- Complete the Deed in Lieu of Foreclosure form and any other necessary paperwork.

- Transfer the deed to the lender, officially relinquishing ownership of the property.

Homeowners should ensure they understand all terms and implications before proceeding.

Are there any risks associated with a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure can be beneficial, there are potential risks to consider:

- The lender may still pursue a deficiency judgment for any remaining balance on the mortgage.

- Homeowners may lose the opportunity to negotiate a loan modification or other alternatives.

- Not all lenders may accept a Deed in Lieu of Foreclosure.

It's crucial for homeowners to weigh these risks and consult with a legal or financial professional before making a decision.

Documents used along the form

A Deed in Lieu of Foreclosure is an important document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. However, several other forms and documents often accompany this process. Below is a list of commonly used documents that may be necessary when completing a Deed in Lieu of Foreclosure in Ohio.

- Notice of Default: This document informs the borrower that they are in default on their mortgage payments. It serves as a formal notification before the foreclosure process begins.

- Loan Modification Agreement: If the lender agrees to change the terms of the loan to make it more manageable for the borrower, this agreement outlines the new terms and conditions.

- Release of Mortgage: This document releases the lender's claim on the property once the Deed in Lieu of Foreclosure is executed, ensuring that the borrower is no longer responsible for the mortgage.

- Property Condition Disclosure: The borrower may need to provide information about the condition of the property, including any known issues or repairs needed, to the lender.

- Affidavit of Title: This sworn statement confirms the ownership of the property and discloses any liens or encumbrances that may affect the transfer of ownership.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any amounts owed, credits, and debits related to the Deed in Lieu of Foreclosure.

- IRS Form 1099-C: If the lender forgives any debt as part of the Deed in Lieu of Foreclosure, this form is issued to report the cancellation of debt to the IRS.

- Deed of Trust: This document may be used to secure the loan, outlining the lender's rights in relation to the property until the loan is paid off.

- Ohio Mobile Home Bill of Sale: This form is essential for documenting the transaction of a mobile home in Ohio, ensuring all details are recorded for legal purposes. For more information, refer to All Ohio Forms.

- Power of Attorney: If the borrower cannot be present to sign documents, a Power of Attorney allows another individual to act on their behalf in the transaction.

Understanding these documents can help streamline the process and ensure that all necessary steps are taken to complete a Deed in Lieu of Foreclosure effectively. Always consider consulting with a legal professional to navigate these forms accurately.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure can be challenging. Here are eight common misconceptions about this process:

- It eliminates all debts. Many believe that a deed in lieu of foreclosure wipes out all debts associated with the mortgage. However, it only addresses the mortgage debt and may not cover other financial obligations.

- It is the same as a short sale. A deed in lieu of foreclosure and a short sale are not identical. In a short sale, the property is sold for less than the mortgage balance, while a deed in lieu transfers ownership back to the lender without a sale.

- It automatically prevents foreclosure. Some think that signing a deed in lieu of foreclosure stops the foreclosure process immediately. In reality, lenders may still proceed with foreclosure if the deed is not accepted.

- Only homeowners can use it. Many assume that only individual homeowners can file a deed in lieu of foreclosure. In fact, businesses and other entities can also utilize this option.

- It has no impact on credit scores. A common belief is that a deed in lieu of foreclosure does not affect credit scores. However, it can still have a negative impact, similar to a foreclosure.

- It is a quick process. Some expect the deed in lieu process to be fast and simple. While it can be quicker than foreclosure, it still requires paperwork and lender approval, which can take time.

- All lenders accept it. Not every lender accepts a deed in lieu of foreclosure. Each lender has its own policies, and some may prefer to proceed with foreclosure instead.

- It releases all liability. Many think that once a deed in lieu is signed, all liability is gone. However, if there are other liens on the property, the homeowner may still be responsible for those debts.

Being informed about these misconceptions can help individuals make better decisions regarding their options in times of financial distress.