Pennsylvania Quitclaim Deed Document

In the realm of real estate transactions, the Pennsylvania Quitclaim Deed form serves as a vital instrument for property owners seeking to transfer ownership rights without the complexities of a warranty deed. This form is particularly useful in situations where the grantor wishes to convey their interest in a property to another party without guaranteeing that the title is free of claims or encumbrances. The quitclaim deed is often employed among family members, during divorce settlements, or in cases where the property is being transferred as a gift. It streamlines the transfer process, allowing for a quick and straightforward exchange of property rights. However, while it simplifies the transaction, it is essential for both parties to understand the implications of such a transfer, as the recipient receives whatever interest the grantor holds—be it full ownership or a partial claim. This form requires specific information, including the names of both the grantor and grantee, a description of the property, and the signature of the grantor, all of which must be executed in accordance with Pennsylvania state laws to ensure validity. By understanding the nuances of the Pennsylvania Quitclaim Deed, individuals can navigate their property transactions with greater confidence and clarity.

Discover More Quitclaim Deed Forms for Different States

How Do I File a Quit Claim Deed - A Quitclaim Deed is often used to remove one partner from a jointly held property.

Quit Claim Deed Form Ohio - The document allows one person to give up their claim to a property, regardless of ownership status.

The process of buying or selling an all-terrain vehicle (ATV) in New York necessitates the use of the New York ATV Bill of Sale form, which serves as a legal record of the transaction. It is essential for both parties to complete this document accurately to avoid any disputes and to comply with state regulations. For those seeking the form, it can be found at https://nypdfforms.com/atv-bill-of-sale-form, ensuring that all required information is documented properly.

Florida Quit Claim Deed Filled Out - This deed facilitates fast transfers without extensive paperwork.

Quitclaim Deed Ny - Quitclaim Deeds are often used for transferring property between spouses.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of property from one party to another. While it has its unique features, it shares similarities with several other documents in property law. Below are four documents that are comparable to a Quitclaim Deed:

- Warranty Deed: Like a Quitclaim Deed, a Warranty Deed transfers ownership of property. However, it provides additional assurances. The grantor guarantees that they hold clear title to the property and will defend it against any claims. This assurance is not present in a Quitclaim Deed.

- Grant Deed: A Grant Deed also conveys property ownership, similar to a Quitclaim Deed. However, it includes implied warranties that the property has not been sold to anyone else and is free from encumbrances, unless stated otherwise. This makes it a bit more secure than a Quitclaim Deed.

- Deed of Trust: A Deed of Trust is used in real estate transactions to secure a loan. While it does not transfer ownership outright like a Quitclaim Deed, it involves the transfer of interest in the property as collateral for the loan. This document establishes a relationship between the borrower, lender, and a third-party trustee.

- Hold Harmless Agreement: When navigating legal liabilities, ensure you understand the Hold Harmless Agreement principles necessary for protection while entering into agreements.

- Lease Agreement: Although fundamentally different in purpose, a Lease Agreement shares a commonality with a Quitclaim Deed in that it involves the transfer of rights to use property. A lease allows a tenant to occupy a property for a specified period, while a Quitclaim Deed transfers ownership rights permanently.

