Texas Articles of Incorporation Document

When starting a business in Texas, one of the first steps you’ll need to take is filing the Articles of Incorporation. This essential document lays the groundwork for your corporation, establishing its legal existence and defining its purpose. It includes important details such as the corporation's name, the address of its registered office, and the name of its registered agent. Additionally, the Articles of Incorporation specify the number of shares the corporation is authorized to issue, which is crucial for future fundraising and ownership structure. Understanding the requirements and implications of this form can help ensure that your business is set up correctly from the start. By carefully completing the Articles of Incorporation, you not only comply with state regulations but also create a solid foundation for your company’s growth and success.

Discover More Articles of Incorporation Forms for Different States

Ohio Secretary of State Llc Filing - They may specify the number of shares the corporation is authorized to issue.

The New York Boat Bill of Sale form is a legal document used to transfer ownership of a boat from one party to another. This form includes essential details such as the buyer's and seller's information, a description of the boat, and the sale price. Completing this document ensures that the transaction is recorded properly and protects the interests of both parties involved. For more information, you can visit the nypdfforms.com/boat-bill-of-sale-form/.

Articles of Incorporation Florida - Filing fees are typically required when submitting the Articles of Incorporation.

Similar forms

- Bylaws: Bylaws serve as the internal rules governing the operations of a corporation. Like the Articles of Incorporation, they outline essential information, such as the structure of the organization, the roles of officers, and the procedures for meetings. However, while the Articles are filed with the state, bylaws are typically kept internally and are not submitted to any governmental body.

- Last Will and Testament: To secure your final wishes, refer to the comprehensive Last Will and Testament resources that help ensure your assets are distributed according to your desires.

- Operating Agreement: For limited liability companies (LLCs), the operating agreement functions similarly to the Articles of Incorporation for corporations. It establishes the framework for the LLC's management and operation, detailing ownership, responsibilities, and procedures. Both documents are foundational to the entity's existence and governance.

- Certificate of Incorporation: In some states, the terms "Articles of Incorporation" and "Certificate of Incorporation" are used interchangeably. Both documents serve the same purpose: to legally establish a corporation in the eyes of the state. They include similar information, such as the company name, purpose, and registered agent, ensuring compliance with state laws.

- Business License: A business license is a permit issued by a government authority that allows an individual or company to conduct business within a certain jurisdiction. While it does not contain the structural details found in the Articles of Incorporation, both documents are essential for legal operation. The Articles establish the entity's legitimacy, while the business license grants permission to operate within a specific area.

