Pennsylvania Operating Agreement Document

In the realm of business formation, particularly for limited liability companies (LLCs) in Pennsylvania, the Operating Agreement serves as a vital document that outlines the internal workings of the company. This agreement lays the groundwork for how the LLC will operate, detailing the roles and responsibilities of its members, the distribution of profits and losses, and the procedures for making key decisions. Importantly, it also addresses how new members can join the company and how existing members can exit, ensuring a smooth transition and continuity of operations. By defining the management structure, the Operating Agreement helps prevent misunderstandings among members and provides a clear framework for resolving disputes. Additionally, while Pennsylvania does not legally require an Operating Agreement for LLCs, having one is strongly recommended to protect members' interests and clarify expectations. This document not only serves as a reference point for members but also enhances the credibility of the LLC in the eyes of banks, investors, and potential partners.

Discover More Operating Agreement Forms for Different States

How Much Does an Llc Cost in Texas - The Operating Agreement can set forth the procedures for meetings and voting.

To facilitate the refund process for state income tax or school district income tax, taxpayers should complete the Ohio IT AR form, which can be found through resources like All Ohio Forms. This document is crucial for those who have already filed their returns using Ohio IT 1040 or SD 100, as it provides the necessary framework for detailing withheld taxes, estimated payments, and overall tax liability, ensuring a thorough and accurate refund claim.

Florida Llc Operating Agreement Template - Members can outline the procedures for handling financial records and accounting.

Similar forms

- Partnership Agreement: This document outlines the roles, responsibilities, and financial arrangements between partners in a business. Like an Operating Agreement, it helps to clarify expectations and prevent disputes.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they set forth the rules for how the organization operates, including how decisions are made and how meetings are conducted.

- Divorce Settlement Agreement: This essential document delineates terms regarding asset division, child support, and alimony, ensuring all parties are clear on their rights and obligations. For more information, review All Washington Forms to assist you in this process.

- Shareholder Agreement: This agreement is used among shareholders of a corporation. It details the rights and obligations of shareholders, much like an Operating Agreement does for members of an LLC, ensuring all parties understand their roles and responsibilities.

- Joint Venture Agreement: This document governs the relationship between two or more parties working together on a specific project. It shares similarities with an Operating Agreement by establishing the terms of collaboration and outlining each party's contributions and profit-sharing.

- LLC Membership Certificate: While not an agreement, this document signifies ownership in an LLC. It is similar to an Operating Agreement in that it represents the member's stake and rights within the company, reinforcing the structure and governance outlined in the Operating Agreement.

