Fill a Valid Profit And Loss Form

The Profit and Loss form, often referred to as the P&L statement, serves as a crucial tool for individuals and businesses alike in understanding their financial performance over a specific period. This document provides a comprehensive overview of revenues, costs, and expenses, ultimately revealing the net profit or loss incurred. By detailing income sources and categorizing expenditures, the form allows users to assess their financial health and make informed decisions. Essential components include total revenue, cost of goods sold, gross profit, operating expenses, and net income. A well-prepared Profit and Loss form not only aids in tracking financial progress but also supports strategic planning and budgeting efforts. Understanding this form can empower stakeholders to identify trends, manage resources effectively, and enhance overall financial literacy.

Additional PDF Templates

Free Printable Puppy Health Guarantee Template - All vaccinations will be documented and provided to the buyer upon pickup.

The New York ATV Bill of Sale form is an essential document that records the sale and transfer of ownership of an all-terrain vehicle (ATV). This form provides vital information about the buyer, seller, and the ATV being sold, ensuring a smooth transaction and legal protection for both parties. If you are ready to complete your ATV sale, please fill out the ATV Bill of Sale form by clicking the button below.

Employee Advance Agreement - Submit a request for an advance on already earned pay.

Similar forms

- Income Statement: This document summarizes revenues and expenses over a specific period, much like the Profit and Loss form. Both provide insights into a company's financial performance.

- Balance Sheet: While the Profit and Loss form focuses on income and expenses, the Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific point in time. Together, they offer a complete view of financial health.

Mobile Home Bill of Sale: To facilitate the transfer of ownership, refer to our comprehensive Mobile Home Bill of Sale resources for accurate documentation and legal protection.

- Cash Flow Statement: This document tracks the flow of cash in and out of a business, similar to how the Profit and Loss form tracks income and expenses. Both are crucial for understanding liquidity.

- Statement of Retained Earnings: This statement outlines changes in retained earnings over a period, connecting net income from the Profit and Loss form to equity on the Balance Sheet.

- Trial Balance: This report lists all account balances at a given time, ensuring that total debits equal total credits. It supports the accuracy of the Profit and Loss form by verifying underlying account data.

- Budget Report: A Budget Report compares projected revenues and expenses against actual figures. Like the Profit and Loss form, it assesses financial performance but focuses on future planning.

- Sales Report: This document details sales revenue over a period, similar to the revenue section of the Profit and Loss form. Both help evaluate business performance and sales trends.

- Expense Report: An Expense Report itemizes business expenses incurred during a specific period. It aligns with the expense section of the Profit and Loss form, providing detailed insights into spending.

- Financial Summary Report: This report provides an overview of financial performance, including key metrics from the Profit and Loss form. It distills complex data into easily digestible information for stakeholders.

