Blank Operating Agreement Form

An Operating Agreement is a vital document for any Limited Liability Company (LLC), serving as the backbone of its internal structure and governance. This agreement outlines the roles and responsibilities of members, detailing how the business will be managed and how profits and losses will be distributed. It addresses key aspects such as decision-making processes, voting rights, and procedures for adding or removing members. Additionally, it often includes provisions for handling disputes, transferring ownership interests, and what happens in the event of a member's departure or death. By clearly defining these elements, an Operating Agreement helps to prevent misunderstandings and conflicts among members, ensuring smooth operations and fostering a collaborative environment. Whether you are forming a new LLC or revising an existing agreement, understanding the components of an Operating Agreement is essential for establishing a solid foundation for your business.

State-specific Guidelines for Operating Agreement Forms

Operating Agreement Document Categories

Other Templates:

Acord Binder - Completion of the Acord 50 WM can enhance an employer's reputation regarding employee care.

Free Printable Gift Deed Form - The transfer of property through a Gift Deed is typically irreversible once completed.

An Arizona Bill of Sale is a legal document used to transfer ownership of an item from one person to another. This form provides essential details about the transaction, including the parties involved and a description of the item being sold. For a smooth and secure transfer, consider filling out the form by visiting Top Document Templates.

Bill of Sale Document - Bills of Sale can typically be completed in a few minutes, making them convenient.

Similar forms

-

Partnership Agreement: This document outlines the terms and conditions agreed upon by partners in a business. Like an Operating Agreement, it details the roles, responsibilities, and profit-sharing arrangements among partners, ensuring everyone is on the same page.

-

Bylaws: Bylaws serve as the internal rules governing a corporation. Similar to an Operating Agreement, they define the structure of the organization, including how decisions are made, the roles of officers, and procedures for meetings.

Purchase Agreement: This legal document captures the terms of a sale between a buyer and a seller, ensuring both parties understand their obligations and rights. To simplify the process, consider the Purchase Agreement.

-

Shareholder Agreement: This document is crucial for corporations with multiple shareholders. It outlines the rights and obligations of shareholders, much like an Operating Agreement does for members of an LLC, ensuring smooth operations and conflict resolution.

-

Joint Venture Agreement: When two or more parties collaborate on a specific project, a Joint Venture Agreement is created. It shares similarities with an Operating Agreement by defining the contributions, responsibilities, and profit distribution among the parties involved.