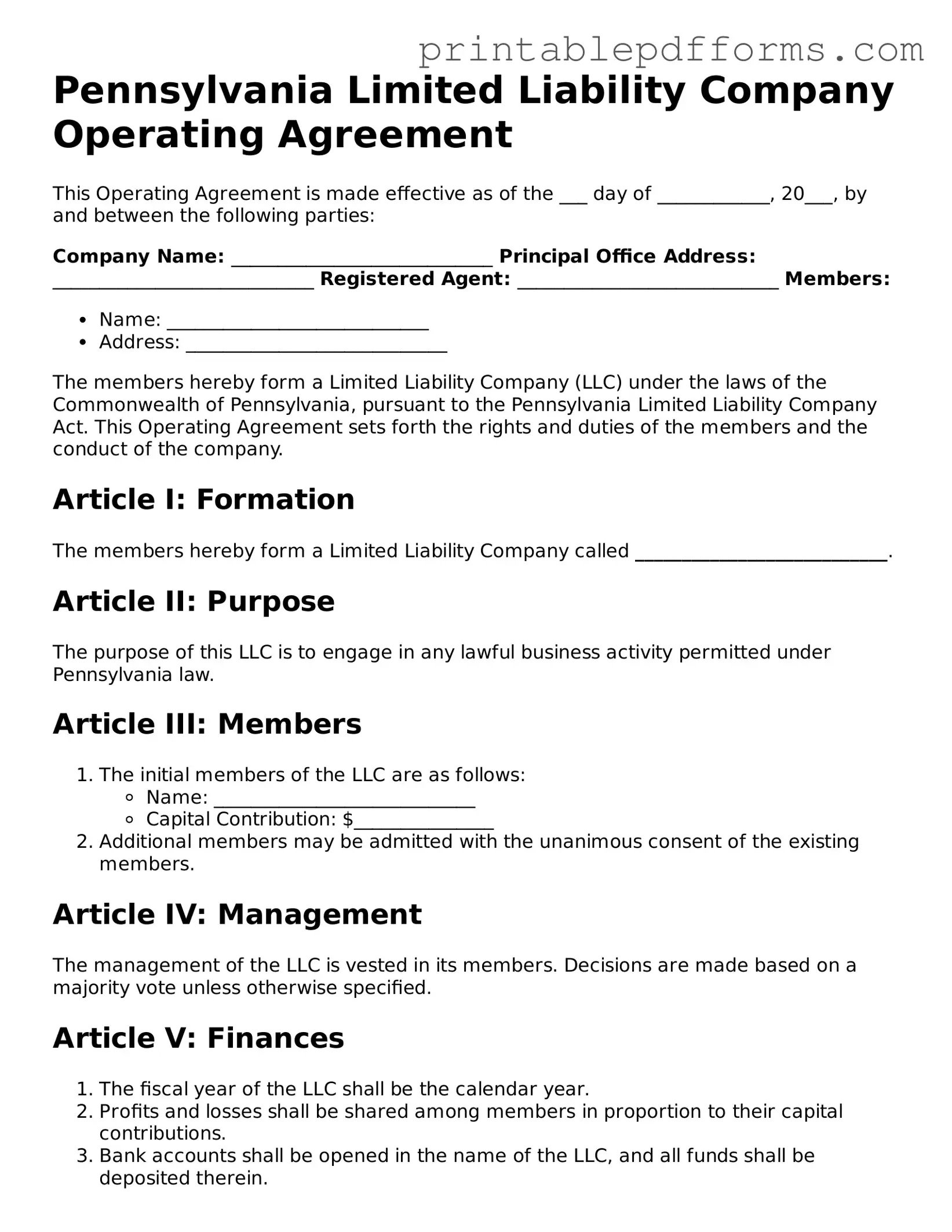

Document Example

Pennsylvania Limited Liability Company Operating Agreement

This Operating Agreement is made effective as of the ___ day of ____________, 20___, by and between the following parties:

Company Name: ____________________________ Principal Office Address: ____________________________ Registered Agent: ____________________________ Members:- Name: ____________________________

- Address: ____________________________

The members hereby form a Limited Liability Company (LLC) under the laws of the Commonwealth of Pennsylvania, pursuant to the Pennsylvania Limited Liability Company Act. This Operating Agreement sets forth the rights and duties of the members and the conduct of the company.

Article I: Formation

The members hereby form a Limited Liability Company called ___________________________.

Article II: Purpose

The purpose of this LLC is to engage in any lawful business activity permitted under Pennsylvania law.

Article III: Members

- The initial members of the LLC are as follows:

- Name: ____________________________

- Capital Contribution: $_______________

- Additional members may be admitted with the unanimous consent of the existing members.

Article IV: Management

The management of the LLC is vested in its members. Decisions are made based on a majority vote unless otherwise specified.

Article V: Finances

- The fiscal year of the LLC shall be the calendar year.

- Profits and losses shall be shared among members in proportion to their capital contributions.

- Bank accounts shall be opened in the name of the LLC, and all funds shall be deposited therein.

Article VI: Transfers of Membership Interests

No member may transfer their interest in the LLC without the written consent of all remaining members.

Article VII: Dissolution

- The LLC may be dissolved upon the unanimous decision of the members.

- Upon dissolution, assets shall be distributed according to the members' capital contributions after all debts are paid.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members.

In witness whereof, the members have executed this Operating Agreement as of the date first above written.

Member Signatures:- ____________________________________ (Name)

- ____________________________________ (Name)

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Operating Agreement outlines the management structure and operational procedures for an LLC. |

| Governing Law | This agreement is governed by the Pennsylvania Uniform Limited Liability Company Act. |

| Members | All members of the LLC should sign the Operating Agreement to ensure mutual understanding and agreement. |

| Flexibility | The Operating Agreement allows for flexibility in defining roles, responsibilities, and profit-sharing among members. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended for LLCs in Pennsylvania. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help avoid litigation. |

| Amendments | Members can amend the Operating Agreement as needed, provided that all members agree to the changes. |

| Record Keeping | Maintaining a copy of the Operating Agreement is essential for legal and tax purposes. |

Crucial Questions on This Form

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. It serves as an internal guide for the members, detailing their rights, responsibilities, and the rules governing the business. While it is not required by law, having an Operating Agreement is highly recommended to avoid disputes and ensure smooth operations.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement is beneficial for several reasons:

- Clarifies Roles: It defines the roles and responsibilities of each member, helping to prevent misunderstandings.

- Establishes Procedures: It outlines the procedures for making decisions, handling finances, and resolving disputes.

- Protects Limited Liability: A well-drafted Operating Agreement reinforces the limited liability status of the LLC, protecting personal assets from business debts.

- Facilitates Business Operations: It provides a clear framework for how the business will operate, which can be especially helpful during transitions or when bringing in new members.

Do I need a lawyer to draft my Operating Agreement?

While it is not mandatory to hire a lawyer, it is often advisable, especially if your LLC has multiple members or if you anticipate complex operations. A legal professional can help ensure that the agreement complies with Pennsylvania laws and meets the specific needs of your business. However, many templates are available online for those who prefer a DIY approach.

