Pennsylvania Promissory Note Document

The Pennsylvania Promissory Note form is an essential financial document used to outline the terms of a loan between a borrower and a lender. This form serves to formalize the agreement, detailing the amount borrowed, interest rates, repayment schedule, and any applicable fees. Both parties must understand their rights and obligations as stipulated in the note. The document typically includes information such as the names and addresses of the borrower and lender, the loan amount, and the due date for repayment. Additionally, it may address what happens in the event of default, ensuring that both parties are clear on the consequences of failing to meet the agreed-upon terms. By using this form, individuals and businesses can create a legally binding agreement that protects their interests and fosters trust in financial transactions.

Discover More Promissory Note Forms for Different States

Promissory Note Form California - Having both parties acknowledge receipt of funds can strengthen the note's legal standing.

In order to accurately complete the Ohio Traffic Crash Report form, designated as OH-1, individuals may refer to helpful resources such as All Ohio Forms which provide guidance on the necessary information required for effective documentation of traffic incidents.

Ohio Promissory Note Requirements - It is a crucial instrument for documenting loans of any size.

Similar forms

Loan Agreement: Like a promissory note, a loan agreement outlines the terms of borrowing, including the amount, interest rate, and repayment schedule.

- Hold Harmless Agreement: When entering into contracts that may involve risk, consider the important Hold Harmless Agreement template to clearly define liability responsibilities.

Mortgage: A mortgage secures a loan with property as collateral, similar to how a promissory note may secure a loan with personal guarantees.

Installment Agreement: This document details a payment plan for a debt, resembling the structured payment terms found in a promissory note.

Personal Guarantee: A personal guarantee may accompany a promissory note, ensuring that an individual is responsible for the debt if the borrower defaults.

Security Agreement: This document grants a lender a security interest in specific assets, akin to how a promissory note may outline collateral for a loan.

Bill of Exchange: A bill of exchange is a written order to pay a specified amount, similar to a promissory note in its function as a financial instrument.

Debt Acknowledgment: This document confirms that a debt exists and specifies the amount owed, paralleling the acknowledgment of debt in a promissory note.

Loan Application: While not a binding agreement, a loan application initiates the borrowing process and outlines the borrower's intent, similar to a promissory note’s purpose.

Forbearance Agreement: This agreement allows a borrower to temporarily pause payments, similar to how a promissory note may provide flexibility in repayment terms.

