Blank Owner Financing Contract Form

Owner financing is an increasingly popular option for buyers and sellers in real estate transactions, providing a flexible alternative to traditional mortgage financing. This arrangement allows the seller to act as the lender, offering the buyer a loan to purchase the property. The Owner Financing Contract form is a crucial document that outlines the terms of this agreement, ensuring both parties understand their rights and responsibilities. Key elements of the form include the purchase price, down payment amount, interest rate, repayment schedule, and any applicable fees. Additionally, it addresses contingencies, default conditions, and the process for resolving disputes. By clearly delineating these terms, the Owner Financing Contract helps protect both the buyer's and seller's interests, fostering a smoother transaction and potentially avoiding misunderstandings down the line.

Popular Owner Financing Contract Documents:

Purchase Agreement Addendum - Specifies changes in price, payment methods, or timelines.

The necessary Real Estate Purchase Agreement guidelines are crucial for anyone looking to engage in property transactions in California, ensuring all parties understand their rights and obligations within the sale process.

Terminate Real Estate Agent Contract Letter - Provides an official way to conclude the relationship formed by the agreement.

Similar forms

The Owner Financing Contract is a unique agreement that allows a buyer to purchase a property directly from the seller, with the seller acting as the lender. However, there are several other documents that share similarities with this contract. Below are seven documents that are comparable to the Owner Financing Contract, along with explanations of how they relate:

- Mortgage Agreement: This document outlines the terms under which a borrower receives a loan from a lender to purchase real estate. Like the Owner Financing Contract, it includes details about repayment terms and the consequences of default.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money to a lender at a defined time. Similar to the Owner Financing Contract, it establishes the borrower's obligation to repay the loan.

- Lease Purchase Agreement: This document allows a tenant to lease a property with the option to buy it later. Both agreements facilitate a path to ownership, making them similar in purpose and structure.

- Installment Sale Agreement: In this type of agreement, the seller finances the sale of the property, allowing the buyer to make payments over time. This mirrors the Owner Financing Contract's structure of seller financing.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale, including price and contingencies. Like the Owner Financing Contract, it serves as a foundational document for the sale process.

- Deed of Trust: This legal document secures a loan by transferring the title of the property to a trustee until the loan is paid off. It shares similarities with the Owner Financing Contract in securing the seller's interest in the property.

- Real Estate Purchase Agreement: Understanding this essential document is key for anyone looking to navigate the complexities of buying or selling property in New York. It outlines the terms and conditions of the sale, including the responsibilities of both the buyer and seller. For more information, please visit https://nyforms.com/real-estate-purchase-agreement-template/.

- Seller Financing Addendum: This is an additional document that can be added to a standard purchase agreement to outline the terms of seller financing. It is directly related to the Owner Financing Contract in detailing the financing arrangement.

