Pennsylvania Durable Power of Attorney Document

In Pennsylvania, the Durable Power of Attorney (DPOA) form serves as a crucial legal document that allows individuals to appoint someone they trust to make decisions on their behalf in various matters, particularly when they become unable to do so themselves. This form is especially important for managing financial affairs, healthcare decisions, and other personal matters during periods of incapacity. The DPOA remains effective even if the principal, the person granting the authority, loses the ability to make decisions due to illness or injury. It is essential for individuals to understand the different powers they can grant, which may include handling bank transactions, managing real estate, and making medical decisions. By carefully selecting an agent and clearly outlining the scope of authority, individuals can ensure their wishes are respected and their affairs are managed according to their preferences. Additionally, the DPOA can be tailored to fit specific needs, making it a flexible tool for planning ahead. Understanding this form can provide peace of mind, knowing that trusted individuals will be in place to advocate for one’s interests in challenging times.

Discover More Durable Power of Attorney Forms for Different States

Ny Poa - Having this document can help facilitate smoother transitions during health crises.

When engaging in a boat transaction in New York, it is crucial to utilize the New York Boat Bill of Sale form, as this legal document not only facilitates the transfer of ownership but also provides vital protection for both parties. For those looking to complete this form accurately and efficiently, more information can be found at nypdfforms.com/boat-bill-of-sale-form.

Durable Power of Attorney Paperwork - Your designated agent can make timely decisions regarding your property and finances when you’re unable.

How to Get Power of Attorney in Ohio - Finally, the Durable Power of Attorney reinforces autonomy, allowing individuals to define how they want their affairs managed when they cannot do so themselves.

Durable Financial Power of Attorney California - Keeping this form in place can prevent family disputes later on.

Similar forms

- General Power of Attorney: Similar to a Durable Power of Attorney, this document allows one person to act on behalf of another in various matters. However, it typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form specifically grants authority to make medical decisions for someone who is unable to do so. It focuses solely on healthcare matters, unlike the broader scope of a Durable Power of Attorney.

- Special Power of Attorney: A Special Power of Attorney is tailored for specific tasks or situations, allowing someone to act on behalf of another in designated matters. This form of power can cover areas such as real estate transactions or handling bank accounts, and understanding its limitations is important to ensure proper execution under specific circumstances. For more detailed information, you can refer to All Ohio Forms.

- Living Will: While not a power of attorney, a living will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate. It complements a Healthcare Power of Attorney but does not appoint someone to make decisions.

- Financial Power of Attorney: This document is similar in that it allows someone to manage financial matters on behalf of another. However, it may not be durable, meaning it can become void if the principal becomes incapacitated.

- Trust Agreement: A trust can manage assets for beneficiaries and appoint a trustee to handle those assets. While it serves a different purpose, both a trust and a Durable Power of Attorney can help manage affairs when someone is unable to do so.

- Will: A will outlines how a person's assets should be distributed after death. Unlike a Durable Power of Attorney, it takes effect only upon death and does not grant authority to manage affairs while the person is alive.

- Appointment of Guardian: This document allows someone to designate a guardian for their minor children or dependents. It shares similarities in the sense that it grants authority to another person, but it is focused on care rather than financial or legal matters.

- Advance Directive: This document combines elements of a living will and a healthcare power of attorney. It provides instructions for medical care and designates someone to make decisions, similar to the Durable Power of Attorney but specifically for health-related issues.

