Blank Single-Member Operating Agreement Form

The Single-Member Operating Agreement is an essential document for anyone operating a single-member limited liability company (LLC). This form outlines the structure and operational guidelines for the business, ensuring clarity and legal protection for the owner. It typically includes key elements such as the purpose of the LLC, the management structure, and the distribution of profits and losses. Additionally, it addresses how the business will be managed and what happens in various scenarios, such as the sale of the company or the addition of new members. By having this agreement in place, the single member can help safeguard personal assets from business liabilities while establishing a clear framework for business operations. This document not only serves as a reference for the owner but also provides essential information for banks, investors, and legal entities, reinforcing the legitimacy of the business. Overall, a well-crafted Single-Member Operating Agreement is a critical tool for any solo entrepreneur looking to operate their LLC effectively and confidently.

Similar forms

Partnership Agreement: This document outlines the terms and conditions of a partnership between two or more individuals. Similar to a Single-Member Operating Agreement, it defines roles, responsibilities, and profit-sharing arrangements among partners.

Bylaws: Bylaws serve as the governing rules for a corporation, detailing the management structure and operational procedures. Like the Single-Member Operating Agreement, they establish guidelines for decision-making and the responsibilities of officers.

- Operating Agreement: For managing your LLC effectively, consider utilizing our detailed Operating Agreement template resources to ensure proper governance and operational clarity.

Shareholder Agreement: This agreement is used among shareholders of a corporation and specifies the rights and obligations of each shareholder. It is akin to a Single-Member Operating Agreement in that it governs the ownership and management of the business.

Operating Agreement for Multi-Member LLC: This document is similar in purpose to a Single-Member Operating Agreement but is designed for LLCs with multiple members. It outlines the management structure and the distribution of profits, akin to how a single-member agreement functions for one owner.

Articles of Incorporation: These are filed with the state to legally establish a corporation. While not identical, they share the common goal of defining the structure and purpose of a business, similar to how a Single-Member Operating Agreement outlines the operational framework for an LLC.

