Fill a Valid P 45 It Form

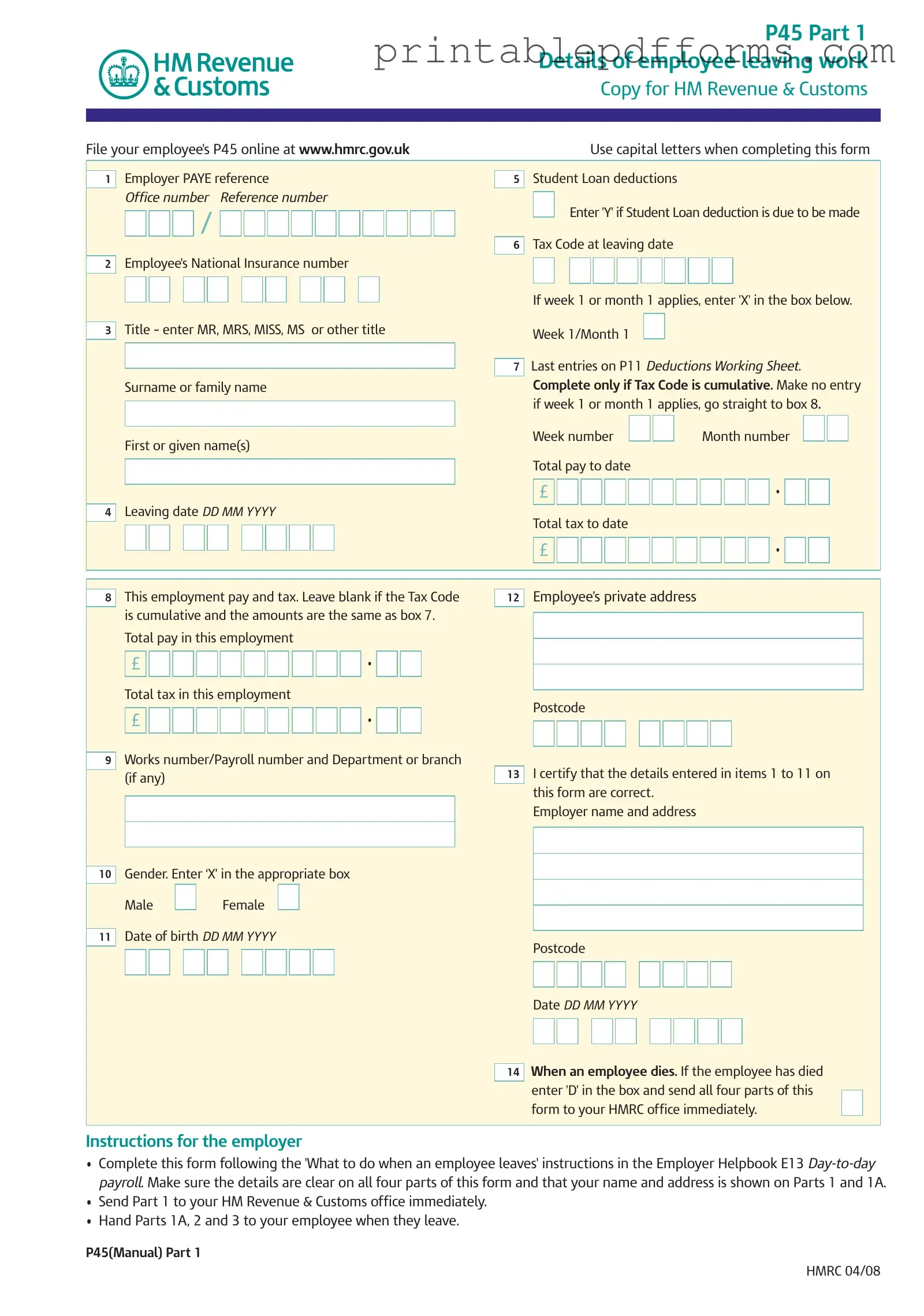

The P45 form is a crucial document for both employees and employers in the United Kingdom, particularly when an employee leaves a job. It consists of three parts, each serving a specific purpose in the process of transferring employment information. Part 1 is sent to HM Revenue & Customs (HMRC) and contains essential details such as the employee's National Insurance number, tax code at the time of leaving, and total pay and tax deductions to date. This information helps HMRC update the employee's tax records and ensures that the correct tax is applied in future employment. Part 1A is for the employee's personal records, while Parts 2 and 3 are provided to the new employer, facilitating a smooth transition between jobs. The form also addresses specific situations, such as student loan deductions and the process to follow if an employee passes away. Clear instructions guide employers on how to complete the form accurately, reinforcing the importance of prompt submission to HMRC. Understanding the P45 form is vital for employees to manage their tax obligations effectively and for employers to comply with legal requirements when an employee departs.