Document Example

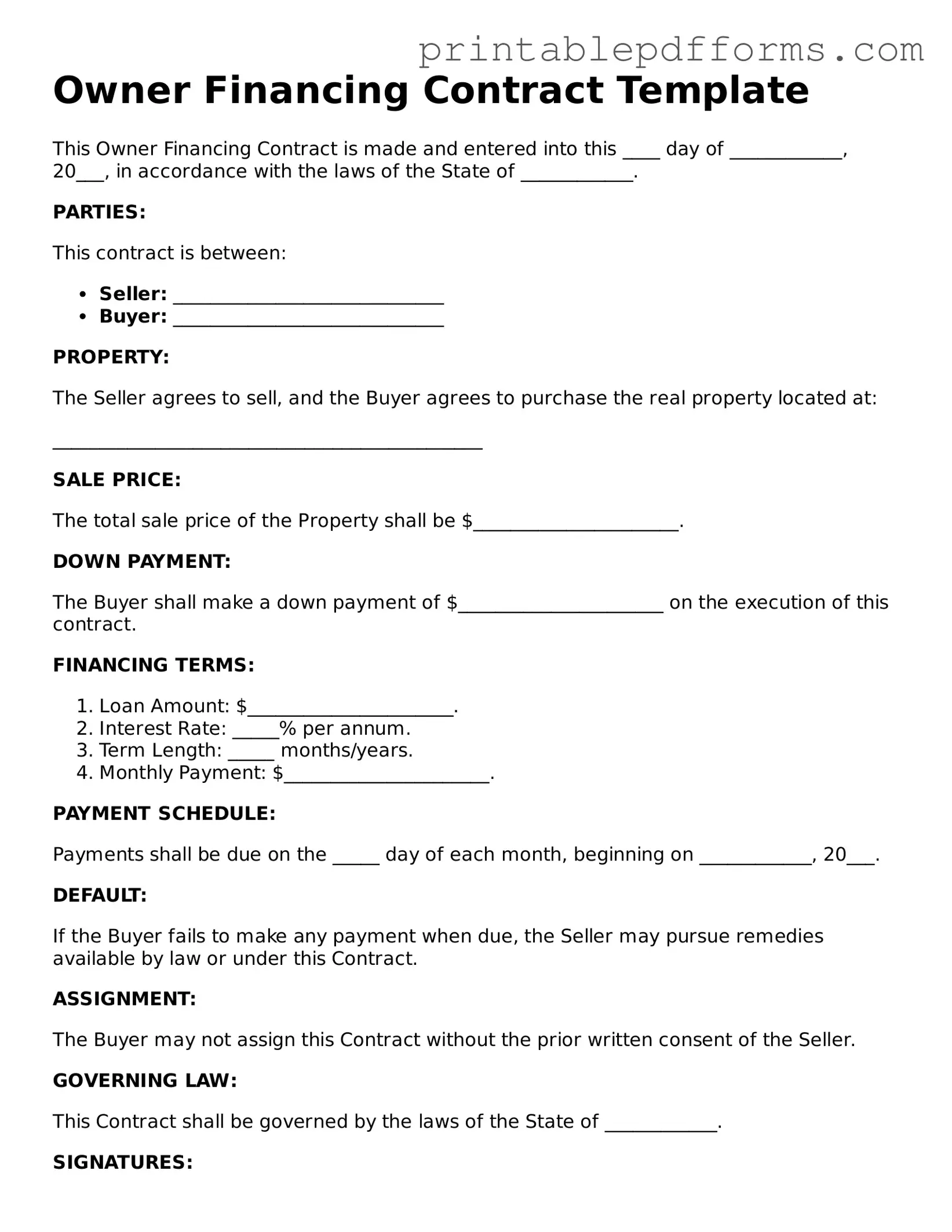

Owner Financing Contract Template

This Owner Financing Contract is made and entered into this ____ day of ____________, 20___, in accordance with the laws of the State of ____________.

PARTIES:

This contract is between:

- Seller: _____________________________

- Buyer: _____________________________

PROPERTY:

The Seller agrees to sell, and the Buyer agrees to purchase the real property located at:

______________________________________________

SALE PRICE:

The total sale price of the Property shall be $______________________.

DOWN PAYMENT:

The Buyer shall make a down payment of $______________________ on the execution of this contract.

FINANCING TERMS:

- Loan Amount: $______________________.

- Interest Rate: _____% per annum.

- Term Length: _____ months/years.

- Monthly Payment: $______________________.

PAYMENT SCHEDULE:

Payments shall be due on the _____ day of each month, beginning on ____________, 20___.

DEFAULT:

If the Buyer fails to make any payment when due, the Seller may pursue remedies available by law or under this Contract.

ASSIGNMENT:

The Buyer may not assign this Contract without the prior written consent of the Seller.

GOVERNING LAW:

This Contract shall be governed by the laws of the State of ____________.

SIGNATURES:

IN WITNESS WHEREOF, the parties hereto have executed this Owner Financing Contract on the day and year first above written.

Seller Signature: _________________________________

Date: _____________

Buyer Signature: _________________________________

Date: _____________

WITNESS:

__________________________________

Date: _____________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer, allowing them to purchase property without traditional bank financing. |

| Governing Law | The governing laws for Owner Financing Contracts vary by state. For example, in California, the relevant laws include the California Civil Code sections pertaining to real property transactions. |

| Payment Structure | These contracts typically outline the payment structure, including down payment, interest rate, and repayment schedule, which can be customized to meet the needs of both parties. |

| Legal Protections | Owner Financing Contracts provide legal protections for both the buyer and seller, ensuring that the terms of the agreement are enforceable under state law. |

| Risk Factors | Buyers may face risks such as higher interest rates or potential foreclosure if they default on payments, while sellers risk not receiving full payment if the buyer fails to adhere to the contract. |

Crucial Questions on This Form

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer in which the seller provides financing to the buyer to purchase a property. Instead of the buyer obtaining a traditional mortgage from a bank or financial institution, the seller allows the buyer to make payments directly to them over a specified period. This arrangement can benefit both parties, as it can facilitate a sale when traditional financing is difficult to obtain.

Who benefits from using an Owner Financing Contract?

Both sellers and buyers can benefit from this type of financing. Sellers may attract more potential buyers by offering flexible payment options, especially in a tight credit market. They can also receive a steady income stream from the payments. Buyers, on the other hand, may find it easier to qualify for financing, particularly if they have poor credit or limited access to traditional loans. Additionally, they may negotiate more favorable terms than those typically offered by banks.

