Fill a Valid Payroll Check Form

The Payroll Check form is an essential tool for businesses, ensuring that employees receive their hard-earned wages accurately and on time. This form typically includes important details such as the employee's name, identification number, and pay period, making it easy to track payments. It also outlines the gross pay, deductions for taxes and benefits, and the net pay that the employee will actually receive. By providing a clear breakdown of earnings and deductions, the Payroll Check form promotes transparency and helps employees understand their compensation. Additionally, it may include information about the employer, such as the company name and address, reinforcing the connection between the employee and their workplace. Understanding how to properly fill out and utilize this form is crucial for both employers and employees, as it plays a significant role in maintaining accurate payroll records and ensuring compliance with labor laws.

Additional PDF Templates

Job Application in Spanish - If you are under 18, indicate if you can provide a valid work permit.

Consolation Bracket - Establish a method for documenting each team’s journey.

Understanding the complexities of traffic incidents is crucial for improving road safety, and the Ohio Traffic Crash Report form plays a key role in this process by providing essential data that helps identify trends and areas for improvement. For those interested in accessing this form, you can find it among numerous resources at All Ohio Forms, ensuring that law enforcement personnel have the necessary tools to document these critical events effectively.

Form for Direct Deposit - Check with your bank regarding their processing times for incoming direct deposits.

Similar forms

-

Pay Stub: A pay stub provides a detailed breakdown of an employee's earnings for a specific pay period. Like the Payroll Check form, it includes information on gross pay, deductions, and net pay. Both documents serve as proof of payment and help employees understand their compensation.

-

W-2 Form: The W-2 form summarizes an employee's annual earnings and tax withholdings. Similar to the Payroll Check form, it is crucial for tax reporting purposes. Both documents reflect the income an employee has earned, but the W-2 provides a broader view over the entire year.

-

Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account. It relates to the Payroll Check form as both involve the payment process. However, the direct deposit form focuses on the method of payment rather than the details of the payment itself.

- Hold Harmless Agreement Form: To protect yourself from liability, consider using the essential Hold Harmless Agreement document before engaging in potentially risky activities.

-

Payroll Register: A payroll register is a detailed report of all employee payments for a specific period. Like the Payroll Check form, it records payment amounts and deductions. However, the payroll register is typically used by employers for record-keeping, while the Payroll Check form is for employee distribution.