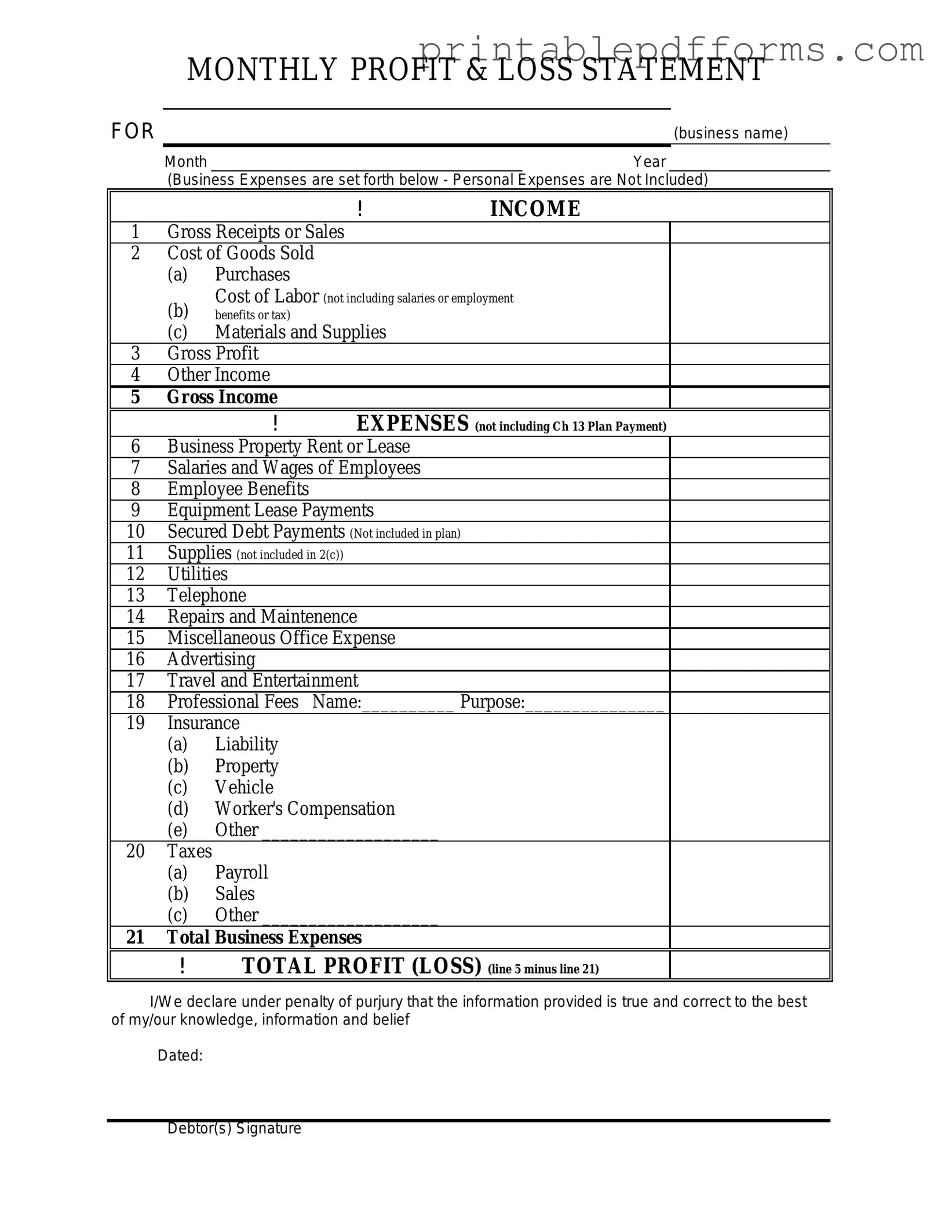

Document Example

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form summarizes a business's revenues and expenses over a specific period, helping to assess financial performance. |

| Components | This form typically includes sections for total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Businesses often prepare this form monthly, quarterly, or annually, depending on their reporting needs. |

| Tax Implications | The information on the Profit and Loss form is crucial for tax reporting, as it affects taxable income. |

| State-Specific Forms | Some states require specific Profit and Loss forms, governed by local tax laws, such as California's Revenue and Taxation Code. |

| Comparative Analysis | Businesses can use the Profit and Loss form to compare financial performance over different periods, aiding in trend analysis. |

| Stakeholder Use | Investors, lenders, and management rely on this form to make informed decisions about the business's financial health. |

Crucial Questions on This Form

- It provides insights into revenue and expenses.

- It helps identify trends over time.

- It is essential for tax preparation.

- Investors and lenders often require it to assess financial health.

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs related to running the business, such as rent and salaries.

- Net Profit: The final profit after all expenses have been deducted from revenue.

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes a company's revenues, costs, and expenses over a specific period. This form helps businesses understand their financial performance and profitability.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

How often should I prepare a Profit and Loss form?

Businesses typically prepare a Profit and Loss form on a monthly, quarterly, or annual basis. The frequency depends on the size of the business and its reporting requirements. Regular updates can help in making informed financial decisions.

What sections are included in a Profit and Loss form?

A standard Profit and Loss form includes the following sections:

Can I use a Profit and Loss form for tax purposes?

Yes, the Profit and Loss form is essential for tax purposes. It provides a clear picture of your business's income and expenses, which is necessary for accurately reporting taxable income. Always ensure that the information is accurate and up-to-date.

