Blank Quitclaim Deed Form

A Quitclaim Deed is an essential legal document that facilitates the transfer of property rights from one party to another. This form is particularly useful when individuals wish to relinquish their interest in real estate without making any guarantees about the title's validity. It is commonly employed in various situations, such as transferring property between family members, settling divorce agreements, or clearing up title issues. Unlike other types of deeds, a Quitclaim Deed does not provide warranties or assurances regarding the property’s ownership status. This lack of warranty means that the recipient receives only the interest that the grantor possesses at the time of transfer. Understanding the Quitclaim Deed's purpose, benefits, and limitations is crucial for anyone involved in real estate transactions, as it can significantly impact property rights and future ownership claims.

State-specific Guidelines for Quitclaim Deed Forms

Popular Quitclaim Deed Documents:

Transfer on Death Deed California - It provides a straightforward way to convey property without a will.

Corrective Deed California - It solidifies the rightful ownership, aiding in future transactions.

To navigate the complexities of debt resolution in property transactions, understanding the Ohio Payoff Form is essential. This crucial document, managed by the Collections Enforcement Section under the Attorney General of Ohio, facilitates realtors and title companies in obtaining necessary payoff information regarding debts owed to the state. With the requirement of consent from involved parties for information release, it ensures transparency and efficiency in clearing certified debts and liens. For more information and resources, you can visit All Ohio Forms, which further assist in this important process.

Lady Bird Deed Michigan Form - It provides peace of mind for property owners regarding their legacy.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and provides protection against future claims. Unlike a quitclaim deed, it offers more security to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property ownership and includes assurances that the property is free from liens. However, it does not provide the same level of protection as a warranty deed.

- Deed of Trust: This document secures a loan by placing a lien on the property. It involves three parties: the borrower, the lender, and a trustee, unlike a quitclaim deed, which involves only the buyer and seller.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified period in exchange for rent. While it does not transfer ownership, it establishes rights similar to those in a quitclaim deed.

- Trailer Bill of Sale: This essential document records the sale of a trailer in Georgia, ensuring proper ownership transfer; for more details, visit here.

- Bill of Sale: This document transfers ownership of personal property. While it is used for tangible items, it serves a similar purpose of transferring ownership, much like a quitclaim deed does for real estate.

- Power of Attorney: This document grants one person the authority to act on behalf of another. While not a property transfer document, it can facilitate the signing of a quitclaim deed on behalf of the property owner.

- Affidavit of Title: This document is a sworn statement confirming the seller's ownership of the property and the absence of claims against it. It complements a quitclaim deed by providing additional assurance about the title.

- Partition Deed: This document is used when co-owners of property decide to divide their interests. It formally transfers ownership of specific portions, similar to how a quitclaim deed transfers interest in the entire property.

