Pennsylvania Transfer-on-Death Deed Document

In Pennsylvania, the Transfer-on-Death Deed (TODD) serves as an important tool for individuals looking to streamline the process of transferring real estate upon their death. This legal instrument allows property owners to designate one or more beneficiaries who will receive their property without the need for probate, thereby simplifying the transfer process and potentially reducing associated costs. The TODD form must be properly executed and recorded to be effective, ensuring that the wishes of the property owner are honored after their passing. Importantly, this deed does not affect the owner's rights during their lifetime; they can sell, mortgage, or alter the property as they see fit. Additionally, the TODD provides a clear mechanism for heirs to inherit property, minimizing the potential for disputes among family members. Understanding the nuances of this form is crucial for anyone considering its use, as it can significantly impact estate planning and the management of one's assets.

Discover More Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Florida Form - Property can be transferred using this deed without the complexities of a will.

When engaging in the sale of a mobile home, utilizing the Ohio Mobile Home Bill of Sale form is vital for ensuring a clear and legally binding transaction. This document captures essential details that protect both parties involved, providing proof of ownership transfer and the agreed-upon terms. For comprehensive guidance and access to necessary documents, visit All Ohio Forms, which can help streamline the process and prevent potential disputes down the line.

How Much Does a Beneficiary Deed Cost - Making changes to the deed may require proper legal language and notarization.

Texas Transfer on Death Deed Form - This deed provides peace of mind, knowing that your wishes regarding property distribution can be clearly stated and followed.

Similar forms

- Will: A will specifies how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but typically requires probate, whereas the deed avoids this process.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. Similar to a Transfer-on-Death Deed, it bypasses probate but involves more management during the person's life.

- Beneficiary Designation: Commonly used for bank accounts and retirement plans, this document allows individuals to name beneficiaries who will receive assets upon death. It operates similarly to a Transfer-on-Death Deed by directly transferring assets outside of probate.

- Joint Tenancy: In joint tenancy, two or more people own property together. Upon the death of one owner, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed operates.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to designate beneficiaries who will receive the account balance after their death. Like a Transfer-on-Death Deed, it ensures a direct transfer of assets without going through probate.

- Transfer-on-Death Registration for Securities: This allows individuals to register securities in a way that they automatically transfer to a designated beneficiary upon death, mirroring the functionality of a Transfer-on-Death Deed.

- Life Estate Deed: This deed grants someone the right to use a property during their lifetime, with the property passing to another person upon death. It shares similarities with the Transfer-on-Death Deed in terms of property transfer upon death.

- Mobile Home Bill of Sale: A critical document that explicitly details the transfer of ownership of a mobile home, ensuring legal protection and clarity for both parties involved in the transaction. For more information, visit https://freebusinessforms.org.

- Durable Power of Attorney: While primarily used for financial decisions, this document can allow an agent to manage assets, including property. It can work alongside a Transfer-on-Death Deed but does not directly transfer property upon death.

- Community Property with Right of Survivorship: This arrangement allows married couples to own property together, automatically transferring ownership to the surviving spouse upon death. It functions similarly to a Transfer-on-Death Deed in terms of asset transfer.