Document Example

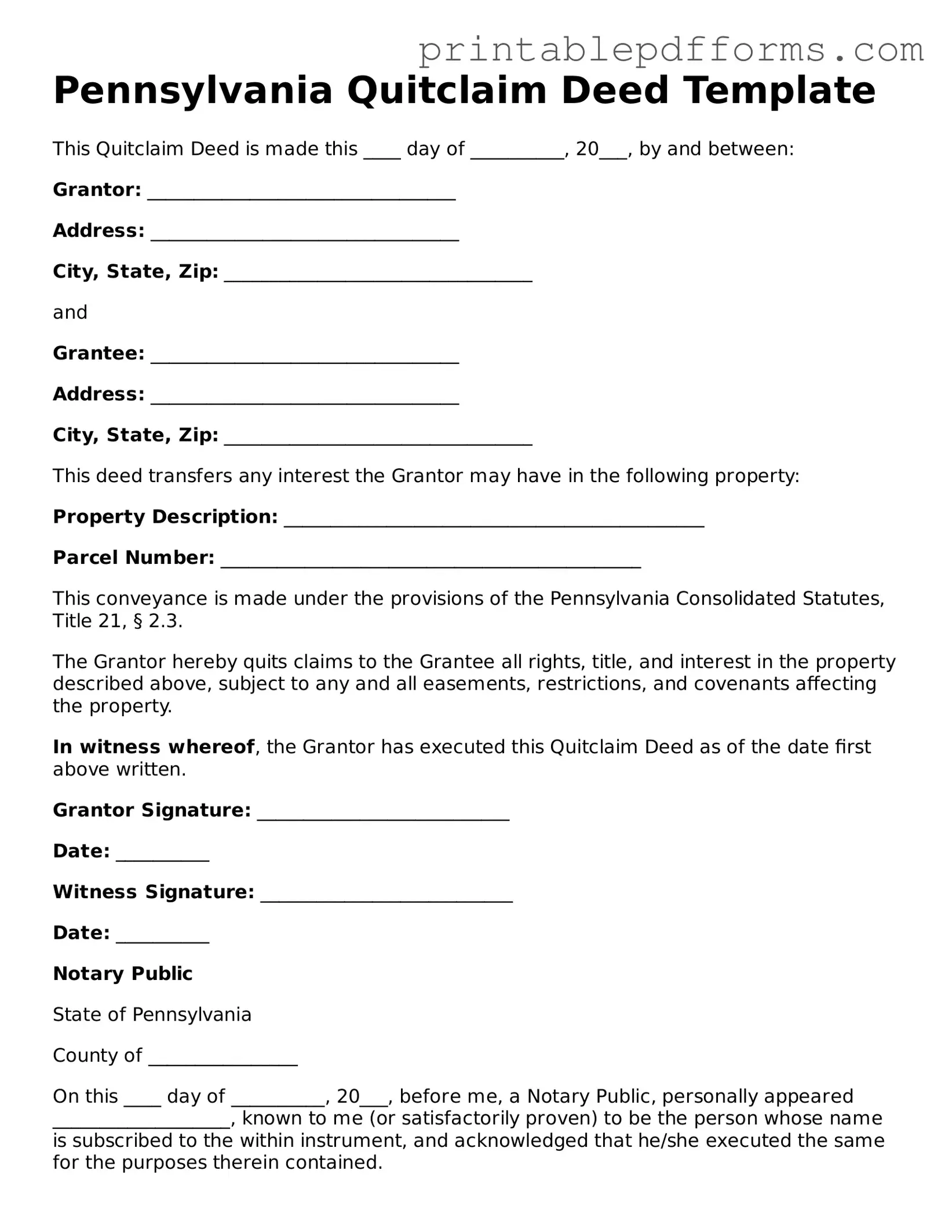

Pennsylvania Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20___, by and between:

Grantor: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

and

Grantee: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

This deed transfers any interest the Grantor may have in the following property:

Property Description: _____________________________________________

Parcel Number: _____________________________________________

This conveyance is made under the provisions of the Pennsylvania Consolidated Statutes, Title 21, § 2.3.

The Grantor hereby quits claims to the Grantee all rights, title, and interest in the property described above, subject to any and all easements, restrictions, and covenants affecting the property.

In witness whereof, the Grantor has executed this Quitclaim Deed as of the date first above written.

Grantor Signature: ___________________________

Date: __________

Witness Signature: ___________________________

Date: __________

Notary Public

State of Pennsylvania

County of ________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared ___________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Witness my hand and seal:

__________________________________

Notary Public

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of property without any guarantees or warranties. |

| Governing Law | The Pennsylvania Quitclaim Deed is governed by Title 21, Chapter 5 of the Pennsylvania Consolidated Statutes. |

| Purpose | This form is typically used to transfer property between family members or to clear up title issues. |

| Parties Involved | The grantor (the person transferring the property) and the grantee (the person receiving the property) are the main parties involved. |

| Consideration | While consideration (payment) is often included, it is not required for the deed to be valid in Pennsylvania. |

| Signature Requirement | The grantor must sign the quitclaim deed in front of a notary public for it to be legally binding. |

| Recording | To protect the rights of the grantee, the quitclaim deed should be recorded in the county where the property is located. |

| Tax Implications | Transfer taxes may apply when using a quitclaim deed, depending on the county regulations. |

| Limitations | A quitclaim deed does not guarantee that the grantor holds clear title to the property, which means the grantee may face risks. |

Crucial Questions on This Form

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of property from one person to another. In Pennsylvania, this type of deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the seller has in the property at the time of the transfer. This makes Quitclaim Deeds common for transferring property between family members or in situations where the seller is unsure of their title status.

How do I complete a Quitclaim Deed in Pennsylvania?

To complete a Quitclaim Deed in Pennsylvania, follow these steps:

- Gather the necessary information, including the names of the grantor (seller) and grantee (buyer), the property's legal description, and the address.

- Obtain a Quitclaim Deed form. This can be found online or at a local legal stationery store.

- Fill out the form accurately, ensuring all details are correct.

- Sign the deed in front of a notary public. Both the grantor and the notary must be present for the signing.

- Record the completed deed with the county recorder of deeds where the property is located. This step is crucial for the deed to be legally effective.

