Fill a Valid Stock Transfer Ledger Form

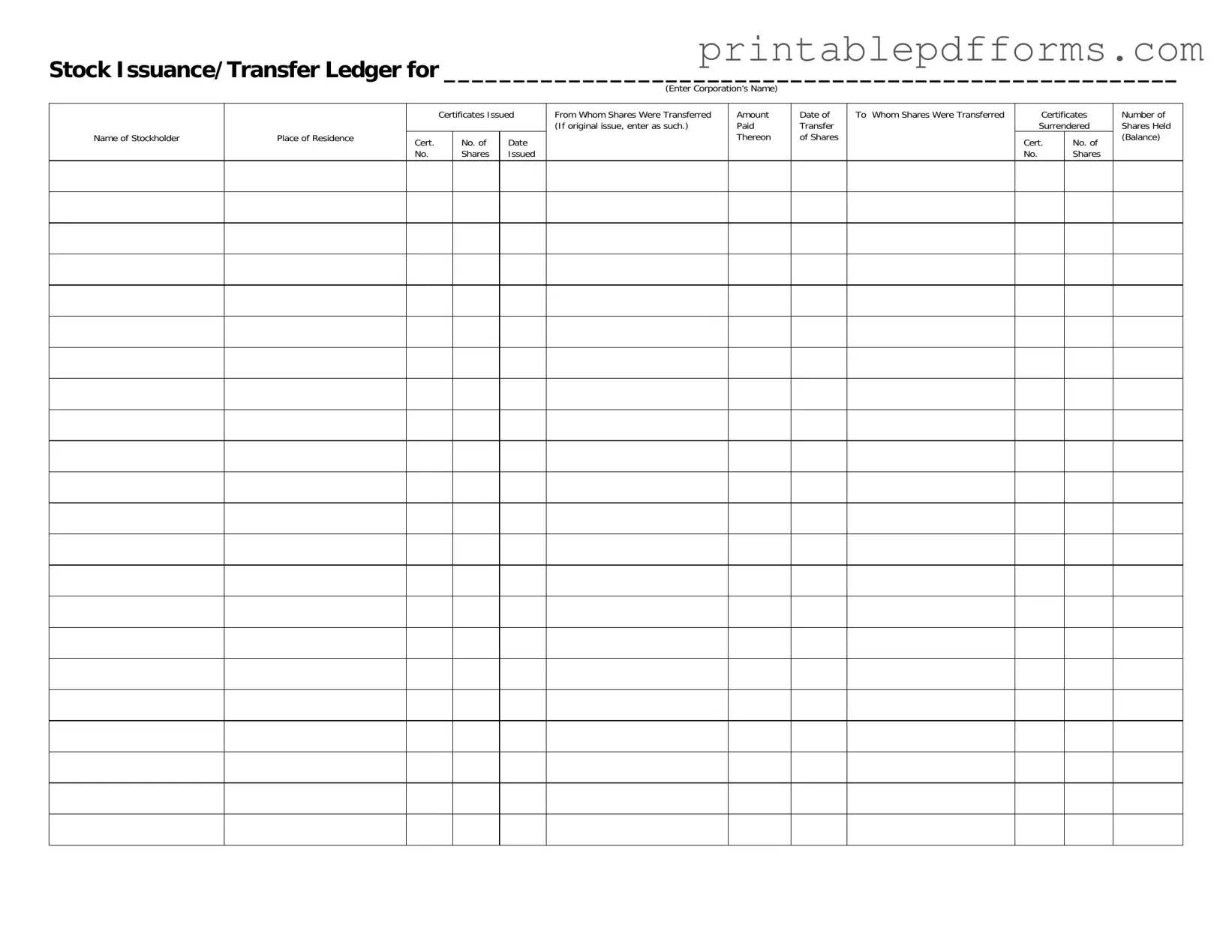

The Stock Transfer Ledger form serves as an important document for corporations managing their stock issuance and transfers. This form captures essential information about the stockholder, including their name and place of residence. It tracks the certificates issued, detailing the certificate numbers, dates, and the number of shares involved in each transaction. When shares are transferred, the form requires information about the previous holder, indicating whether it is an original issue or a transfer. It also notes the amount paid for the shares, ensuring transparency in financial transactions. Additionally, the date of transfer and the new holder's details are recorded, providing a complete picture of ownership changes. The form requires the surrender of certificates, and it concludes with a balance of the number of shares held by the stockholder after the transfer. This comprehensive approach ensures accurate record-keeping and compliance with corporate governance standards.

Additional PDF Templates

Navpers 1336 3 - The NAVPERS 1336 3 form must be filled out accurately to avoid complications.

To officially validate your employment history, you might need an Employment Verification Letter. This document not only verifies your position and tenure at the company but also provides crucial salary details, ensuring transparency in your job profile.

Can Dogs Fly Internationally - The form sets guidelines for the animal’s readiness to travel.

Similar forms

-

Shareholder Register: Similar to the Stock Transfer Ledger, the Shareholder Register lists all shareholders of a corporation, along with their contact information and the number of shares they own. It serves as an official record of ownership and can help track changes over time.

-

Non-disclosure Agreements: This form is essential for protecting sensitive information shared between parties, ensuring confidentiality and safeguarding trade secrets. For more details, refer to All Ohio Forms.

-

Stock Certificate: A Stock Certificate represents ownership in a corporation. Like the Stock Transfer Ledger, it includes details such as the shareholder's name, the number of shares owned, and the certificate number. Both documents are essential for confirming ownership.

