Ohio Employment Verification Document

The Ohio Employment Verification form is an essential document that plays a crucial role in the employment process for both employers and employees. This form is designed to confirm an individual's employment status, including details such as job title, duration of employment, and salary information. Employers often use it to validate a candidate's work history, while employees may need it for various purposes, such as applying for loans, renting an apartment, or seeking government assistance. Completing this form accurately is vital, as it helps ensure that all parties have a clear understanding of the employment relationship. Additionally, the form may include sections for both the employer and employee to provide necessary signatures, ensuring that the information is verified and acknowledged by both sides. Understanding the importance of this form can streamline the hiring process and foster transparency in employment verification, making it a key component of workforce management in Ohio.

Discover More Employment Verification Forms for Different States

How to Fill Out Verification of Employment/loss of Income Form Florida - Encourages transparency in the employment sector.

When engaging in the sale or purchase of a tractor in Georgia, it is important to utilize the appropriate documentation to protect both parties involved. The georgiapdf.com/tractor-bill-of-sale provides a reliable means to record the essential information regarding the transaction, thereby ensuring clarity and legal backing for the transfer of ownership.

Similar forms

- Pay Stubs: Pay stubs provide proof of employment and income. They typically include the employee's name, employer's name, pay period, and gross earnings. Like the Employment Verification form, they confirm the individual's employment status.

- W-2 Forms: W-2 forms summarize an employee's annual wages and the taxes withheld. They serve as an official record of employment and earnings, similar to the Employment Verification form, which also verifies employment details.

- Offer Letters: Offer letters outline the terms of employment, including job title, salary, and start date. They confirm the individual's employment status and details, paralleling the purpose of the Employment Verification form.

- Reference Letters: Reference letters from employers or supervisors validate an individual's work experience and skills. They serve as a testament to employment history, akin to the Employment Verification form's role in confirming employment.

- Motor Vehicle Bill of Sale: This document records the sale of a vehicle in Ohio and is essential for proving ownership transfer. It is often required for registration and legal protection, making it a vital part of the vehicle transaction process. For more information, you can refer to All Ohio Forms.

- Employment Contracts: Employment contracts detail the terms of employment, including duties, salary, and duration of employment. They provide a formal acknowledgment of employment, similar to the information provided in the Employment Verification form.

