Blank Promissory Note Form

When engaging in financial transactions, clarity and security are paramount, and a Promissory Note serves as a vital tool in achieving both. This straightforward yet powerful document outlines the terms of a loan between a borrower and a lender, ensuring that both parties understand their rights and obligations. Typically, it includes essential details such as the principal amount, interest rate, repayment schedule, and any penalties for late payments. The Promissory Note not only acts as a written promise to repay the borrowed sum but also provides legal protection should disputes arise. In addition, it may specify whether the loan is secured or unsecured, which can significantly impact the lender's recourse in the event of default. Understanding the intricacies of this form can empower individuals and businesses alike to navigate their financial commitments with confidence and transparency.

State-specific Guidelines for Promissory Note Forms

Promissory Note Document Categories

Other Templates:

Letter of Intent Template Free - A Letter of Intent can serve to prioritize the interests of each party involved.

Change of Rater Ncoer - Leadership capabilities are evaluated based on trust and influence.

The Ohio Payoff Form is crucial for facilitating clear communication between realtors, title companies, and the State when it comes to addressing certified debts and liens. Ensuring that the necessary consent is obtained is key to releasing important financial information, thereby expediting the payoff process. For additional resources and forms related to this process, you can visit All Ohio Forms, which offer comprehensive support for handling these essential transactions efficiently.

Bill Lading - A complete and accurate form enhances trust between shippers and carriers.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms under which money is borrowed. It specifies the amount, interest rate, repayment schedule, and consequences for default. Both documents serve to formalize the borrowing arrangement, ensuring clarity for both parties.

- Real Estate Purchase Agreement: This vital document outlines the terms and conditions for property sales in Texas, ensuring the interests of both parties are protected. Detailed understanding of the agreement’s components aids in a seamless transaction process. For more information, visit freebusinessforms.org/.

- Mortgage: A mortgage is a specific type of loan secured by real property. Similar to a promissory note, it includes terms for repayment and consequences for non-payment. However, a mortgage also involves the property itself as collateral, providing additional security for the lender.

- Credit Agreement: This document details the terms of a line of credit or credit card. It shares similarities with a promissory note in that it outlines the borrowing limit, interest rates, and repayment terms. Both documents establish a legal framework for the lender-borrower relationship.

- Installment Agreement: An installment agreement allows for the repayment of a debt in scheduled payments over time. Like a promissory note, it specifies the total amount owed, payment amounts, and due dates. Both documents aim to provide a clear understanding of the repayment process.

- Secured Note: A secured note is similar to a promissory note but includes collateral to back the loan. It details the terms of repayment and specifies what asset secures the loan. This added layer of security for the lender mirrors the fundamental purpose of a promissory note.