What terms should be included in an Owner Financing Contract?

When drafting an Owner Financing Contract, several key terms should be clearly outlined to protect both parties:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount the buyer pays upfront, which can influence the financing terms.

- Interest Rate: The rate at which interest will accrue on the unpaid balance, which should be competitive yet fair.

- Payment Schedule: A detailed outline of when payments are due, including the frequency (monthly, quarterly) and duration of the loan.

- Default Terms: Conditions under which the seller can take action if the buyer fails to make payments.

- Property Taxes and Insurance: Clarification on who is responsible for these costs during the financing period.

Are there risks associated with Owner Financing Contracts?

Yes, there are several risks that both buyers and sellers should consider. For sellers, the primary risk is that the buyer may default on payments, leading to potential financial loss and the need for legal action to reclaim the property. Buyers may face risks as well, including the possibility of hidden liens on the property or unclear terms that could lead to disputes. It is crucial for both parties to conduct thorough due diligence and seek legal advice before entering into such agreements.

How can parties ensure the contract is legally binding?

To ensure that an Owner Financing Contract is legally binding, it is essential to follow these steps:

- Both parties should sign the contract in the presence of a notary public to validate the agreement.

- Consider having the contract reviewed by a qualified attorney to ensure compliance with state laws and regulations.

- Record the contract with the appropriate local government office, which can provide public notice of the agreement and protect the buyer's interest in the property.

Can an Owner Financing Contract be modified?

Yes, an Owner Financing Contract can be modified, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the seller and buyer to maintain legal validity. It is advisable to consult with a legal professional when making modifications to ensure that the new terms are clear and enforceable.

Documents used along the form

When engaging in an owner financing arrangement, several important documents often accompany the Owner Financing Contract. Each of these forms serves a specific purpose and contributes to the overall clarity and legality of the transaction. Understanding these documents can help ensure a smooth process for both the buyer and the seller.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount. It includes details such as the interest rate, repayment schedule, and consequences for defaulting on the loan.

- Deed of Trust: This legal instrument secures the loan by transferring the property title to a neutral third party, known as a trustee, until the borrower fully repays the loan. It protects the lender's interest in the property.

- Purchase Agreement: This document establishes the terms of the sale, including the purchase price, property description, and any contingencies. It lays the groundwork for the transaction and is essential for both parties.

- Real Estate Purchase Agreement: This essential document lays out the specific terms of sale and is critical for any real estate transaction in Colorado. For a resource on this form, you can visit Colorado PDF Forms.

- Disclosure Statement: This form provides important information about the property, such as its condition and any known issues. It ensures that the buyer is fully informed before completing the purchase.

- Amortization Schedule: This schedule outlines the breakdown of each payment over the life of the loan. It details how much of each payment goes toward principal and interest, helping the borrower understand their financial obligations.

- Closing Statement: This document summarizes the financial details of the transaction at closing. It includes all costs associated with the sale, ensuring transparency and clarity for both parties involved.

Having these documents prepared and understood is crucial in any owner financing situation. They not only protect the interests of both the buyer and the seller but also promote a transparent and fair transaction. By taking the time to review and comprehend each document, all parties can move forward with confidence.

Misconceptions

Understanding owner financing can be challenging. Many misconceptions surround the Owner Financing Contract form. Below are some common misunderstandings and clarifications.

- Owner financing is only for buyers with poor credit. This is not true. While owner financing can be beneficial for buyers with credit issues, it is also an option for buyers who prefer more flexible terms or who want to avoid traditional lenders.

- Owner financing means the seller has to act as a bank. Sellers do not become traditional lenders. They simply provide financing to the buyer. The seller retains certain rights and responsibilities throughout the process.

- All owner financing contracts are the same. Each contract can vary significantly based on the terms agreed upon by both parties. Customization is common and often necessary to fit the specific situation.

- Owner financing eliminates the need for a real estate agent. While some buyers and sellers choose to handle transactions without an agent, it is still advisable to consult professionals for legal and financial guidance.

- The seller has no recourse if the buyer defaults. This is incorrect. The seller can take legal action to reclaim the property if the buyer fails to make payments as agreed.

- Owner financing is always a risky option for sellers. While there are risks, such as buyer default, sellers can mitigate these risks through thorough vetting and clear contract terms.

- Owner financing is only for residential properties. This is a misconception. Owner financing can apply to various types of properties, including commercial real estate.

- Buyers have unlimited time to pay off the loan. This is not accurate. Owner financing agreements typically include a specific repayment timeline that both parties must adhere to.

- Interest rates are always lower in owner financing agreements. Interest rates can vary. They may be higher or lower than traditional financing, depending on the agreement reached between the seller and buyer.