Ohio Transfer-on-Death Deed Document

The Ohio Transfer-on-Death Deed (TOD) form offers a straightforward way for property owners to ensure their real estate is transferred directly to designated beneficiaries upon their death, bypassing the often lengthy probate process. This legal tool allows individuals to maintain full control of their property during their lifetime while providing peace of mind regarding its future. By filling out the TOD form, property owners can specify who will inherit their property, which can include family members, friends, or charitable organizations. The form must be properly executed and recorded with the county recorder's office to be valid. Importantly, the TOD deed does not take effect until the owner passes away, meaning the property remains part of the owner’s estate until that time. This feature makes the TOD deed an appealing option for those looking to simplify the transfer of their property without the complications that often arise in estate planning. Understanding the nuances of this form can empower property owners to make informed decisions about their assets and ensure a smooth transition for their loved ones.

Discover More Transfer-on-Death Deed Forms for Different States

Pennsylvania Transfer on Death Deed Form - This deed enables a smooth transfer of property without going through probate, simplifying the process for heirs.

To facilitate property transfers, consider this user-friendly guide on creating a comprehensive Quitclaim Deed for Missouri. You can access the template by following the link below.

comprehensive Quitclaim Deed templateWhere Can I Get a Tod Form - Creating a Transfer-on-Death Deed does not affect your ability to sell or mortgage the property while you are living.

Texas Transfer on Death Deed Form - Clearly drafting and documenting your intentions through this deed can prevent misunderstandings among heirs.

Similar forms

- Will: A will outlines how a person's assets will be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries but requires probate, while the deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. Both documents provide a way to transfer property outside of probate, but a trust can manage assets while the individual is still alive.

-

Georgia Tractor Bill of Sale: This form is essential for documenting the ownership transfer of a tractor in Georgia, including vital information about the buyer, seller, and the tractor. For more information, visit georgiapdf.com/tractor-bill-of-sale/.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. Similar to a Transfer-on-Death Deed, it ensures that assets pass directly to beneficiaries without going through probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner passes away, their share automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed functions.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to designate a beneficiary who will receive the funds upon their death. Like a Transfer-on-Death Deed, POD accounts bypass probate, ensuring a smooth transfer of assets.

- Life Estate Deed: A life estate deed allows individuals to retain the right to use their property during their lifetime while designating a beneficiary to receive it after their death. This is similar to a Transfer-on-Death Deed in that it facilitates the transfer of property without probate.

