Blank Promissory Note for a Car Form

When purchasing a vehicle, many individuals find themselves in need of financing, which often leads to the creation of a promissory note for the car. This important document serves as a written promise to repay a specified amount of money over a defined period. It outlines key details, such as the total loan amount, interest rate, repayment schedule, and any applicable penalties for late payments. By clearly stating the obligations of both the borrower and the lender, the promissory note helps to establish a mutual understanding and protects the rights of both parties involved in the transaction. Additionally, it may include provisions for collateral, ensuring that the vehicle itself secures the loan. Understanding the components of this form is essential for anyone looking to finance a car, as it not only formalizes the agreement but also serves as a critical reference throughout the repayment process.

Popular Promissory Note for a Car Documents:

Release and Satisfaction of Promissory Note - This release serves as an important record for tax considerations as well.

For those looking to create a loan agreement, utilizing a New Jersey Promissory Note form can be essential. This legally binding document not only lays out the terms of the repayment but also helps protect the interests of both parties involved. Understanding the importance of this form is crucial for effective financial planning in New Jersey, and you can find resources for creating such documents at All New Jersey Forms.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing money. It details the amount borrowed, interest rates, repayment schedule, and the consequences of default.

- Lease Agreement: While a lease agreement typically pertains to renting property, it shares similarities with a promissory note in that it establishes a payment structure and outlines responsibilities for both parties involved.

- Installment Agreement: This document allows a borrower to repay a debt in smaller, manageable payments over time. Like a promissory note, it specifies the total amount owed and the repayment terms.

- Security Agreement: A security agreement often accompanies a promissory note when collateral is involved. It outlines the rights of the lender over the collateral in case of default, similar to how a promissory note secures the loan.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. It resembles a promissory note in that it holds someone accountable for the debt.

- Promissory Note: The foundation of borrowing in North Carolina, a Promissory Note serves not only as a promise to repay but also formally records the agreement between lender and borrower, and can be easily accessed through North Carolina PDF Forms for convenience.

- Mortgage Note: A mortgage note is a specific type of promissory note used in real estate transactions. It includes the borrower's promise to repay the loan and details about the property used as collateral.

- Debt Acknowledgment: This document serves as a formal recognition of a debt owed. It can be similar to a promissory note in that it confirms the amount due and the agreement between the parties regarding repayment.