Document Example

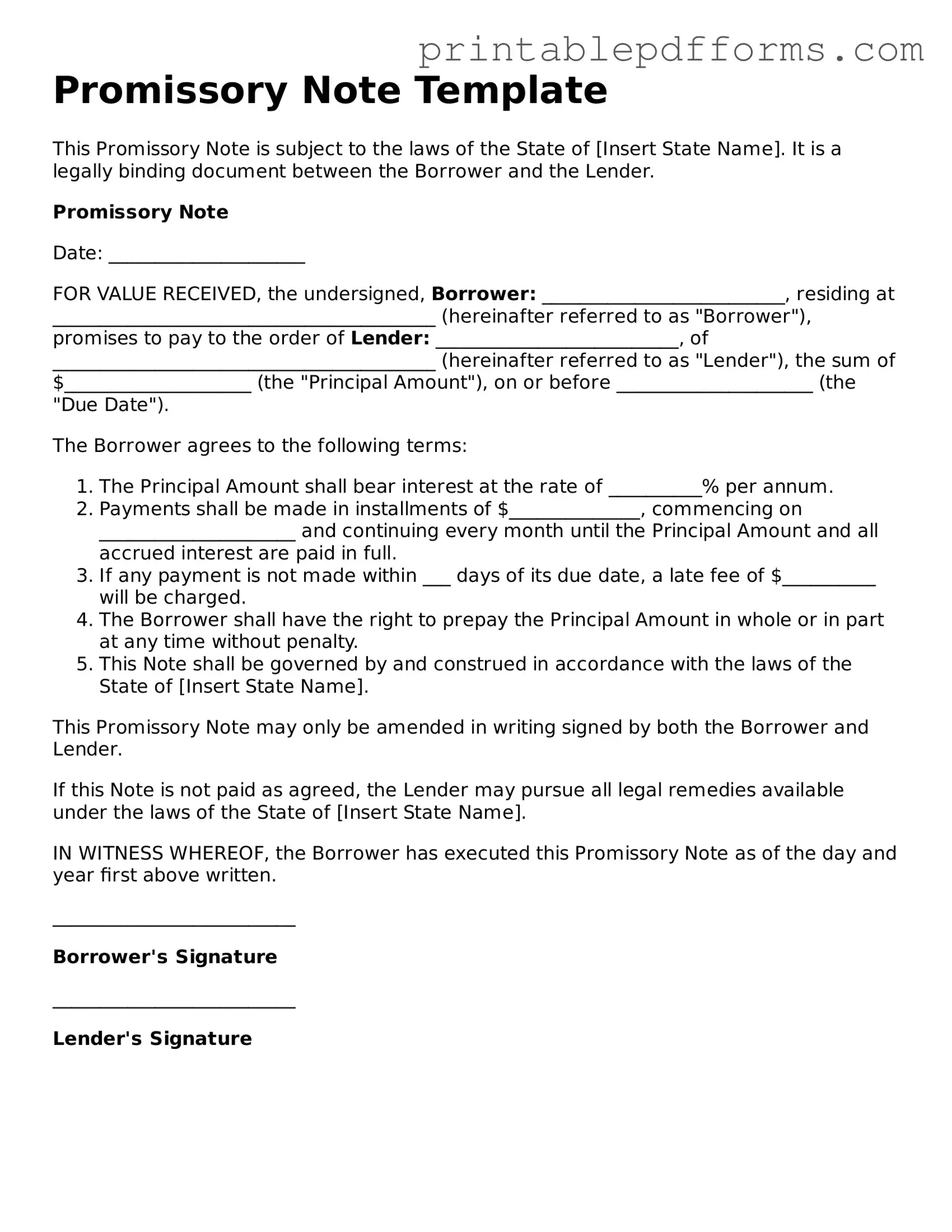

Promissory Note Template

This Promissory Note is subject to the laws of the State of [Insert State Name]. It is a legally binding document between the Borrower and the Lender.

Promissory Note

Date: _____________________

FOR VALUE RECEIVED, the undersigned, Borrower: __________________________, residing at _________________________________________ (hereinafter referred to as "Borrower"), promises to pay to the order of Lender: __________________________, of _________________________________________ (hereinafter referred to as "Lender"), the sum of $____________________ (the "Principal Amount"), on or before _____________________ (the "Due Date").

The Borrower agrees to the following terms:

- The Principal Amount shall bear interest at the rate of __________% per annum.

- Payments shall be made in installments of $______________, commencing on _____________________ and continuing every month until the Principal Amount and all accrued interest are paid in full.

- If any payment is not made within ___ days of its due date, a late fee of $__________ will be charged.

- The Borrower shall have the right to prepay the Principal Amount in whole or in part at any time without penalty.

- This Note shall be governed by and construed in accordance with the laws of the State of [Insert State Name].

This Promissory Note may only be amended in writing signed by both the Borrower and Lender.

If this Note is not paid as agreed, the Lender may pursue all legal remedies available under the laws of the State of [Insert State Name].