Document Example

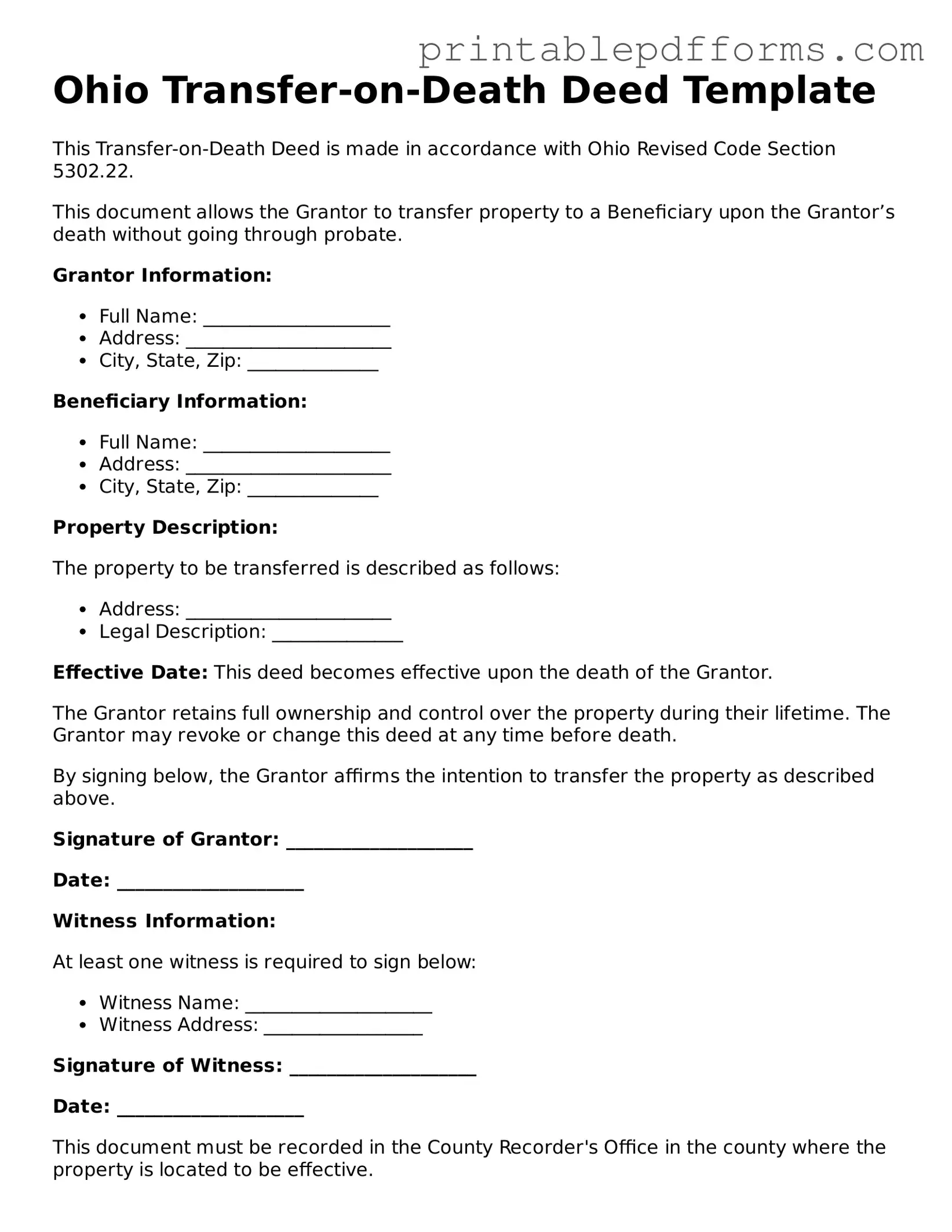

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with Ohio Revised Code Section 5302.22.

This document allows the Grantor to transfer property to a Beneficiary upon the Grantor’s death without going through probate.

Grantor Information:

- Full Name: ____________________

- Address: ______________________

- City, State, Zip: ______________

Beneficiary Information:

- Full Name: ____________________

- Address: ______________________

- City, State, Zip: ______________

Property Description:

The property to be transferred is described as follows:

- Address: ______________________

- Legal Description: ______________

Effective Date: This deed becomes effective upon the death of the Grantor.

The Grantor retains full ownership and control over the property during their lifetime. The Grantor may revoke or change this deed at any time before death.

By signing below, the Grantor affirms the intention to transfer the property as described above.

Signature of Grantor: ____________________

Date: ____________________

Witness Information:

At least one witness is required to sign below:

- Witness Name: ____________________

- Witness Address: _________________

Signature of Witness: ____________________

Date: ____________________

This document must be recorded in the County Recorder's Office in the county where the property is located to be effective.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Beneficiaries | Multiple beneficiaries can be named, and they can be individuals or entities such as trusts. |

| Revocation | The deed can be revoked at any time before the death of the property owner, ensuring flexibility in estate planning. |

| Filing Requirements | The deed must be signed and notarized, and it should be recorded with the county recorder’s office to be effective. |

| Tax Implications | Property transferred via this deed does not incur gift tax during the owner's lifetime, as ownership remains with the grantor until death. |

| Effect on Creditors | The property remains subject to the owner's creditors until their death, meaning creditors can still make claims against the property. |

| Survivorship | If a beneficiary predeceases the owner, their share can be designated to alternate beneficiaries, preventing complications. |

| Legal Assistance | While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting an attorney is advisable to ensure compliance with all legal requirements. |

Crucial Questions on This Form

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Ohio to transfer real estate to a designated beneficiary upon their death. This deed enables the property owner to retain full control of the property during their lifetime. The transfer occurs automatically, without the need for probate, making the process simpler and more efficient for heirs.

How do I create a Transfer-on-Death Deed in Ohio?