Document Example

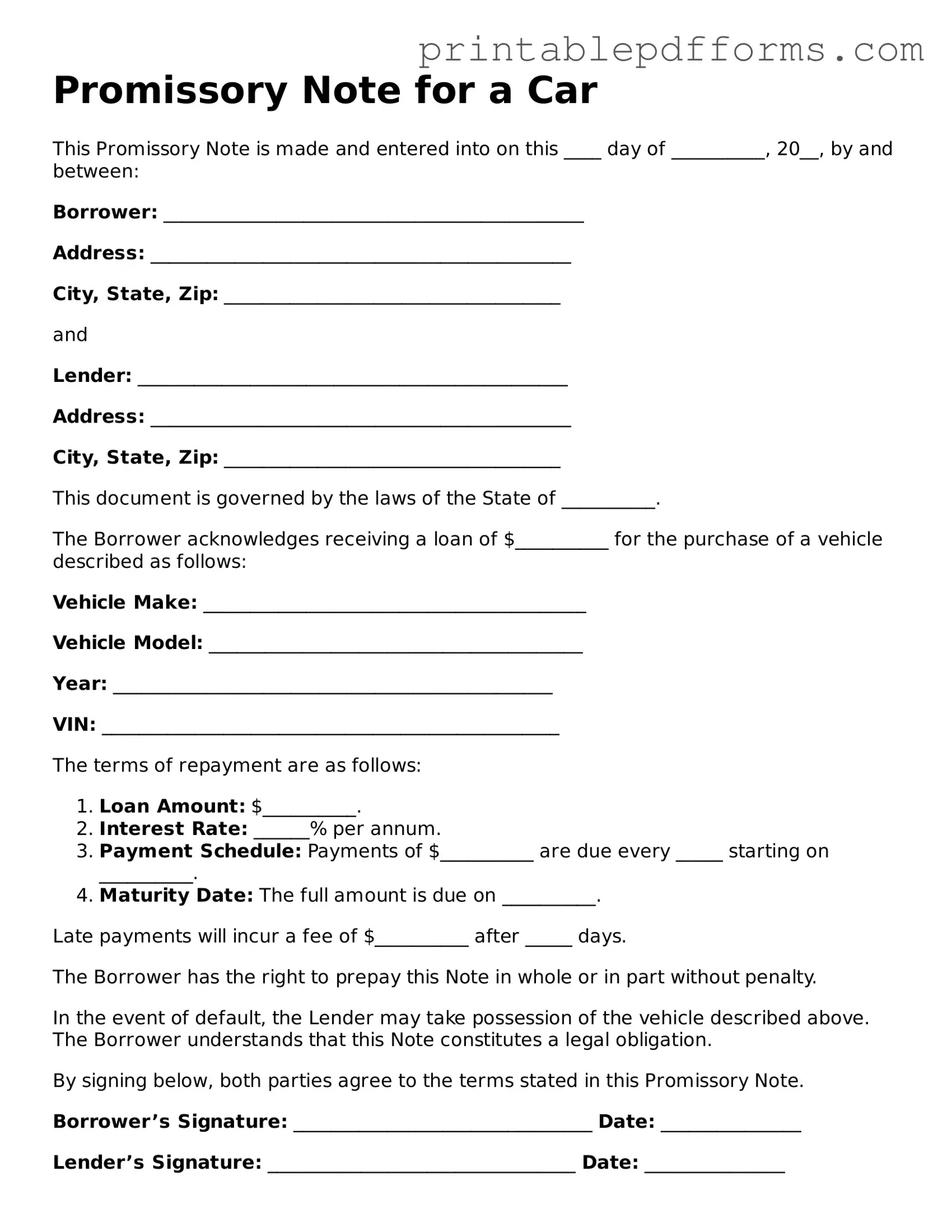

Promissory Note for a Car

This Promissory Note is made and entered into on this ____ day of __________, 20__, by and between:

Borrower: _____________________________________________

Address: _____________________________________________

City, State, Zip: ____________________________________

and

Lender: ______________________________________________

Address: _____________________________________________

City, State, Zip: ____________________________________

This document is governed by the laws of the State of __________.

The Borrower acknowledges receiving a loan of $__________ for the purchase of a vehicle described as follows:

Vehicle Make: _________________________________________

Vehicle Model: ________________________________________

Year: _______________________________________________

VIN: _________________________________________________

The terms of repayment are as follows:

- Loan Amount: $__________.

- Interest Rate: ______% per annum.

- Payment Schedule: Payments of $__________ are due every _____ starting on __________.

- Maturity Date: The full amount is due on __________.

Late payments will incur a fee of $__________ after _____ days.

The Borrower has the right to prepay this Note in whole or in part without penalty.

In the event of default, the Lender may take possession of the vehicle described above. The Borrower understands that this Note constitutes a legal obligation.

By signing below, both parties agree to the terms stated in this Promissory Note.

Borrower’s Signature: ________________________________ Date: _______________

Lender’s Signature: _________________________________ Date: _______________

This document serves as a binding agreement. Ensure you keep a copy for your records.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money to the seller or lender for the purchase of a vehicle. |

| Key Components | The note typically includes the borrower's name, the lender's name, the loan amount, interest rate, payment schedule, and terms of default. |

| Governing Law | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), which varies by state. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the borrower and include clear terms regarding repayment. |

Crucial Questions on This Form

What is a Promissory Note for a Car?

A Promissory Note for a Car is a written agreement between a borrower and a lender. It outlines the terms under which the borrower agrees to repay a loan used to purchase a vehicle. This document typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. Essentially, it serves as a legal promise to pay back the borrowed money.

Why do I need a Promissory Note for a Car?

Having a Promissory Note is important for several reasons:

- Legal Protection: It provides a clear record of the loan terms, protecting both the lender and the borrower in case of disputes.

- Clarity: It outlines the responsibilities of each party, reducing misunderstandings regarding payment expectations.

