Pennsylvania Deed in Lieu of Foreclosure Document

In Pennsylvania, homeowners facing the threat of foreclosure often seek alternatives to protect their financial well-being and preserve their credit. One viable option is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender. This arrangement can provide significant benefits for both parties involved. For the homeowner, it can mean a quicker resolution to their financial troubles, potentially avoiding the lengthy and stressful foreclosure process. The lender, on the other hand, can save time and resources by accepting the property instead of pursuing foreclosure. The Deed in Lieu of Foreclosure form outlines the terms of this transfer, including the rights and obligations of both the homeowner and the lender. It typically includes provisions addressing any outstanding mortgage balances, the condition of the property, and the timeline for the transfer. Understanding this form is crucial for anyone considering this option, as it can lead to a smoother transition and a fresh start for those in financial distress.

Discover More Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Foreclosure Sample - This option allows for a smoother transition for the borrower into financial recovery.

When engaging in a trailer sale, it is important to utilize the proper documentation to avoid complications. The Georgia Trailer Bill of Sale serves as a crucial component of this process, ensuring that the transfer of ownership is recorded officially. For those looking to streamline their sale, resources such as georgiapdf.com/trailer-bill-of-sale/ can provide helpful guidance and access to the necessary forms.

Deed in Lieu of Foreclosure Texas - Borrowers should understand the implications of giving up their property through this deed.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The lender usually agrees to forgive the remaining mortgage balance after receiving the property.

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in order to avoid foreclosure. This document shares similarities with several other legal forms used in real estate and financial transactions. Below are five documents that are similar to the Deed in Lieu of Foreclosure:

- Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a short sale allows a homeowner to sell their property for less than the amount owed on the mortgage. Both options aim to avoid foreclosure, but a short sale involves selling the home to a third party instead of transferring it directly to the lender.

- Bill of Sale - The New York Trailer Bill of Sale form is crucial for transferring ownership of a trailer, ensuring clarity and legal compliance in the transaction. More information can be found at https://freebusinessforms.org.

- Loan Modification Agreement: This document modifies the terms of an existing mortgage to make it more affordable for the borrower. While a Deed in Lieu of Foreclosure relinquishes the property, a loan modification keeps the homeowner in their home by adjusting payment terms.

- Forebearance Agreement: A forbearance agreement temporarily pauses or reduces mortgage payments. Similar to a Deed in Lieu of Foreclosure, it helps homeowners avoid foreclosure, but it does not involve transferring the property to the lender.

- Quitclaim Deed: A quitclaim deed transfers ownership rights in a property without guaranteeing that the title is clear. While a Deed in Lieu of Foreclosure is a more formal process involving a lender, both documents facilitate the transfer of property ownership.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to restructure debts. While a Deed in Lieu of Foreclosure results in the homeowner giving up the property, bankruptcy can offer a chance to retain ownership while addressing financial difficulties.

