Ohio Operating Agreement Document

In Ohio, the Operating Agreement form serves as a crucial document for Limited Liability Companies (LLCs), outlining the internal management structure and operational guidelines of the business. This agreement plays a significant role in defining the roles and responsibilities of members, detailing voting rights, and establishing procedures for decision-making. It also addresses how profits and losses will be allocated among members, ensuring clarity in financial matters. Furthermore, the Operating Agreement can stipulate the process for adding or removing members, as well as procedures for resolving disputes. By providing a clear framework for operations, this document helps protect the interests of all members and enhances the overall stability of the LLC. While not mandated by law, having a well-crafted Operating Agreement is highly recommended, as it can prevent misunderstandings and potential conflicts down the line.

Discover More Operating Agreement Forms for Different States

How to Make an Operating Agreement - An Operating Agreement outlines the internal workings of a business entity, typically an LLC.

In addition to the Washington Divorce Settlement Agreement form, which clearly defines the terms of a divorce, you can find a variety of essential documents needed for various legal processes. To explore these resources and make your divorce proceedings more manageable, visit All Washington Forms, where you can access the necessary forms and information to guide you through this challenging time.

How Much Does an Llc Cost in Texas - It can specify whether members can transfer their interests to others.

How to Register an Llc - An Operating Agreement serves to protect personal assets from business liabilities.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules and procedures for a corporation. They govern the management structure, roles of officers, and the process for decision-making.

Durable Power of Attorney: To ensure that decisions regarding your well-being are made by a trusted individual, consider our essential Durable Power of Attorney document resources for comprehensive guidance.

- Partnership Agreement: This document details the terms and conditions of a partnership. Like an Operating Agreement, it specifies the rights, responsibilities, and profit-sharing among partners.

- Shareholder Agreement: A shareholder agreement is akin to an Operating Agreement for corporations. It establishes the rights and obligations of shareholders, including how shares can be transferred and how decisions are made.

- Member Resolution: This document records decisions made by the members of a limited liability company (LLC). It serves a similar purpose to an Operating Agreement by documenting important actions and agreements among members.

- Joint Venture Agreement: A joint venture agreement outlines the terms of collaboration between two or more parties. It shares similarities with an Operating Agreement in that it clarifies each party’s contributions, responsibilities, and profit distribution.

- Franchise Agreement: This document governs the relationship between a franchisor and a franchisee. Like an Operating Agreement, it defines the rights and obligations of both parties, including operational guidelines and financial arrangements.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can accompany an Operating Agreement. Both documents protect sensitive information and define the terms under which parties can share proprietary details.