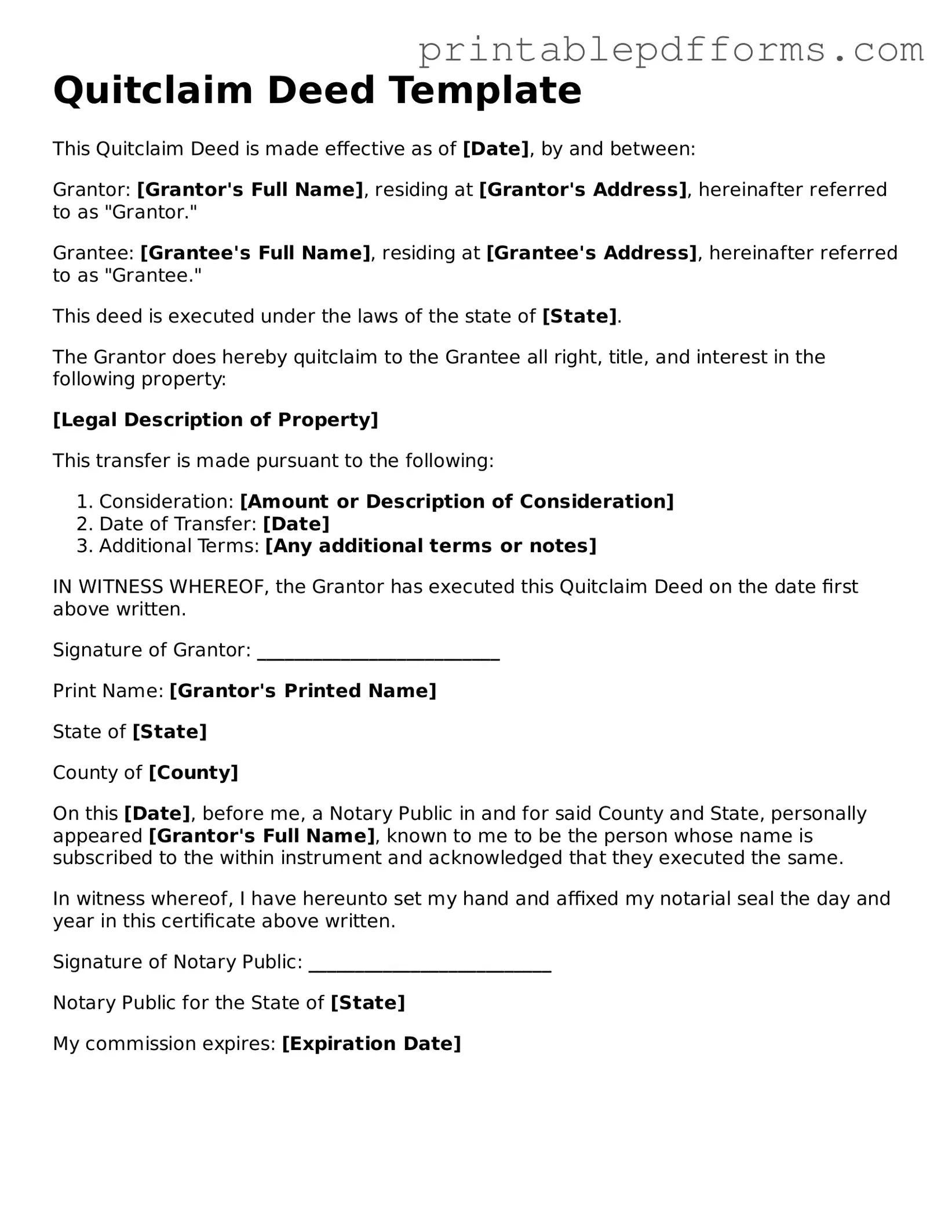

Document Example

Quitclaim Deed Template

This Quitclaim Deed is made effective as of [Date], by and between:

Grantor: [Grantor's Full Name], residing at [Grantor's Address], hereinafter referred to as "Grantor."

Grantee: [Grantee's Full Name], residing at [Grantee's Address], hereinafter referred to as "Grantee."

This deed is executed under the laws of the state of [State].

The Grantor does hereby quitclaim to the Grantee all right, title, and interest in the following property:

[Legal Description of Property]

This transfer is made pursuant to the following:

- Consideration: [Amount or Description of Consideration]

- Date of Transfer: [Date]

- Additional Terms: [Any additional terms or notes]

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

Signature of Grantor: __________________________

Print Name: [Grantor's Printed Name]

State of [State]

County of [County]

On this [Date], before me, a Notary Public in and for said County and State, personally appeared [Grantor's Full Name], known to me to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same.

In witness whereof, I have hereunto set my hand and affixed my notarial seal the day and year in this certificate above written.

Signature of Notary Public: __________________________

Notary Public for the State of [State]

My commission expires: [Expiration Date]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Usage | Commonly used in situations such as divorce settlements, property transfers between family members, or clearing up title issues. |

| Governing Law | In the United States, quitclaim deeds are governed by state law. For example, in California, the relevant law is found in the California Civil Code. |

| Liability | The grantor (the person transferring the property) does not guarantee that the title is free from claims or encumbrances. |

| Recording | It is advisable to record the quitclaim deed with the local county recorder’s office to provide public notice of the property transfer. |

Crucial Questions on This Form

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. It provides no guarantees about the property title, meaning the grantor (the person transferring the property) does not assure the grantee (the person receiving the property) that they have clear title to the property. This type of deed is often used in situations such as divorce settlements or transferring property between family members.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in various situations, including:

- Transferring property between family members.

- Clearing up title issues or disputes.

- Transferring property in divorce settlements.

- Adding or removing a spouse or partner from the title.

Consider using a Quitclaim Deed when you trust the other party and do not require a guarantee of the property's title.

What are the risks associated with a Quitclaim Deed?

