Blank Real Estate Purchase Agreement Form

The Real Estate Purchase Agreement (REPA) serves as a critical document in the process of buying and selling property. This agreement outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It typically includes essential elements such as the purchase price, financing details, and the closing date, ensuring that both parties have a clear understanding of their obligations. Additionally, the REPA often addresses contingencies, such as inspections and appraisals, which can protect the buyer’s interests and provide avenues for negotiation. The agreement also specifies any included fixtures and personal property, thereby preventing potential disputes post-sale. By encompassing these key aspects, the Real Estate Purchase Agreement not only facilitates a smoother transaction but also serves to safeguard the rights and responsibilities of both buyers and sellers in the complex world of real estate transactions.

State-specific Guidelines for Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Document Categories

Other Templates:

Gf Applications - Share your hopes for a romantic partnership.

Codicil to a Will Alberta - A change in marital status can necessitate a codicil.

When preparing to incorporate, it's essential to understand the importance of the Washington Articles of Incorporation form, which lays the groundwork for your new business entity. This document outlines the corporation's structure and key details, ensuring compliance with state regulations. For added assistance in completing this process, you can refer to resources such as All Washington Forms, which can provide valuable insights and templates.

Rental Application Form Template - Specify the type of housing you are looking for, such as apartment or house.

Similar forms

The Real Estate Purchase Agreement is a vital document in the home buying process, but it shares similarities with several other important documents in real estate transactions. Here are eight documents that resemble the Real Estate Purchase Agreement:

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like a purchase agreement, it specifies the rights and responsibilities of both parties.

- Option Agreement: This allows a buyer the right, but not the obligation, to purchase a property at a specified price within a certain timeframe. It shares the same foundational purpose of defining terms for a property transaction.

- Sales Contract: Similar to the purchase agreement, this document details the terms of sale for a property, including price, contingencies, and closing date, ensuring both parties are clear on the transaction's specifics.

- Operating Agreement: This essential document governs the operations and management of an LLC, outlining ownership and financial arrangements. Similar to the other documents, it ensures clarity among members, making it vital for effective functioning. For more information, you can visit All Ohio Forms.

- Escrow Agreement: This document involves a third party holding funds or documents until certain conditions are met. It parallels the purchase agreement by ensuring that both buyer and seller fulfill their obligations before the transaction is completed.

- Title Insurance Policy: While primarily a protective measure, this document is connected to the purchase agreement as it ensures that the buyer receives a clear title to the property, as stipulated in the purchase agreement.

- Disclosure Statements: Sellers often provide these to inform buyers of any known issues with the property. They work alongside the purchase agreement to ensure transparency and protect the buyer’s interests.

- Financing Agreement: This document outlines the terms of any loans involved in the purchase. It complements the purchase agreement by detailing how the buyer will finance the property acquisition.

- Closing Statement: This final document summarizes the financial transactions involved in the sale. It is similar to the purchase agreement in that it confirms the agreed-upon terms and ensures that all parties are on the same page at closing.

