Pennsylvania Articles of Incorporation Document

In the state of Pennsylvania, the Articles of Incorporation form serves as a foundational document for establishing a corporation. This form is essential for individuals or groups seeking to create a legal entity that operates independently of its owners. Among the major aspects covered in this form are the corporation's name, which must be unique and not misleading; the purpose of the corporation, outlining its intended business activities; and the registered office address, which provides a physical location for official correspondence. Additionally, the form requires the identification of the corporation's incorporators, who are responsible for filing the document and ensuring compliance with state laws. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, which is crucial for understanding ownership and investment opportunities. By carefully completing this form, prospective business owners lay the groundwork for their corporate structure, ensuring that they adhere to legal requirements while also protecting their personal assets from potential liabilities associated with the business.

Discover More Articles of Incorporation Forms for Different States

Ohio Secretary of State Llc Filing - They provide a framework for the company’s operations and decision-making.

The Texas Motor Vehicle Bill of Sale form is an important legal document that formalizes the sale of a motor vehicle in Texas. By detailing crucial information such as the buyer, seller, vehicle specifics, and sale price, this document helps prevent ambiguities in the transaction. For a convenient template, you can visit freebusinessforms.org/ to ensure a smooth process for both parties involved in the sale.

Articles of Incorporation Florida - This document can be vital for attracting future investors.

Similar forms

Bylaws: Bylaws outline the internal governance structure of a corporation. They detail the rules for meetings, voting procedures, and the roles of officers and directors.

Operating Agreement: For limited liability companies (LLCs), an operating agreement serves a similar purpose to bylaws, defining the management structure and member responsibilities.

Certificate of Formation: This document is required in some states for LLCs and serves as a foundational document, similar to Articles of Incorporation for corporations.

Business Plan: While not a legal document, a business plan outlines the company's goals, strategies, and structure, which can complement the Articles of Incorporation.

Shareholder Agreement: This agreement governs the relationship between shareholders, addressing issues such as share transfers and voting rights, similar to how Articles of Incorporation establish the framework for ownership.

- Notice to Quit Form: This legal document is essential for landlords in Ohio, allowing them to formally notify tenants of lease violations, such as non-payment of rent, and is a crucial step in the eviction process. For more information, consult All Ohio Forms.

Partnership Agreement: For partnerships, this document outlines the terms of the partnership, including roles, profit sharing, and responsibilities, akin to how Articles of Incorporation define a corporation's structure.

Certificate of Good Standing: This document verifies that a corporation is legally registered and compliant with state regulations, reinforcing the legitimacy established by the Articles of Incorporation.

Tax Identification Number (TIN) Application: Applying for a TIN is essential for tax purposes. It is often necessary to have Articles of Incorporation to obtain a TIN for a corporation.

Annual Report: Corporations are typically required to file annual reports to maintain good standing. This report provides updates on the corporation's activities and structure, similar to the information in the Articles of Incorporation.

Registered Agent Designation: This document names the registered agent for a corporation, ensuring there is a designated point of contact for legal matters, which complements the information provided in the Articles of Incorporation.

