Blank Power of Attorney Form

The Power of Attorney form is a vital legal document that allows one person, known as the principal, to grant authority to another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This form can be tailored to fit various needs, whether for financial matters, medical decisions, or general affairs. A Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be limited to specific tasks and timeframes. Additionally, the form must be signed and often notarized to ensure its validity. Understanding the implications of this document is crucial, as it empowers the agent to act in the principal's best interests, making it essential for individuals to choose someone they trust. The Power of Attorney form serves as a safeguard, providing peace of mind for both the principal and their loved ones, especially in times of uncertainty or crisis.

State-specific Guidelines for Power of Attorney Forms

Power of Attorney Document Categories

Other Templates:

Transfer on Death Deed California - Beneficiaries receive the property outright with no additional conditions.

To facilitate ownership transfers effectively, it’s crucial to utilize a proper legal document. Consider using a thorough "Arkansas bill of sale template" to ensure every detail is accurately recorded and the transaction is secure. For more information, you can explore the available options by accessing our Bill of Sale resource.

What Is a P45 in the Uk - The P45 is critical for those applying for Jobseeker's Allowance after leaving a job.

Similar forms

Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Power of Attorney, it allows a person to express their desires about health care decisions, but it specifically focuses on end-of-life care rather than appointing someone to make decisions on their behalf.

- ADP Pay Stub: The Top Document Templates provide templates that help employees understand their earnings and deductions in a clear format.

Health Care Proxy: A health care proxy is a document that designates a person to make medical decisions for someone else if they are unable to do so. This is similar to a Power of Attorney in that it grants authority to another individual, but it is specifically limited to health care matters.

Financial Power of Attorney: A financial power of attorney is a specific type of Power of Attorney that grants someone the authority to manage financial matters. While both documents allow for delegation of authority, a financial Power of Attorney focuses solely on financial decisions, whereas a general Power of Attorney can encompass a broader range of responsibilities.

Trust Document: A trust document establishes a legal entity that holds assets for the benefit of specific individuals. Similar to a Power of Attorney, it allows for the management of assets, but it does so in a way that can provide benefits over a longer term and often involves more complex arrangements regarding the distribution of those assets.