Document Example

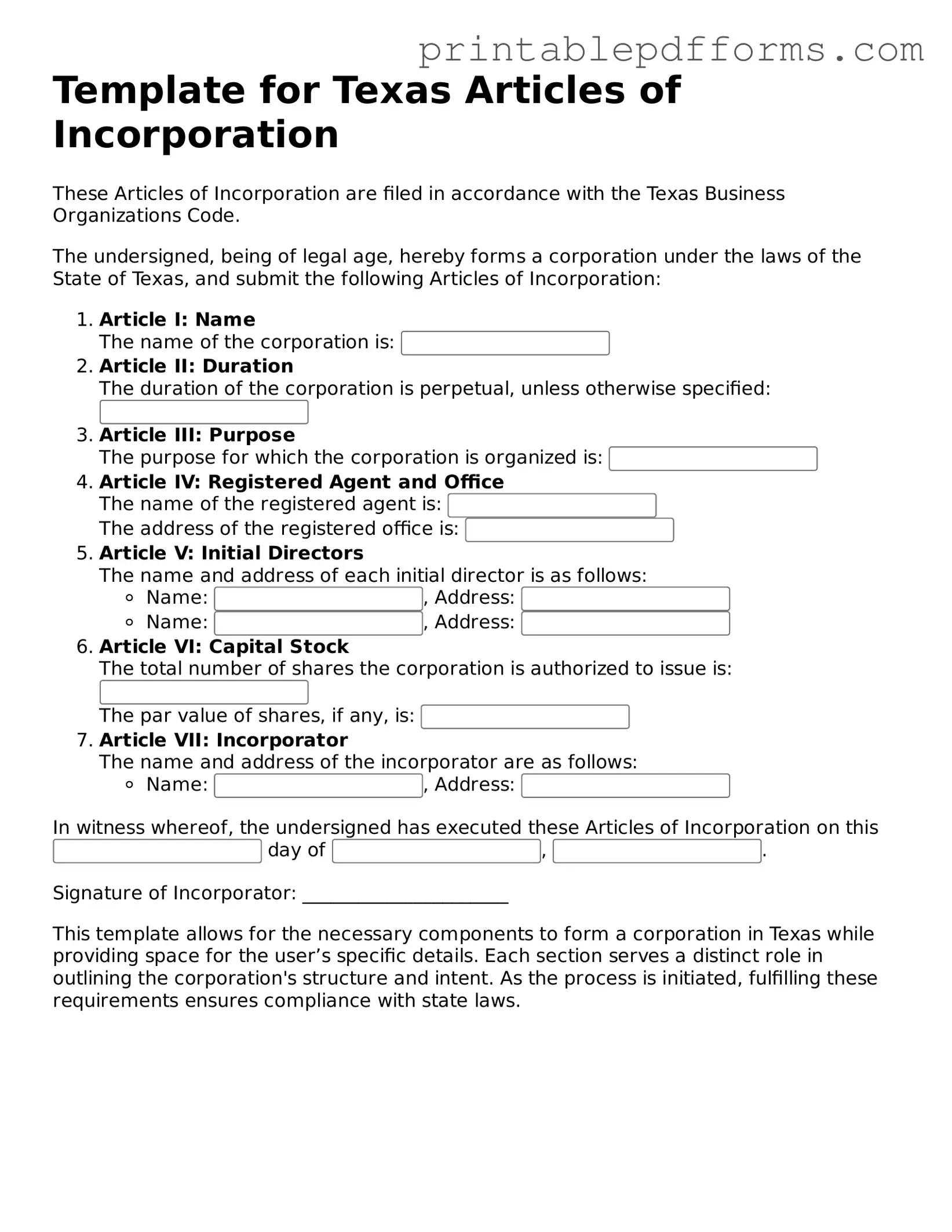

Template for Texas Articles of Incorporation

These Articles of Incorporation are filed in accordance with the Texas Business Organizations Code.

The undersigned, being of legal age, hereby forms a corporation under the laws of the State of Texas, and submit the following Articles of Incorporation:

- Article I: Name

The name of the corporation is: - Article II: Duration

The duration of the corporation is perpetual, unless otherwise specified: - Article III: Purpose

The purpose for which the corporation is organized is: - Article IV: Registered Agent and Office

The name of the registered agent is:

The address of the registered office is: - Article V: Initial Directors

The name and address of each initial director is as follows:- Name: , Address:

- Name: , Address:

- Article VI: Capital Stock

The total number of shares the corporation is authorized to issue is:

The par value of shares, if any, is: - Article VII: Incorporator

The name and address of the incorporator are as follows:- Name: , Address:

In witness whereof, the undersigned has executed these Articles of Incorporation on this day of , .

Signature of Incorporator: ______________________

This template allows for the necessary components to form a corporation in Texas while providing space for the user’s specific details. Each section serves a distinct role in outlining the corporation's structure and intent. As the process is initiated, fulfilling these requirements ensures compliance with state laws.PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to establish a corporation in Texas, providing a legal framework for the entity's existence. |

| Governing Law | The formation and operation of corporations in Texas are governed by the Texas Business Organizations Code. |

| Filing Requirements | To complete the Articles of Incorporation, the form must be filed with the Texas Secretary of State along with the required filing fee. |

| Information Required | Key information such as the corporation's name, registered agent, and purpose must be included in the form. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record, allowing transparency regarding the corporation's formation. |

Crucial Questions on This Form

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document required to establish a corporation in Texas. It outlines essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form with the Texas Secretary of State is the first step in forming a corporation in the state.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Texas must file the Articles of Incorporation. This includes individuals or groups planning to operate a business as a corporation. It is important for both for-profit and nonprofit entities to complete this form to gain legal recognition.