Document Example

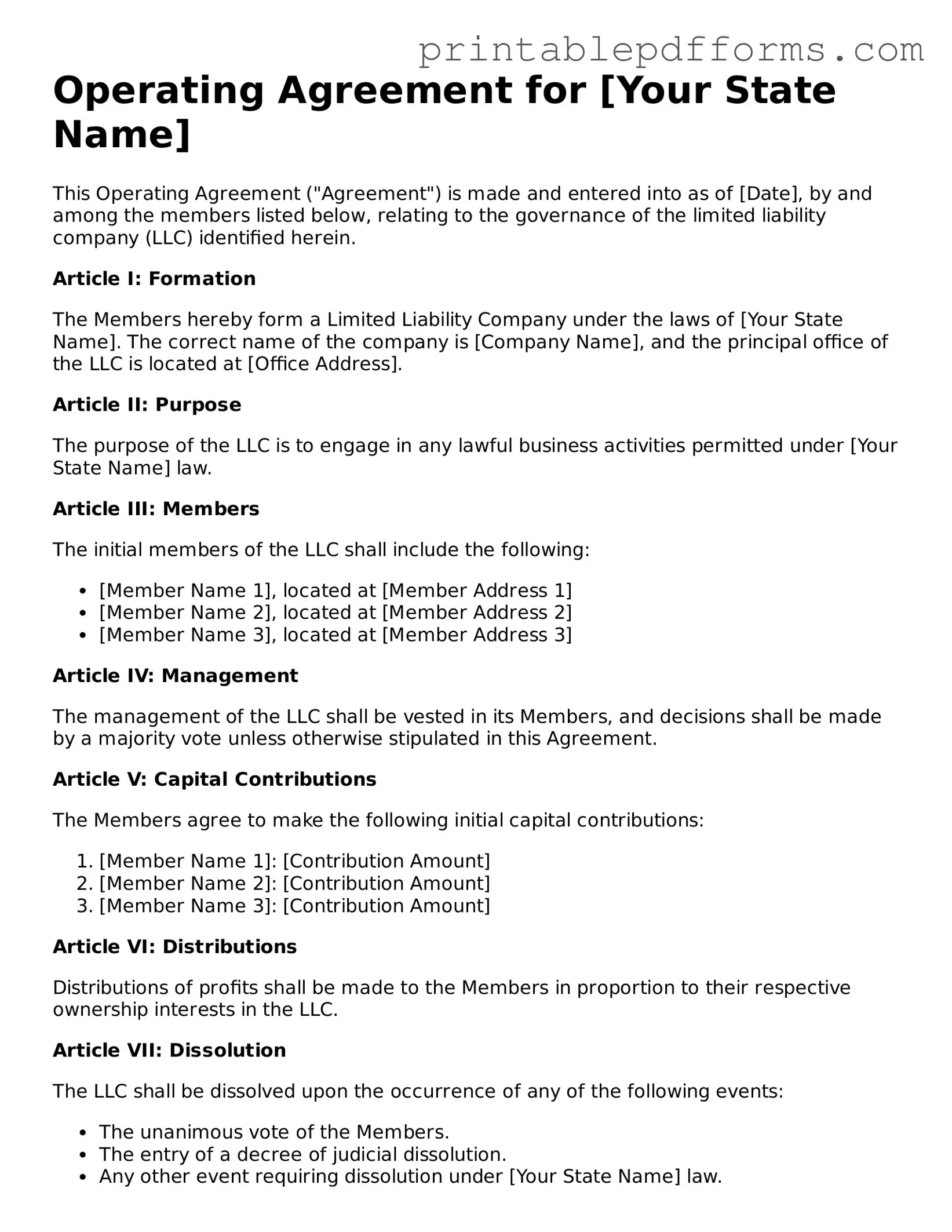

Operating Agreement for [Your State Name]

This Operating Agreement ("Agreement") is made and entered into as of [Date], by and among the members listed below, relating to the governance of the limited liability company (LLC) identified herein.

Article I: Formation

The Members hereby form a Limited Liability Company under the laws of [Your State Name]. The correct name of the company is [Company Name], and the principal office of the LLC is located at [Office Address].

Article II: Purpose

The purpose of the LLC is to engage in any lawful business activities permitted under [Your State Name] law.

Article III: Members

The initial members of the LLC shall include the following:

- [Member Name 1], located at [Member Address 1]

- [Member Name 2], located at [Member Address 2]

- [Member Name 3], located at [Member Address 3]

Article IV: Management

The management of the LLC shall be vested in its Members, and decisions shall be made by a majority vote unless otherwise stipulated in this Agreement.

Article V: Capital Contributions

The Members agree to make the following initial capital contributions:

- [Member Name 1]: [Contribution Amount]

- [Member Name 2]: [Contribution Amount]

- [Member Name 3]: [Contribution Amount]

Article VI: Distributions

Distributions of profits shall be made to the Members in proportion to their respective ownership interests in the LLC.

Article VII: Dissolution

The LLC shall be dissolved upon the occurrence of any of the following events:

- The unanimous vote of the Members.

- The entry of a decree of judicial dissolution.

- Any other event requiring dissolution under [Your State Name] law.

Article VIII: Amendments

This Agreement may be amended only with the unanimous consent of all Members.

This document is intended to be a general template and should be customized to meet specific needs and legal requirements in [Your State Name]. Each Member affirms that they have read, understood, and agreed to the terms set forth herein:

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

___________________________

[Member Name 1]

Date: ________________________

___________________________

[Member Name 2]

Date: ________________________

___________________________

[Member Name 3]

Date: ________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | An Operating Agreement outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Legal Requirement | While not mandatory in all states, having an Operating Agreement is highly recommended for LLCs to define roles and responsibilities. |

| State-Specific Laws | The governing laws vary by state. For example, in California, the relevant laws are found in the California Corporations Code. |

| Member Rights | The agreement specifies the rights and obligations of each member, including profit sharing and decision-making processes. |

| Amendments | Operating Agreements can be amended as needed, but usually require a formal process, such as a vote among members. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help avoid costly litigation. |

| Confidentiality | Many Operating Agreements include confidentiality clauses to protect sensitive business information. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a fixed term. |

Crucial Questions on This Form

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC). It serves as a guide for how the LLC will be run, detailing the rights and responsibilities of its members. This document is crucial for defining how decisions are made, how profits are distributed, and how disputes are resolved.