Additional PDF Templates

Faa 8050-2 - The form standardizes the documentation required for aircraft transactions.

The New York Bill of Sale form is a vital legal document that securely facilitates the transfer of ownership of personal property, ensuring all parties understand their rights and responsibilities. By incorporating important details about the seller, buyer, and the item being sold, it serves as more than just a receipt; it provides clarity and protection for both parties involved in the transaction. For those looking to create this document, resources such as https://freebusinessforms.org/ can be invaluable.

Credit Application Template for Business - Your business's credit needs begin with filling out this application.

Similar forms

P60: This document summarizes an employee's total pay and deductions for the tax year. Like the P45, it provides important information for tax purposes and is issued by the employer at the end of the tax year.

P11D: This form details expenses and benefits provided to employees. It is similar to the P45 in that it is used for reporting to HMRC, but it focuses on non-cash benefits rather than income.

P50: This form is used to claim a tax refund after leaving a job. It is similar to the P45 as both relate to tax matters and are necessary for completing tax returns.

P85: This document is used when an individual leaves the UK to work abroad. Like the P45, it helps manage tax obligations and ensures proper reporting to HMRC.

P14: This form was used to report an employee's pay and deductions for the tax year. While it has been replaced by the P60, it served a similar purpose to the P45 in terms of reporting employment income.

- Medical Power of Attorney - The Ohio Medical Power of Attorney form is essential for residents to appoint someone to make health care decisions on their behalf when they're unable to do so. For more information, visit All Ohio Forms.

P45 (Part 1A): This part of the P45 is specifically for the employee and contains similar information as Part 1 but is intended for the employee's records.

P45 (Part 2): This part is provided to the new employer, similar to Part 3, ensuring that the new employer has the necessary information about the employee's previous employment.

P45 (Part 3): This part is for the new employer to complete and send to HMRC. It is similar to the P45 in that it contains employment information necessary for tax calculations.

Tax Return (SA100): This form is used by self-assessment taxpayers to report income and claim tax reliefs. It is similar to the P45 as both are essential for accurate tax reporting.

Jobseeker's Allowance Claim Form: This form is used when applying for unemployment benefits. It relates to the P45 in that both documents provide information about employment status and income.

Document Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 1 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of employee leaving work |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy for HM Revenue & Customs |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Office number |

Reference number |

|

|

|

|

Enter 'Y' if Student Loan deduction is due to be made |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|

||||||||||||||||||||||||

|

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

||||||||||||||||||||||||||

|

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. Make no entry |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if week 1 or month 1 applies, go straight to box 8. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

8 |

|

This employment pay and tax. Leave blank if the Tax Code |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

is cumulative and the amounts are the same as box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When an employee dies. If the employee has died |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter 'D' in the box and send all four parts of this |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

form to your HMRC office immediately. |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for the employer

•Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13

•Send Part 1 to your HM Revenue & Customs office immediately.

•Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1

HMRC 04/08

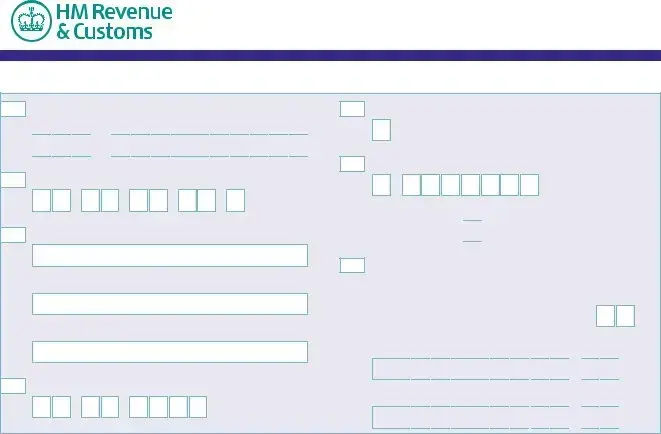

P45 Part 1A

Details of employee leaving work

Copy for employee

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Office number |

Reference number |

|

|

|

|

Student Loan deductions to continue |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6 there will be no entries here. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

||||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

8 |

|

This employment pay and tax. If no entry here, the amounts |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

are those shown at box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the employee