Document Example

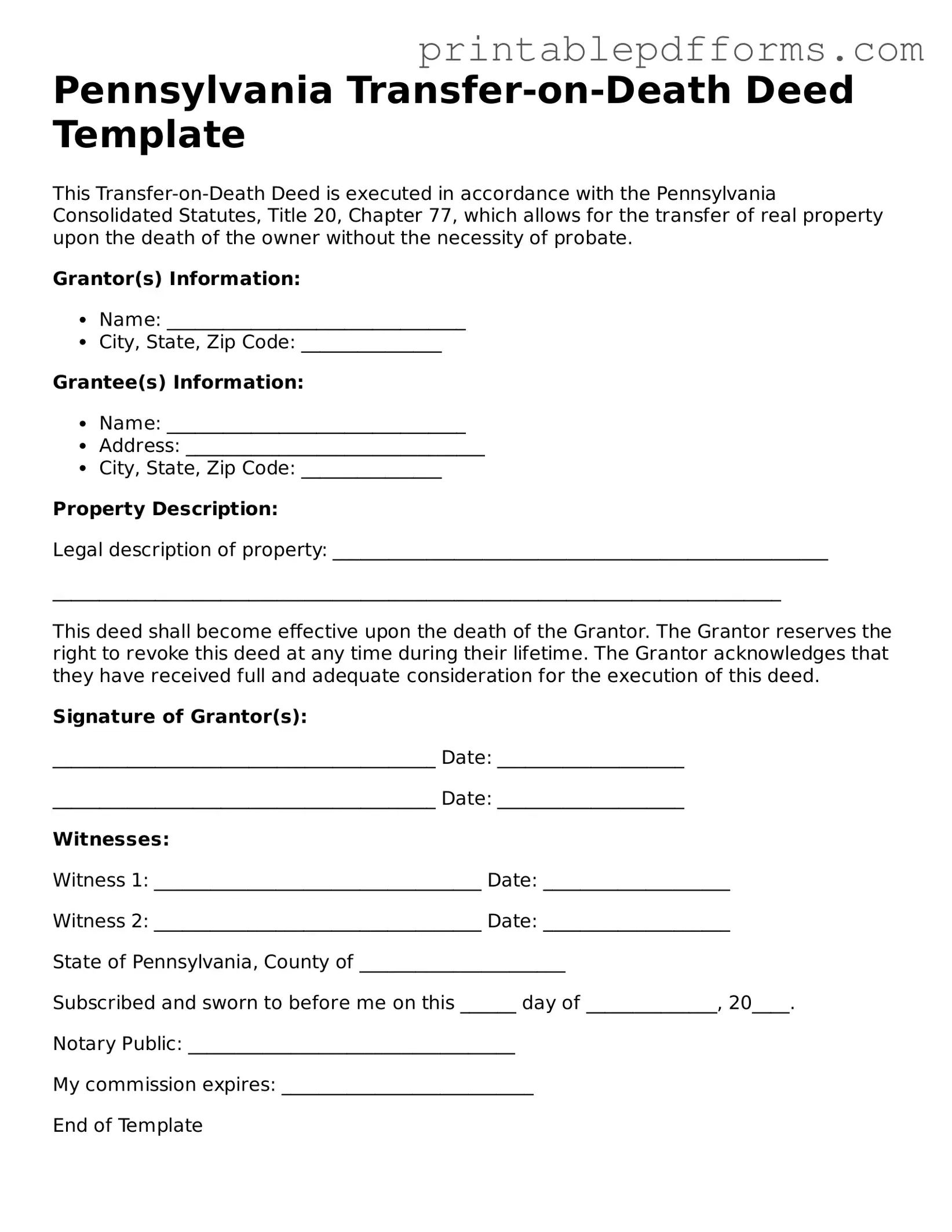

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Pennsylvania Consolidated Statutes, Title 20, Chapter 77, which allows for the transfer of real property upon the death of the owner without the necessity of probate.

Grantor(s) Information:

- Name: ________________________________

- City, State, Zip Code: _______________

Grantee(s) Information:

- Name: ________________________________

- Address: ________________________________

- City, State, Zip Code: _______________

Property Description:

Legal description of property: _____________________________________________________

______________________________________________________________________________

This deed shall become effective upon the death of the Grantor. The Grantor reserves the right to revoke this deed at any time during their lifetime. The Grantor acknowledges that they have received full and adequate consideration for the execution of this deed.

Signature of Grantor(s):

_________________________________________ Date: ____________________

_________________________________________ Date: ____________________

Witnesses:

Witness 1: ___________________________________ Date: ____________________

Witness 2: ___________________________________ Date: ____________________

State of Pennsylvania, County of ______________________

Subscribed and sworn to before me on this ______ day of ______________, 20____.

Notary Public: ___________________________________

My commission expires: ___________________________

End of Template

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Pennsylvania Consolidated Statutes, Title 20, Chapter 77. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the death of the owner, allowing flexibility in estate planning. |

| Requirements | The deed must be signed by the owner and recorded with the county recorder of deeds to be valid. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner's death, ensuring the owner retains full control during their lifetime. |

Crucial Questions on This Form

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed helps avoid probate, simplifying the transfer process. The property owner retains full control of the property during their lifetime, and the beneficiary does not have any rights until the owner passes away.