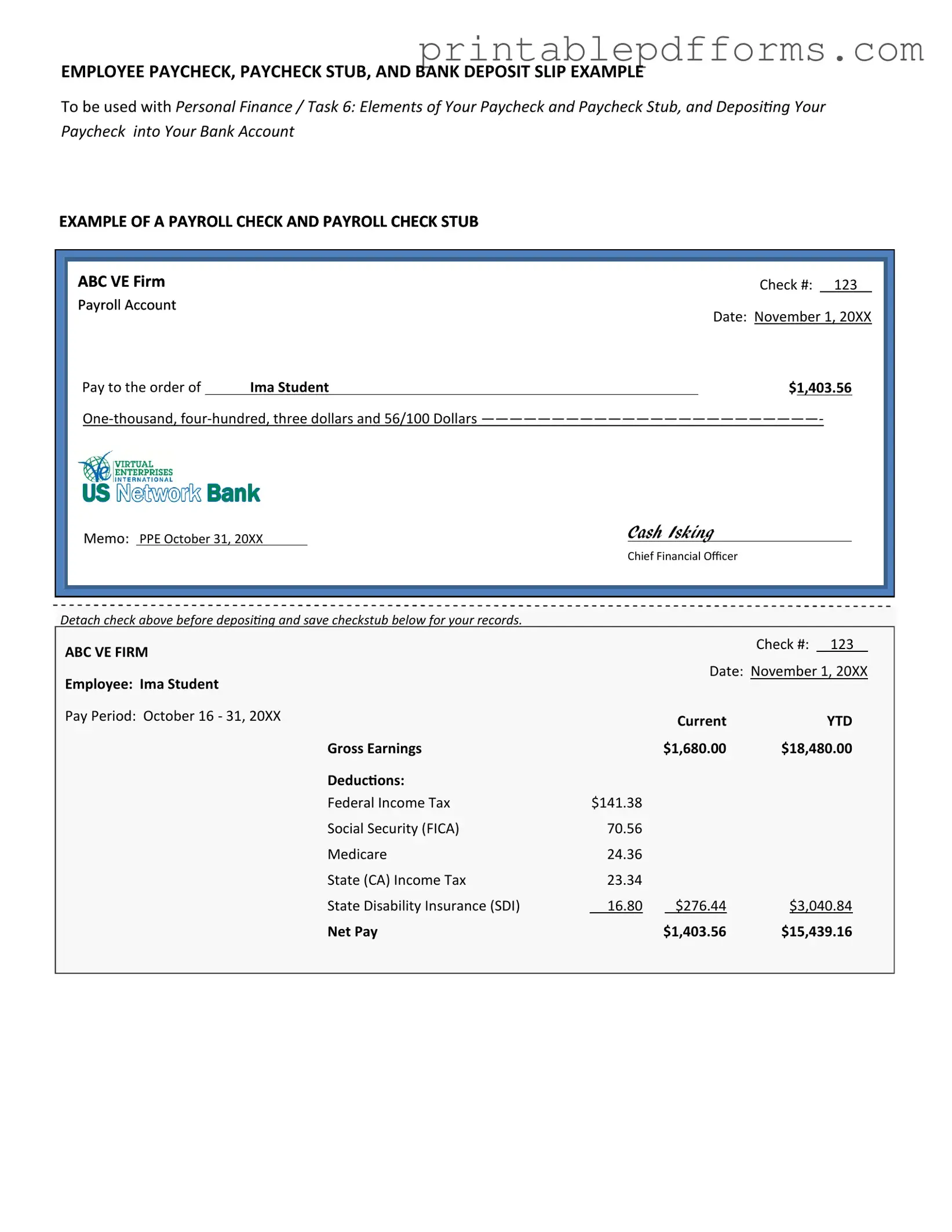

Document Example

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

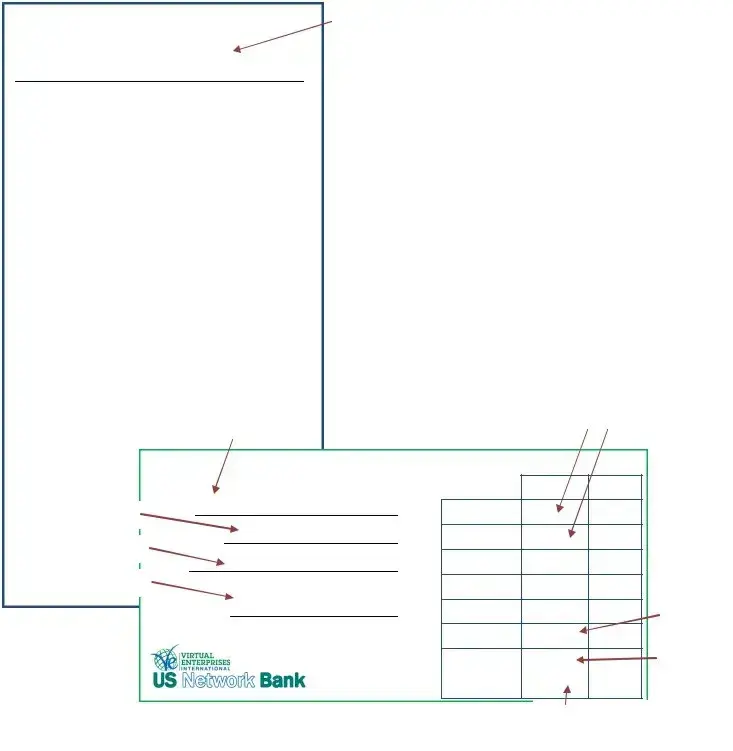

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to document the payment of wages to employees. |

| Components | This form typically includes employee information, payment amount, and pay period dates. |

| Frequency | Employers may issue payroll checks weekly, bi-weekly, or monthly, depending on company policy. |

| State Variations | Different states may have specific requirements regarding payroll checks, including deductions and tax withholdings. |

| Governing Laws | In the U.S., the Fair Labor Standards Act (FLSA) governs minimum wage and overtime pay, impacting payroll checks. |

| Record Keeping | Employers must maintain records of payroll checks for a specific period, often three to five years. |

| Electronic Options | Many employers now offer direct deposit options, allowing employees to receive payments electronically instead of physical checks. |

Crucial Questions on This Form

What is a Payroll Check form?

The Payroll Check form is a document used by employers to issue payments to employees for their work. It details the amount earned, deductions, and net pay. This form ensures that employees receive their wages accurately and on time.

Who needs to fill out the Payroll Check form?