Document Example

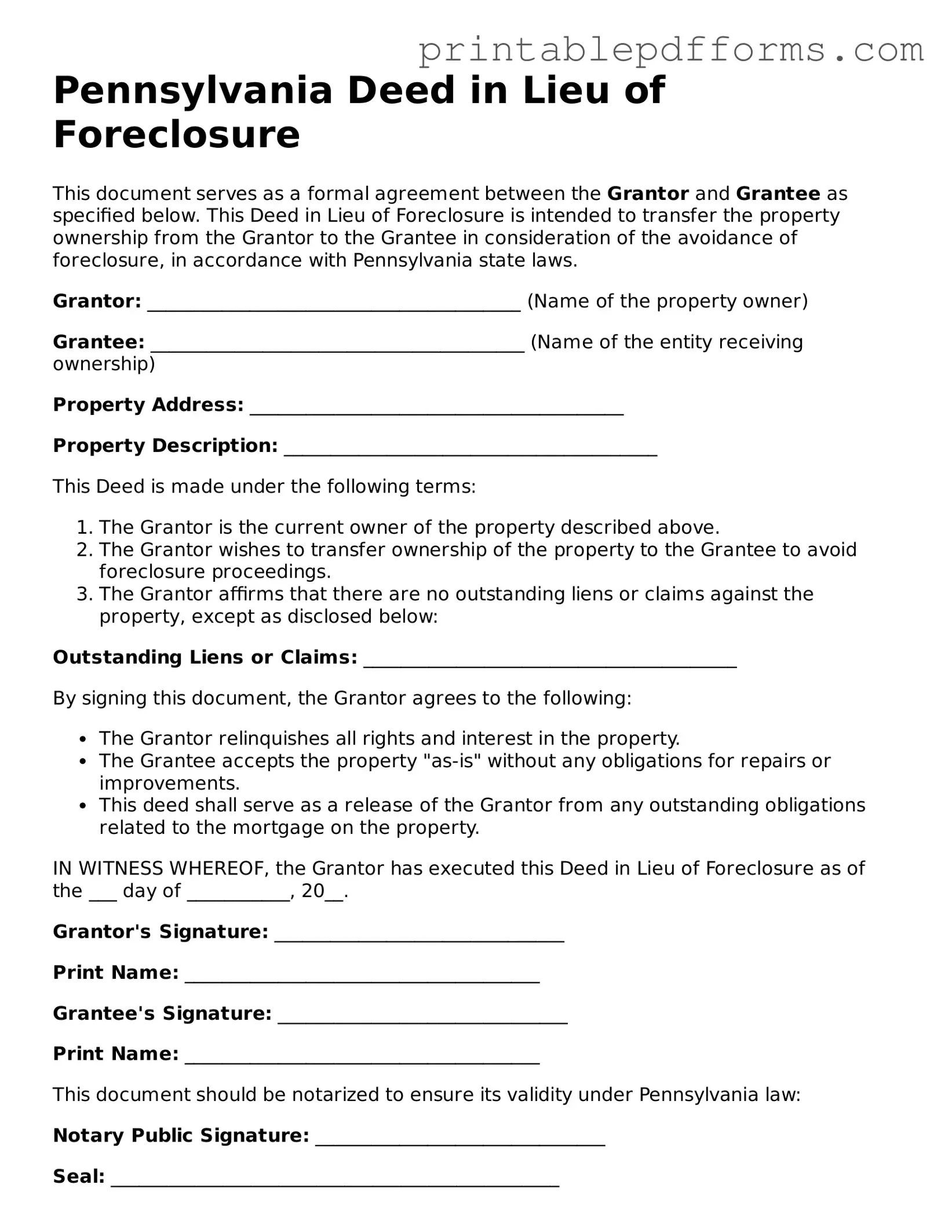

Pennsylvania Deed in Lieu of Foreclosure

This document serves as a formal agreement between the Grantor and Grantee as specified below. This Deed in Lieu of Foreclosure is intended to transfer the property ownership from the Grantor to the Grantee in consideration of the avoidance of foreclosure, in accordance with Pennsylvania state laws.

Grantor: ________________________________________ (Name of the property owner)

Grantee: ________________________________________ (Name of the entity receiving ownership)

Property Address: ________________________________________

Property Description: ________________________________________

This Deed is made under the following terms:

- The Grantor is the current owner of the property described above.

- The Grantor wishes to transfer ownership of the property to the Grantee to avoid foreclosure proceedings.

- The Grantor affirms that there are no outstanding liens or claims against the property, except as disclosed below:

Outstanding Liens or Claims: ________________________________________

By signing this document, the Grantor agrees to the following:

- The Grantor relinquishes all rights and interest in the property.

- The Grantee accepts the property "as-is" without any obligations for repairs or improvements.

- This deed shall serve as a release of the Grantor from any outstanding obligations related to the mortgage on the property.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the ___ day of ___________, 20__.

Grantor's Signature: _______________________________

Print Name: ______________________________________

Grantee's Signature: _______________________________

Print Name: ______________________________________

This document should be notarized to ensure its validity under Pennsylvania law:

Notary Public Signature: _______________________________

Seal: ________________________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by the Pennsylvania Consolidated Statutes, Title 68, Chapter 250. |

| Eligibility | Homeowners facing financial difficulties may be eligible if they cannot keep up with mortgage payments. |

| Process | The homeowner must negotiate with the lender and complete the deed transfer process. |

| Benefits | This option can help homeowners avoid the lengthy foreclosure process and potential credit damage. |

| Considerations | Homeowners should understand the implications, including the possibility of remaining debt or tax consequences. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid foreclosure. This option is often pursued when a homeowner is struggling to make mortgage payments and sees no feasible way to keep the home. By opting for this route, the homeowner can potentially mitigate the negative impacts of foreclosure on their credit score and overall financial situation.

How does the process work in Pennsylvania?