Document Example

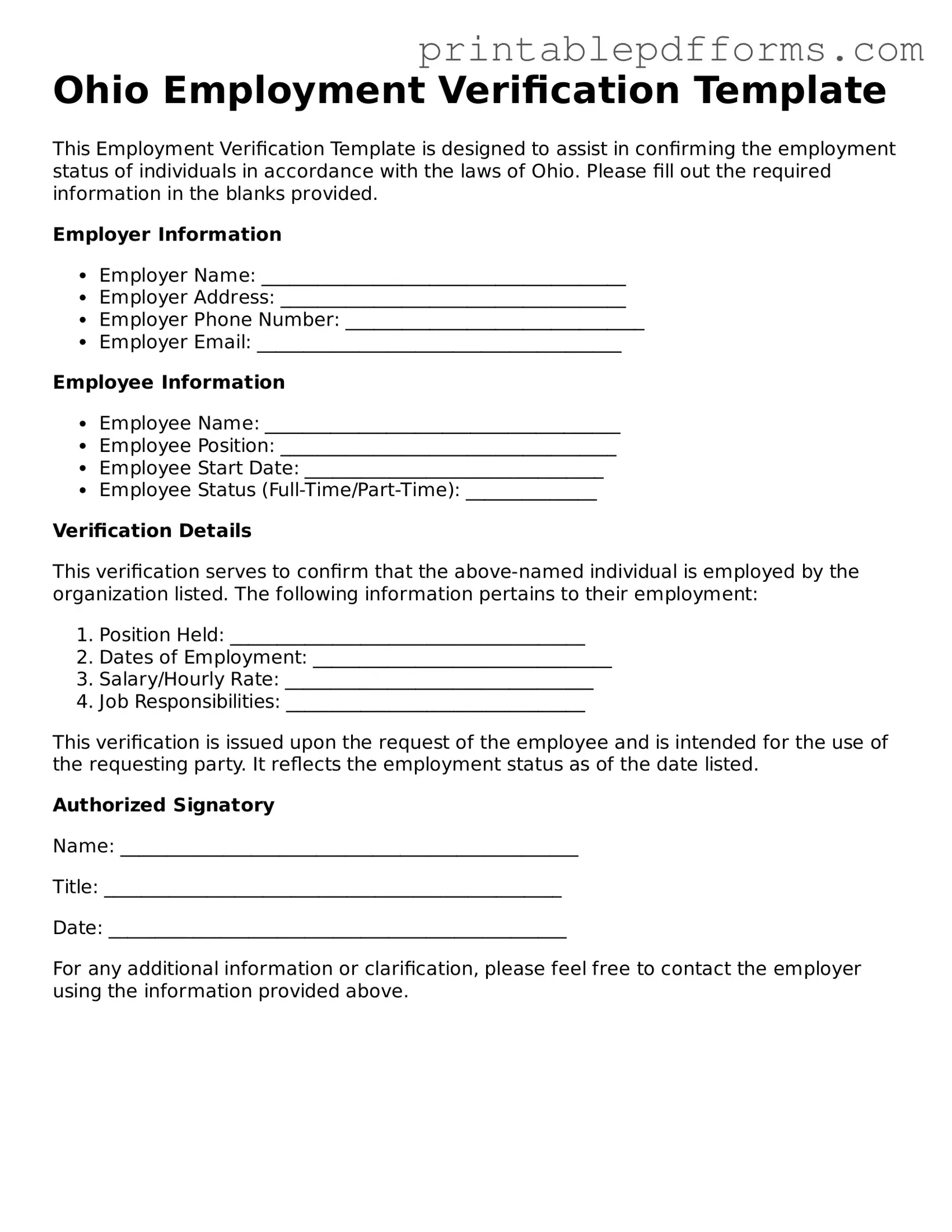

Ohio Employment Verification Template

This Employment Verification Template is designed to assist in confirming the employment status of individuals in accordance with the laws of Ohio. Please fill out the required information in the blanks provided.

Employer Information

- Employer Name: _______________________________________

- Employer Address: _____________________________________

- Employer Phone Number: ________________________________

- Employer Email: _______________________________________

Employee Information

- Employee Name: ______________________________________

- Employee Position: ____________________________________

- Employee Start Date: ________________________________

- Employee Status (Full-Time/Part-Time): ______________

Verification Details

This verification serves to confirm that the above-named individual is employed by the organization listed. The following information pertains to their employment:

- Position Held: ______________________________________

- Dates of Employment: ________________________________

- Salary/Hourly Rate: _________________________________

- Job Responsibilities: ________________________________

This verification is issued upon the request of the employee and is intended for the use of the requesting party. It reflects the employment status as of the date listed.

Authorized Signatory

Name: _________________________________________________

Title: _________________________________________________

Date: _________________________________________________

For any additional information or clarification, please feel free to contact the employer using the information provided above.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Employment Verification form is used to confirm an individual's employment status and details with their employer. |

| Required Information | This form typically requires the employee's name, job title, dates of employment, and salary information. |

| Who Uses It? | Employers and employees utilize this form, often during background checks or when applying for loans and housing. |

| Governing Law | Ohio Revised Code § 4111.14 outlines the requirements for employment verification in the state. |

| Format | The form can be provided in various formats, including paper and electronic versions, depending on the employer's preference. |

| Confidentiality | Employers must handle the information on this form with care, ensuring compliance with privacy laws. |

| Submission | Once completed, the form is typically submitted to the requesting party, such as a lender or new employer. |

Crucial Questions on This Form

What is the Ohio Employment Verification form?

The Ohio Employment Verification form is a document used by employers to confirm an individual's employment status, including details such as job title, salary, and duration of employment. This form is often required for various purposes, including loan applications, rental agreements, and background checks.

Who needs to fill out the Ohio Employment Verification form?

Typically, employers are responsible for completing the Ohio Employment Verification form. However, employees may need to request this verification for personal reasons, such as applying for a mortgage or renting an apartment. It is essential for employees to communicate their need for this form to their employer.

What information is required on the form?