Document Example

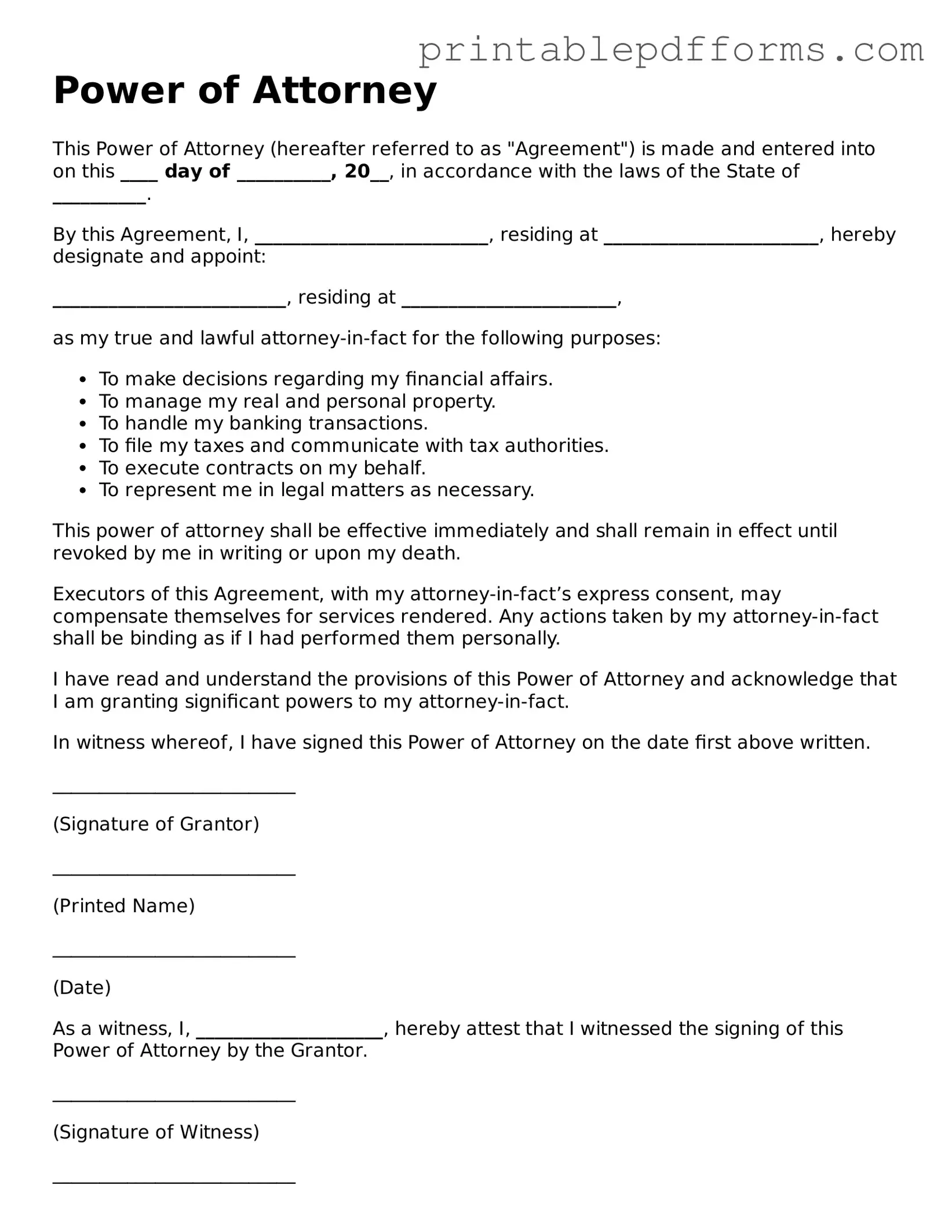

Power of Attorney

This Power of Attorney (hereafter referred to as "Agreement") is made and entered into on this ____ day of __________, 20__, in accordance with the laws of the State of __________.

By this Agreement, I, _________________________, residing at _______________________, hereby designate and appoint:

_________________________, residing at _______________________,

as my true and lawful attorney-in-fact for the following purposes:

- To make decisions regarding my financial affairs.

- To manage my real and personal property.

- To handle my banking transactions.

- To file my taxes and communicate with tax authorities.

- To execute contracts on my behalf.

- To represent me in legal matters as necessary.

This power of attorney shall be effective immediately and shall remain in effect until revoked by me in writing or upon my death.

Executors of this Agreement, with my attorney-in-fact’s express consent, may compensate themselves for services rendered. Any actions taken by my attorney-in-fact shall be binding as if I had performed them personally.

I have read and understand the provisions of this Power of Attorney and acknowledge that I am granting significant powers to my attorney-in-fact.

In witness whereof, I have signed this Power of Attorney on the date first above written.

__________________________

(Signature of Grantor)

__________________________

(Printed Name)

__________________________

(Date)

As a witness, I, ____________________, hereby attest that I witnessed the signing of this Power of Attorney by the Grantor.

__________________________

(Signature of Witness)

__________________________

(Printed Name)

__________________________

(Date)

Note: This document may require notarization under state law.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types of POA | There are different types of POA, including durable, non-durable, and springing POA, each serving different purposes. |

| State-Specific Forms | Each state has its own requirements and forms for POA, governed by state laws such as the Uniform Power of Attorney Act. |

| Durability | A durable POA remains in effect even if the principal becomes incapacitated, while a non-durable POA does not. |

| Agent's Authority | The agent's powers can be broad or limited, depending on how the POA is drafted. |

| Revocation | The principal can revoke a POA at any time, as long as they are mentally competent to do so. |

Crucial Questions on This Form

What is a Power of Attorney?

A Power of Attorney (POA) is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, known as the principal. This arrangement can cover a wide range of decisions, including financial, medical, and legal matters. The principal grants authority to the agent to make decisions and take actions as specified in the document.

Why would someone need a Power of Attorney?

Individuals often choose to create a Power of Attorney for various reasons, such as:

- Planning for incapacity due to illness or injury.

- Managing financial affairs when unable to do so personally.

- Facilitating real estate transactions or business dealings.

- Making healthcare decisions when the principal is unable to communicate.

What types of Power of Attorney are available?

There are several types of Power of Attorney, including:

- General Power of Attorney: Grants broad powers to the agent to act on behalf of the principal in various matters.

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

- Medical Power of Attorney: Specifically allows the agent to make healthcare decisions for the principal.

- Limited Power of Attorney: Restricts the agent's authority to specific tasks or time periods.

How do I create a Power of Attorney?

Creating a Power of Attorney typically involves the following steps:

- Determine the type of POA that fits your needs.

