Blank Release of Promissory Note Form

The Release of Promissory Note form is an essential document that facilitates the formal conclusion of a loan agreement, ensuring that all parties involved can move forward with clarity and security. This form serves as an official acknowledgment that the borrower has fulfilled their obligations under the promissory note, effectively releasing them from any further financial responsibilities associated with the loan. It typically includes key details such as the names of the borrower and lender, the original loan amount, and the date of the note's release. Additionally, it may outline any conditions that must be met prior to the release, providing a safeguard for both parties. By using this form, individuals can protect their interests while also promoting transparency in financial transactions. Understanding its components and implications is crucial for anyone involved in lending or borrowing, as it not only signifies the end of a debt but also helps maintain a positive relationship between the lender and borrower.

Popular Release of Promissory Note Documents:

Loan Note Template - Can specify collateral involved in the car loan agreement.

Understanding the specific requirements for a promissory note is essential for both parties involved in a loan agreement. In New Jersey, utilizing the correct documentation is vital, which is why you can refer to All New Jersey Forms to find the necessary templates that comply with state laws. This ensures that the terms of repayment, interest, and other financial obligations are clearly defined and legally enforceable.

Similar forms

- Release of Lien: This document removes a legal claim against a property or asset. Like the Release of Promissory Note, it signifies that a debt obligation has been satisfied.

- Cancellation of Contract: This form terminates a contract between parties. It functions similarly by indicating that the parties no longer have obligations to each other.

- Debt Settlement Agreement: This document outlines the terms under which a debt is settled. It shares the common goal of resolving outstanding financial obligations.

- Waiver of Liability: This form releases one party from liability claims. Both documents emphasize the release of responsibilities and obligations.

- Quitclaim Deed: This legal document transfers interest in property without guaranteeing clear title. It parallels the Release of Promissory Note by transferring ownership or interest once debts are cleared.

Blank Promissory Note Template: For those needing a structured format, a useful resource is available at patemplates.com/, which provides a comprehensive template to aid in drafting a promissory note.

- Termination of Lease Agreement: This document ends a lease early. Similar to the Release of Promissory Note, it signifies that all parties are free from further obligations.

- Mutual Release Agreement: This form allows both parties to release each other from claims. It mirrors the intent of the Release of Promissory Note by ending obligations.

- Settlement Agreement: This document resolves disputes and outlines terms for settlement. Like the Release of Promissory Note, it finalizes the terms of a financial agreement.