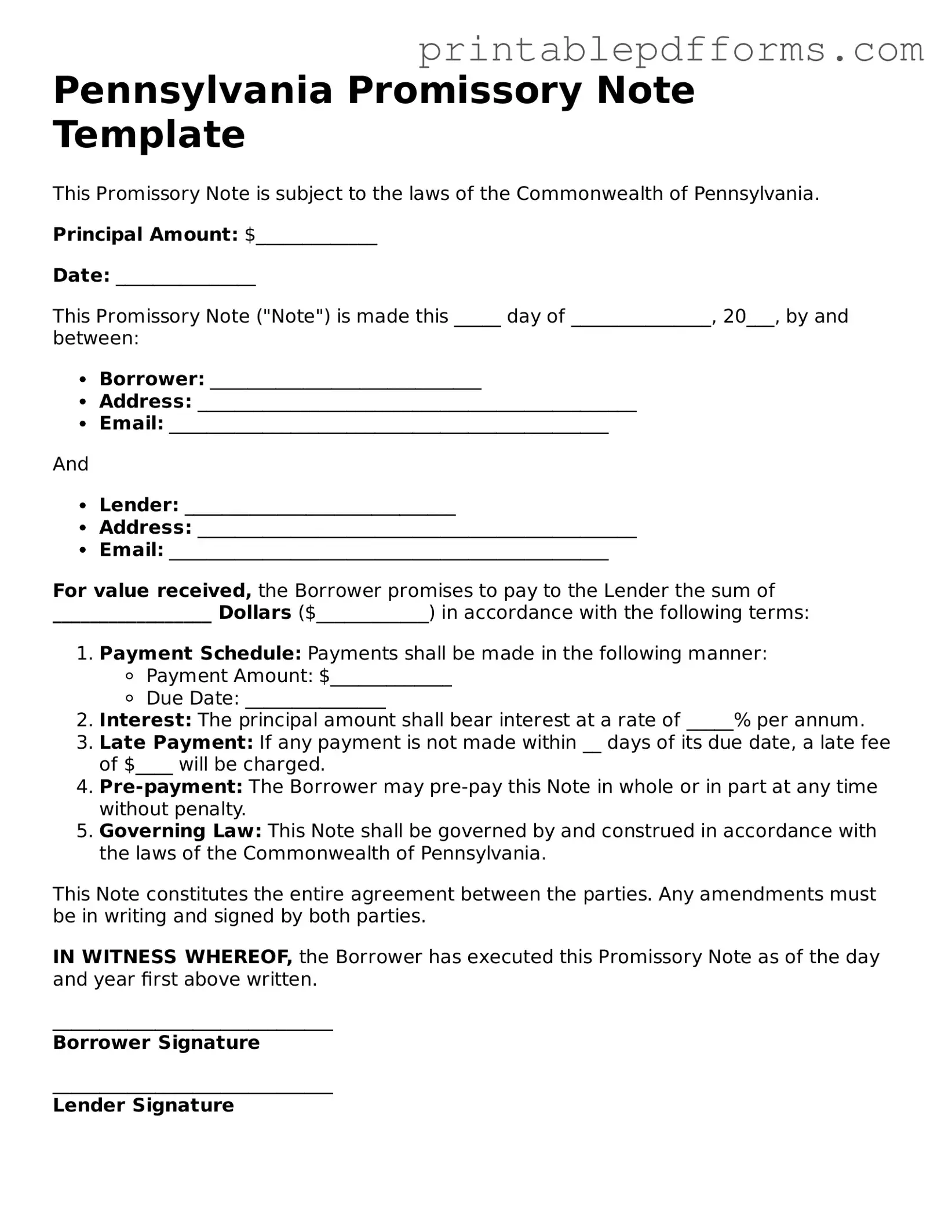

Document Example

Pennsylvania Promissory Note Template

This Promissory Note is subject to the laws of the Commonwealth of Pennsylvania.

Principal Amount: $_____________

Date: _______________

This Promissory Note ("Note") is made this _____ day of _______________, 20___, by and between:

- Borrower: _____________________________

- Address: _______________________________________________

- Email: _______________________________________________

And

- Lender: _____________________________

- Address: _______________________________________________

- Email: _______________________________________________

For value received, the Borrower promises to pay to the Lender the sum of _________________ Dollars ($____________) in accordance with the following terms:

- Payment Schedule: Payments shall be made in the following manner:

- Payment Amount: $_____________

- Due Date: _______________

- Interest: The principal amount shall bear interest at a rate of _____% per annum.

- Late Payment: If any payment is not made within __ days of its due date, a late fee of $____ will be charged.

- Pre-payment: The Borrower may pre-pay this Note in whole or in part at any time without penalty.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

This Note constitutes the entire agreement between the parties. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

______________________________

Borrower Signature

______________________________

Lender Signature

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in Pennsylvania. |

| Parties Involved | Typically, there are two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note can specify an interest rate, which must comply with Pennsylvania usury laws. |

| Payment Terms | Payment terms must be clearly outlined, including the due date and method of payment. |

| Signatures | Both parties must sign the note for it to be legally binding. |

| Witnesses | While not required, having a witness sign can strengthen the enforceability of the note. |

| Default Clause | A default clause can be included, outlining the consequences if the borrower fails to make payments. |

| Amendments | Any amendments to the promissory note should be documented in writing and signed by both parties. |

Crucial Questions on This Form

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document in which one party, known as the borrower, agrees to repay a specified amount of money to another party, known as the lender, under agreed-upon terms. This document outlines the amount borrowed, the interest rate, payment schedule, and any other relevant terms of the loan.

What are the key components of a Promissory Note?