Document Example

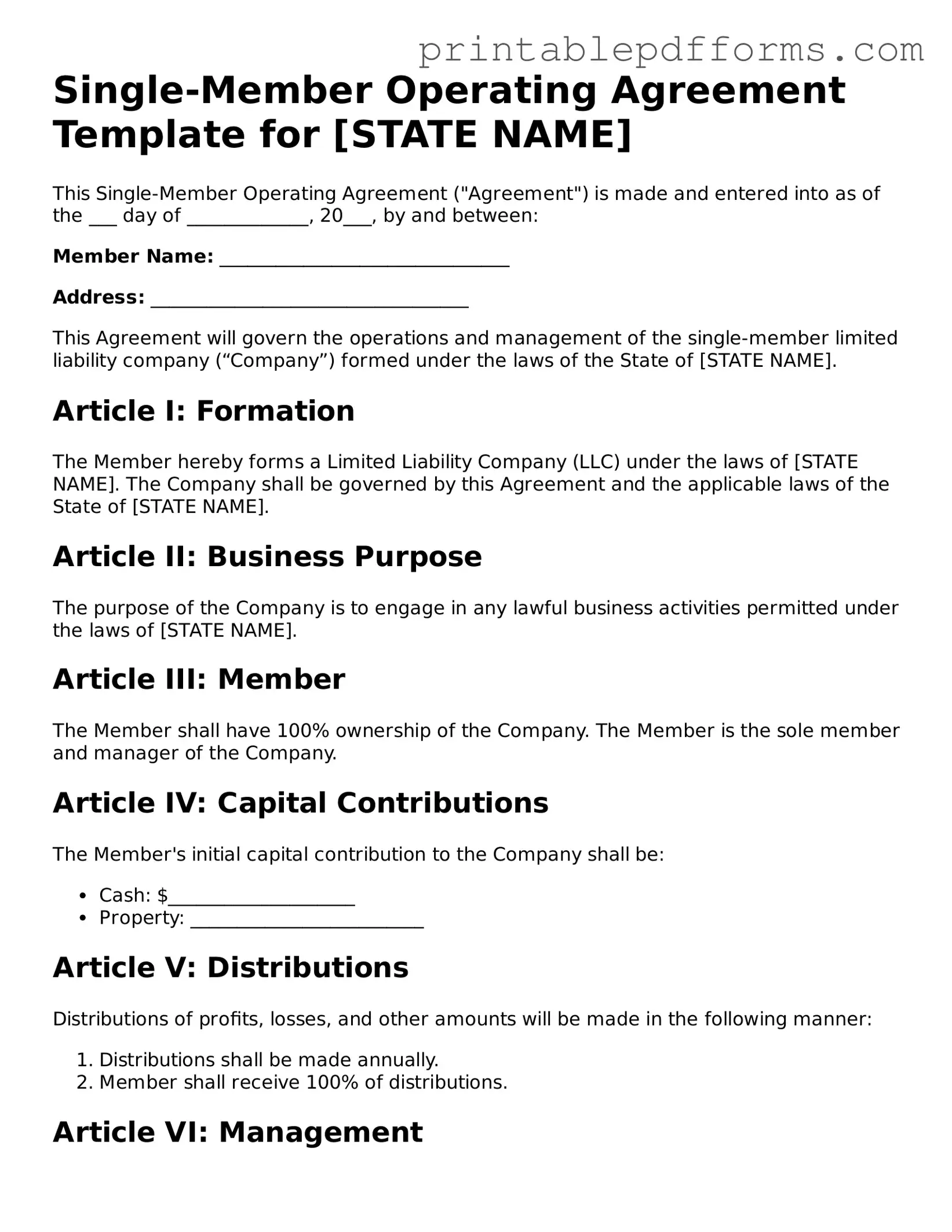

Single-Member Operating Agreement Template for [STATE NAME]

This Single-Member Operating Agreement ("Agreement") is made and entered into as of the ___ day of _____________, 20___, by and between:

Member Name: _______________________________

Address: __________________________________

This Agreement will govern the operations and management of the single-member limited liability company (“Company”) formed under the laws of the State of [STATE NAME].

Article I: Formation

The Member hereby forms a Limited Liability Company (LLC) under the laws of [STATE NAME]. The Company shall be governed by this Agreement and the applicable laws of the State of [STATE NAME].

Article II: Business Purpose

The purpose of the Company is to engage in any lawful business activities permitted under the laws of [STATE NAME].

Article III: Member

The Member shall have 100% ownership of the Company. The Member is the sole member and manager of the Company.

Article IV: Capital Contributions

The Member's initial capital contribution to the Company shall be:

- Cash: $____________________

- Property: _________________________

Article V: Distributions

Distributions of profits, losses, and other amounts will be made in the following manner:

- Distributions shall be made annually.

- Member shall receive 100% of distributions.

Article VI: Management

The Member shall manage the Company. All decisions regarding the Company's business and affairs shall be made by the Member.

Article VII: Indemnification

The Company shall indemnify the Member against any losses, liabilities, or expenses incurred in connection with the Company's business to the fullest extent allowed under the law.

Article VIII: Miscellaneous

This Agreement constitutes the entire agreement between the Member and the Company. Any amendments shall be in writing and signed by the Member.

IN WITNESS WHEREOF, the undersigned has executed this Single-Member Operating Agreement as of the date first above written.

Member Signature: _______________________________

Date: ________________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to establish the rights and responsibilities of the sole member, protecting personal assets from business liabilities. |

| State-Specific Requirements | Each state may have specific requirements for the formation and content of an operating agreement. For example, California and New York have unique provisions under their LLC laws. |

| Governing Law | The governing law for a Single-Member Operating Agreement is typically the state in which the LLC is formed. This can include laws from states such as Delaware, Texas, or Florida. |

| Flexibility | The agreement allows for flexibility in management and operational decisions, enabling the member to tailor the document to their specific business needs. |

| Legal Recognition | While not always required, having a written operating agreement is highly recommended. It provides legal recognition of the LLC's structure and can be crucial in disputes. |

Crucial Questions on This Form

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational procedures of a single-member limited liability company (LLC). This agreement serves as an internal guideline for the owner, detailing how the business will be run, how profits and losses will be handled, and what happens in various scenarios such as the sale of the business or the death of the owner. Although it is not always required by law, having this document can provide clarity and protection for the owner.

Why is it important to have a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is crucial for several reasons:

- Legal Protection: This document helps separate personal assets from business liabilities, reinforcing the limited liability status of the LLC.

