Pennsylvania Last Will and Testament Document

Creating a Last Will and Testament in Pennsylvania is an essential step in ensuring that your wishes regarding your estate are honored after your passing. This legal document serves as a roadmap for distributing your assets, appointing guardians for minor children, and designating an executor to manage your affairs. In Pennsylvania, the will must be signed by the testator, the person making the will, and witnessed by at least two individuals who are not beneficiaries. It is crucial to ensure that the will is written clearly to avoid any confusion or disputes among heirs. Additionally, Pennsylvania allows for the use of a handwritten will, known as a holographic will, provided it meets specific criteria. Understanding the various components of the Pennsylvania Last Will and Testament form can help you navigate the complexities of estate planning, ensuring that your intentions are carried out smoothly and in accordance with state laws.

Discover More Last Will and Testament Forms for Different States

Free Will Kit Ohio - Can include an alternate beneficiary plan if primary beneficiaries predecease the individual.

For those looking to navigate the sale of their all-terrain vehicles successfully, utilizing a reliable resource for an ATV Bill of Sale template is crucial. You can find a comprehensive guide at this ATV Bill of Sale resource to ensure that all necessary information is included for a smooth transaction.

Free Will Forms to Print - Encourages proactive thinking about end-of-life decisions.

Similar forms

- Living Will: This document outlines your wishes regarding medical treatment in case you become unable to communicate. Like a Last Will and Testament, it is a critical part of planning for the future, but it focuses specifically on health care decisions.

- Durable Power of Attorney: This form allows you to designate someone to make financial decisions on your behalf if you become incapacitated. Both documents empower someone to act according to your wishes, but the Durable Power of Attorney is focused on financial matters.

Divorce Settlement Agreement: A divorce settlement agreement outlines the terms agreed upon by both parties in a divorce, including division of assets, child support, and alimony. It provides a clear framework for what is expected from each individual post-divorce, ensuring that both parties understand their rights and obligations. To simplify your divorce process and ensure everything is settled fairly, click the button below to start filling out your form. For further information, refer to All Washington Forms.

- Health Care Proxy: Similar to a Living Will, a Health Care Proxy appoints someone to make medical decisions for you. Both documents ensure your health care preferences are respected, but the Proxy specifically assigns a person to make those choices.

- Trust: A trust allows you to manage your assets during your lifetime and after your death. While a Last Will and Testament distributes your assets after death, a trust can provide ongoing management and protection of those assets.

- Codicil: This is an amendment to an existing will. It allows you to make changes without creating a new Last Will and Testament. Both documents serve the purpose of expressing your final wishes, but a Codicil modifies an existing document.

- Letter of Instruction: This informal document provides guidance to your loved ones about your wishes and preferences after your death. While a Last Will and Testament is a legal document, a Letter of Instruction can convey personal messages and details not covered in the will.