Document Example

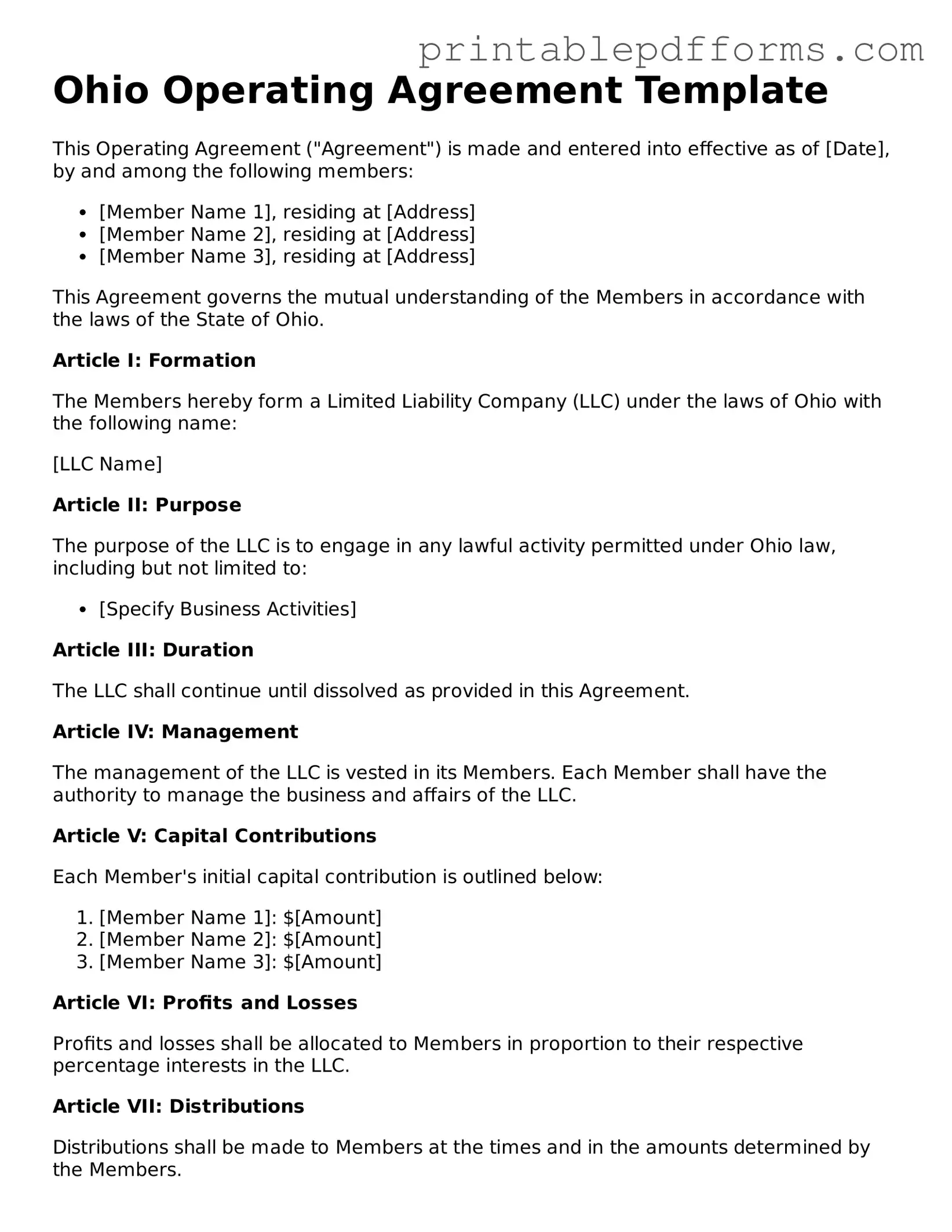

Ohio Operating Agreement Template

This Operating Agreement ("Agreement") is made and entered into effective as of [Date], by and among the following members:

- [Member Name 1], residing at [Address]

- [Member Name 2], residing at [Address]

- [Member Name 3], residing at [Address]

This Agreement governs the mutual understanding of the Members in accordance with the laws of the State of Ohio.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the laws of Ohio with the following name:

[LLC Name]

Article II: Purpose

The purpose of the LLC is to engage in any lawful activity permitted under Ohio law, including but not limited to:

- [Specify Business Activities]

Article III: Duration

The LLC shall continue until dissolved as provided in this Agreement.

Article IV: Management

The management of the LLC is vested in its Members. Each Member shall have the authority to manage the business and affairs of the LLC.

Article V: Capital Contributions

Each Member's initial capital contribution is outlined below:

- [Member Name 1]: $[Amount]

- [Member Name 2]: $[Amount]

- [Member Name 3]: $[Amount]

Article VI: Profits and Losses

Profits and losses shall be allocated to Members in proportion to their respective percentage interests in the LLC.

Article VII: Distributions

Distributions shall be made to Members at the times and in the amounts determined by the Members.

Article VIII: Indemnification

The LLC shall indemnify, to the fullest extent permitted by Ohio law, the Members against any losses or claims arising from their role in the LLC.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Miscellaneous

This Agreement shall be governed by and construed in accordance with the laws of the State of Ohio.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement on the day and year first above written.

______________________________

[Member Name 1]

______________________________

[Member Name 2]

______________________________

[Member Name 3]

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | An Ohio Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | The Ohio Revised Code, specifically Section 1705, governs the formation and operation of LLCs in Ohio. |

| Purpose | The agreement serves to clarify the rights and responsibilities of members and managers within the LLC. |

| Not Mandatory | While not legally required, having an Operating Agreement is highly recommended for LLCs in Ohio. |

| Customization | Members can customize the agreement to fit their specific needs and business objectives. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help avoid litigation. |

| Amendments | Members can amend the Operating Agreement as needed, following the procedures outlined within the document. |

Crucial Questions on This Form

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the management structure, responsibilities, and operational procedures of a limited liability company (LLC) in Ohio. This agreement serves as a foundational guide for how the LLC will operate, detailing the rights and duties of its members. It is essential for protecting the interests of all parties involved and ensuring that the business runs smoothly.

Why is an Operating Agreement important for an LLC in Ohio?

Having an Operating Agreement is crucial for several reasons:

- Clarifies Roles: It defines the roles and responsibilities of each member, which helps prevent misunderstandings.

- Protects Limited Liability: By having a formal agreement, members can reinforce the limited liability status of the LLC, protecting personal assets from business liabilities.

- Establishes Rules: It sets forth the rules for decision-making, profit distribution, and handling disputes, providing a clear framework for operations.

- Facilitates Business Operations: The agreement can streamline processes and help in the management of the LLC by providing guidelines for various scenarios.

Do all LLCs in Ohio need an Operating Agreement?

While Ohio law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Without one, the LLC will be governed by the default rules set by state law, which may not align with the members' intentions. An Operating Agreement allows members to customize their business operations and governance, ensuring their specific needs and preferences are met.

What should be included in an Ohio Operating Agreement?

An effective Ohio Operating Agreement should cover several key components:

- Basic Information: Name of the LLC, principal office address, and formation date.