The P45 is in three parts. Please keep this part (Part 1A) safe. Copies are not available. You might need the information in Part 1A to fill in a Tax Return if you are sent one.

Please read the notes in Part 2 that accompany Part 1A. The notes give some important information about what you should do next and what you should do with Parts 2 and 3 of this form.

Tax credits

Tax credits are flexible. They adapt to changes in your life, such as leaving a job. If you need to let us know about a change in your income, phone 0845 300 3900.

To the new employer

If your new employee gives you this Part 1A, please return it to them. Deal with Parts 2 and 3 as normal.

P45(Manual) Part 1A |

HMRC 04/08 |

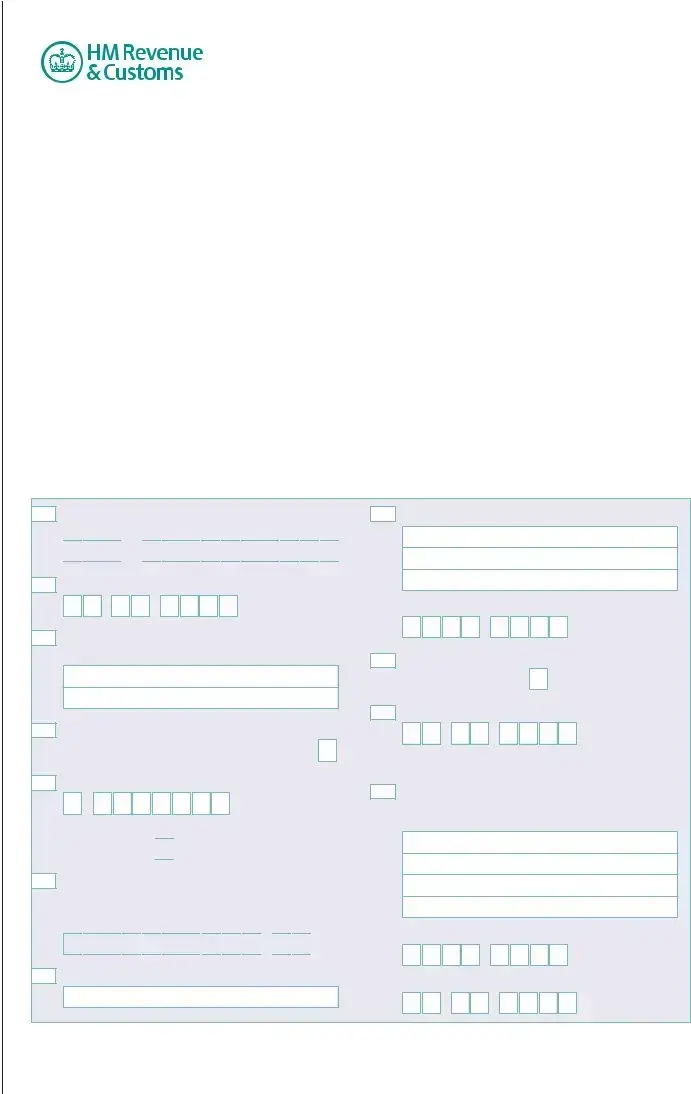

P45 Part 2 Details of employee leaving work

Copy for new employer

1

2

3

4

Employer PAYE reference

Office number Reference number

/

/

Employee's National Insurance number

Title - enter MR, MRS, MISS, MS or other title

Surname or family name

First or given name(s)

Leaving date DD MM YYYY

5Student Loan deductions

Student Loan deductions to continue

6Tax Code at leaving date

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

7Last entries on P11 Deductions Working Sheet. Complete only if Tax Code is cumulative. If there is an ‘X’ at box 6, there will be no entries here.