- Operational Clarity: It provides a clear framework for decision-making and business operations, which can be especially helpful if the owner decides to bring in partners or sell the business in the future.

- Dispute Resolution: In the event of disagreements or unforeseen circumstances, the agreement outlines how issues should be resolved, reducing potential conflicts.

What should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement typically includes the following elements:

- Business Information: Name, address, and purpose of the LLC.

- Ownership Structure: A statement confirming that the LLC is a single-member entity.

- Management Details: How the business will be managed and who will make decisions.

- Financial Arrangements: How profits and losses will be allocated, as well as any provisions for capital contributions.

- Amendment Procedures: How changes to the agreement can be made in the future.

Can I create a Single-Member Operating Agreement on my own?

Yes, you can create a Single-Member Operating Agreement on your own. Many templates are available online, which can serve as a helpful starting point. However, it is advisable to consult with a legal professional to ensure that the agreement meets all necessary legal requirements and adequately protects your interests. A well-crafted agreement can save you time, money, and potential legal issues down the line.

Documents used along the form

A Single-Member Operating Agreement is an essential document for individuals forming a single-member limited liability company (LLC). It outlines the management structure and operational procedures of the LLC. In addition to this agreement, several other forms and documents are commonly used to ensure the smooth operation of a single-member LLC. Here is a list of these documents, each with a brief description.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Employer Identification Number (EIN): An EIN is issued by the IRS and is necessary for tax purposes. It allows the LLC to open a bank account, hire employees, and file taxes.

- Bylaws: While not always required for LLCs, bylaws outline the rules and procedures for the internal management of the company, helping to establish clear governance.

- Membership Certificate: This certificate serves as proof of ownership of the LLC. It can be used for personal records and may be required for certain transactions.

- Operating Agreement: This crucial document delineates the management structure and operating procedures of your LLC. For more detailed insights and templates, refer to Colorado PDF Forms.

- Bank Resolution: This document authorizes the opening of a business bank account in the name of the LLC. It often specifies who has the authority to manage the account.

- Operating Procedures: A detailed document that outlines the day-to-day operations of the LLC. This can include guidelines on decision-making and financial management.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business.

- Tax Forms: Depending on the structure of the LLC, various tax forms may need to be filed, such as Form 1065 or Schedule C, to report income and expenses.

- Non-Disclosure Agreement (NDA): If the LLC works with contractors or partners, an NDA may be necessary to protect sensitive information and trade secrets.

- Purchase Agreements: If the LLC plans to buy or sell assets, purchase agreements will outline the terms and conditions of the transactions.

Having these documents in place can help ensure that the single-member LLC operates smoothly and remains compliant with state and federal regulations. Each document serves a unique purpose and contributes to the overall functionality and legality of the business.

Misconceptions

Understanding the Single-Member Operating Agreement is essential for any sole proprietor looking to establish their business as a limited liability company (LLC). However, several misconceptions can cloud the clarity of this important document. Here are six common misconceptions:

- 1. A Single-Member Operating Agreement is not necessary. Many believe that because they are the only member, they do not need an operating agreement. In reality, this document helps define the structure of the business and can provide legal protection.

- 2. The agreement is only for large businesses. Some people think that operating agreements are only relevant for larger companies. However, even small businesses benefit from having a clear operating agreement to outline management and operational procedures.

- 3. The agreement must be filed with the state. There is a misconception that the operating agreement needs to be submitted to the state. In fact, this document is typically kept internally and is not required to be filed, although it is important for maintaining LLC status.

- 4. The agreement can be verbal. Some individuals assume that a verbal agreement is sufficient. While verbal agreements can be legally binding, having a written operating agreement is crucial for clarity and enforceability.

- 5. Once created, the agreement cannot be changed. There is a belief that an operating agreement is set in stone. In reality, it can be amended as the business evolves or as circumstances change, allowing for flexibility in management and operations.

- 6. All operating agreements are the same. Many think that a single template will suffice for all LLCs. However, each business has unique needs, and the operating agreement should be tailored to reflect the specific goals and structure of the business.

By addressing these misconceptions, business owners can better understand the importance of a Single-Member Operating Agreement and how it can serve as a foundational document for their LLC.