Typically, the Payroll Check form needs to be completed by employers or payroll administrators. Employees do not fill it out themselves, but they should ensure that their payment information is accurate and up-to-date in the company’s payroll system.

What information is required on the Payroll Check form?

The Payroll Check form generally requires the following information:

- Employee’s name

- Employee’s identification number

- Pay period dates

- Gross pay amount

- Deductions (taxes, benefits, etc.)

- Net pay amount

- Employer’s signature

How often should the Payroll Check form be completed?

The Payroll Check form should be completed for each pay period. Depending on the company's payroll schedule, this could be weekly, bi-weekly, or monthly. Timely completion is crucial to ensure that employees are paid promptly.

What happens if there is an error on the Payroll Check form?

If an error occurs, it is important to address it immediately. Employees should notify their payroll department as soon as they notice a mistake. Corrections may involve issuing a new check or adjusting the next payroll cycle to rectify the error.

Can the Payroll Check form be submitted electronically?

Yes, many companies now accept electronic submissions of the Payroll Check form. However, this depends on the company's policies and the payroll software being used. Always check with your payroll department for specific guidelines.

What should I do if I don’t receive my paycheck?

If a paycheck is not received, employees should take the following steps:

- Check with your bank to ensure there are no issues with the deposit.

- Review your payroll records to confirm the payment was processed.

- Contact your payroll department to report the missing paycheck.

Is the Payroll Check form the same as a pay stub?

No, the Payroll Check form is not the same as a pay stub. The Payroll Check form is used to issue payment, while a pay stub provides a detailed breakdown of earnings and deductions for a specific pay period. Employees should receive a pay stub along with their paycheck.

How long should I keep my Payroll Check forms?

It is advisable to keep Payroll Check forms and related documents for at least three years. This period allows for adequate record-keeping in case of audits or discrepancies. Always follow your company’s specific retention policy as well.

What should I do if I have questions about my Payroll Check form?

If you have questions, reach out to your payroll department or HR representative. They can provide clarification on any aspects of the Payroll Check form, including deductions, payment schedules, and more. Don’t hesitate to ask for help.

Documents used along the form

When managing payroll, several forms and documents work alongside the Payroll Check form to ensure accurate and compliant processing. Each of these documents plays a crucial role in maintaining proper records and meeting legal requirements.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- I-9 Form: This document verifies an employee's identity and eligibility to work in the United States. Employers must keep it on file for all employees.

- Payroll Register: A detailed report that summarizes all payroll transactions for a specific period. It includes employee earnings, deductions, and net pay.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank account, providing a convenient payment method.

- Time Sheet: This document records the hours worked by employees. It helps ensure accurate payment based on actual hours worked.

- Pay Stub: A document provided to employees that outlines their earnings, deductions, and net pay for a specific pay period. It serves as a record of payment.

- Articles of Incorporation: A necessary document for setting up a new corporation in Washington, detailing the company's name, purpose, and initial directors. For more information, review All Washington Forms to assist with the incorporation process.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees complete it to specify their state withholding preferences.

- Employee Handbook: This comprehensive guide outlines company policies, procedures, and benefits. It helps employees understand their rights and responsibilities.

- Benefits Enrollment Form: Employees use this form to enroll in company-sponsored benefits, such as health insurance or retirement plans, ensuring they receive the appropriate coverage.

Utilizing these documents alongside the Payroll Check form helps streamline payroll processes and maintain compliance with federal and state regulations. Proper record-keeping is essential for both employers and employees to ensure smooth operations and avoid potential issues.

Misconceptions

Many people have misunderstandings about the Payroll Check form. Here are seven common misconceptions:

- Payroll checks are only for hourly employees. This is not true. Both hourly and salaried employees can receive payroll checks.

- All payroll checks are the same. In reality, payroll checks can vary based on the employee's pay rate, hours worked, and deductions.

- Payroll checks are always issued weekly. Companies have different pay schedules. Some pay bi-weekly or monthly, depending on their policies.

- Once a payroll check is issued, it cannot be changed. While it can be challenging, corrections can be made if there are errors in the paycheck.

- Payroll checks do not require any documentation. Employers must keep accurate records of hours worked, wages, and deductions for each employee.

- Employees cannot dispute their payroll checks. Employees have the right to question any discrepancies and seek clarification from their employer.

- All deductions on a payroll check are optional. Some deductions, like taxes and social security, are mandatory and must be taken from each paycheck.

Understanding these misconceptions can help employees navigate their payroll checks more effectively and ensure they receive the compensation they deserve.