Week number |

|

|

Month number |

Total pay to date |

|

|

|

£

•

•

Total tax to date

£

•

•

To the employee

This form is important to you. Take good care of it and keep it safe. Copies are not available. Please keep

Parts 2 and 3 of the form together and do not alter them in any way.

Going to a new job

Claiming Jobseeker's Allowance or

Employment and Support Allowance (ESA)

Take this form to your Jobcentre Plus office. They will pay you any tax refund you may be entitled to when your claim ends, or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, or you will have tax deducted using the emergency code and may pay too much tax. If you do not want your new employer to know the details on this form, send it to your HM Revenue & Customs (HMRC) office immediately with a letter saying so and giving the name and address of your new employer. HMRC can make special arrangements, but you may pay too much tax for a while as a result of this.

Going abroad

Not working and not claiming Jobseeker's Allowance or Employment and Support Allowance (ESA)

If you have paid tax and wish to claim a refund ask for form P50 Claiming Tax back when you have stopped working from any HMRC office or Enquiry Centre.

Help

If you need further help you can contact any HMRC office or Enquiry Centre. You can find us in The Phone Book under HM Revenue & Customs or go to www.hmrc.gov.uk

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom from any HMRC office or Enquiry Centre.

Becoming

You must register with HMRC within three months of becoming

to get a copy of the booklet SE1 Are you thinking of working for yourself?

To the new employer

Check this form and complete boxes 8 to 18 in Part 3 and prepare a form P11 Deductions Working Sheet. Follow the instructions in the Employer Helpbook E13

P45(Manual) Part 2 |

HMRC 04/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 3 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New employee details |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For completion by new employer |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

1 |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Office number Reference number |

|

|

|

|

|

Student Loan deductions to continue |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS or other title |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

3 |

|

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6, there will be no entries here. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

|

|

Month number |

|

|

|

|

||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8

New employer PAYE reference

Office number Reference number

/

/

15

Employee's private address

9Date new employment started DD MM YYYY

10Works number/Payroll number and Department or branch (if any)

11Enter 'P' here if employee will not be paid by you between the date employment began and the next 5 April.

12Enter Tax Code in use if different to the Tax Code at box 6

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

13If the tax figure you are entering on P11 Deductions Working Sheet differs from box 7 (see the E13 Employer Helpbook

figure here.

£

•

•

14New employee's job title or job description

Postcode

16Gender. Enter ‘X’ in the appropriate box

Male |

|

Female |

17Date of birth DD MM YYYY

Declaration

18I have prepared a P11 Deductions Working Sheet in accordance with the details above.

Employer name and address

Postcode

Date DD MM YYYY

P45(Manual) Part 3 |

HMRC 04/08 |

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The P45 form is used in the UK to document an employee's leaving details, including their tax and pay information, which is necessary for tax purposes. |

| Parts of the Form | The P45 consists of three parts: Part 1 is for HM Revenue & Customs, Part 1A is for the employee, and Parts 2 and 3 are for the new employer. |

| Student Loan Deductions | The form includes a section for indicating whether student loan deductions are applicable, which helps ensure proper tax handling for employees with such loans. |

| Completion Instructions | Employers must complete the form accurately, following guidelines provided in the Employer Helpbook E13, ensuring clarity on all parts before submission. |

| Submission Requirement | Employers are required to send Part 1 of the P45 to HMRC immediately after an employee leaves, while Parts 1A, 2, and 3 should be given to the employee. |

| Governing Law | The P45 form is governed by UK tax law, specifically under the Income Tax (Pay As You Earn) Regulations. |

Crucial Questions on This Form

What is the P45 form and why is it important?

The P45 form is a document issued by an employer when an employee leaves their job. It provides essential information about the employee's earnings and the taxes paid during their employment. This form is crucial for both the employee and the new employer. It ensures that the employee is taxed correctly in their new position and helps avoid overpayment of taxes. The P45 has multiple parts, with specific sections designated for the employer, the employee, and the new employer.

How do I complete the P45 form correctly?

Completing the P45 form requires attention to detail. Here are the key steps to follow:

- Fill in the employer's PAYE reference and office number.

- Provide the employee's National Insurance number and personal details, including their name, address, and date of birth.