Document Example

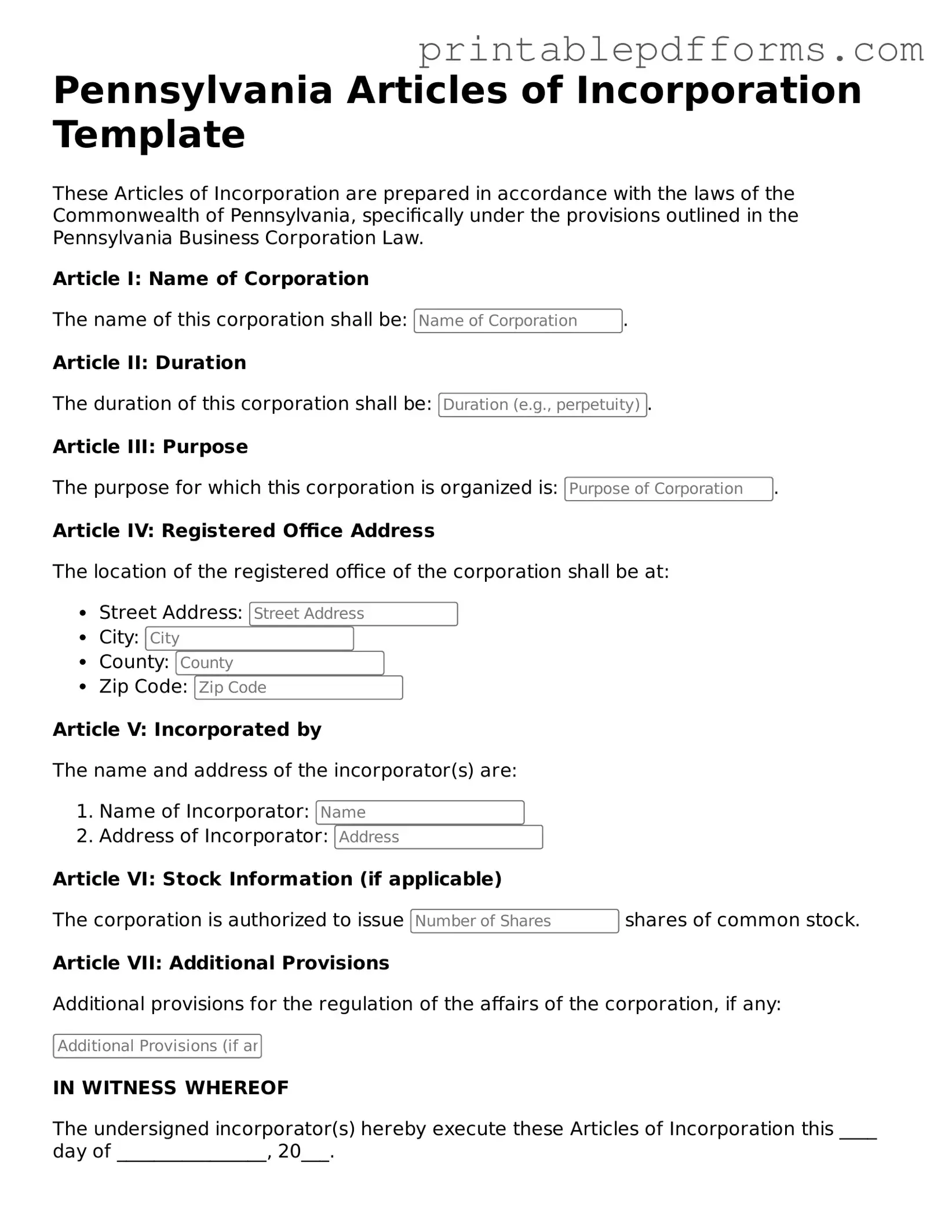

Pennsylvania Articles of Incorporation Template

These Articles of Incorporation are prepared in accordance with the laws of the Commonwealth of Pennsylvania, specifically under the provisions outlined in the Pennsylvania Business Corporation Law.

Article I: Name of Corporation

The name of this corporation shall be: .

Article II: Duration

The duration of this corporation shall be: .

Article III: Purpose

The purpose for which this corporation is organized is: .

Article IV: Registered Office Address

The location of the registered office of the corporation shall be at:

- Street Address:

- City:

- County:

- Zip Code:

Article V: Incorporated by

The name and address of the incorporator(s) are:

- Name of Incorporator:

- Address of Incorporator:

Article VI: Stock Information (if applicable)

The corporation is authorized to issue shares of common stock.

Article VII: Additional Provisions

Additional provisions for the regulation of the affairs of the corporation, if any:

IN WITNESS WHEREOF

The undersigned incorporator(s) hereby execute these Articles of Incorporation this ____ day of ________________, 20___.

Signature: ___________________________

Name:

PDF Form Specs

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | The form is used to officially create a corporation in the state of Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations seeking to operate legally in Pennsylvania. |

| Information Needed | The form requires the corporation's name, registered office address, and the names of the incorporators. |

| Name Availability | The proposed name of the corporation must be unique and not deceptively similar to existing entities. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | There is a filing fee associated with submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Publication Requirement | In some cases, corporations may need to publish a notice of incorporation in a local newspaper. |

| Effective Date | The Articles of Incorporation can specify an effective date, which can be the date of filing or a future date. |

| Amendments | Once filed, the Articles of Incorporation can be amended to reflect changes in corporate structure or purpose. |

Crucial Questions on This Form

What are the Pennsylvania Articles of Incorporation?

