Ohio Power of Attorney Document

In Ohio, the Power of Attorney form serves as a vital legal tool that empowers individuals to designate someone they trust to make decisions on their behalf. This form can cover a wide range of financial and healthcare matters, ensuring that your wishes are respected even when you cannot voice them yourself. It allows the appointed agent to manage your financial affairs, handle real estate transactions, or make critical medical decisions in times of need. Importantly, Ohio law provides options for both durable and non-durable powers of attorney, giving you the flexibility to choose how long the authority lasts and under what circumstances it remains effective. Additionally, the form must be signed and notarized to be valid, which underscores the importance of following the proper legal procedures. Understanding the nuances of the Ohio Power of Attorney form is essential for anyone looking to secure their future and ensure their affairs are handled according to their wishes.

Discover More Power of Attorney Forms for Different States

California Durable Power of Attorney - This document provides authority to a designated agent to make decisions for the principal.

Understanding the process surrounding the Ohio Notice to Quit form is crucial for both landlords and tenants. This form is not just a notification; it sets the stage for the subsequent legal proceedings if necessary. Landlords can find resources and templates to assist in this matter, such as those available at All Ohio Forms, which can help ensure that all legal requirements are met properly.

Nys Power of Attorney Form - The principal must be of sound mind when executing the Power of Attorney.

Similar forms

-

Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. Like a Power of Attorney, it allows individuals to express their preferences about healthcare decisions, but it specifically addresses end-of-life care.

-

Advance Healthcare Directive: This document combines a living will and a healthcare Power of Attorney. It not only states medical preferences but also designates someone to make healthcare decisions on behalf of the individual if they are unable to do so.

-

Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if the person becomes incapacitated. It grants authority to manage financial and legal matters, similar to a general Power of Attorney, but with a focus on durability in times of incapacity.

- Ohio Articles of Incorporation Form: To establish a corporation in Ohio, make sure to complete the crucial Articles of Incorporation documentation for legal recognition.

-

Financial Power of Attorney: This document allows someone to make financial decisions on behalf of another person. It is similar to a general Power of Attorney but specifically focuses on financial matters, such as managing bank accounts, paying bills, and handling investments.

-

Trust Document: A trust document establishes a legal arrangement where one party holds property for the benefit of another. Like a Power of Attorney, it involves the management of assets, but it typically provides more comprehensive control over how and when assets are distributed.