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

__________________________

Borrower's Signature

__________________________

Lender's Signature

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Key Components | It typically includes the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| Governing Laws | Each state has its own laws governing promissory notes, often found in the Uniform Commercial Code (UCC). |

| Enforceability | For a promissory note to be enforceable, it must be clear, unambiguous, and signed by the borrower. |

Crucial Questions on This Form

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a particular time or on demand. It serves as a legal document that outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any other conditions that may apply. By signing this document, the borrower acknowledges their obligation to repay the loan as agreed.

Who typically uses a Promissory Note?

Promissory notes are commonly used in various situations, including:

- Personal loans between friends or family members.

- Business loans where one entity lends money to another.

- Real estate transactions, often used in seller financing.

- Student loans and other educational financing.

In each of these scenarios, a promissory note helps clarify the terms of the loan and provides a legal framework for repayment.

What are the essential components of a Promissory Note?

A well-drafted promissory note should include the following key elements:

- Borrower and Lender Information: Names and contact details of both parties.

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, if applicable.

- Repayment Terms: A detailed schedule outlining how and when payments will be made.

- Default Terms: Conditions that would constitute a default and the consequences of such an event.

- Signatures: Both parties must sign the document to make it legally binding.

Including these components ensures clarity and protects the rights of both the borrower and the lender.

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document, provided it meets certain criteria. For it to be enforceable, the note must clearly outline the terms of the loan and be signed by both parties. If a borrower fails to repay as agreed, the lender has the right to take legal action to recover the owed amount. However, it is essential to ensure that the note complies with applicable laws to maintain its enforceability.

Can a Promissory Note be modified after it is signed?

Yes, a promissory note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This ensures that the new terms are clear and legally binding. Open communication between the borrower and lender is crucial when discussing any changes to the original agreement.

Documents used along the form

A Promissory Note is an important document used to outline the terms of a loan. When creating or managing a loan agreement, several other forms and documents may also be necessary. Each of these documents serves a specific purpose and helps ensure clarity and protection for all parties involved.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any conditions that must be met. It acts as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security. It outlines the lender's rights in case of default and provides assurance to the lender.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and other costs. It ensures that borrowers understand their financial obligations before agreeing to the loan.

- Guaranty Agreement: In some cases, a third party may agree to take responsibility for the loan if the borrower defaults. This document outlines the guarantor's obligations and provides additional security for the lender.

- Articles of Incorporation: This document is essential for establishing a corporation in New York, outlining crucial details such as the corporation's name, purpose, and structure. For further information, you can refer to nypdfforms.com/articles-of-incorporation-form/.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components. It helps borrowers understand how their payments affect the loan balance over time.

Understanding these documents can help both lenders and borrowers navigate the loan process with confidence. Each form plays a vital role in ensuring that all parties are informed and protected throughout the duration of the loan agreement.

Misconceptions

When it comes to promissory notes, many people hold misconceptions that can lead to confusion. Here are five common misunderstandings about this important financial document:

- Promissory notes are only for large loans. Many believe that these documents are only necessary for substantial amounts of money. In reality, promissory notes can be used for any amount, big or small. They serve as a clear record of the agreement between the lender and borrower, regardless of the loan size.

- Promissory notes are the same as contracts. While both documents are legally binding, they serve different purposes. A promissory note specifically outlines the promise to repay a loan, while a contract may cover a broader range of agreements and terms.

- Once signed, a promissory note cannot be changed. This is not true. Although a promissory note is a binding agreement, the parties involved can agree to modify its terms. However, any changes should be documented in writing and signed by both parties to avoid future disputes.

- Only banks can issue promissory notes. This is a common myth. Individuals can create and issue promissory notes as well. Friends, family members, or private lenders can all use this document to formalize a loan agreement.

- Promissory notes do not require interest. While it is possible to create a promissory note without interest, many loans do involve interest rates. The terms of the note should clearly state whether interest will be charged and, if so, how it will be calculated.

Understanding these misconceptions can help you navigate the world of promissory notes more effectively. Whether you are lending money or borrowing, being informed is key to a successful agreement.