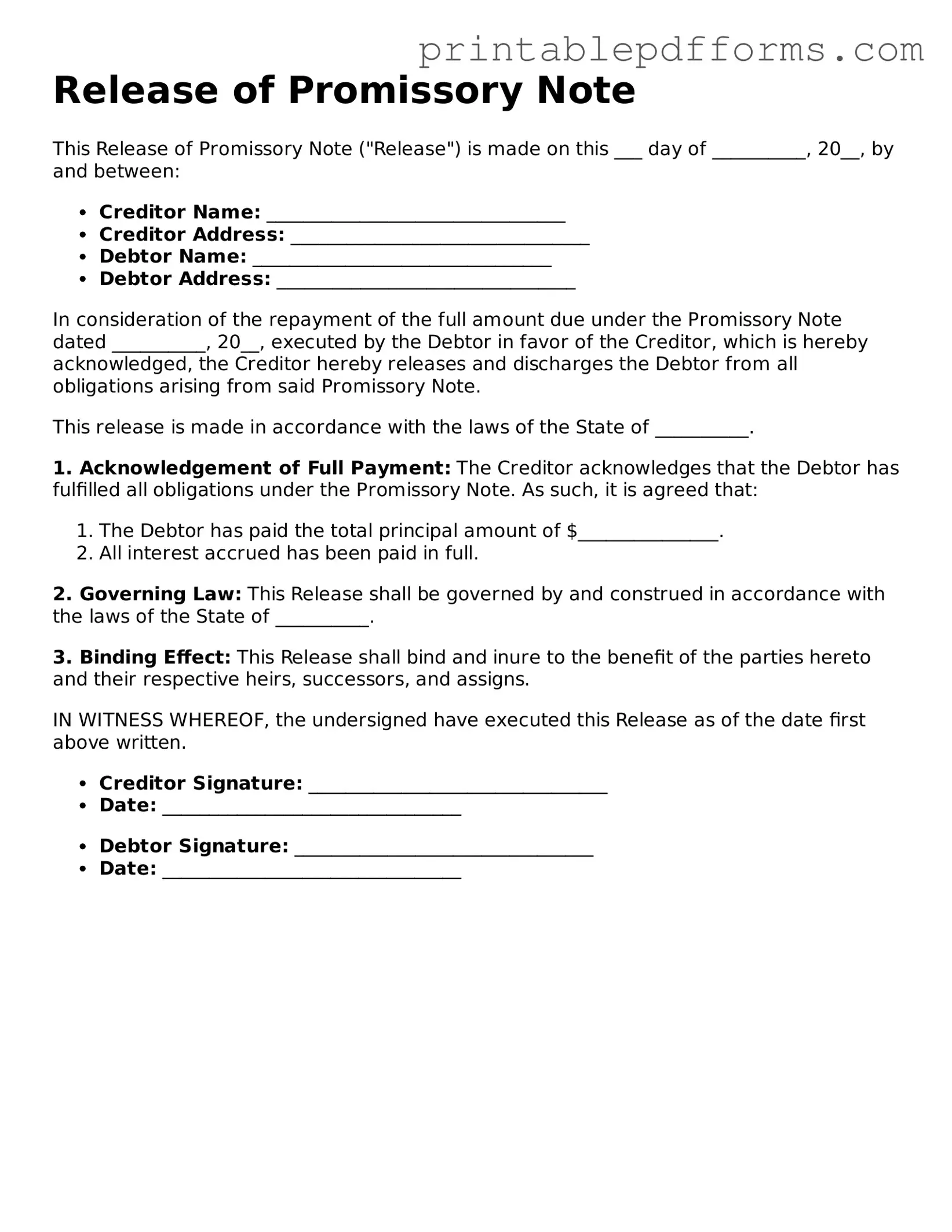

Document Example

Release of Promissory Note

This Release of Promissory Note ("Release") is made on this ___ day of __________, 20__, by and between:

- Creditor Name: ________________________________

- Creditor Address: ________________________________

- Debtor Name: ________________________________

- Debtor Address: ________________________________

In consideration of the repayment of the full amount due under the Promissory Note dated __________, 20__, executed by the Debtor in favor of the Creditor, which is hereby acknowledged, the Creditor hereby releases and discharges the Debtor from all obligations arising from said Promissory Note.

This release is made in accordance with the laws of the State of __________.

1. Acknowledgement of Full Payment: The Creditor acknowledges that the Debtor has fulfilled all obligations under the Promissory Note. As such, it is agreed that:

- The Debtor has paid the total principal amount of $_______________.

- All interest accrued has been paid in full.

2. Governing Law: This Release shall be governed by and construed in accordance with the laws of the State of __________.

3. Binding Effect: This Release shall bind and inure to the benefit of the parties hereto and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the undersigned have executed this Release as of the date first above written.

- Creditor Signature: ________________________________

- Date: ________________________________

- Debtor Signature: ________________________________

- Date: ________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a legal document that formally cancels a promissory note, indicating that the borrower has fulfilled their obligation. |

| Purpose | This form serves to protect both the lender and borrower by providing proof that the debt has been satisfied and that no further payments are required. |

| Governing Law | The laws governing the Release of Promissory Note may vary by state. For example, in California, it is governed by the California Civil Code. |

| Signatures Required | The document typically requires signatures from both the lender and the borrower to validate the release. |

| Filing | While not always necessary, filing the release with a local government office can provide additional protection and public notice of the cancellation. |

| Effectiveness | Once executed, the Release of Promissory Note effectively discharges the borrower's debt, ensuring that the lender cannot pursue further claims related to that note. |

Crucial Questions on This Form

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that officially states that a borrower has fulfilled their obligations under a promissory note. This means that the lender acknowledges that the borrower has paid off the debt, and the lender no longer has a claim to any payments related to that note.

