Pennsylvania Real Estate Purchase Agreement Document

The Pennsylvania Real Estate Purchase Agreement is a vital document in the home buying process, serving as a blueprint for the transaction between buyers and sellers. This form outlines essential terms and conditions, including the purchase price, financing details, and closing date. It also specifies the responsibilities of both parties regarding inspections, repairs, and contingencies, ensuring that everyone is on the same page throughout the process. Additionally, the agreement addresses important aspects such as earnest money deposits, title searches, and the transfer of property ownership. By clearly defining the expectations and obligations of both the buyer and the seller, this form helps to minimize misunderstandings and disputes, paving the way for a smoother transaction. Understanding the intricacies of this agreement can empower buyers and sellers alike, providing them with the confidence needed to navigate the real estate market in Pennsylvania.

Discover More Real Estate Purchase Agreement Forms for Different States

Purchase and Sale Agreement Florida - Facilitates compliance with federal regulations impacting the transaction.

The proper completion of the Georgia Tractor Bill of Sale form is essential for documenting the ownership transfer of a tractor in Georgia, and can be conveniently accessed at georgiapdf.com/tractor-bill-of-sale. This form captures vital information about all parties involved and the tractor's specifications, ensuring clarity and legality in the transaction process.

How to Make a Purchase Agreement - This document can establish the rights of the parties for final walk-through inspections before closing.

Similar forms

- Lease Agreement: Like a Real Estate Purchase Agreement, a lease agreement outlines the terms under which a tenant can occupy a property. It specifies the duration of the lease, rent amount, and responsibilities of both parties.

- Option to Purchase Agreement: This document grants a potential buyer the right to purchase a property at a later date. It includes terms similar to those in a purchase agreement, such as price and time frame.

- Sales Contract: A sales contract is used in various transactions, including real estate. It details the terms of sale, including price, payment methods, and contingencies, much like a Real Estate Purchase Agreement.

- Listing Agreement: This document is between a property owner and a real estate agent. It outlines the agent's responsibilities and the terms under which the property will be marketed, sharing similarities in structure and purpose.

- Escrow Agreement: An escrow agreement involves a third party holding funds or documents until certain conditions are met. It often accompanies a purchase agreement and ensures that both parties fulfill their obligations.

- Buyer’s Agency Agreement: This document establishes a relationship between a buyer and an agent. It outlines the agent's duties and the buyer's rights, similar to the representation aspects found in a purchase agreement.

Quitclaim Deed: When transferring property ownership without guarantees, you can utilize the simple Quitclaim Deed document for a straightforward approach.

- Seller’s Disclosure Statement: This statement is provided by the seller to inform potential buyers of known issues with the property. It complements the purchase agreement by ensuring transparency about the property’s condition.

- Financing Agreement: This document details the terms of a loan for purchasing real estate. It shares similarities with a purchase agreement in that it outlines financial obligations and conditions for securing the property.

- Title Insurance Policy: A title insurance policy protects against losses from disputes over property ownership. While it serves a different function, it is often associated with real estate transactions and is referenced in purchase agreements.

- Home Inspection Agreement: This agreement outlines the terms for a home inspection before purchase. It ensures that buyers are aware of the property’s condition, similar to the contingencies often included in a purchase agreement.

