Ohio Promissory Note Document

The Ohio Promissory Note form serves as a critical financial instrument, facilitating the borrowing and lending of money between parties. This legally binding document outlines the terms under which the borrower agrees to repay the lender, including the principal amount, interest rate, and repayment schedule. It is essential for both parties to clearly understand their rights and obligations as stipulated in the note. The form typically includes essential details such as the names and addresses of the borrower and lender, the date of the agreement, and any collateral offered to secure the loan. Additionally, it may specify the consequences of default, thereby protecting the lender's interests. By providing a structured framework for these transactions, the Ohio Promissory Note helps to ensure clarity and reduce the potential for disputes, making it a vital component of financial agreements in the state.

Discover More Promissory Note Forms for Different States

Florida Promissory Note Requirements - A promissory note does not require notarization, but it may be beneficial to do so.

The Ohio Motor Vehicle Bill of Sale form is a critical document that records the essential details of the sale of a vehicle between two parties in Ohio. It serves as proof of transaction and establishes the transfer of ownership from the seller to the buyer. The importance of this document cannot be overstated as it is often required for vehicle registration and legal protection. For more information and resources, you can refer to All Ohio Forms.

Promissory Note Form California - This document outlines the borrower's commitment to repay a loan under agreed terms.

New York Promissory Note Requirements - Online templates for promissory notes are widely available, simplifying the process of creating one.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and consequences of default. Like a promissory note, it serves as a legal document that establishes the borrower's obligation to repay the loan.

- Tractor Bill of Sale: This document serves as proof of ownership transfer for a tractor, ensuring that both parties are protected during the transaction. For more details, you can visit georgiapdf.com/tractor-bill-of-sale/.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. It includes a promissory note as part of the documentation, detailing the borrower's promise to repay the loan secured by the property.

- Installment Agreement: This document allows a borrower to repay a debt in regular installments over a set period. Similar to a promissory note, it specifies the repayment terms and the total amount owed.

- Secured Note: A secured note is backed by collateral, providing the lender with additional security. Like a promissory note, it contains the borrower's promise to repay but includes details about the collateral in case of default.

- Personal Guarantee: A personal guarantee is a promise made by an individual to be responsible for another party's debt. It shares similarities with a promissory note in that it creates a legal obligation for repayment, ensuring the lender has recourse if the primary borrower defaults.