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information:

- Corporation Name: The name must be unique and not already in use by another entity in Texas.

- Purpose: A brief description of the business activities the corporation will engage in.

- Registered Agent: The name and address of the person or entity designated to receive legal documents on behalf of the corporation.

- Incorporators: The names and addresses of the individuals responsible for filing the Articles of Incorporation.

- Share Information: The total number of shares the corporation is authorized to issue and their par value, if applicable.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can follow these steps:

- Complete the form with the required information.

- Submit the form online through the Texas Secretary of State's website or mail it to their office.

- Pay the filing fee, which varies depending on the type of corporation.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 3 to 5 business days for online submissions and longer for mailed forms. If you need expedited processing, you may request it for an additional fee.

What happens after filing the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a certificate of incorporation from the Texas Secretary of State. After that, the corporation must comply with ongoing requirements, such as obtaining necessary licenses, holding annual meetings, and filing annual reports.

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you must file a Certificate of Amendment with the Texas Secretary of State. This document will outline the changes you want to make. There may be a fee associated with the amendment process.

Is legal assistance necessary to file the Articles of Incorporation?

While it is not mandatory to have legal assistance, many people find it helpful. A legal consultant can ensure that the form is filled out correctly and that all requirements are met. This can help avoid delays or issues down the road.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation is just one of several important documents you may need. Here are some other key forms and documents that often accompany the Articles of Incorporation.

- Bylaws: These are the internal rules that govern how your corporation will operate. Bylaws outline the roles of officers, how meetings are conducted, and procedures for decision-making.

- Statement of Intent to Incorporate: This document indicates your intention to form a corporation. It is often submitted along with the Articles of Incorporation to provide clarity on the purpose of the corporation.

- Operating Agreement: The Ohio Operating Agreement form is vital for LLCs, serving as the governing framework for operations and management, outlining ownership and financial arrangements. For more details, visit All Ohio Forms.

- Certificate of Formation: Similar to the Articles of Incorporation, this document is required for LLCs in Texas. It outlines the basic information about the business, such as its name, purpose, and registered agent.

- Employer Identification Number (EIN) Application: This form is necessary for tax purposes. The EIN is used to identify your corporation for federal tax filings and is often required when opening a business bank account.

- Initial Report: Some states require an initial report after incorporation. This document provides the state with updated information about the corporation, including the names of directors and officers.

Each of these documents plays a crucial role in establishing and maintaining your corporation. Ensuring you have all the necessary paperwork can help streamline the incorporation process and set a solid foundation for your business.

Misconceptions

The Texas Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in Texas. However, several misconceptions surround this form that can lead to confusion. Here are seven common misconceptions:

-

It’s only necessary for large businesses.

Many believe that only large corporations need to file Articles of Incorporation. In reality, any business entity looking to operate as a corporation in Texas must complete this form, regardless of size.

-

Filing is a one-time process.

Some people think that once the Articles of Incorporation are filed, no further action is needed. However, corporations must adhere to ongoing compliance requirements, including annual reports and franchise tax filings.

-

It can be filled out without any help.

While it is possible to fill out the form independently, many find it beneficial to seek guidance. Understanding the implications of each section can help avoid costly mistakes.

-

All corporations must have a board of directors.

While most corporations do require a board, some small businesses may opt for a simpler structure. It’s essential to review the specific requirements based on the type of corporation being formed.

-

Articles of Incorporation are the same as bylaws.

This misconception can lead to confusion. Articles of Incorporation establish the existence of the corporation, while bylaws govern the internal management and operational procedures.

-

Only the owner needs to sign the document.

In Texas, the Articles of Incorporation must be signed by the incorporators. Depending on the structure, this may include multiple individuals, not just the owner.

-

Once filed, the name cannot be changed.

Some believe that the corporate name is set in stone once the Articles are filed. However, corporations can amend their Articles to change the name, provided they follow the proper procedures.

Understanding these misconceptions can help streamline the incorporation process and ensure compliance with Texas regulations.