Document Example

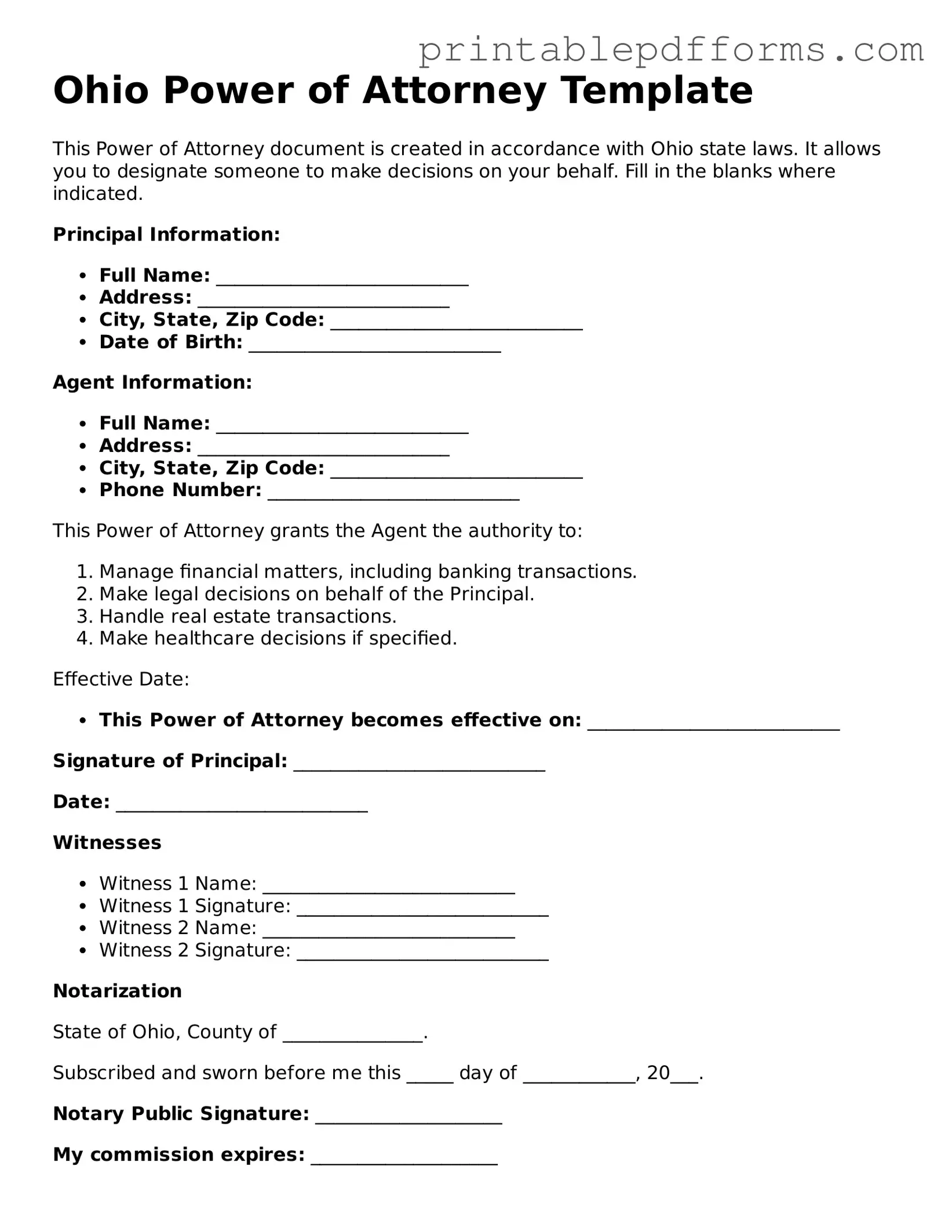

Ohio Power of Attorney Template

This Power of Attorney document is created in accordance with Ohio state laws. It allows you to designate someone to make decisions on your behalf. Fill in the blanks where indicated.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

- Date of Birth: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

- Phone Number: ___________________________

This Power of Attorney grants the Agent the authority to:

- Manage financial matters, including banking transactions.

- Make legal decisions on behalf of the Principal.

- Handle real estate transactions.

- Make healthcare decisions if specified.

Effective Date:

- This Power of Attorney becomes effective on: ___________________________

Signature of Principal: ___________________________

Date: ___________________________

Witnesses

- Witness 1 Name: ___________________________

- Witness 1 Signature: ___________________________

- Witness 2 Name: ___________________________

- Witness 2 Signature: ___________________________

Notarization

State of Ohio, County of _______________.

Subscribed and sworn before me this _____ day of ____________, 20___.

Notary Public Signature: ____________________

My commission expires: ____________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Ohio Power of Attorney form allows an individual to designate another person to make decisions on their behalf. |

| Governing Law | Ohio Revised Code, Section 1337.01 et seq. governs the Power of Attorney in Ohio. |

| Types of Powers | The form can grant general, limited, or specific powers, depending on the individual's needs. |

| Durability | A Power of Attorney can be durable, meaning it remains in effect if the principal becomes incapacitated. |

| Signature Requirements | The form must be signed by the principal and acknowledged before a notary public or signed by two witnesses. |

| Revocation | The principal can revoke the Power of Attorney at any time as long as they are competent. |

| Agent’s Duties | The agent must act in the best interest of the principal and adhere to the powers granted in the document. |

| Limitations | The form cannot authorize an agent to make certain decisions, such as those related to the principal’s health care unless specifically granted. |

Crucial Questions on This Form

-

What is a Power of Attorney in Ohio?

A Power of Attorney (POA) is a legal document that allows one person (the principal) to authorize another person (the agent) to make decisions on their behalf. This can include financial matters, healthcare decisions, and other important issues. In Ohio, a POA can be tailored to meet the specific needs of the principal, providing flexibility in how it is used.

-

What types of Power of Attorney are available in Ohio?

Ohio recognizes several types of Power of Attorney, including:

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

- Springing Power of Attorney: Becomes effective only upon the occurrence of a specified event, such as the principal's incapacity.

- Healthcare Power of Attorney: Specifically grants authority to make medical decisions on behalf of the principal.

-

How do I create a Power of Attorney in Ohio?

To create a Power of Attorney in Ohio, follow these steps:

- Choose a trusted individual to act as your agent.

- Complete the Power of Attorney form, ensuring it includes your name, the agent’s name, and the powers granted.

- Sign the document in the presence of a notary public.

- Provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

-

Do I need a lawyer to create a Power of Attorney?

No, you do not need a lawyer to create a Power of Attorney in Ohio. However, consulting a lawyer can be beneficial, especially if your situation is complex or if you have specific concerns. A legal professional can help ensure that the document meets all legal requirements and reflects your wishes accurately.

-

Can I revoke a Power of Attorney in Ohio?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To revoke, you must create a written revocation document and notify your agent and any institutions that had a copy of the original POA. It's important to formally communicate your decision to avoid any confusion.

-

What happens if my agent cannot serve?