Document Example

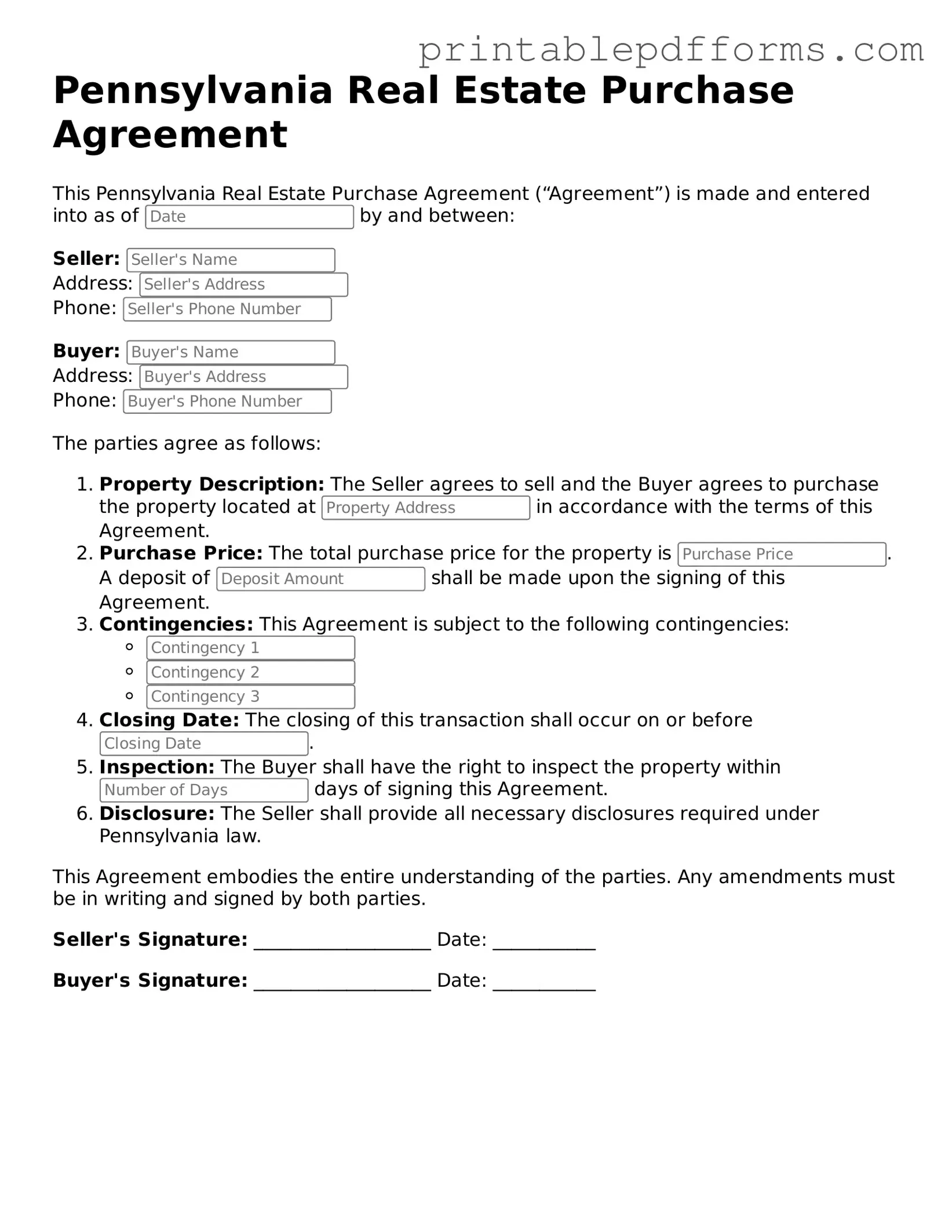

Pennsylvania Real Estate Purchase Agreement

This Pennsylvania Real Estate Purchase Agreement (“Agreement”) is made and entered into as of by and between:

Seller:

Address:

Phone:

Buyer:

Address:

Phone:

The parties agree as follows:

- Property Description: The Seller agrees to sell and the Buyer agrees to purchase the property located at in accordance with the terms of this Agreement.

- Purchase Price: The total purchase price for the property is . A deposit of shall be made upon the signing of this Agreement.

- Contingencies: This Agreement is subject to the following contingencies:

- Closing Date: The closing of this transaction shall occur on or before .

- Inspection: The Buyer shall have the right to inspect the property within days of signing this Agreement.

- Disclosure: The Seller shall provide all necessary disclosures required under Pennsylvania law.

This Agreement embodies the entire understanding of the parties. Any amendments must be in writing and signed by both parties.

Seller's Signature: ___________________ Date: ___________

Buyer's Signature: ___________________ Date: ___________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Real Estate Purchase Agreement is governed by the laws of the Commonwealth of Pennsylvania. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Essential Components | The agreement typically includes details such as the purchase price, property description, and closing date. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied before the sale can proceed. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Crucial Questions on This Form

What is the Pennsylvania Real Estate Purchase Agreement form?

The Pennsylvania Real Estate Purchase Agreement is a legal document used in real estate transactions within the state. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves to protect both parties by clearly defining their rights and obligations throughout the transaction process.

What key elements are included in the agreement?

A typical Pennsylvania Real Estate Purchase Agreement includes several critical components:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Purchase Price: The agreed-upon price for the property.

- Deposit Amount: Information about the earnest money deposit, including the amount and when it is due.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspection contingencies.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

Who typically prepares the Real Estate Purchase Agreement?