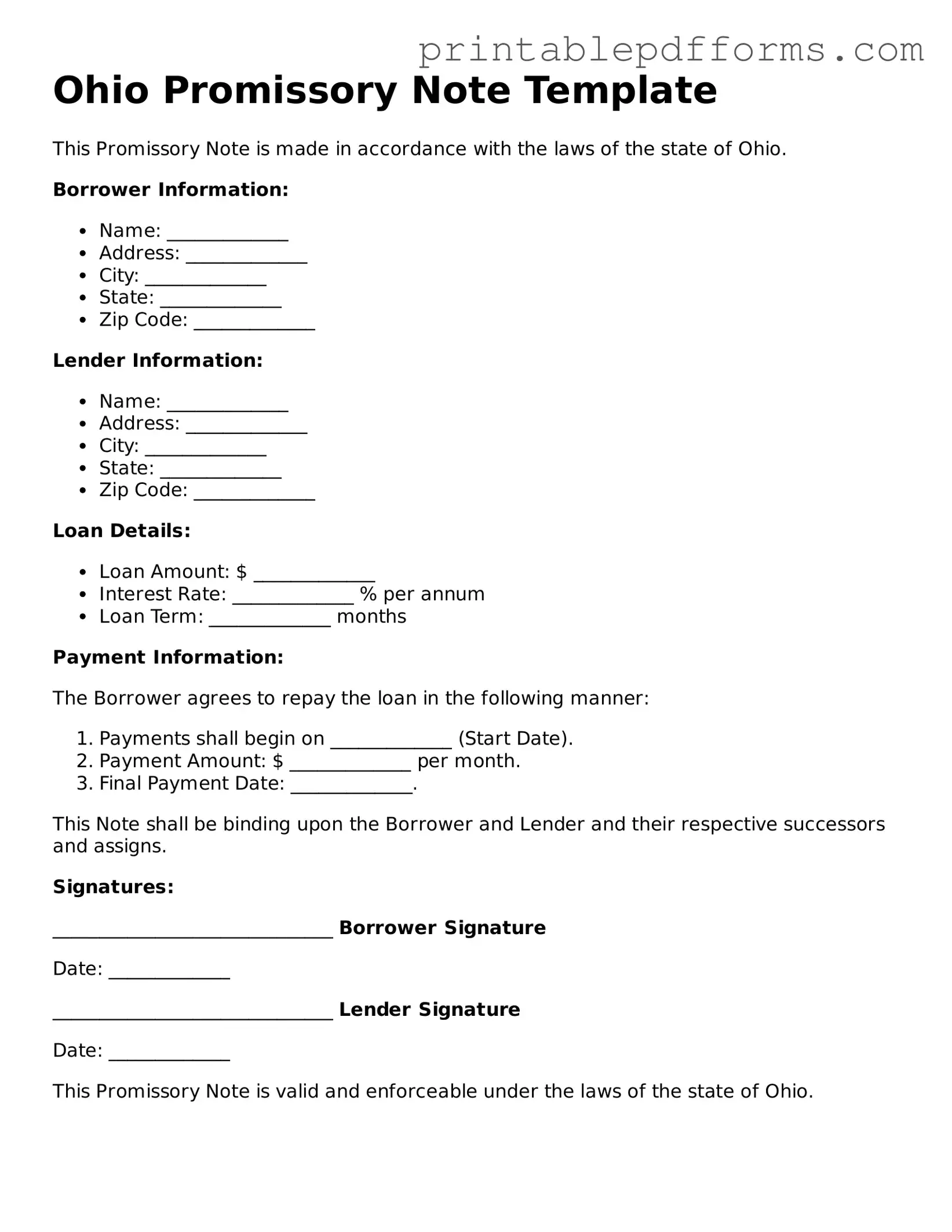

Document Example

Ohio Promissory Note Template

This Promissory Note is made in accordance with the laws of the state of Ohio.

Borrower Information:

- Name: _____________

- Address: _____________

- City: _____________

- State: _____________

- Zip Code: _____________

Lender Information:

- Name: _____________

- Address: _____________

- City: _____________

- State: _____________

- Zip Code: _____________

Loan Details:

- Loan Amount: $ _____________

- Interest Rate: _____________ % per annum

- Loan Term: _____________ months

Payment Information:

The Borrower agrees to repay the loan in the following manner:

- Payments shall begin on _____________ (Start Date).

- Payment Amount: $ _____________ per month.

- Final Payment Date: _____________.

This Note shall be binding upon the Borrower and Lender and their respective successors and assigns.

Signatures:

______________________________ Borrower Signature

Date: _____________

______________________________ Lender Signature

Date: _____________

This Promissory Note is valid and enforceable under the laws of the state of Ohio.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Ohio Promissory Note is governed by Ohio Revised Code § 1303.01 et seq., which outlines the laws related to negotiable instruments. |

| Requirements | To be valid, the note must include the amount owed, the interest rate (if any), the payment due date, and the signatures of the parties involved. |

| Types | Promissory notes can be secured or unsecured. A secured note is backed by collateral, while an unsecured note is not. |

| Enforceability | If properly executed, a promissory note is legally enforceable in a court of law, allowing the holder to seek repayment. |

| Transferability | Promissory notes in Ohio can be transferred to another party through endorsement, making them negotiable instruments. |

Crucial Questions on This Form

What is a Promissory Note in Ohio?