Document Example

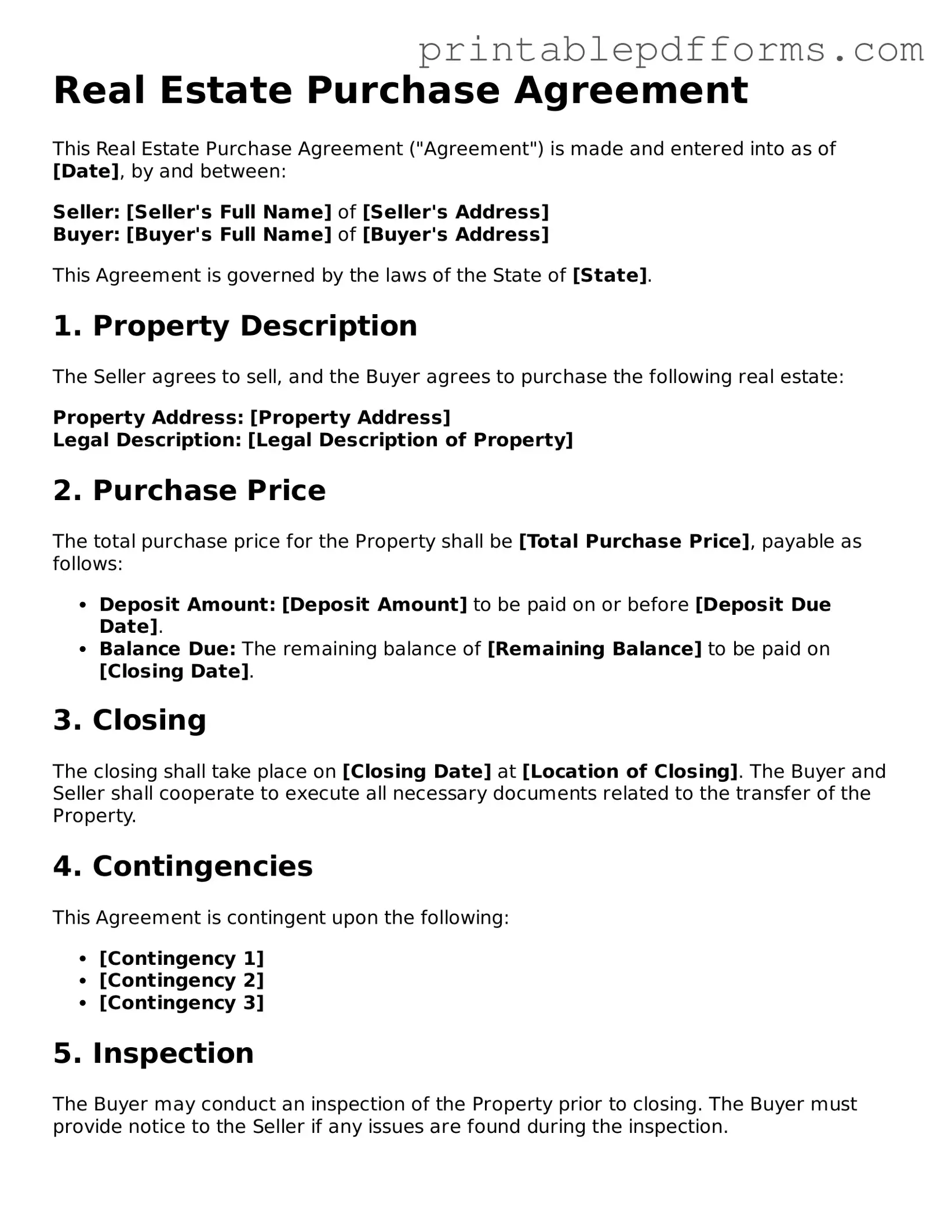

Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of [Date], by and between:

Seller: [Seller's Full Name] of [Seller's Address]

Buyer: [Buyer's Full Name] of [Buyer's Address]

This Agreement is governed by the laws of the State of [State].

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase the following real estate:

Property Address: [Property Address]

Legal Description: [Legal Description of Property]

2. Purchase Price

The total purchase price for the Property shall be [Total Purchase Price], payable as follows:

- Deposit Amount: [Deposit Amount] to be paid on or before [Deposit Due Date].

- Balance Due: The remaining balance of [Remaining Balance] to be paid on [Closing Date].

3. Closing

The closing shall take place on [Closing Date] at [Location of Closing]. The Buyer and Seller shall cooperate to execute all necessary documents related to the transfer of the Property.

4. Contingencies

This Agreement is contingent upon the following:

- [Contingency 1]

- [Contingency 2]

- [Contingency 3]

5. Inspection

The Buyer may conduct an inspection of the Property prior to closing. The Buyer must provide notice to the Seller if any issues are found during the inspection.

6. Representations and Warranties

Each party represents and warrants the following:

- The Seller is the legal owner of the Property and has the authority to sell.

- The Buyer has the financial capacity to purchase the Property.

7. Governing Law

This Agreement shall be governed by the laws of the State of [State].

8. Signatures

By signing below, both parties agree to the terms of this Agreement:

_______________________

Seller's Signature

Date: [Seller's Signature Date]

_______________________

Buyer's Signature

Date: [Buyer's Signature Date]

This document is intended for informational purposes only and does not constitute legal advice. It is recommended that both parties consult with an attorney before signing.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale between a buyer and a seller. |

| Essential Components | This agreement typically includes details such as the purchase price, property description, closing date, and contingencies. |

| Governing Law | The specific laws governing the agreement can vary by state. For example, in California, it is governed by the California Civil Code. |

| Contingencies | Common contingencies may involve financing, inspections, and appraisals. These protect the buyer's interests. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms outlined. |

Crucial Questions on This Form

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller outlining the terms and conditions of a property sale. This document serves to protect both parties by clearly defining the responsibilities and obligations involved in the transaction. It typically includes details such as the purchase price, property description, closing date, and any contingencies that must be met before the sale is finalized.

What key elements should be included in the agreement?

When drafting a Real Estate Purchase Agreement, it's crucial to include the following key elements:

- Parties Involved: Clearly identify the buyer and seller, including their legal names and contact information.