Document Example

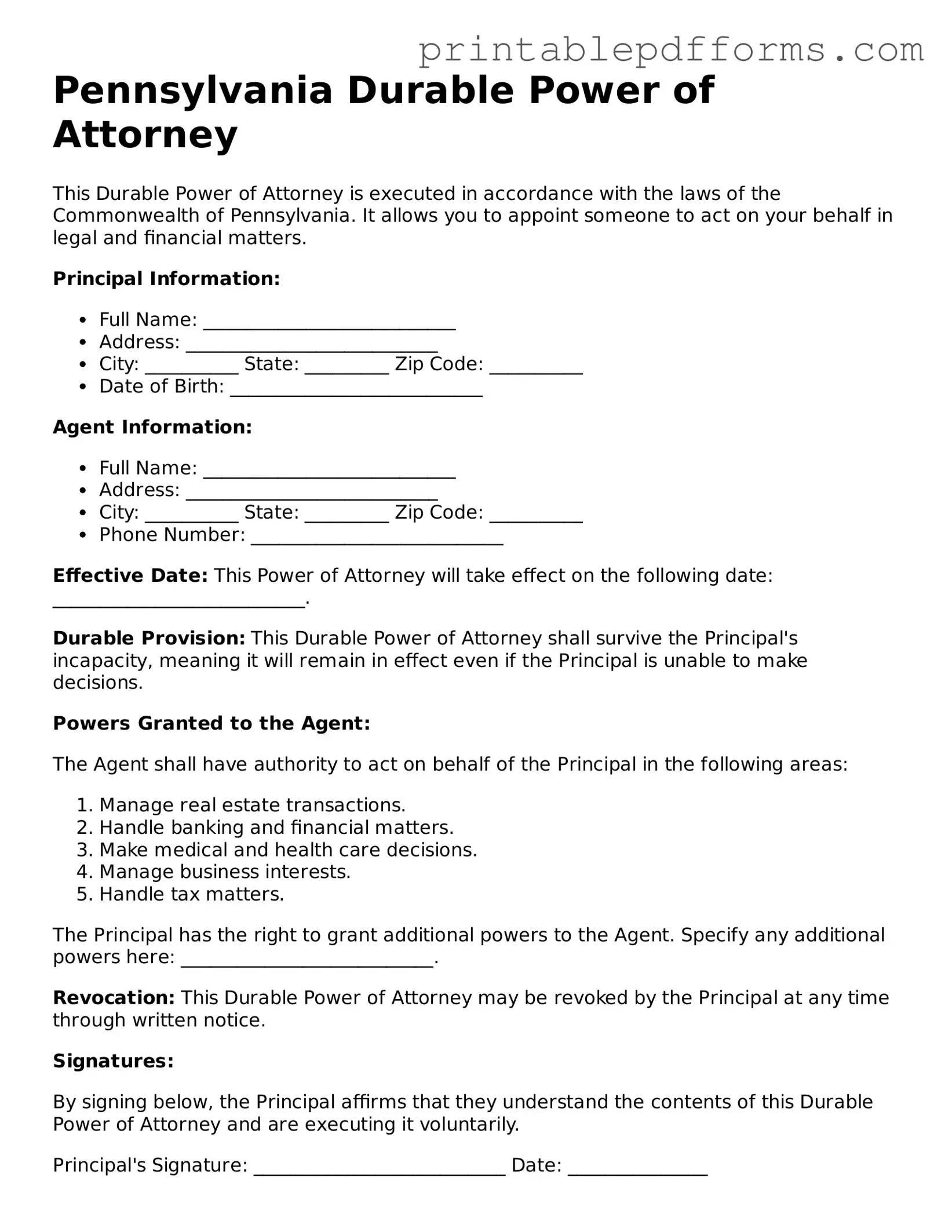

Pennsylvania Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the Commonwealth of Pennsylvania. It allows you to appoint someone to act on your behalf in legal and financial matters.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City: __________ State: _________ Zip Code: __________

- Date of Birth: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City: __________ State: _________ Zip Code: __________

- Phone Number: ___________________________

Effective Date: This Power of Attorney will take effect on the following date: ___________________________.

Durable Provision: This Durable Power of Attorney shall survive the Principal's incapacity, meaning it will remain in effect even if the Principal is unable to make decisions.

Powers Granted to the Agent:

The Agent shall have authority to act on behalf of the Principal in the following areas:

- Manage real estate transactions.

- Handle banking and financial matters.

- Make medical and health care decisions.

- Manage business interests.

- Handle tax matters.

The Principal has the right to grant additional powers to the Agent. Specify any additional powers here: ___________________________.

Revocation: This Durable Power of Attorney may be revoked by the Principal at any time through written notice.

Signatures:

By signing below, the Principal affirms that they understand the contents of this Durable Power of Attorney and are executing it voluntarily.

Principal's Signature: ___________________________ Date: _______________

Agent's Signature: ___________________________ Date: _______________

Witness Signatures:

- Witness 1 Name: ___________________________ Signature: ___________________________

- Witness 2 Name: ___________________________ Signature: ___________________________

State of Pennsylvania

County of ________________

Subscribed and sworn to before me, this _______ day of __________, 20____.

Notary Public: ___________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in Pennsylvania allows an individual to designate another person to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Laws | The Durable Power of Attorney is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 56. |

| Durability | This type of power of attorney remains effective even after the principal becomes incapacitated, which distinguishes it from a standard power of attorney. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Agent's Authority | The agent's authority can be broad or limited, depending on the specifications laid out in the document, allowing for tailored decision-making powers. |

Crucial Questions on This Form

What is a Pennsylvania Durable Power of Attorney?