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a certain time or on demand. In Ohio, this document serves as a legal instrument that outlines the terms of the loan or debt agreement. It includes details such as the principal amount, interest rate, payment schedule, and any penalties for late payments. The note can be secured or unsecured, depending on whether collateral is involved.

What are the essential elements of an Ohio Promissory Note?

For a Promissory Note to be legally enforceable in Ohio, it should include the following essential elements:

- Parties Involved: The names and addresses of the borrower and lender.

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Payment Terms: The schedule for repayment, including due dates and payment amounts.

- Signatures: Signatures of both the borrower and lender, indicating their agreement to the terms.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps prevent disputes in the future regarding the terms of the loan.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to take legal action. This may involve filing a lawsuit to recover the owed amount. Additionally, if the note is secured by collateral, the lender may have the right to seize the collateral to satisfy the debt. The specific actions available to the lender will depend on the terms of the Promissory Note and applicable Ohio laws.

Is it necessary to have a lawyer review a Promissory Note?

While it is not legally required to have a lawyer review a Promissory Note, it is highly recommended, especially for larger loans or complex agreements. A legal professional can ensure that the document complies with Ohio laws and adequately protects the interests of both parties. Having legal guidance can also help clarify any terms that may be confusing or ambiguous.

Documents used along the form

When dealing with a promissory note in Ohio, there are several other documents that may be useful or necessary to ensure that all aspects of the loan agreement are clear and legally binding. Below is a list of common forms and documents that often accompany a promissory note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the expectations of both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, a security agreement is essential. It details the specific assets that back the loan and provides the lender with rights to those assets in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required, especially for business loans. This document holds an individual personally responsible for the loan, ensuring that the lender has recourse if the borrowing entity fails to repay.

- Articles of Incorporation: This essential document is required for establishing a corporation in New York, detailing the corporation's name, purpose, and structure. For more information, refer to nypdfforms.com/articles-of-incorporation-form/.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal. It helps borrowers understand their financial obligations better.

- Disclosure Statement: This document provides important information about the loan, including any fees, terms, and conditions. It ensures that borrowers are fully informed before signing the promissory note.

Having these documents in place can help clarify the relationship between the lender and borrower, protecting both parties and ensuring a smoother transaction. Always consider consulting with a legal professional when preparing these forms to ensure compliance with Ohio laws.

Misconceptions

Understanding the Ohio Promissory Note form can be challenging, and several misconceptions often arise. Here are nine common misunderstandings, clarified for better comprehension.

-

All promissory notes are the same.

Many believe that all promissory notes follow a one-size-fits-all format. In reality, the terms can vary significantly based on the agreement between the parties involved.

-

Only formal contracts require a promissory note.

Some think that promissory notes are only needed in formal agreements. However, even informal loans between friends or family can benefit from a written note to clarify terms.

-

A promissory note must be notarized.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be enforceable in Ohio.

-

Promissory notes are only for large sums of money.

Many assume that these notes are only applicable for significant loans. In truth, they can be used for any amount, no matter how small.

-

Once signed, a promissory note cannot be changed.

Some people think that a signed note is set in stone. Modifications can be made, but they usually require the consent of both parties and should be documented properly.

-

Interest rates are mandatory in promissory notes.

It is a common belief that all promissory notes must include interest. However, parties can agree to a zero-interest loan, and this can be clearly stated in the document.

-

Promissory notes are not legally binding.

Some individuals believe that these notes lack legal enforceability. In fact, a properly executed promissory note is a legally binding document that can be upheld in court.

-

Only lenders need to worry about promissory notes.

This misconception leads many borrowers to overlook the importance of understanding the terms. Both parties should be fully aware of their rights and obligations as outlined in the note.

-

Promissory notes are only relevant in Ohio.

While this discussion focuses on Ohio, promissory notes are used across the United States. Each state may have its own rules, but the concept remains broadly applicable.

By dispelling these misconceptions, individuals can better navigate the use of promissory notes and ensure that their financial agreements are clear and enforceable.