If your chosen agent is unable or unwilling to serve, the Power of Attorney may specify an alternate agent. If no alternate is named, or if all agents are unable to act, you may need to appoint a new agent through a new Power of Attorney document.

-

Are there any limitations to the Power of Attorney in Ohio?

Yes, there are limitations. For instance, a Power of Attorney cannot authorize an agent to make decisions that are illegal or against public policy. Additionally, certain actions, like making or changing a will, typically cannot be delegated through a POA. Always clarify what powers you wish to grant to avoid misunderstandings.

-

How long does a Power of Attorney last in Ohio?

A Power of Attorney in Ohio remains effective until it is revoked by the principal, the principal passes away, or the specified conditions for a springing POA are met. If you want your POA to end at a specific time or event, make sure to include that in the document.

-

What should I consider when choosing an agent?

Choosing an agent is a significant decision. Consider the following:

- Trustworthiness: Your agent should be someone you can trust to act in your best interests.

- Availability: Ensure that your agent is willing and able to take on the responsibilities.

- Understanding: Your agent should understand your values and preferences, especially regarding healthcare and financial decisions.

-

Can a Power of Attorney make healthcare decisions for me?

Yes, if you create a Healthcare Power of Attorney, your agent can make medical decisions on your behalf when you are unable to do so. This includes decisions about treatments, medications, and end-of-life care. It’s crucial to discuss your wishes with your agent to ensure they understand your preferences.

Documents used along the form

When creating a Power of Attorney in Ohio, there are several other forms and documents that can be useful to ensure that all legal and personal needs are addressed. Below is a list of these documents, each serving a specific purpose in conjunction with the Power of Attorney.

- Living Will: This document outlines an individual's wishes regarding medical treatment in situations where they are unable to communicate their preferences. It specifies what types of life-sustaining measures should or should not be taken.

- Health Care Power of Attorney: Similar to a standard Power of Attorney, this form specifically grants someone the authority to make medical decisions on behalf of an individual if they become incapacitated.

- Durable Power of Attorney: This version of the Power of Attorney remains effective even if the individual becomes incapacitated. It is essential for long-term planning and management of affairs.

- Financial Power of Attorney: This document allows a designated person to manage financial matters on behalf of the individual, including paying bills, managing investments, and handling real estate transactions.

- Declaration of Guardian: This form allows an individual to name a preferred guardian in the event that they become unable to care for themselves. It can provide peace of mind regarding future care.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for various accounts, such as life insurance policies or retirement accounts, ensuring that assets are distributed according to the individual's wishes.

- Bill of Sale: To effectively document the transfer of property in Washington, it’s essential to utilize a All Washington Forms that accurately details the transaction. This form serves as proof of sale and captures the necessary information about the buyer, seller, and item sold.

- Trust Documents: Establishing a trust can help manage and protect assets during a person's lifetime and after their passing. Trust documents outline how assets should be managed and distributed.

Utilizing these documents in conjunction with the Power of Attorney can help ensure that an individual's wishes are respected and that their affairs are managed effectively, even in challenging circumstances.

Misconceptions

Many people have misconceptions about the Ohio Power of Attorney form. Understanding the facts can help individuals make informed decisions. Here are six common misconceptions:

- 1. A Power of Attorney is only for financial matters. Many believe that a Power of Attorney can only be used for financial decisions. In reality, a Power of Attorney can also cover healthcare decisions, allowing someone to make medical choices on your behalf if you become unable to do so.

- 2. The Power of Attorney is permanent. Some think that once a Power of Attorney is established, it cannot be revoked. However, you can revoke a Power of Attorney at any time as long as you are mentally competent. This flexibility allows you to change your mind as circumstances evolve.

- 3. All Powers of Attorney are the same. There are different types of Power of Attorney forms, including durable and non-durable. A durable Power of Attorney remains effective even if you become incapacitated, while a non-durable Power of Attorney ceases to be effective under those circumstances.

- 4. Anyone can be appointed as an agent. Some people assume that any person can be designated as an agent. While it is true that you can choose anyone you trust, it is important to select someone who is responsible and understands your wishes. Certain individuals, such as your healthcare provider, may not be eligible.

- 5. A Power of Attorney can be used to control all aspects of your life. A common belief is that a Power of Attorney grants complete control over all personal matters. In reality, the authority granted is limited to what you specify in the document. You can tailor the powers to fit your needs.

- 6. Once signed, the Power of Attorney is automatically effective. Some individuals think that signing the document makes it effective immediately. In Ohio, a Power of Attorney can be set to become effective only upon the occurrence of a specific event, such as your incapacitation. This allows for greater control over when the powers are activated.

By addressing these misconceptions, individuals can better navigate the complexities of the Ohio Power of Attorney form and ensure that their wishes are respected.