A Pennsylvania Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can be managed without interruption.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney is a proactive step in planning for the future. It provides several benefits:

- Ensures that someone you trust can manage your affairs if you are unable to do so.

- Reduces the need for court intervention in the event of incapacity.

- Allows you to specify the powers granted to your agent, giving you control over your financial and legal matters.

Who can be appointed as an agent in a Durable Power of Attorney?

In Pennsylvania, you can appoint any competent adult as your agent. This includes family members, friends, or professionals such as attorneys or financial advisors. It is essential to choose someone you trust, as they will have significant authority over your affairs.

What powers can I grant my agent?

You have the flexibility to grant a wide range of powers to your agent, including but not limited to:

- Managing bank accounts and financial transactions.

- Buying or selling property.

- Handling tax matters.

- Making healthcare decisions if specified in a combined document.

It is crucial to clearly outline the powers you wish to grant in the document to avoid confusion later on.

How does the Durable Power of Attorney become effective?

A Durable Power of Attorney becomes effective immediately upon signing, unless you specify a different start date in the document. If you want it to activate only upon your incapacity, you can include a clause that outlines this condition.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions or parties of the change.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer draft your Durable Power of Attorney, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes, especially if your situation is complex.

Is a Durable Power of Attorney the same as a Healthcare Power of Attorney?

No, a Durable Power of Attorney primarily deals with financial and legal matters. In contrast, a Healthcare Power of Attorney specifically authorizes someone to make medical decisions on your behalf. It’s possible to have both documents in place to cover different aspects of your life.

Where can I find the Pennsylvania Durable Power of Attorney form?

You can obtain the Pennsylvania Durable Power of Attorney form from various sources, including:

- The Pennsylvania Department of Aging website.

- Local legal aid organizations.

- Law offices that specialize in estate planning.

Make sure to use the most current version of the form to ensure compliance with state laws.

Documents used along the form

The Pennsylvania Durable Power of Attorney form allows an individual to designate someone to make financial and legal decisions on their behalf. When creating or utilizing this document, several other forms and documents may be relevant. Below is a list of commonly used documents that often accompany the Durable Power of Attorney in Pennsylvania.

- Advance Healthcare Directive: This document outlines an individual's preferences regarding medical treatment and healthcare decisions if they become unable to communicate their wishes.

- Living Will: A living will specifies the types of medical treatment an individual desires or does not desire in situations where they are terminally ill or incapacitated.

- Employment Verification Form: This essential document aids employers in confirming the employment status of their workers, providing details such as job title and income. For those needing to complete or request this form, simply visit All Washington Forms.

- Will: A will is a legal document that expresses how a person's assets and affairs should be handled after their death, including the distribution of property and the appointment of guardians for minor children.

- Healthcare Power of Attorney: This form allows an individual to designate someone to make healthcare decisions on their behalf, separate from financial matters covered by the Durable Power of Attorney.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority to manage financial matters but may not have the same durability in case of incapacitation.

- Revocation of Power of Attorney: This document is used to formally revoke a previously granted Power of Attorney, ensuring that the designated agent no longer has authority to act on behalf of the principal.

Understanding these documents can help individuals ensure that their wishes are respected and their affairs are managed according to their preferences. Each document serves a specific purpose and may be important for comprehensive planning.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: Once a Durable Power of Attorney is signed, it cannot be changed.

- Misconception 3: A Durable Power of Attorney is only necessary for the elderly.

- Misconception 4: The agent must be a family member.

- Misconception 5: A Durable Power of Attorney is the same as a living will.

- Misconception 6: A Durable Power of Attorney is effective only after the principal becomes incapacitated.

While many people associate Durable Power of Attorney with financial decisions, it can also encompass health care decisions. This document allows an agent to make medical choices on behalf of the principal if they become incapacitated.

This is not true. The principal can revoke or modify the Durable Power of Attorney at any time, as long as they are mentally competent to do so. It is essential to communicate any changes clearly to all parties involved.

Individuals of any age can benefit from having a Durable Power of Attorney. Accidents or sudden illnesses can happen to anyone, making it wise to have a plan in place regardless of age.

While many choose family members as their agents, it is not a requirement. Anyone the principal trusts, including friends or professionals, can be designated as an agent in the Durable Power of Attorney.

These two documents serve different purposes. A living will outlines a person's wishes regarding medical treatment at the end of life, while a Durable Power of Attorney grants someone the authority to make decisions on behalf of the principal in various situations, including financial and health care matters.

In Pennsylvania, a Durable Power of Attorney can be effective immediately upon signing, unless specified otherwise. This means the agent can begin making decisions on behalf of the principal right away, depending on the terms outlined in the document.