Pennsylvania Deed Document

The Pennsylvania Deed form plays a crucial role in the transfer of property ownership within the state. This document serves as a legal instrument that conveys real estate from one party to another, ensuring that the transaction is recognized by law. Essential components of the form include the names of the grantor (the seller) and the grantee (the buyer), a detailed description of the property being transferred, and the consideration, or payment, involved in the transaction. Additionally, the deed must be signed by the grantor and may require notarization to validate the transfer. Understanding the nuances of this form is vital for both buyers and sellers, as it protects their interests and ensures compliance with state regulations. Properly executing the Pennsylvania Deed form can help prevent future disputes and provide clarity regarding property rights, making it a fundamental step in any real estate transaction.

Discover More Deed Forms for Different States

Ohio Deed Transfer Form - This form lays out the boundary lines of the property conveyed.

Nys Deed Form - Deeds can vary significantly based on state laws and regulations.

Who Has the Deed to My House - A Deed is a legal document that transfers property ownership from one party to another.

Understanding the significance of the Ohio Medical Power of Attorney form is vital for effective health care planning, as it not only empowers individuals to make their wishes known but also ensures that those decisions align with their values. For further assistance in navigating this process, consider visiting All Ohio Forms to access the necessary documentation and guidance.

How Long Does It Take to Record a Deed in Florida - Some deeds come with covenants that outline obligations for the property.

Similar forms

- Title Transfer Document: Similar to a deed, this document serves to transfer ownership of property from one party to another. It outlines the specifics of the transaction, including the parties involved and the property description.

- Lease Agreement: A lease agreement is akin to a deed in that it outlines the rights and responsibilities of the parties regarding the use of a property. While a deed transfers ownership, a lease grants temporary possession.

- Bill of Sale: This document is used to transfer ownership of personal property. Like a deed, it provides proof of the transaction and includes details about the item being sold, the buyer, and the seller.

- Mortgage Agreement: A mortgage agreement is similar to a deed in that it involves real property. It secures a loan with the property as collateral, detailing the obligations of the borrower and lender.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. While not a property transfer document, it can empower someone to execute a deed on behalf of the property owner.

- Quitclaim Deed: A quitclaim deed is a specific type of deed that transfers whatever interest the grantor has in a property without guaranteeing that the title is clear. It is often used among family members or in divorce settlements.

- Dirt Bike Bill of Sale: The https://freebusinessforms.org/ is a crucial document for ensuring a smooth transfer of ownership when buying or selling dirt bikes in New York State.

- Trust Agreement: A trust agreement establishes a legal entity that holds property for the benefit of another. Similar to a deed, it outlines how property will be managed and transferred, but focuses on the fiduciary relationship.