Who can use a Transfer-on-Death Deed in Pennsylvania?

Any individual who owns real estate in Pennsylvania can utilize a Transfer-on-Death Deed. This includes homeowners, property investors, and other property owners. However, it is important to note that the deed must be executed in accordance with Pennsylvania law to be valid.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

- Obtain the Pennsylvania Transfer-on-Death Deed form.

- Fill out the form with the necessary information, including the property description and the name of the beneficiary.

- Sign the deed in the presence of a notary public.

- Record the deed with the county recorder of deeds in the county where the property is located.

Make sure to keep a copy of the recorded deed for your records.

Can I change the beneficiary on a Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time while you are alive. To do this, you must execute a new Transfer-on-Death Deed that revokes the previous one. It is crucial to record the new deed with the county recorder of deeds to ensure that the change is legally recognized.

Are there any limitations to using a Transfer-on-Death Deed?

There are several limitations to consider when using a Transfer-on-Death Deed:

- The deed cannot be used for certain types of property, such as commercial properties or properties held in a trust.

- It does not provide protection from creditors; the property may still be subject to claims against the estate.

- All beneficiaries must be individuals; entities such as corporations or partnerships cannot be named as beneficiaries.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed becomes void. In such cases, the property owner should update the deed to name a new beneficiary. If no new beneficiary is designated, the property will then be distributed according to the property owner's will or, if there is no will, according to Pennsylvania's intestacy laws.

Documents used along the form

The Pennsylvania Transfer-on-Death Deed form allows property owners to designate a beneficiary who will receive the property upon their death, avoiding probate. However, this form is often used alongside other important documents that help clarify intentions and ensure a smooth transfer of assets. Below are some commonly associated documents.

- Last Will and Testament: This legal document outlines how a person's assets should be distributed after their death. It can include various bequests and appoint an executor to manage the estate.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to specify who will receive the assets upon the account holder's death. They take precedence over wills in many cases.

- Tractor Bill of Sale: This essential document records the ownership transfer of a tractor in Georgia, providing important details about the buyer, seller, and tractor, and can be accessed at georgiapdf.com/tractor-bill-of-sale/.

- Power of Attorney: This document allows an individual to designate someone else to make financial or legal decisions on their behalf while they are alive. It can be particularly useful if the property owner becomes incapacitated.

- Property Deed: This is the legal document that proves ownership of real estate. It may need to be updated or referenced when executing a Transfer-on-Death Deed to ensure clarity of ownership.

Understanding these documents can help individuals navigate the complexities of estate planning. Each serves a unique purpose, and together they create a comprehensive plan for asset distribution and management.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed (TOD) can be confusing. Many people hold misconceptions about its purpose and functionality. Here are six common misunderstandings:

-

It is the same as a will.

While both a TOD deed and a will deal with the transfer of property after death, they operate differently. A TOD deed allows for the direct transfer of property without going through probate, whereas a will must go through the probate process, which can be lengthy and costly.

-

It can be used for any type of property.

Not all properties are eligible for a TOD deed. Typically, this deed is used for real estate. Other types of property, such as personal belongings or bank accounts, cannot be transferred using a TOD deed.

-

Once signed, it cannot be changed.

This is not true. A TOD deed can be revoked or modified at any time before the owner passes away. This flexibility allows individuals to adjust their estate plans as needed.

-

It automatically transfers property upon death.

While the TOD deed does facilitate the transfer of property after death, it only takes effect when the owner passes away. Until that time, the owner retains full control over the property.

-

It eliminates the need for an executor.

Even with a TOD deed, an executor may still be necessary for managing other aspects of the estate. The TOD deed specifically addresses the transfer of the designated property but does not replace the need for an executor to handle other estate matters.

-

It is only for married couples.

Anyone can utilize a TOD deed, regardless of marital status. This tool is available to individuals, couples, or even co-owners who wish to designate a beneficiary for their property.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning in Pennsylvania.