- Credit Reporting: If the loan is reported to credit bureaus, having a formal note can help build credit history for the borrower.

How do I fill out a Promissory Note for a Car?

Filling out a Promissory Note is straightforward. Follow these steps:

- Identify the Parties: Include the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly state the total amount being borrowed.

- Set the Interest Rate: Indicate the interest rate, if applicable, and whether it is fixed or variable.

- Outline the Repayment Terms: Detail the payment schedule, including due dates and the number of payments.

- Include Additional Terms: Add any other relevant information, such as late fees or prepayment options.

What happens if I miss a payment on my Promissory Note?

Missing a payment can have serious consequences. Typically, the lender may charge a late fee, and repeated missed payments can lead to more severe actions, such as:

- Damage to your credit score, which can affect future borrowing.

- Potential repossession of the vehicle if the loan is secured by the car.

- Legal action to recover the owed amount, which may lead to additional costs.

It’s always best to communicate with the lender if you anticipate any issues with making a payment. They may offer options to help you stay on track.

Documents used along the form

When financing a vehicle, several important documents accompany the Promissory Note for a Car. Each of these documents plays a crucial role in the transaction, ensuring that both the buyer and seller are protected and that all terms are clearly understood. Below is a list of commonly used forms and documents that often accompany the Promissory Note.

- Bill of Sale: This document serves as proof of the sale and includes details about the vehicle, such as make, model, year, and VIN. It also outlines the purchase price and the date of the transaction.

- Vehicle Title: The title is a legal document that indicates ownership of the vehicle. It must be transferred from the seller to the buyer during the sale.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan. It provides clarity on the financial obligations of the borrower.

- Credit Application: If financing is involved, a credit application may be required. This form gathers information about the borrower's financial history to determine eligibility for the loan.

- Insurance Verification: Proof of insurance is often required before finalizing the sale. This document confirms that the buyer has obtained insurance coverage for the vehicle.

- Promissory Note: For clarity in vehicle financing, it's important to reference the detailed Promissory Note documentation requirements to ensure all agreements are legally sound.

- Odometer Disclosure Statement: This form verifies the vehicle's mileage at the time of sale. It protects against odometer fraud and ensures transparency in the transaction.

- Financing Disclosure: This document outlines the terms of the financing, including total costs, payment schedules, and any penalties for late payments. It ensures that the borrower is fully informed about the loan terms.

- Power of Attorney: In some cases, a power of attorney may be needed to allow one party to act on behalf of another in the transaction, particularly for title transfers or loan documents.

- Warranty Document: If applicable, this document details any warranties provided with the vehicle, including coverage terms and duration, giving the buyer peace of mind regarding potential repairs.

Understanding these documents can help streamline the car buying process and ensure that all parties are well-informed. Each form serves a specific purpose, contributing to a smooth and legally sound transaction.

Misconceptions

Understanding the Promissory Note for a Car can be challenging due to common misconceptions. Here are ten prevalent myths along with clarifications.

- A Promissory Note is the same as a car title. A promissory note is a promise to pay, while a car title proves ownership.

- Only banks can issue a Promissory Note. Individuals can create a promissory note for personal loans, not just banks or financial institutions.

- A Promissory Note must be notarized. While notarization adds validity, it is not a legal requirement for all promissory notes.

- Once signed, a Promissory Note cannot be changed. Modifications can be made if both parties agree, but they should be documented properly.

- A Promissory Note guarantees loan approval. Signing a note does not guarantee that a lender will approve the loan.

- Interest rates on a Promissory Note are fixed. Interest rates can be negotiable and may vary based on the agreement between the parties.

- Defaulting on a Promissory Note has no consequences. Defaulting can lead to legal action, including collection efforts and potential loss of the vehicle.

- Promissory Notes are only for large loans. They can be used for any amount, big or small, depending on the agreement.

- A Promissory Note is unnecessary if there’s a verbal agreement. Written documentation is crucial for clarity and legal protection.

- Once the loan is paid off, the Promissory Note is irrelevant. It is important to keep the note until all obligations are fulfilled and the debt is formally released.

These misconceptions can lead to confusion. Understanding the true nature of a Promissory Note is essential for both borrowers and lenders.