How do I interpret the results of my Profit and Loss form?

Interpreting the results involves analyzing key figures such as gross profit, operating profit, and net profit. A positive net profit indicates that your business is making money, while a negative figure suggests a loss. Comparing these figures to previous periods can reveal trends and help in strategic planning.

What if my Profit and Loss form shows a loss?

A loss on your Profit and Loss form can be concerning, but it is essential to investigate the reasons behind it. Look for areas where costs can be reduced or revenue can be increased. Consulting with a financial advisor may also provide valuable insights and strategies for improvement.

Is there software available to help me create a Profit and Loss form?

Yes, many accounting software options can help you create and manage your Profit and Loss form. Popular choices include QuickBooks, Xero, and FreshBooks. These tools often automate data entry and provide templates, making the process easier and more efficient.

How do I ensure accuracy in my Profit and Loss form?

To ensure accuracy, regularly update your financial records and reconcile them with bank statements. Double-check all entries for errors and discrepancies. It may also be beneficial to have a professional accountant review your P&L statement periodically.

Can a Profit and Loss form help with budgeting?

Absolutely. A Profit and Loss form provides historical data that can inform your budgeting process. By analyzing past revenues and expenses, you can make more accurate projections for future financial planning. This can lead to more effective resource allocation and strategic decision-making.

Documents used along the form

The Profit and Loss form is a crucial document for businesses, providing an overview of income and expenses over a specific period. However, several other forms and documents complement this financial statement, offering a more comprehensive view of a company’s financial health. Here are four important documents often used alongside the Profit and Loss form.

- Balance Sheet: This document summarizes a company’s assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the business owns and owes, providing a snapshot of its financial stability.

- Residential Lease Agreement: This legal document outlines the terms and conditions between a landlord and a tenant for the rental of residential property, ensuring both parties' rights and responsibilities are clearly defined. For more information, refer to All Ohio Forms.

- Cash Flow Statement: This statement details the cash inflows and outflows from operating, investing, and financing activities during a particular period. It highlights how well a company manages its cash, ensuring it can meet its obligations and invest in growth.

- Statement of Retained Earnings: This document outlines the changes in retained earnings over a specific period. It shows how much profit has been reinvested in the business versus distributed to shareholders, offering insights into a company's growth strategy.

- Tax Returns: These forms are filed with the IRS and provide a summary of income, expenses, and tax liabilities for a given year. Tax returns are essential for compliance and can also be used to assess a company’s financial performance over time.

These documents, when reviewed together, provide a clearer picture of a business's financial situation. Understanding each of these forms can help business owners, investors, and stakeholders make informed decisions about the company’s future.

Misconceptions

Understanding the Profit and Loss (P&L) form is crucial for anyone involved in business finances. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the P&L form:

- The P&L form only shows revenue. Many believe that the P&L form only highlights income. In reality, it also details expenses, providing a complete picture of profitability.

- All expenses are deductible. Some think that every expense listed on the P&L can be deducted from taxes. However, only certain business-related expenses qualify for deductions under tax laws.

- The P&L form reflects cash flow. People often confuse the P&L with cash flow statements. The P&L shows profitability over a period, while cash flow statements track actual cash movement.

- Only large businesses need a P&L form. It’s a common belief that only big companies require a P&L. In truth, any business, regardless of size, benefits from tracking profits and losses.

- The P&L form is static. Some assume the P&L remains unchanged once completed. In fact, it can be updated regularly to reflect new data and better inform business decisions.

- Profit equals cash in hand. Many think that profit shown on the P&L means cash available. Profit is an accounting measure, while cash flow can differ based on various factors.

- The P&L is only for internal use. Some believe that the P&L is only for internal stakeholders. However, it can also be important for investors and lenders who want to assess a company’s financial health.

- Understanding the P&L is unnecessary for non-financial roles. It’s a misconception that only finance professionals need to understand the P&L. In fact, having a grasp of it can benefit anyone involved in business operations.

Being aware of these misconceptions can help individuals and businesses make better financial decisions and improve overall understanding of their financial health.