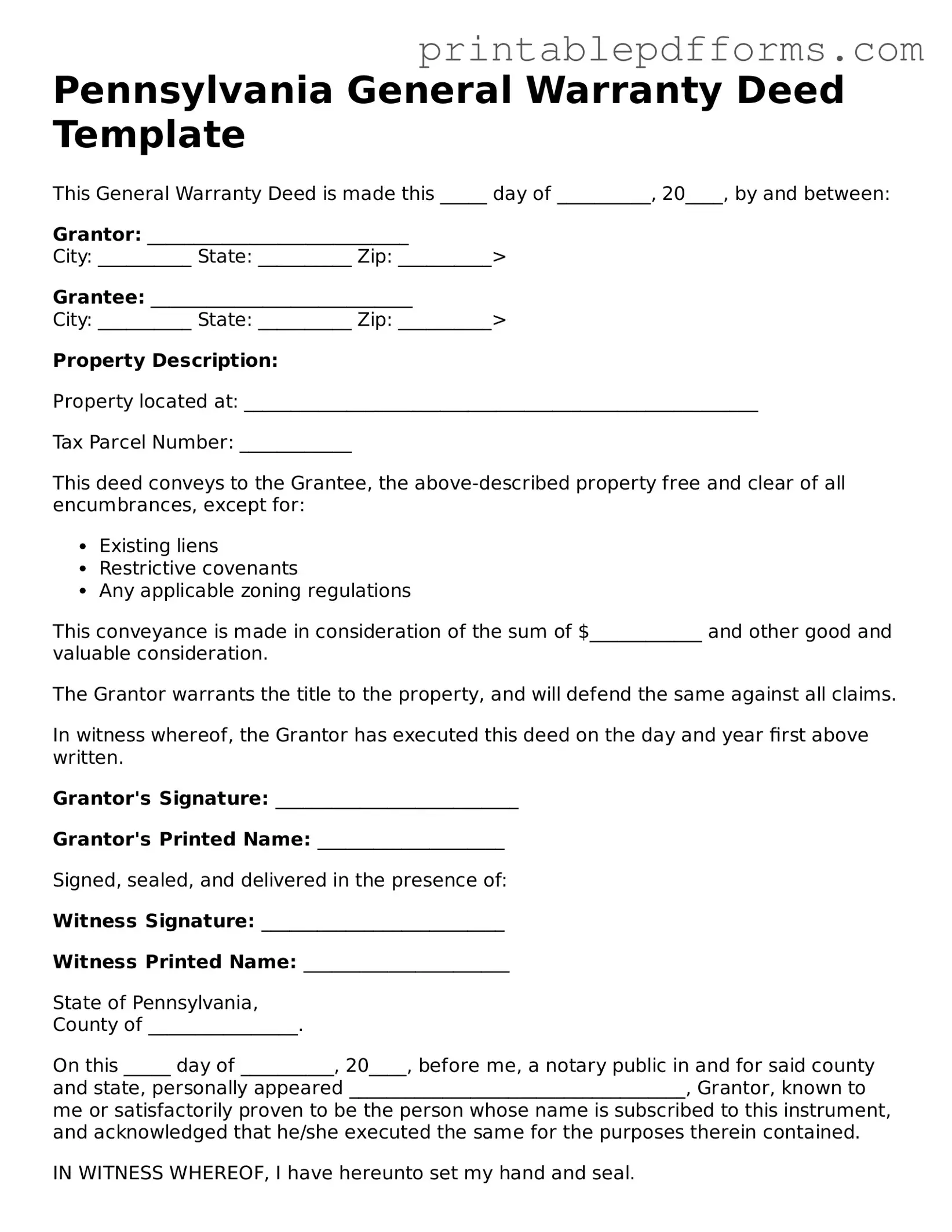

Document Example

Pennsylvania General Warranty Deed Template

This General Warranty Deed is made this _____ day of __________, 20____, by and between:

Grantor: ____________________________

Grantee: ____________________________

Property Description:

Property located at: _______________________________________________________

Tax Parcel Number: ____________

This deed conveys to the Grantee, the above-described property free and clear of all encumbrances, except for:

- Existing liens

- Restrictive covenants

- Any applicable zoning regulations

This conveyance is made in consideration of the sum of $____________ and other good and valuable consideration.

The Grantor warrants the title to the property, and will defend the same against all claims.

In witness whereof, the Grantor has executed this deed on the day and year first above written.

Grantor's Signature: __________________________

Grantor's Printed Name: ____________________

Signed, sealed, and delivered in the presence of:

Witness Signature: __________________________

Witness Printed Name: ______________________

State of Pennsylvania,

County of ________________.

On this _____ day of __________, 20____, before me, a notary public in and for said county and state, personally appeared ____________________________________, Grantor, known to me or satisfactorily proven to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and seal.

Notary Public Signature: __________________________

Notary Public Printed Name: ____________________

My commission expires: ____________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Deed form is used to legally transfer ownership of real estate from one party to another. |

| Types of Deeds | Pennsylvania recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes in property transfer. |

| Governing Laws | The Pennsylvania Deed form is governed by Title 21 of the Pennsylvania Consolidated Statutes, particularly the Real Property Law. |

| Filing Requirements | After execution, the deed must be recorded in the county where the property is located to ensure public notice and protect the rights of the new owner. |

Crucial Questions on This Form

What is a Pennsylvania Deed?

A Pennsylvania deed is a legal document used to transfer ownership of real estate from one party to another. It serves as a formal record of the transaction and outlines the rights and responsibilities associated with the property. There are several types of deeds, including warranty deeds and quitclaim deeds, each serving different purposes and offering varying levels of protection to the buyer.

What types of deeds are available in Pennsylvania?

In Pennsylvania, the most common types of deeds include:

- Warranty Deed: This type guarantees that the seller has clear title to the property and has the right to sell it. It protects the buyer from any future claims against the property.

- Quitclaim Deed: This deed transfers whatever interest the seller has in the property without any guarantees. It is often used between family members or in divorce settlements.

- Special Warranty Deed: This deed provides some level of warranty but only for the time the seller owned the property. It does not cover any issues that may have arisen before the seller’s ownership.

How do I obtain a Pennsylvania Deed?

To obtain a Pennsylvania deed, you typically need to draft the document, ensuring it includes all necessary information such as the names of the grantor (seller) and grantee (buyer), a legal description of the property, and the date of transfer. It is advisable to consult with a real estate attorney or a qualified professional to ensure the deed complies with state laws.