The Pennsylvania Articles of Incorporation is a legal document that establishes a corporation in the state of Pennsylvania. It serves as the foundational document that outlines the basic structure of the corporation, including its name, purpose, and the address of its registered office. Filing this document with the Pennsylvania Department of State is a crucial step in the process of forming a corporation.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation form, you will need to provide several key pieces of information:

- Name of the Corporation: The name must be unique and not already in use by another entity in Pennsylvania.

- Registered Office Address: This is the official address where legal documents can be served.

- Purpose of the Corporation: A brief description of the business activities the corporation will engage in.

- Incorporators: Names and addresses of the individuals responsible for forming the corporation.

Additional information may be required depending on the type of corporation being formed, such as the number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation in Pennsylvania?

Filing the Articles of Incorporation can be done online or by mail. Here are the steps for both methods:

- Online Filing: Visit the Pennsylvania Department of State's website. You can fill out the form online and pay the filing fee using a credit or debit card.

- Mail Filing: Download and print the Articles of Incorporation form. Complete the form and send it along with a check or money order for the filing fee to the appropriate address listed on the form.

It is important to ensure that all information is accurate to avoid delays in processing.

What is the cost associated with filing the Articles of Incorporation?

The cost to file the Articles of Incorporation in Pennsylvania varies depending on the type of corporation being formed. As of October 2023, the standard filing fee is typically around $125. However, additional fees may apply if expedited processing is requested or if additional services are required. It is advisable to check the Pennsylvania Department of State's website for the most current fee schedule before filing.

Documents used along the form

When forming a corporation in Pennsylvania, several additional forms and documents may be necessary to complete the process. These documents help ensure that the corporation operates legally and efficiently. Below is a list of common forms and documents often used alongside the Pennsylvania Articles of Incorporation.

- Bylaws: This document outlines the rules and procedures for operating the corporation. It includes details about meetings, voting, and the roles of officers and directors.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report typically includes basic information about the corporation's structure and operations.

- Employer Identification Number (EIN): This number, issued by the IRS, is necessary for tax purposes. It is used to identify the corporation for federal tax filings.

- Business License: Depending on the type of business and location, a specific license may be required to operate legally within the municipality or state.

- Fictitious Name Registration: If the corporation plans to operate under a name different from its legal name, it must register that name with the state.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders, including how shares can be bought, sold, or transferred.

- : This document is vital for requesting a change of physician or additional treatment in workers' compensation cases. For more information, visit georgiapdf.com/wc-200a-georgia/.

- Meeting Minutes: Keeping records of meetings is essential. Minutes provide a summary of decisions made and actions taken during board or shareholder meetings.

- Consent Resolutions: These are written agreements that outline decisions made by the board of directors or shareholders without holding a formal meeting.

- Annual Reports: Corporations are often required to file annual reports with the state, detailing financial performance and other significant changes.

- Registered Agent Form: This form designates an individual or business entity to receive legal documents on behalf of the corporation.

Each of these documents plays a crucial role in the establishment and ongoing management of a corporation in Pennsylvania. Understanding these requirements can help ensure compliance and smooth operation.

Misconceptions

- Misconception 1: The Articles of Incorporation are only for large businesses.

- Misconception 2: Filing Articles of Incorporation guarantees business success.

- Misconception 3: The process is overly complicated and time-consuming.

- Misconception 4: Articles of Incorporation are the same as a business license.

- Misconception 5: Once filed, Articles of Incorporation cannot be changed.

This is incorrect. Any business, regardless of size, can file Articles of Incorporation. This form is essential for establishing a legal entity, whether it's a small startup or a large corporation.

Filing the form does not ensure that a business will thrive. Success depends on various factors, including market demand, management, and business strategy.

While there are steps involved, the process is straightforward. Many resources are available to help guide individuals through the filing, making it manageable.

This is a common misunderstanding. Articles of Incorporation establish a corporation, while a business license permits operation within a specific jurisdiction. Both are necessary but serve different purposes.

In fact, amendments can be made. If business circumstances change, the Articles can be updated by following the proper legal procedures.