The process typically begins with the homeowner contacting their lender to discuss the possibility of a Deed in Lieu of Foreclosure. If both parties agree, the homeowner will need to provide documentation that demonstrates their financial hardship. The lender will then review the situation and may require the homeowner to fill out specific forms. Once approved, the homeowner will sign the Deed, transferring ownership to the lender. It is crucial for the homeowner to ensure that any remaining mortgage debt is settled or forgiven as part of this agreement.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to opting for a Deed in Lieu of Foreclosure:

- Less damage to credit score: A Deed in Lieu may have a less severe impact on a homeowner's credit compared to a foreclosure.

- Potential for debt forgiveness: Homeowners may negotiate with lenders to forgive any remaining mortgage debt after the transfer.

- Quicker resolution: The process can often be completed more quickly than a foreclosure, allowing homeowners to move on sooner.

- Less public stigma: Unlike foreclosure, which is a public record, a Deed in Lieu is less visible and may carry less social stigma.

Are there any drawbacks to consider?

While a Deed in Lieu of Foreclosure can be beneficial, it is not without its drawbacks. Homeowners should consider the following:

- Possible tax implications: The IRS may view forgiven debt as taxable income, leading to unexpected tax liabilities.

- Loss of property: Homeowners will lose their home and any equity they may have built up.

- Not all lenders accept this option: Some lenders may not offer a Deed in Lieu as a viable solution, limiting options for homeowners.

- Impact on future borrowing: Although less severe than foreclosure, a Deed in Lieu can still affect future creditworthiness and borrowing ability.

Documents used along the form

A Deed in Lieu of Foreclosure is an important document in the context of real estate and mortgage issues. However, several other forms and documents often accompany this process to ensure a smooth transition and clear communication between parties. Below is a list of related documents that may be necessary.

- Loan Modification Agreement: This document outlines the new terms of a loan, such as changes to interest rates or repayment schedules, often used to help borrowers avoid foreclosure.

- Notice of Default: A formal notification sent to the borrower indicating that they have failed to meet the terms of their mortgage agreement, typically preceding foreclosure actions.

- Release of Mortgage: This document releases the lien on the property once the mortgage has been paid off or settled, ensuring clear title for the new owner.

- Motorcycle Bill of Sale: This form is essential for documenting the sale of a motorcycle in Ohio and can be found at All Ohio Forms, ensuring a clear transfer of ownership and legal protection for both the buyer and seller.

- Settlement Statement: A detailed breakdown of all financial transactions related to the property transfer, including fees, taxes, and any credits or debits involved.

- Property Condition Disclosure: A form that provides information about the condition of the property, including any known defects or issues, which must be disclosed to potential buyers.

- Quitclaim Deed: A legal document that transfers whatever interest the grantor has in the property to the grantee without guaranteeing that the title is clear.

- Affidavit of Title: A sworn statement by the seller affirming that they hold clear title to the property and that there are no undisclosed liens or claims against it.

- Power of Attorney: A document that grants one person the authority to act on behalf of another in legal or financial matters, often used when one party cannot be present for the transaction.

Each of these documents plays a critical role in the process surrounding a Deed in Lieu of Foreclosure. Understanding their functions can help all parties involved navigate the complexities of real estate transactions more effectively.

Misconceptions

Understanding the Pennsylvania Deed in Lieu of Foreclosure form is crucial for homeowners facing financial difficulties. However, several misconceptions can cloud judgment and decision-making. Here are four common misconceptions:

- It completely eliminates debt. Many believe that signing a Deed in Lieu of Foreclosure wipes out all debts associated with the property. In reality, while it may relieve you of the mortgage obligation, it does not necessarily absolve you of other debts, such as second mortgages or liens.

- It is a quick and easy solution. Some think that a Deed in Lieu of Foreclosure is a fast way to resolve financial issues. However, the process can be lengthy and requires negotiation with the lender, who must agree to accept the deed in lieu of foreclosure.

- It has no impact on credit scores. A common belief is that this option does not affect credit ratings. In fact, a Deed in Lieu of Foreclosure can significantly impact your credit score, similar to a foreclosure, and may remain on your credit report for several years.

- It is the same as a short sale. Many confuse a Deed in Lieu of Foreclosure with a short sale. While both involve transferring ownership to the lender, a short sale typically requires selling the property for less than the mortgage balance, whereas a deed in lieu simply transfers ownership without a sale.

Being informed about these misconceptions can help you make better decisions during a challenging time. Always consult with a qualified professional to understand your options fully.