Document Example

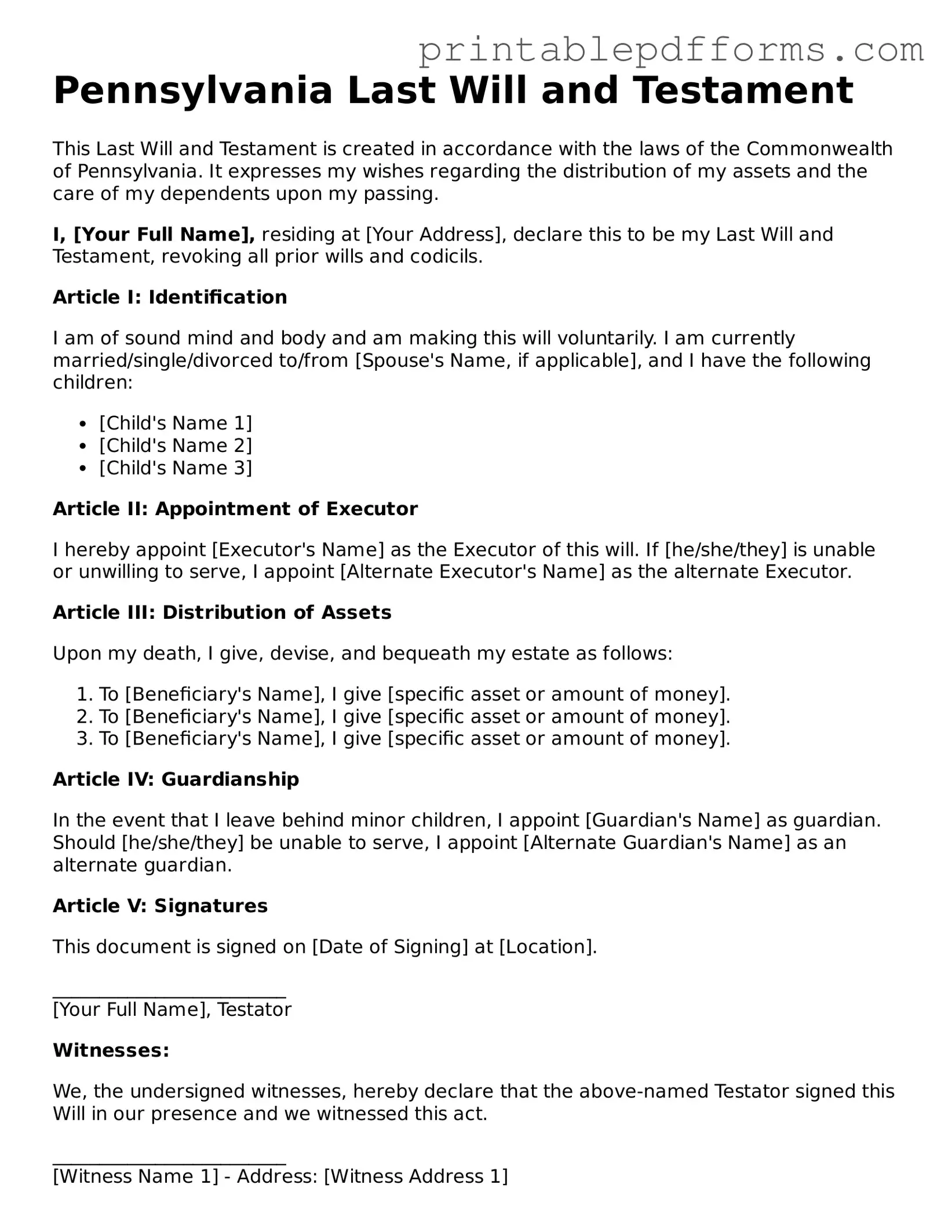

Pennsylvania Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the Commonwealth of Pennsylvania. It expresses my wishes regarding the distribution of my assets and the care of my dependents upon my passing.

I, [Your Full Name], residing at [Your Address], declare this to be my Last Will and Testament, revoking all prior wills and codicils.

Article I: Identification

I am of sound mind and body and am making this will voluntarily. I am currently married/single/divorced to/from [Spouse's Name, if applicable], and I have the following children:

- [Child's Name 1]

- [Child's Name 2]

- [Child's Name 3]

Article II: Appointment of Executor

I hereby appoint [Executor's Name] as the Executor of this will. If [he/she/they] is unable or unwilling to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

Article III: Distribution of Assets

Upon my death, I give, devise, and bequeath my estate as follows:

- To [Beneficiary's Name], I give [specific asset or amount of money].

- To [Beneficiary's Name], I give [specific asset or amount of money].

- To [Beneficiary's Name], I give [specific asset or amount of money].

Article IV: Guardianship

In the event that I leave behind minor children, I appoint [Guardian's Name] as guardian. Should [he/she/they] be unable to serve, I appoint [Alternate Guardian's Name] as an alternate guardian.

Article V: Signatures

This document is signed on [Date of Signing] at [Location].

_________________________

[Your Full Name], Testator

Witnesses:

We, the undersigned witnesses, hereby declare that the above-named Testator signed this Will in our presence and we witnessed this act.

_________________________

[Witness Name 1] - Address: [Witness Address 1]

_________________________

[Witness Name 2] - Address: [Witness Address 2]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Legal Age Requirement | In Pennsylvania, individuals must be at least 18 years old to create a valid Last Will and Testament. |

| Witnesses | The will must be signed in the presence of at least two witnesses, who must also sign the document. |

| Revocation | A Last Will and Testament can be revoked at any time by the testator, typically through a new will or a written declaration. |

| Holographic Wills | Pennsylvania recognizes holographic wills, which are handwritten and signed by the testator, provided they meet specific criteria. |

| Governing Law | The Pennsylvania Probate, Estates and Fiduciaries Code governs the creation and execution of wills in the state. |

| Probate Process | After the testator's death, the will must go through probate, which involves validating the will and administering the estate according to its terms. |

Crucial Questions on This Form

What is a Last Will and Testament in Pennsylvania?

A Last Will and Testament is a legal document that outlines how a person wishes their assets and property to be distributed after their death. In Pennsylvania, this document can also appoint guardians for minor children and specify funeral arrangements. It serves to ensure that your wishes are honored and can help avoid disputes among family members.