-

Transfer Agreement: This document outlines the terms and conditions under which shares are transferred from one party to another. It is similar to the Stock Transfer Ledger in that it records the specifics of the transaction, including the parties involved and the number of shares transferred.

-

Dividend Record: The Dividend Record documents the distribution of dividends to shareholders. It shares similarities with the Stock Transfer Ledger by tracking ownership and the number of shares held, which determines dividend eligibility.

-

Corporate Minutes: Corporate Minutes are the official record of the proceedings of a corporation's meetings. They often include decisions related to stock issuance and transfers, making them similar to the Stock Transfer Ledger in maintaining an accurate history of ownership changes.

Document Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger is used to record the issuance and transfer of stock within a corporation. |

| Required Information | It must include the corporation’s name, stockholder details, certificate numbers, dates of issuance, and transfer details. |

| Legal Compliance | In many states, maintaining an accurate Stock Transfer Ledger is required by corporate governance laws. |

| Record Keeping | This ledger serves as an official record, ensuring transparency and accountability in stock ownership. |

Crucial Questions on This Form

What is a Stock Transfer Ledger?

A Stock Transfer Ledger is a record that tracks the issuance and transfer of shares in a corporation. It helps maintain an accurate account of who owns shares and how many shares each stockholder has. This document is essential for managing ownership and ensuring compliance with corporate regulations.

Why do I need a Stock Transfer Ledger?

Maintaining a Stock Transfer Ledger is important for several reasons:

- It provides a clear record of stock ownership.

- It helps in tracking changes in ownership over time.

- It ensures compliance with state and federal regulations.

- It aids in the distribution of dividends and other shareholder communications.

What information is included in the Stock Transfer Ledger?

The Stock Transfer Ledger typically includes the following details:

- Corporation's name

- Name of the stockholder

- Place of residence of the stockholder

- Certificates issued and their numbers

- Date of issuance

- Number of shares issued

- Details of the transfer, including the date and parties involved

- Certificates surrendered and the balance of shares held

How do I fill out the Stock Transfer Ledger?

To fill out the Stock Transfer Ledger, follow these steps:

- Enter the corporation’s name at the top of the form.

- List each stockholder's name and place of residence.

- Record the certificates issued, including their numbers and the date.

- Document the number of shares issued and from whom they were transferred.

- Note the amount paid for the shares and the date of transfer.

- Indicate to whom the shares were transferred and the certificates surrendered.

- Finally, update the number of shares held by each stockholder to reflect the balance.

Who is responsible for maintaining the Stock Transfer Ledger?

The responsibility for maintaining the Stock Transfer Ledger usually falls on the corporation's secretary or another designated officer. This person ensures that the ledger is updated accurately and promptly whenever shares are issued or transferred.

Can I use a digital format for the Stock Transfer Ledger?

Yes, many corporations opt to use digital formats for their Stock Transfer Ledger. This can simplify the process of updating records and make it easier to access information. However, ensure that the digital format complies with any legal requirements and that the information remains secure.

What happens if I don’t maintain a Stock Transfer Ledger?

Failing to maintain a Stock Transfer Ledger can lead to several issues, such as:

- Confusion over stock ownership.

- Potential legal complications.

- Difficulties in distributing dividends or communicating with shareholders.

- Non-compliance with regulatory requirements, which may result in penalties.

Documents used along the form

The Stock Transfer Ledger form is an essential document for tracking the issuance and transfer of shares within a corporation. Alongside this form, several other documents are commonly used to ensure proper record-keeping and compliance with regulations. Here’s a brief overview of these related documents.

- Stock Certificate: This document serves as proof of ownership for shares in a corporation. It includes details such as the stockholder's name, the number of shares owned, and the corporation’s name. Stock certificates are often issued when shares are first purchased and must be surrendered when shares are transferred.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders within a corporation. It may cover aspects such as voting rights, transfer restrictions, and dividend distribution. This document helps prevent disputes among shareholders and clarifies expectations.

- Transfer Request Form: When a stockholder wishes to transfer shares, they typically fill out a transfer request form. This document includes information about the seller, buyer, and the number of shares being transferred. It serves as a formal request to update the Stock Transfer Ledger.

- Trailer Bill of Sale: This form is essential for the legal transfer of trailer ownership in Florida, acting as proof of the transaction and protecting both parties involved. For more information on how to complete this process, read here.

- Board Resolution: A board resolution may be required to approve the transfer of shares. This document records the board's decision regarding the transfer and ensures that it complies with the corporation's bylaws. It provides an official record of the approval process.

These documents, when used in conjunction with the Stock Transfer Ledger form, help maintain accurate records of stock ownership and facilitate smooth transactions within the corporation. Keeping these forms organized ensures compliance and clarity in share management.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion among stockholders and corporations alike. Here are four common misunderstandings:

- It is only for large corporations. Many believe that only large corporations need to maintain a Stock Transfer Ledger. In reality, any corporation that issues stock, regardless of size, must keep this record to ensure proper tracking of ownership and compliance with regulations.

- It is optional to maintain a Stock Transfer Ledger. Some think that keeping a Stock Transfer Ledger is optional. This is not true. It is a legal requirement for corporations to maintain accurate records of stock transfers to protect both the corporation and its shareholders.

- Only the corporation needs to fill it out. There is a misconception that only the corporation is responsible for completing the Stock Transfer Ledger. In fact, both the corporation and the stockholders play a role in ensuring that the information is accurate and up to date.

- Once completed, it doesn’t need to be updated. Some individuals believe that once the Stock Transfer Ledger is filled out, it remains unchanged. However, this is incorrect. The ledger must be continuously updated to reflect any changes in stock ownership or other relevant information.