- Member Information: Names and addresses of all members, along with their ownership percentages.

- Management Structure: Whether the LLC will be member-managed or manager-managed.

- Voting Rights: Details on how decisions will be made and the voting process.

- Profit and Loss Distribution: Guidelines on how profits and losses will be allocated among members.

- Dispute Resolution: Procedures for resolving disputes among members.

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. Members can agree to make changes as needed to reflect new circumstances or preferences. It is advisable to document any amendments in writing and have all members sign off on them. This helps maintain clarity and ensures that all parties are aware of the changes made to the agreement.

How can I create an Operating Agreement for my Ohio LLC?

Creating an Operating Agreement can be done through several methods:

- Template Use: Many online resources offer templates that can be customized to fit your LLC's specific needs.

- Legal Assistance: Consulting with a legal professional can provide tailored advice and ensure compliance with Ohio laws.

- Member Collaboration: Involving all members in the drafting process can help ensure that everyone's interests are represented and that the agreement reflects the group's consensus.

Documents used along the form

When forming a Limited Liability Company (LLC) in Ohio, several documents complement the Operating Agreement. Each of these documents serves a specific purpose and helps ensure that the LLC operates smoothly and in compliance with state laws. Below is a list of common forms and documents associated with the Ohio Operating Agreement.

- Articles of Organization: This is the foundational document filed with the Ohio Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Consent Form: This document is used to document the agreement of all members regarding significant decisions or changes within the LLC. It ensures that all members are on the same page.

- Bylaws: Although not always required for LLCs, bylaws outline the internal rules and procedures for managing the company. They can cover topics such as meetings, voting rights, and member responsibilities.

- Operating Procedures: This document details the day-to-day operations of the LLC, including how decisions are made and how profits and losses are distributed among members.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can help clarify ownership stakes and rights within the company.

- Tax Forms: For tax purposes, it's important to use the correct forms, such as the Ohio IT AR form, to manage income tax refunds and obligations; for more details, refer to All Ohio Forms.

- Tax Identification Number (TIN) Application: An LLC needs a TIN for tax purposes. This document is submitted to the IRS to obtain a unique identification number for the business.

- Annual Reports: Ohio requires LLCs to file annual reports to maintain good standing. This document updates the state on the company’s activities and confirms its current status.

- Business Licenses and Permits: Depending on the nature of the business, certain licenses and permits may be required to operate legally. This document ensures compliance with local, state, and federal regulations.

- Bank Account Documentation: Opening a business bank account typically requires various documents, including the Operating Agreement and Articles of Organization. This helps separate personal and business finances.

Understanding these documents is essential for anyone looking to establish an LLC in Ohio. Each plays a crucial role in ensuring that the business operates legally and effectively. Proper documentation can prevent misunderstandings and promote transparency among members.

Misconceptions

Understanding the Ohio Operating Agreement form is crucial for anyone involved in a limited liability company (LLC) in Ohio. However, several misconceptions often arise. Below is a list of common misunderstandings regarding this important document.

- It is not necessary to have an Operating Agreement. Many believe that an Operating Agreement is optional. In reality, while Ohio law does not require it, having one is highly recommended to outline the management structure and operating procedures of your LLC.

- All members must sign the Operating Agreement. Some think that every member's signature is mandatory for the agreement to be valid. In fact, while it is best practice to have all members sign, the agreement can still be enforceable even if not all members sign it.

- The Operating Agreement is a public document. There is a misconception that the Operating Agreement must be filed with the state and is therefore public. This is incorrect; the Operating Agreement is a private document and does not need to be filed with the Ohio Secretary of State.

- Once created, the Operating Agreement cannot be changed. Some individuals believe that an Operating Agreement is set in stone. However, it can be amended as needed, provided all members agree to the changes and follow the amendment procedures outlined in the agreement.

- It only addresses ownership percentages. Many think that the Operating Agreement solely deals with ownership stakes. In reality, it covers various aspects, including management roles, voting rights, profit distribution, and procedures for adding or removing members.

- Operating Agreements are only for large companies. There is a belief that only large LLCs need an Operating Agreement. In truth, every LLC, regardless of size, benefits from having a well-drafted Operating Agreement to clarify expectations and responsibilities.

- Verbal agreements are sufficient. Some people assume that a verbal agreement among members is enough. However, without a written Operating Agreement, misunderstandings and disputes can arise more easily, leading to potential legal issues.

- All Operating Agreements are the same. Many believe that a generic template will suffice for any LLC. Each Operating Agreement should be tailored to the specific needs and circumstances of the business and its members.

- Operating Agreements are only relevant during disputes. Some think that an Operating Agreement only matters when conflicts occur. In reality, it serves as a foundational document that guides the daily operations and decision-making processes of the LLC.

Addressing these misconceptions can help ensure that your LLC operates smoothly and that all members understand their rights and responsibilities. A well-crafted Operating Agreement is an essential tool for any business venture.