Who can create a Last Will and Testament in Pennsylvania?

In Pennsylvania, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means you should be able to understand the nature of the document and the implications of your decisions. There are no specific requirements regarding citizenship or residency, but it is advisable to be familiar with Pennsylvania laws if you plan to create a will there.

What are the requirements for a valid Last Will and Testament in Pennsylvania?

To be considered valid, a Last Will and Testament in Pennsylvania must meet the following criteria:

- The will must be in writing.

- The testator (the person making the will) must sign the will at the end.

- The will must be witnessed by at least two individuals who are present at the same time.

These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest.

Can I change my Last Will and Testament once it is created?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. This is often done through a codicil, which is an amendment to the original will. Alternatively, you can revoke the old will and create a new one. It’s essential to follow the same legal requirements for the new document to ensure its validity.

What happens if I die without a Last Will and Testament in Pennsylvania?

If you die without a will, you are considered to have died "intestate." In this case, Pennsylvania's intestacy laws will determine how your assets are distributed. Typically, your property will go to your closest relatives, such as your spouse or children. However, this process may not reflect your wishes and can lead to complications or disputes among family members.

How do I ensure my Last Will and Testament is properly executed?

To ensure your Last Will and Testament is properly executed, consider the following steps:

- Consult an attorney who specializes in estate planning to help draft your will.

- Make sure you sign the document in the presence of two witnesses.

- Keep the original document in a safe place, such as a safe deposit box or with your attorney.

- Inform your executor and family members about the location of your will.

Taking these steps can help avoid legal issues and ensure your wishes are followed.

Is it necessary to hire a lawyer to create a Last Will and Testament in Pennsylvania?

While it is not legally required to hire a lawyer to create a Last Will and Testament in Pennsylvania, it is highly recommended. An attorney can provide valuable guidance, ensure that your will complies with state laws, and help you address any specific concerns or complexities in your estate. This can save your loved ones from potential legal challenges and confusion after your passing.

Documents used along the form

When preparing a Pennsylvania Last Will and Testament, several other forms and documents may be necessary to ensure a comprehensive estate plan. These documents help clarify your wishes, manage your assets, and facilitate the probate process.

- Power of Attorney: This document allows you to designate someone to make financial decisions on your behalf if you become incapacitated.

- Healthcare Power of Attorney: This form appoints an individual to make medical decisions for you when you are unable to do so.

- Ohio IT AR Form: For those looking to file for a state income tax refund in Ohio, it is crucial to understand the intricacies of the All Ohio Forms. This form must be filed after completing your Ohio income tax return and is essential for ensuring accurate tax refund calculations.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you cannot communicate your wishes.

- Revocable Living Trust: This document holds your assets during your lifetime and specifies how they should be distributed upon your death, avoiding probate.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts like life insurance and retirement plans, ensuring assets pass directly to them.

- Affidavit of Heirship: This document helps establish the rightful heirs of a deceased person's estate, often used when no will exists.

- Estate Inventory Form: This form lists all assets owned by the deceased, helping to provide a clear picture of the estate for probate proceedings.

- Letter of Instruction: This informal document provides guidance to your executor about your wishes, funeral arrangements, and other personal matters.

- Codicil: A codicil is an amendment to an existing will, allowing changes without needing to create an entirely new document.

Each of these documents serves a specific purpose and can enhance the effectiveness of your estate planning. It is advisable to consult with a legal professional to ensure all forms are completed correctly and meet your needs.

Misconceptions

-

Misconception 1: A handwritten will is not valid in Pennsylvania.

This is not entirely true. Pennsylvania recognizes handwritten wills, also known as holographic wills, as valid if they meet certain criteria. However, it is generally safer to use a formal will to avoid disputes.

-

Misconception 2: You can write a will without any witnesses.

In Pennsylvania, a will must be signed by the testator (the person making the will) and witnessed by at least two individuals who are present at the same time. Without witnesses, the will may be challenged in court.

-

Misconception 3: Once a will is made, it cannot be changed.

This is incorrect. A will can be amended or revoked at any time as long as the testator is of sound mind. Changes can be made through a codicil or by creating an entirely new will.

-

Misconception 4: Only wealthy individuals need a will.

This is a common misunderstanding. Everyone, regardless of their financial situation, can benefit from having a will. A will helps ensure that personal wishes are honored and can simplify the process for loved ones after one’s passing.

-

Misconception 5: A will can cover all types of assets.

While a will can distribute many types of assets, certain assets, like life insurance policies or retirement accounts, may pass outside of the will based on beneficiary designations. It’s important to review all assets when planning.