Key components of a Pennsylvania Promissory Note typically include:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any penalties for late payments

- Signatures of both parties

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It serves as evidence of the debt and the terms under which it must be repaid. If the borrower fails to make payments as agreed, the lender can take legal action to enforce the terms of the note.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can ensure that the document complies with Pennsylvania laws and adequately protects the interests of both parties.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified. Both parties must agree to the changes, and it is advisable to document any modifications in writing. This helps avoid disputes in the future and ensures clarity regarding the new terms.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. These may include:

- Negotiating a new payment plan with the borrower

- Charging late fees as stipulated in the note

- Pursuing legal action to recover the owed amount

It is important for lenders to follow legal procedures when seeking repayment.

Are there any tax implications related to a Promissory Note?

Yes, there can be tax implications. For example, interest income received by the lender may be subject to taxation. Additionally, if the borrower does not repay the loan, the lender may need to report the loss as a bad debt. Consulting a tax professional is advisable for specific guidance.

How can I ensure my Promissory Note is enforceable?

To ensure that a Promissory Note is enforceable, consider the following steps:

- Clearly outline the terms and conditions

- Include all necessary details about the parties involved

- Ensure that both parties sign and date the document

- Consider having the document notarized

Taking these steps can help strengthen the enforceability of the note in case of a dispute.

Documents used along the form

When dealing with a Pennsylvania Promissory Note, several other forms and documents may accompany it to ensure clarity and legal compliance. Each of these documents serves a unique purpose in the lending process, providing additional information or establishing specific terms between the parties involved.

- Loan Agreement: This document outlines the terms of the loan in detail, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- ATV Bill of Sale: The nypdfforms.com/atv-bill-of-sale-form is essential for documenting the sale and transfer of ownership of an all-terrain vehicle in New York, ensuring compliance with state regulations.

- Security Agreement: If the loan is secured by collateral, a Security Agreement will describe the collateral in detail. This document protects the lender's interests by ensuring they have a claim to the collateral if the borrower defaults on the loan.

- Disclosure Statement: This form provides essential information about the loan, including fees, interest rates, and terms. It ensures that the borrower fully understands their obligations and the costs associated with the loan.

- Amortization Schedule: This document breaks down the repayment plan into manageable payments over time. It shows how much of each payment goes toward principal and interest, helping the borrower budget effectively.

Incorporating these documents alongside the Pennsylvania Promissory Note can enhance the understanding and security of the lending arrangement. By ensuring all parties are informed and protected, the process can proceed smoothly and efficiently.

Misconceptions

There are several misconceptions regarding the Pennsylvania Promissory Note form. Understanding these misconceptions can help individuals navigate the process more effectively.

- Misconception 1: A Promissory Note must be notarized to be valid.

- Misconception 2: Only banks can issue Promissory Notes.

- Misconception 3: Promissory Notes are only for large loans.

- Misconception 4: A verbal agreement is sufficient for a Promissory Note.

- Misconception 5: The terms of a Promissory Note cannot be modified.

- Misconception 6: A Promissory Note is the same as a loan agreement.

- Misconception 7: There are no legal consequences for failing to repay a Promissory Note.

- Misconception 8: A Promissory Note does not need to specify a repayment schedule.

- Misconception 9: Promissory Notes are only for personal loans.

While notarization can provide additional legal protection, it is not a requirement for a Promissory Note to be valid in Pennsylvania.

Any individual or business can create and issue a Promissory Note as long as it meets the necessary legal criteria.

Promissory Notes can be used for any amount of money, regardless of size. They are flexible financial instruments.

While verbal agreements may be enforceable in some cases, a written Promissory Note is recommended for clarity and legal standing.

The terms can be amended if both parties agree to the changes and document them properly.

While both documents relate to borrowing money, a Promissory Note specifically outlines the borrower's promise to repay the loan.

Failure to repay can lead to legal action, including lawsuits and damage to credit scores.

Including a repayment schedule is crucial for clarity and helps avoid disputes between the parties involved.

They can also be used in business transactions, making them versatile financial tools for various situations.