- Choose a trustworthy agent to act on your behalf.

- Draft the document, ensuring it includes all necessary details and powers.

- Sign the document in accordance with state laws, which may require witnesses or notarization.

Can I revoke a Power of Attorney?

Yes, a Power of Attorney can be revoked at any time, as long as the principal is mentally competent. To revoke, the principal should create a written revocation document and notify the agent and any relevant institutions or individuals. It is advisable to keep a copy of the revocation for personal records.

What happens if I don’t have a Power of Attorney?

Without a Power of Attorney, if an individual becomes incapacitated, family members may need to go through a court process to obtain guardianship or conservatorship. This process can be lengthy, costly, and may not reflect the individual’s wishes regarding who should make decisions on their behalf.

Are there any risks associated with granting Power of Attorney?

Yes, granting Power of Attorney carries certain risks. The principal must choose an agent who is trustworthy, as the agent will have significant control over the principal’s affairs. Misuse of authority can lead to financial loss or other negative outcomes. It is crucial to understand the powers being granted and to establish clear limitations if necessary.

Can a Power of Attorney be used after the principal's death?

No, a Power of Attorney is terminated upon the principal’s death. After death, the management of the deceased’s estate typically falls under the jurisdiction of the executor named in the will or a court-appointed administrator if there is no will.

Is a Power of Attorney valid in all states?

While a Power of Attorney is generally recognized across the United States, the specific requirements and laws governing POAs can vary by state. It is essential to ensure that the document complies with the laws of the state where it will be used. Consulting with a legal professional can help ensure compliance and effectiveness.

Documents used along the form

A Power of Attorney (POA) form allows one person to act on behalf of another in legal or financial matters. When creating or using a POA, you may also need other documents to ensure comprehensive management of affairs. Here are five common forms that often accompany a Power of Attorney.

- Living Will: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It specifies what life-sustaining measures you do or do not want.

- Health Care Proxy: A health care proxy designates someone to make medical decisions on your behalf if you are unable to do so. This person will ensure your health care preferences are honored.

- Articles of Incorporation: This crucial document is necessary for those starting a corporation in California and can be completed using the Business Registration Form, helping to streamline the incorporation process.

- Durable Power of Attorney: Similar to a standard POA, this document remains effective even if you become incapacitated. It allows your agent to manage your financial affairs without interruption.

- Will: A will is a legal document that outlines how you want your assets distributed after your death. It can also name guardians for minor children and specify your funeral wishes.

- Trust Agreement: This document establishes a trust to manage your assets during your lifetime and after your death. It can help avoid probate and provide specific instructions for asset distribution.

These documents work together with a Power of Attorney to provide a clear framework for managing your affairs, both during your lifetime and after. It's important to consider your specific needs and consult with a legal professional to ensure everything is in order.

Misconceptions

Understanding the Power of Attorney (POA) form is crucial for anyone considering this legal document. However, several misconceptions often cloud the understanding of its purpose and function. Here are six common misconceptions:

- 1. A Power of Attorney gives someone complete control over your life. Many people believe that granting a POA means handing over all decision-making power. In reality, you can specify which powers you want to grant, whether it’s for financial matters, healthcare decisions, or both.

- 2. A Power of Attorney is only for the elderly or those who are ill. This misconception limits the use of POAs. Anyone can benefit from a POA, especially if they travel frequently or want to ensure someone can make decisions on their behalf in case of an emergency.

- 3. A Power of Attorney is permanent and cannot be revoked. A POA can be revoked at any time as long as the principal is mentally competent. You have the right to change your mind and cancel the document whenever you wish.

- 4. All Power of Attorney forms are the same. Not all POA forms are created equal. Different states have varying laws, and the specific powers granted can differ significantly. It’s essential to use a form that complies with your state’s regulations.

- 5. A Power of Attorney can make medical decisions only when you are incapacitated. This is not entirely accurate. A medical POA can be effective immediately or only when you become incapacitated, depending on how it is drafted. It’s important to clarify this when creating the document.

- 6. Once a Power of Attorney is in place, you no longer have control over your affairs. This is a common fear. However, as the principal, you retain the right to manage your affairs as long as you are capable. The agent acts on your behalf only when you choose or when specified in the document.

Clearing up these misconceptions can empower individuals to make informed decisions regarding their legal affairs. Understanding the nuances of a Power of Attorney can lead to better planning and peace of mind.