Creating a Transfer-on-Death Deed involves several steps:

- Obtain the appropriate form. You can find the Ohio Transfer-on-Death Deed form online or through local county offices.

- Fill out the form with accurate information. Include details such as the property description, your name as the owner, and the name of the beneficiary.

- Sign the deed in the presence of a notary public. This step is crucial, as the deed must be notarized to be legally valid.

- Record the deed with the county recorder's office where the property is located. This ensures that the deed is part of the public record.

Can I change or revoke a Transfer-on-Death Deed after it has been created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must execute a new TODD or a revocation document. It is essential to record the new deed or revocation with the county recorder's office to ensure that your wishes are accurately reflected in the public record. Keep in mind that if you do not properly revoke the previous deed, it may still be considered valid.

Are there any limitations to using a Transfer-on-Death Deed in Ohio?

While a Transfer-on-Death Deed offers many advantages, there are some limitations to consider:

- The deed can only be used for real estate, not personal property or financial accounts.

- All beneficiaries must be individuals or specific entities. You cannot name a trust or an estate as a beneficiary.

- If you have outstanding debts or liens against the property, those obligations may need to be settled before the property can be transferred to the beneficiary.

Understanding these limitations is crucial in planning your estate effectively.

Documents used along the form

When dealing with property transfer in Ohio, the Transfer-on-Death Deed (TOD) is a useful tool. However, it is often accompanied by other important documents to ensure a smooth transition of property ownership. Here are some commonly used forms and documents that may be relevant.

- Will: A legal document that outlines how a person's assets, including property, should be distributed after their death. It can also name guardians for minor children.

- Living Trust: This document allows a person to place their assets into a trust during their lifetime. It can help avoid probate and manage property distribution according to the person's wishes.

- Mobile Home Bill of Sale: This document is essential for recording the sale and purchase details of a mobile home in Ohio, legally documenting the transaction and providing proof of ownership change. It is important for legal, tax purposes, and serves as evidence in case of disputes regarding the sale. For more information, you can refer to All Ohio Forms.

- Affidavit of Heirship: A sworn statement that identifies the heirs of a deceased person. This document can help establish ownership of property when there is no will.

- Property Deed: A legal document that conveys ownership of property. When a property is transferred, a new deed must be created to reflect the change in ownership.

- Change of Beneficiary Form: If the property is part of a trust or has other beneficiary designations, this form updates who will inherit the property upon the owner's death.

Understanding these documents can help ensure that your property is transferred according to your wishes. Each form plays a specific role in the overall process, making it important to consider them carefully.

Misconceptions

Understanding the Ohio Transfer-on-Death Deed form can be challenging. Here are nine common misconceptions about this legal document:

- It is a Will. Many people think a Transfer-on-Death Deed functions like a will. However, it is not a will; it allows property to pass directly to beneficiaries without going through probate.

- It requires court approval. Some believe that a Transfer-on-Death Deed needs to be approved by a court. In reality, it becomes effective automatically upon the death of the property owner.

- It can only be used for residential property. There is a misconception that this deed is limited to homes. It can actually be used for various types of real estate, including land and commercial properties.

- Beneficiaries have immediate rights to the property. Many think beneficiaries can access the property as soon as the deed is filed. However, they must wait until the property owner passes away.

- It eliminates all estate taxes. Some believe using a Transfer-on-Death Deed avoids estate taxes entirely. While it simplifies the transfer process, estate taxes may still apply depending on the overall estate value.

- It cannot be revoked. There is a belief that once a Transfer-on-Death Deed is filed, it cannot be changed. In fact, the property owner can revoke or change the deed at any time before their death.

- It only works for single owners. Some think this deed is only applicable to individuals who own property alone. Joint owners can also utilize a Transfer-on-Death Deed, allowing for a smooth transition of ownership.

- It is only for Ohio residents. People may assume that only Ohio residents can use this deed. While it is specific to Ohio law, similar deeds exist in other states, each with its own regulations.

- Legal assistance is not needed. Some believe they can easily fill out the form without help. Although the form may seem straightforward, legal advice can ensure that it meets all requirements and serves the owner's intentions.