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to hire an attorney to create a Quitclaim Deed, it is often advisable. An attorney can help ensure that the deed is filled out correctly and meets all legal requirements. They can also provide guidance on any potential issues with the property title that you may not be aware of.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees associated with filing a Quitclaim Deed in Pennsylvania. These fees can vary by county but generally include:

- A recording fee, which is charged by the county recorder of deeds.

- Potential transfer taxes, depending on the property's value and local regulations.

It’s important to check with your local county office for the exact amounts.

Can a Quitclaim Deed be used to remove someone from a property title?

Yes, a Quitclaim Deed can be used to remove someone from a property title. If one owner wishes to transfer their interest in the property to the other owner or to a third party, a Quitclaim Deed can accomplish this. However, it is essential to understand that this does not eliminate any financial obligations tied to the property, such as mortgages. The remaining owners may still be responsible for these obligations.

What happens if there are issues with the title after using a Quitclaim Deed?

Since a Quitclaim Deed does not guarantee a clear title, if issues arise after the transfer, the grantee (buyer) may have limited recourse. They cannot hold the grantor (seller) liable for any title defects discovered after the deed is executed. This is why it is crucial to conduct a title search before completing the transaction. A title search can reveal any existing liens or claims against the property that could affect ownership.

Documents used along the form

When dealing with property transfers in Pennsylvania, the Quitclaim Deed is a crucial document. However, several other forms and documents often accompany it to ensure a smooth transaction. Understanding these additional documents can help clarify the entire process and protect the interests of all parties involved.

- Property Transfer Tax Form: This form is required to report the sale of real estate and calculate any applicable transfer taxes. It ensures that the state receives its due revenue from property transactions.

- Title Search Report: A title search report provides a history of the property’s ownership. It reveals any liens, encumbrances, or claims against the property, ensuring the buyer knows what they are acquiring.

- Affidavit of Residence: This document may be needed to confirm the residency status of the seller. It can help clarify tax responsibilities and eligibility for certain exemptions.

- Settlement Statement (HUD-1): This detailed document outlines all the financial aspects of the transaction. It lists the costs, fees, and credits associated with the sale, ensuring transparency for both parties.

- Ohio Traffic Crash Report Form: Understanding the detailed documentation requirements for accidents is crucial. For comprehensive information, refer to All Ohio Forms.

- Power of Attorney: If the seller cannot be present at the closing, a power of attorney allows someone else to act on their behalf. This document must be properly executed to be valid.

- Certificate of Good Standing: Often required for corporate sellers, this certificate proves that the entity is authorized to conduct business in Pennsylvania and is in compliance with state regulations.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and any outstanding dues. They are essential for buyers to understand the community's requirements.

- Disclosure Statement: Sellers must provide a disclosure statement detailing any known issues with the property. This document protects buyers by ensuring they are informed about potential problems.

- Deed of Trust or Mortgage Agreement: If financing is involved, these documents outline the terms of the loan and the obligations of both the borrower and lender. They secure the lender's interest in the property.

Each of these documents plays a vital role in the property transfer process in Pennsylvania. By familiarizing oneself with them, buyers and sellers can navigate the complexities of real estate transactions more confidently and effectively.

Misconceptions

When it comes to property transfers in Pennsylvania, the quitclaim deed is often misunderstood. Here are five common misconceptions about this type of deed.

-

A quitclaim deed transfers ownership without any guarantees.

Many people believe that a quitclaim deed guarantees clear title to the property. In reality, this type of deed only transfers whatever interest the grantor has in the property, if any. There are no warranties or guarantees about the title.

-

Quitclaim deeds are only used between family members.

While it is true that quitclaim deeds are often used in family transactions, they are not limited to these situations. They can be used in various contexts, including divorce settlements, business transactions, or any scenario where the parties want to transfer property without the need for extensive title searches.

-

A quitclaim deed is the same as a warranty deed.

This misconception can lead to significant misunderstandings. A warranty deed provides guarantees about the title, ensuring the grantee is protected against future claims. In contrast, a quitclaim deed offers no such protections, making it essential to understand the differences before proceeding.

-

Quitclaim deeds do not require notarization.

Some people think that because quitclaim deeds are straightforward, they do not need to be notarized. However, in Pennsylvania, a quitclaim deed must be signed in front of a notary public to be valid. This step is crucial for ensuring the document is legally recognized.

-

Using a quitclaim deed means you cannot sell the property later.

This is simply not true. A quitclaim deed transfers ownership, and the new owner can sell the property just like any other property. However, potential buyers may be cautious due to the lack of title guarantees, so it’s important to be aware of how this may affect future transactions.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in Pennsylvania. Always consider consulting a legal professional to navigate the complexities of real estate transactions.