While buyers and sellers can technically draft the agreement themselves, it is common for real estate agents or attorneys to prepare it. Real estate professionals are familiar with the necessary legal requirements and can ensure that the agreement is comprehensive and compliant with Pennsylvania laws.

Can the terms of the agreement be negotiated?

Yes, the terms of the Pennsylvania Real Estate Purchase Agreement are negotiable. Buyers and sellers can discuss and modify various aspects of the agreement, such as the purchase price, contingencies, and closing date. It is important for both parties to communicate openly to reach a mutually acceptable agreement.

What happens if one party fails to fulfill their obligations?

If one party does not fulfill their obligations under the agreement, the other party may have several options. They can seek to enforce the contract, which may involve legal action. Alternatively, they may choose to terminate the agreement, depending on the specific circumstances and the terms outlined in the contract. It's advisable to consult with a legal professional to understand the best course of action.

Is the Real Estate Purchase Agreement legally binding?

Yes, once both parties sign the Pennsylvania Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to adhere to the terms outlined in the agreement. However, certain contingencies may allow for cancellation without penalty if specific conditions are not met.

Where can I obtain a Pennsylvania Real Estate Purchase Agreement form?

Real Estate Purchase Agreement forms can be obtained from various sources, including:

- Real estate agents or brokers

- Legal document providers

- Local real estate associations

- Online legal service websites

It is crucial to ensure that any form used is the most current version and complies with Pennsylvania laws.

Documents used along the form

The Pennsylvania Real Estate Purchase Agreement is a vital document in real estate transactions, but it is often accompanied by several other forms and documents that help clarify the terms and protect the interests of all parties involved. Below is a list of commonly used forms that complement the Purchase Agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known defects or issues with the property. It aims to inform potential buyers about the condition of the home and any repairs that may be necessary.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is mandatory. It informs buyers of the potential risks associated with lead-based paint, ensuring they are aware of any hazards before making a purchase.

- Property Inspection Agreement: This agreement outlines the terms under which a property inspection will be conducted. It typically details the scope of the inspection, the responsibilities of both parties, and any associated fees.

- Financing Contingency Addendum: This addendum allows buyers to make their purchase contingent upon securing financing. It protects buyers by ensuring they are not obligated to complete the purchase if they cannot obtain a mortgage.

- Mobile Home Bill of Sale: Essential for documenting the transfer of ownership of a mobile home, this form includes buyer and seller information, mobile home identification, and sale price, similar to how the https://freebusinessforms.org/ outlines important details for smooth transactions.

- Title Search and Title Insurance Documents: These documents provide information regarding the ownership history of the property and any liens or encumbrances. Title insurance protects buyers against any future claims against the property.

- Closing Disclosure: This document outlines the final terms and costs associated with the mortgage. It must be provided to the buyer at least three days before closing, allowing for a thorough review of all financial details.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

Understanding these forms can enhance the real estate transaction process. Each document plays a crucial role in ensuring that both buyers and sellers are protected and informed throughout the buying and selling experience.

Misconceptions

When it comes to real estate transactions in Pennsylvania, the Real Estate Purchase Agreement (RPA) is a crucial document. However, several misconceptions can lead to confusion among buyers and sellers. Here are six common misunderstandings about the Pennsylvania Real Estate Purchase Agreement form:

- It's Just a Formality: Many people think that signing the RPA is merely a formality. In reality, it is a legally binding contract that outlines the terms of the sale. Ignoring its importance can lead to serious consequences.

- All Agreements Are the Same: Some believe that all real estate purchase agreements are identical. However, the Pennsylvania RPA is specifically designed to comply with state laws and regulations, making it unique to Pennsylvania.

- Verbal Agreements Are Sufficient: A common misconception is that a verbal agreement is enough to finalize a sale. In Pennsylvania, a written agreement is required to enforce the terms of the sale, ensuring that both parties are protected.

- Only Buyers Need to Understand It: Some sellers think they can simply sign the agreement without understanding its contents. Both parties should be familiar with the terms, as they affect everyone involved in the transaction.

- It Can Be Easily Changed After Signing: Many believe that once the RPA is signed, changes can be made without much hassle. In fact, any amendments require mutual consent and often need to be documented in writing to be enforceable.

- It Covers Everything: Some people assume that the RPA includes every detail of the transaction. While it covers essential terms, it may not address all contingencies or specific agreements made outside the contract. Additional documents may be necessary.

Understanding these misconceptions can empower both buyers and sellers to navigate the real estate process more effectively. Always seek clarification and consider consulting a real estate professional to ensure a smooth transaction.