- Property Description: Provide a detailed description of the property, including its address, parcel number, and any included fixtures or appliances.

- Purchase Price: State the agreed-upon purchase price and any earnest money deposit required.

- Contingencies: Specify any conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Closing Date: Indicate the date by which the transaction will be completed.

Why is it important to have a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is essential because it provides legal protection for both parties involved in the transaction. Without this agreement, misunderstandings and disputes can arise, potentially leading to financial loss or legal issues. By clearly outlining the terms of the sale, both the buyer and seller can ensure that their interests are safeguarded throughout the process.

Can a Real Estate Purchase Agreement be modified after it is signed?

Yes, a Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. Common reasons for modifications include changes in closing dates, adjustments to the purchase price, or amendments to contingencies. Always communicate openly and keep a record of any changes to avoid confusion later on.

Documents used along the form

When engaging in a real estate transaction, various documents accompany the Real Estate Purchase Agreement to ensure a smooth process. Each document serves a specific purpose, providing clarity and protection for all parties involved. Below is a list of commonly used forms and documents that often accompany the Real Estate Purchase Agreement.

- Seller's Disclosure Statement: This document outlines any known issues with the property, such as structural problems, environmental hazards, or past repairs. It aims to inform potential buyers about the property's condition before the sale.

- Title Report: A title report details the legal ownership of the property and any liens, easements, or restrictions that may affect it. This document is crucial for ensuring that the seller has the right to sell the property.

- Boat Bill of Sale: This essential form is used for transferring ownership of a boat, ensuring that all parties are protected in the transaction. For more information, visit nypdfforms.com/boat-bill-of-sale-form.

- Property Inspection Report: Conducted by a licensed inspector, this report assesses the property's condition, identifying any necessary repairs or maintenance. Buyers often use this information to negotiate terms or request repairs.

- Loan Estimate: If the buyer is financing the purchase, a loan estimate provides a breakdown of the loan terms, interest rates, and estimated closing costs. This document allows buyers to compare different loan offers.

- Appraisal Report: An appraisal determines the property's fair market value, which is essential for securing financing. Lenders typically require this report to ensure the property is worth the amount being borrowed.

- Closing Disclosure: This document outlines the final terms of the mortgage, including the loan amount, interest rate, and closing costs. It must be provided to the buyer at least three days before closing.

- Earnest Money Agreement: This agreement details the deposit made by the buyer to show their serious intent to purchase the property. It specifies the amount and conditions under which the deposit may be forfeited or returned.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this document informs buyers about potential lead-based paint hazards. Sellers must disclose any known information regarding lead paint in the property.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information about the association's rules, fees, and regulations. Buyers need to understand the obligations and restrictions they may face.

Each of these documents plays a critical role in the real estate transaction process. Understanding their purpose can help buyers and sellers navigate the complexities of property sales more effectively, ensuring that all parties are informed and protected throughout the process.

Misconceptions

When it comes to the Real Estate Purchase Agreement (REPA), many people hold misconceptions that can lead to confusion or even costly mistakes. Understanding these common myths can help buyers and sellers navigate the real estate process more effectively.

- 1. A Real Estate Purchase Agreement is just a formality. Many believe that signing the REPA is merely a formality. In reality, it is a legally binding contract that outlines the terms of the sale, and both parties must adhere to its stipulations.

- 2. All REPA forms are the same. Not all purchase agreements are created equal. Different states and situations may require specific clauses or language. It’s important to use a form that complies with local laws and addresses the unique aspects of the transaction.

- 3. Once signed, the agreement cannot be changed. While a signed REPA is binding, it can be modified if both parties agree to the changes. This is often done through an addendum or amendment, which must also be signed by both parties.

- 4. The REPA guarantees the sale will go through. Signing the agreement does not guarantee the sale will be completed. Various factors, such as financing issues or inspection problems, can derail the process even after the REPA is signed.

- 5. Only real estate agents can draft a REPA. While real estate agents often prepare these agreements, buyers and sellers can also draft their own, provided they understand the necessary components and legal implications.

- 6. The REPA only benefits the seller. This misconception overlooks the fact that the REPA protects both parties. It outlines the buyer's rights and obligations, ensuring they have a clear understanding of what they are purchasing.

- 7. You don’t need legal advice for a REPA. Some believe that legal advice is unnecessary for a REPA. However, consulting a real estate attorney can provide valuable insights and help avoid pitfalls that could arise from misunderstandings or oversights in the agreement.

By dispelling these misconceptions, both buyers and sellers can approach the Real Estate Purchase Agreement with a clearer understanding, leading to a smoother transaction process.