The primary risk of using a Quitclaim Deed is the lack of warranties. Since the grantor does not guarantee the title, the grantee may inherit any existing liens or claims against the property. This could lead to financial liabilities if issues arise after the transfer. It is advisable to conduct a title search before accepting a Quitclaim Deed to understand any potential risks.

How do I complete a Quitclaim Deed?

To complete a Quitclaim Deed, follow these steps:

- Obtain a Quitclaim Deed form, which can be found online or at local legal offices.

- Fill in the names of the grantor and grantee, along with the property description.

- Sign the document in front of a notary public to ensure its validity.

- File the Quitclaim Deed with the appropriate local government office, usually the county recorder's office.

Ensure that all information is accurate to avoid complications in the future.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such assurances. It simply transfers whatever interest the grantor has in the property, if any.

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney to create a Quitclaim Deed, consulting with one is recommended, especially in complex situations. An attorney can help ensure that the deed is properly drafted and executed, minimizing potential disputes or legal issues in the future.

Can a Quitclaim Deed be revoked?

A Quitclaim Deed cannot be revoked once it has been executed and recorded. The transfer of ownership is considered final. However, the parties involved may enter into a new agreement or deed if they wish to reverse the transfer, but this would require a separate legal process.

What happens after I file a Quitclaim Deed?

After filing a Quitclaim Deed, the local government office will record the document, making the transfer of ownership official. The grantee should keep a copy of the recorded deed for their records. It is also advisable to update any relevant property records, such as tax assessments, to reflect the new ownership.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. While this deed serves its purpose effectively, there are several other forms and documents that often accompany it during the property transfer process. Understanding these documents can help ensure a smooth transaction.

- Property Title Search: This document verifies the current ownership and any claims or liens against the property. It helps identify any potential issues that may affect the transfer.

- Dirt Bike Bill of Sale: Essential for transferring ownership of a dirt bike, this document ensures that all details of the sale are properly recorded, providing legal protection to both the buyer and seller. For more information, you can access the Bill of Sale for a Dirt Bike.

- Title Insurance Policy: This insurance protects the buyer and lender from any future claims against the property. It ensures that the title is clear and free of disputes.

- Affidavit of Title: This sworn statement by the seller confirms that they hold clear title to the property and discloses any known issues. It provides assurance to the buyer about the property’s status.

- Bill of Sale: This document is used to transfer personal property associated with the real estate, such as appliances or fixtures. It details what is included in the sale.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including price, contingencies, and closing date. It serves as a foundation for the transaction.

- Closing Statement: This document summarizes the financial aspects of the transaction, including costs, fees, and the final amounts due. It is reviewed at the closing meeting.

- Power of Attorney: In some cases, a property owner may designate another person to act on their behalf during the transaction. This document grants that authority and is essential for remote transactions.

Each of these documents plays a critical role in the property transfer process. By understanding their purpose, parties involved can navigate the transaction with greater confidence and clarity.

Misconceptions

When it comes to real estate transactions, the quitclaim deed often stirs up confusion. Many people misunderstand its purpose and implications. Here are five common misconceptions about the quitclaim deed:

-

A quitclaim deed transfers ownership completely.

This is not entirely accurate. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property. If there are any liens or claims against the property, those may still exist.

-

Quitclaim deeds are only used in divorce cases.

While quitclaim deeds are often used to transfer property between spouses during a divorce, they are not limited to that situation. They can be used for a variety of reasons, including transferring property to family members or clearing up title issues.

-

Using a quitclaim deed is a quick way to avoid probate.

This is a misconception. While a quitclaim deed can transfer property directly to a beneficiary, it does not eliminate the need for probate in all cases. Depending on the circumstances, probate may still be necessary to settle other aspects of an estate.

-

A quitclaim deed provides the same protection as a warranty deed.

Not at all. A warranty deed offers guarantees about the title, including protection against future claims. In contrast, a quitclaim deed comes with no warranties. The buyer assumes all risks regarding the title.

-

You don’t need to record a quitclaim deed.

While it’s true that a quitclaim deed is valid without being recorded, failing to record it can lead to complications. Recording the deed protects the new owner's interest and provides public notice of the ownership change.

Understanding these misconceptions can help you make informed decisions when dealing with property transfers. Always consider consulting a legal professional for guidance tailored to your specific situation.