- Indicate the leaving date and the total pay and tax to date.

- If applicable, mark whether student loan deductions are due and specify the tax code at the leaving date.

- Ensure all entries are clear and accurate, and sign the form to certify its correctness.

Remember, it's essential to send Part 1 of the form to HM Revenue & Customs (HMRC) immediately after the employee leaves, while Parts 1A, 2, and 3 should be handed to the employee.

What should an employee do with their P45?

Upon receiving their P45, an employee should keep Part 1A safe, as it contains vital information for future tax returns. They need to provide Parts 2 and 3 to their new employer when starting a new job. If they are claiming Jobseeker's Allowance or Employment and Support Allowance, they should take the form to their Jobcentre Plus office. It's important to handle this form carefully, as copies are not available.

What happens if the employee dies?

In the unfortunate event of an employee's death, the employer must mark the P45 form with a 'D' in the designated box. All four parts of the form should then be sent to HMRC immediately. This ensures that the tax affairs are handled correctly and that any necessary adjustments are made in a timely manner.

What if I don't have my P45 when starting a new job?

If an employee does not have their P45 when starting a new job, they should inform their new employer. The employer may need to use an emergency tax code until the P45 is provided. This could result in higher tax deductions initially. Employees can request a replacement P45 from their previous employer, but if that is not possible, they should complete a 'starter checklist' provided by their new employer to ensure proper tax calculations.

Documents used along the form

The P45 form is a crucial document used when an employee leaves a job in the UK, detailing their pay and tax information. Along with the P45, several other forms and documents are commonly utilized to ensure a smooth transition for both the employee and the employer. Below is a list of these related documents.

- P60: This form summarizes an employee's total pay and deductions for the tax year. Employers provide it at the end of each tax year, allowing employees to verify their income and tax paid. It is essential for completing tax returns.

- P50: This form is used to claim a tax refund when an employee stops working. If the employee has overpaid taxes, they can request a refund using this form. It is typically necessary when the individual does not have another job lined up.

- ST-12B Georgia form: This form serves as a Purchaser’s Claim for Sales Tax Refund Affidavit, allowing individuals and businesses to formally request a refund of sales tax paid on eligible purchases. For more information, visit georgiapdf.com/st-12b-georgia.

- P85: This document is required when an employee leaves the UK to live or work abroad. It helps HM Revenue & Customs determine the individual's tax status and any potential tax refunds or liabilities.

- P11D: This form is used to report benefits and expenses provided to employees. Employers must complete it for employees who receive non-cash benefits, ensuring proper tax treatment of those benefits.

Understanding these forms and their purposes can facilitate the transition process for employees leaving a job. Each document plays a role in ensuring accurate tax reporting and compliance with regulations, ultimately benefiting both the employee and the employer.

Misconceptions

- My employer will automatically send my P45 to HMRC. This is a common misconception. While employers are required to complete the P45 form when an employee leaves, it is the responsibility of the employee to ensure that it is sent to HMRC.

- I don’t need my P45 if I’m starting a new job. In fact, you will need your P45 to provide your new employer with your tax information. Without it, you may be placed on an emergency tax code.

- The P45 is the same as a payslip. This is not accurate. A payslip provides details of your earnings and deductions for a specific pay period, while the P45 summarizes your total pay and tax deductions for your entire employment.

- Only full-time employees receive a P45. This is incorrect. Any employee, regardless of their work schedule, is entitled to a P45 when they leave a job.

- I can get a replacement P45 if I lose mine. Unfortunately, copies of the P45 are not available. If you lose your P45, you will need to request a new one from your employer.

- The P45 is only necessary for tax purposes. While it is primarily used for tax, the P45 also plays a role in ensuring that your new employer has accurate information for payroll and benefits.

- I don’t need to keep my P45 after I start a new job. This is misleading. It is important to keep your P45, as you may need it for future tax returns or if you encounter issues with your tax code.

- My P45 will automatically update my tax records. This is not true. While the information on your P45 is important, it is up to you to ensure that it is correctly submitted to HMRC.

- If I leave a job due to illness, I don’t need a P45. This is a misconception. Regardless of the reason for leaving, you are entitled to receive a P45 from your employer.