Why do I need an Operating Agreement?

Having an Operating Agreement is important for several reasons:

- It helps prevent misunderstandings among members by clearly stating each person's role and responsibilities.

- It provides a framework for resolving disputes, which can save time and money in the event of a disagreement.

- It can protect your limited liability status by demonstrating that your LLC is a separate entity from its members.

- Some banks and investors may require an Operating Agreement before they will do business with your LLC.

What should be included in an Operating Agreement?

An effective Operating Agreement typically includes the following elements:

- Organization details: The name of the LLC, its purpose, and its principal office location.

- Member information: Names and addresses of all members, along with their ownership percentages.

- Management structure: Whether the LLC will be member-managed or manager-managed, along with the powers and duties of managers.

- Voting rights: How decisions will be made, including voting procedures and required majorities.

- Profit and loss distribution: How profits and losses will be allocated among members.

- Amendment procedures: How the Operating Agreement can be changed in the future.

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many templates are available online to help guide you through the process. However, it’s important to ensure that the document complies with your state’s laws and meets the specific needs of your LLC. Consulting with a lawyer can help ensure that your Operating Agreement is comprehensive and legally sound.

How do I change an Operating Agreement?

To change an Operating Agreement, follow these general steps:

- Review the current Operating Agreement to understand the amendment procedures outlined within it.

- Discuss proposed changes with all members to reach a consensus.

- Draft the amendments clearly, specifying what changes are being made.

- Have all members sign the amended document to indicate their agreement.

- Keep a copy of the amended Operating Agreement with your LLC records.

Documents used along the form

An Operating Agreement is a crucial document for LLCs, outlining the management structure and operational procedures of the business. However, several other forms and documents often accompany it to ensure comprehensive governance and compliance. Below is a list of these essential documents.

- Articles of Organization: This is the foundational document that officially establishes an LLC. It is filed with the state and includes basic information such as the business name, address, and registered agent.

- Member Consent Form: This document records the agreement of members regarding important decisions, such as admitting new members or making significant changes to the business structure. It serves as a formal acknowledgment of member decisions.

- Employment Verification Form: To verify employment status, utilize the essential Employment Verification form guide for your documentation needs.

- Bylaws: While more common in corporations, bylaws can also be useful for LLCs. They outline the rules for internal governance, including meeting procedures and voting rights, helping to clarify how the business operates.

- Initial Capital Contribution Agreement: This document details the initial financial contributions made by each member. It specifies the amount each member invests and can also outline how profits and losses will be shared.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company and may include details like the member’s name and ownership percentage.

- Tax Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required for opening a business bank account. This document is submitted to the IRS and is essential for compliance with federal tax regulations.

Each of these documents plays a vital role in the formation and operation of an LLC. Together, they provide a clear framework for governance, financial contributions, and compliance, ensuring that the business can operate smoothly and effectively.

Misconceptions

Understanding the Operating Agreement form is crucial for anyone involved in a business partnership or limited liability company (LLC). However, several misconceptions can lead to confusion. Here are six common misconceptions:

- Operating Agreements are only necessary for large businesses. Many people believe that only large companies need an Operating Agreement. In reality, even small businesses and single-member LLCs benefit from having one, as it outlines the management structure and operational procedures.

- Operating Agreements are filed with the state. Some assume that the Operating Agreement must be submitted to the state. However, this document is typically kept internal and does not need to be filed, although it may be requested in certain legal situations.

- All Operating Agreements are the same. There is a misconception that a standard template will suffice for all businesses. Each Operating Agreement should be tailored to the specific needs and goals of the business, reflecting its unique structure and operations.

- Once created, an Operating Agreement cannot be changed. Many believe that Operating Agreements are set in stone. In fact, they can be amended as the business evolves, allowing for adjustments in management or ownership.

- Operating Agreements only cover financial aspects. Some think these documents focus solely on financial matters. In truth, they also address management roles, decision-making processes, and dispute resolution, providing a comprehensive framework for the business.

- Legal advice is unnecessary when drafting an Operating Agreement. There is a belief that anyone can draft an Operating Agreement without professional help. While it's possible to create one independently, consulting a legal professional can ensure that all necessary elements are included and compliant with state laws.

Addressing these misconceptions can help ensure that business owners create effective Operating Agreements that protect their interests and promote smooth operations.