The form generally requires the following information:

- Employee's full name

- Employee's job title

- Dates of employment

- Current salary or hourly wage

- Employer's contact information

Employers should ensure that all information provided is accurate and up-to-date to avoid any complications.

How is the Ohio Employment Verification form submitted?

Submission methods can vary depending on the employer's policies. Typically, the completed form can be submitted in one of the following ways:

- Directly to the requesting party (e.g., a bank or landlord)

- Via email or fax, if permitted

- Through a secure online portal, if available

It is crucial to confirm the preferred submission method with the requesting party to ensure a smooth process.

Is there a fee associated with obtaining the form?

Generally, there should not be a fee for obtaining the Ohio Employment Verification form itself. However, some employers may charge a processing fee, especially if the request requires additional verification steps. It is advisable to check with the employer regarding any potential costs.

How long does it take to receive the completed form?

The time frame for receiving the completed Ohio Employment Verification form can vary. Factors influencing this include the employer's workload and their internal processes. Typically, it may take anywhere from a few days to a couple of weeks. For urgent requests, employees should communicate their timelines clearly to their employer.

What should I do if my employer refuses to complete the form?

If an employer is unwilling to complete the Ohio Employment Verification form, it is essential to understand the reasons behind their refusal. Employees can consider the following steps:

- Discuss the matter with their supervisor or HR department.

- Request a written explanation for the refusal.

- Explore alternative forms of verification, such as pay stubs or tax documents.

Open communication can often resolve misunderstandings and lead to a satisfactory outcome.

Can I appeal a decision if my employment verification is incorrect?

If there are inaccuracies in the employment verification, employees should address the issue promptly. Steps to take include:

- Contacting the employer to discuss the discrepancies.

- Providing any necessary documentation to support the correct information.

- Requesting a revised verification form if corrections are made.

Timely action can help ensure that any errors are rectified and do not affect future applications or processes.

Documents used along the form

The Ohio Employment Verification form is a key document used to confirm an individual's employment status. However, it is often accompanied by other forms and documents that provide additional context or information. Below are four commonly used documents that may be relevant in conjunction with the Employment Verification form.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. Employers provide it to employees at the end of the tax year, making it essential for verifying income and employment history.

- Pay Stubs: Pay stubs are issued with each paycheck and detail an employee's earnings for a specific pay period. They include information about gross pay, deductions, and net pay, serving as proof of current employment and income.

- Quitclaim Deed: For those transferring property ownership, our essential Quitclaim Deed form resources provide the necessary legal documentation to ensure a smooth transaction.

- Employment Offer Letter: This document outlines the terms of employment, including job title, salary, and start date. It serves as a formal confirmation of employment and can be useful in verifying a person's job status.

- Tax Returns: Personal tax returns, particularly the 1040 form, provide a comprehensive view of an individual's income over a year. They can be used to verify employment and income, especially for self-employed individuals.

These documents can enhance the verification process, providing a clearer picture of an individual's employment and income history. Always ensure that the information provided is accurate and up to date for effective verification.

Misconceptions

Understanding the Ohio Employment Verification form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Below are six common misconceptions, along with clarifications for each.

-

The form is only required for new employees.

This is not true. The Ohio Employment Verification form can be requested for current employees as well, especially when verifying employment history for loans, background checks, or other purposes.

-

Employers must provide the form for all employees.

Employers are not obligated to provide the form to every employee. The request for verification typically comes from the employee or a third party, such as a financial institution.

-

There is a specific format that must be followed.

While the form should include certain information, there is no mandated format. Employers can create their own version as long as it includes necessary details like employment dates and job title.

-

The form is only used for full-time employees.

This misconception is incorrect. The form can be used for part-time, temporary, and seasonal employees as well. Verification can be necessary for any type of employment.

-

Once submitted, the form cannot be amended.

Employers can amend the form if necessary. If there is an error or if additional information needs to be added, a revised form can be issued.

-

Only HR departments can fill out the form.

While HR typically handles employment verification, other authorized personnel can also complete the form. This flexibility allows for quicker processing when needed.

Addressing these misconceptions can help streamline the employment verification process in Ohio, ensuring that both employees and employers have a clear understanding of their rights and responsibilities.