Why do I need a Release of Promissory Note?

This form is important for both parties involved. For the borrower, it serves as proof that the debt has been satisfied. For the lender, it protects them from any future claims regarding that debt. Having this document can prevent misunderstandings or disputes later on.

How do I complete the Release of Promissory Note form?

To complete the form, follow these steps:

- Gather all necessary information, including the names of the borrower and lender, the date of the original promissory note, and the amount paid.

- Fill in the details accurately in the form.

- Both parties should sign and date the document to make it official.

Is the Release of Promissory Note form legally binding?

Yes, once both parties sign the form, it becomes a legally binding document. This means that it holds up in court if any disputes arise regarding the repayment of the loan. It’s always a good idea to keep a copy for your records.

Where can I obtain a Release of Promissory Note form?

You can find a Release of Promissory Note form online through various legal document websites. Additionally, local legal offices or attorneys can provide you with a template or assist you in drafting one tailored to your situation.

What should I do after completing the form?

After completing the form, both the borrower and lender should keep a signed copy for their records. It’s also wise to send a copy to any relevant financial institutions or credit reporting agencies to update their records regarding the debt status.

Documents used along the form

The Release of Promissory Note form is an important document in the realm of financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. Along with this form, several other documents may be utilized to ensure clarity and legality in the process. Below is a list of commonly used forms and documents that accompany the Release of Promissory Note.

- Promissory Note: This is the original document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Loan Agreement: A comprehensive document that details the terms and conditions of the loan, including the responsibilities of both the borrower and the lender.

- Payment Schedule: A detailed timeline indicating when payments are due, the amounts, and the method of payment, which helps in tracking repayment progress.

- Release of Lien: This document is used to formally remove a lender's claim on the borrower's property once the loan is paid off, ensuring the borrower has clear title to their assets.

- Promissory Note: This is the initial agreement where the borrower promises to repay the lender a specified amount, including interest. It outlines the terms, such as payment schedules and any collateral involved. For more information and to get started on your own Promissory Note, visit https://promissoryform.com/blank-alabama-promissory-note/.

- Debt Settlement Agreement: If the loan was settled for less than the full amount owed, this document outlines the terms of the settlement and releases the borrower from further obligations.

- Affidavit of Payment: A sworn statement confirming that the borrower has made all required payments, which can serve as proof in case of disputes.

- Notice of Default: This document may be issued if the borrower fails to meet payment obligations, outlining the default and potential consequences.

- Credit Report Authorization: A form allowing the lender to check the borrower’s credit history, often used before approving the loan.

- Personal Guarantee: A document where an individual agrees to repay the loan if the primary borrower defaults, adding an additional layer of security for the lender.

These documents collectively ensure that all parties involved in the loan process understand their rights and responsibilities. Proper documentation fosters transparency and can help prevent disputes in the future.

Misconceptions

Understanding the Release of Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Below are five common misconceptions, along with clarifications.

-

It is only necessary for large loans.

Many believe that a Release of Promissory Note is only required for significant financial transactions. In reality, it is important for any loan, regardless of size, to ensure that all parties have a clear understanding of their obligations.

-

It is automatically issued once the loan is paid off.

Some people think that the release happens automatically when the borrower pays off the loan. However, a formal request for a release must be made, and the lender must provide the necessary documentation to finalize the process.

-

Only the borrower needs to sign the release.

There is a misconception that only the borrower’s signature is required on the Release of Promissory Note. In fact, both the borrower and the lender typically need to sign the document to validate the release.

-

It is the same as a cancellation of the loan.

Some individuals confuse the release with a cancellation. While both documents signify the end of a financial obligation, a release formally acknowledges that the debt has been satisfied, whereas a cancellation may imply that the loan was never valid.

-

It has no legal significance.

Many people underestimate the legal importance of the Release of Promissory Note. This document serves as proof that the debt has been paid, which can be crucial in preventing future disputes or claims regarding the loan.

By understanding these misconceptions, individuals can navigate the process more effectively and ensure that their financial agreements are properly documented.