What information is required on a Pennsylvania Deed?

A Pennsylvania deed must include several key elements:

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The consideration, or price, paid for the property.

- The date of the transfer.

- The signature of the grantor, and in some cases, the grantee.

Do I need to have the deed notarized?

Yes, in Pennsylvania, a deed must be notarized to be legally binding. The grantor must sign the deed in the presence of a notary public, who will then affix their seal. This step helps verify the identity of the signer and ensures that the document is executed properly.

Is there a fee to record a deed in Pennsylvania?

Yes, there is a fee to record a deed in Pennsylvania. The amount varies by county and is typically based on the number of pages in the document. Additionally, there may be transfer taxes applicable to the transaction, which can also vary by locality. It is important to check with the local county recorder's office for specific fees and requirements.

How can I check if a deed has been recorded?

To check if a deed has been recorded, you can visit the local county recorder's office or their website. Many counties offer online access to property records where you can search by the names of the parties involved or the property address. If you need assistance, staff at the recorder's office can help guide you through the process.

What happens if a deed is not recorded?

If a deed is not recorded, the transfer of ownership may still be valid between the parties involved. However, failing to record the deed can lead to complications. For instance, if another party claims an interest in the property or if there are disputes regarding ownership, the unrecorded deed may not provide adequate protection for the buyer. Recording is essential for establishing public notice of the ownership transfer.

Can I change or revoke a deed after it has been executed?

Once a deed has been executed and recorded, it cannot simply be changed or revoked. However, the parties involved may execute a new deed to correct any errors or transfer ownership again. This new deed would need to be properly drafted, signed, notarized, and recorded to be effective. It is advisable to consult with a legal professional to ensure that any changes are made correctly.

Documents used along the form

When transferring property in Pennsylvania, several forms and documents accompany the Pennsylvania Deed form to ensure a smooth and legally compliant transaction. Each document serves a specific purpose, contributing to the overall clarity and legality of the property transfer process.

- Property Transfer Tax Form: This form is required to report the sale of real estate and calculate the transfer tax owed to the state and local municipalities.

- Title Search Report: Conducting a title search is essential to verify the property's ownership history, ensuring there are no liens or claims against the property.

- Settlement Statement (HUD-1): This document outlines the financial details of the transaction, including closing costs, fees, and the final purchase price, providing transparency for both parties.

- Sales Tax Refund Affidavit: Individuals and businesses seeking to reclaim overpaid sales tax must complete specific forms such as the https://georgiapdf.com/st-12b-georgia/ to initiate the refund process.

- Affidavit of Residence: This affidavit confirms the seller's residency status, which may be necessary for tax purposes and to affirm eligibility for certain exemptions.

- Power of Attorney: In cases where the seller cannot be present for the closing, a power of attorney allows someone else to sign the deed and other documents on their behalf.

- Disclosure Statement: Sellers must provide a disclosure statement detailing any known issues with the property, such as structural problems or environmental hazards, to inform the buyer adequately.

- Notice of Settlement: This document serves to notify all relevant parties that the settlement has occurred, marking the official transfer of ownership.

Understanding these accompanying documents is crucial for anyone involved in a property transaction in Pennsylvania. Each form plays a vital role in ensuring that the transfer is legally sound and that all parties are adequately informed and protected throughout the process.

Misconceptions

Understanding the Pennsylvania Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All deeds are the same. Many people think that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with unique implications for ownership and liability.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, the deed itself can still be valid without it. However, having a notary helps establish authenticity.

- Only the seller needs to sign the deed. This is not true. Both the seller and the buyer should sign the deed to ensure a proper transfer of ownership.

- Deeds do not need to be recorded. Some believe that recording a deed is optional. In Pennsylvania, recording is crucial as it provides public notice of ownership and protects against future claims.

- Once a deed is signed, it cannot be changed. While it is challenging to change a deed after it has been executed, it is possible to create a new deed to correct errors or update ownership.

- All property transfers require a lawyer. Although having a lawyer can be beneficial, it is not a legal requirement in Pennsylvania. Individuals can handle simple transactions themselves.

- Deeds are only necessary for selling property. This misconception overlooks other scenarios, such as gifting property or transferring ownership between family members, which also require a deed.

- Using a standard deed form is always sufficient. While standard forms can be useful, they may not address specific situations or legal requirements. Customizing a deed to fit the particular circumstances is often necessary.

By clarifying these misconceptions, individuals can navigate the process of handling deeds in Pennsylvania more effectively and confidently.