What should be included in a Pennsylvania Operating Agreement?

Key components of an Operating Agreement typically include:

- Basic Information: Name of the LLC, principal office address, and formation date.

- Member Information: Names of the members and their ownership percentages.

- Management Structure: Details on whether the LLC will be member-managed or manager-managed.

- Voting Rights: How decisions will be made and voting procedures.

- Distributions: How profits and losses will be distributed among members.

- Amendments: Procedures for making changes to the agreement.

How often should I update my Operating Agreement?

It is wise to review and update your Operating Agreement regularly, especially when significant changes occur within the business. This includes adding new members, changing management structures, or altering the way profits are distributed. Regular updates ensure that the agreement remains relevant and reflective of your current business operations.

Is my Operating Agreement a public document?

No, your Operating Agreement is not a public document. It is an internal document that remains private among the members of the LLC. However, the Articles of Organization, which establish the LLC, are filed with the state and are public records. Keeping your Operating Agreement private can help protect sensitive business information.

What happens if I don’t have an Operating Agreement?

If you choose not to create an Operating Agreement, your LLC will be governed by Pennsylvania's default laws for LLCs. These laws may not align with your specific business needs and could lead to unintended consequences. For instance, decision-making processes and profit distribution may not reflect the intentions of the members, potentially resulting in disputes or misunderstandings.

Documents used along the form

The Pennsylvania Operating Agreement is a critical document for limited liability companies (LLCs) operating in the state. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance and facilitate smooth business operations. Below is a list of such documents, each serving a specific purpose.

- Articles of Organization: This document is filed with the Pennsylvania Department of State to officially create an LLC. It includes essential details such as the business name, registered agent, and the purpose of the business.

- Employer Identification Number (EIN) Application: An EIN is required for tax purposes and is obtained from the IRS. This number is essential for opening a business bank account and hiring employees.

- WC-240 Form: This crucial document is designed to inform employees about job offers that align with their health conditions. For more information, visit https://georgiapdf.com/wc-240-georgia.

- Operating Procedures: While the Operating Agreement outlines the overall structure, operating procedures provide detailed guidelines on daily operations, decision-making processes, and member responsibilities.

- Member Consent Forms: These forms are used to document decisions made by LLC members, especially when formal meetings are not held. They can cover various topics, including amendments to the Operating Agreement.

- Bylaws: Bylaws outline the internal rules and regulations governing the LLC's operations. They complement the Operating Agreement by providing additional structure for member meetings and voting procedures.

- Financial Statements: Regular financial statements are necessary for tracking the LLC's financial health. They include balance sheets, income statements, and cash flow statements, which can be crucial for member assessments.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They detail the member's ownership percentage and can be important for record-keeping and transfer of ownership.

- Tax Filings: LLCs must file various tax forms at the federal, state, and local levels. These filings ensure compliance with tax regulations and help maintain good standing with the government.

- Annual Reports: In Pennsylvania, LLCs are required to file annual reports to keep their registration active. These reports provide updated information about the business and its members.

- Non-Disclosure Agreements (NDAs): NDAs protect sensitive business information shared among members or with external parties. They help maintain confidentiality and safeguard proprietary information.

These documents, when used alongside the Pennsylvania Operating Agreement, contribute to a comprehensive framework for managing an LLC effectively. Ensuring that all necessary forms are completed and filed appropriately is vital for legal compliance and operational efficiency.

Misconceptions

Operating agreements are essential documents for businesses, particularly for limited liability companies (LLCs). However, misconceptions often cloud their importance and functionality. Here are four common misconceptions about the Pennsylvania Operating Agreement form:

- It’s Not Necessary for All LLCs: Many people believe that an operating agreement is optional for LLCs in Pennsylvania. While it’s true that the state does not require one, having an operating agreement is crucial. It outlines the management structure and operational procedures, helping to prevent disputes among members.

- It’s Just a Formality: Some think that an operating agreement is merely a formality that doesn’t hold much significance. In reality, it serves as a foundational document that governs the LLC’s operations. It can be used in legal disputes to clarify the intentions of the members, making it far more than just a formality.

- All Operating Agreements Are the Same: There’s a misconception that all operating agreements are generic and can be used interchangeably. Each operating agreement should be tailored to the specific needs and goals of the LLC. This customization ensures that it accurately reflects the members’ intentions and the unique aspects of the business.

- Once Created, It Can’t Be Changed: Some people believe that once an operating agreement is drafted and signed, it cannot be altered. This is not true. Members can amend the operating agreement as needed, provided they follow the procedures outlined within the document itself. Regular reviews and updates can help keep the agreement relevant as the business evolves.

Understanding these misconceptions can help business owners make informed decisions about their LLCs and the importance of having a well-crafted operating agreement.