Texas Deed Document

In the realm of real estate transactions, the Texas Deed form serves as a fundamental document that facilitates the transfer of property ownership from one party to another. This form encapsulates essential details, including the names of the grantor and grantee, a clear description of the property being transferred, and any conditions or restrictions that may apply to the transaction. Notably, the form must be executed with proper signatures and often requires notarization to ensure its validity. Additionally, the Texas Deed can take various forms, such as a General Warranty Deed or a Quitclaim Deed, each serving different purposes and offering varying levels of protection to the grantee. Understanding the nuances of this form is crucial for anyone engaged in buying or selling real estate in Texas, as it not only formalizes the transfer but also plays a pivotal role in establishing the legal rights associated with the property. As such, familiarity with the Texas Deed form is essential for both seasoned investors and first-time homebuyers alike, helping to navigate the complexities of property law with greater confidence.

Discover More Deed Forms for Different States

Who Has the Deed to My House - The duration for which a Deed is valid can vary depending on state laws.

When dealing with trailer transactions, having the proper documentation is vital. For a hassle-free experience, utilize this essential Trailer Bill of Sale document to facilitate the details of your sale, ensuring that both the buyer and seller are protected throughout the process.

House Deed Template - Deeds may also be part of foreclosure processes, as banks will use them to reclaim properties from defaulted borrowers.

Similar forms

The Deed form is a crucial legal document used primarily for the transfer of property rights. Several other documents serve similar purposes in various contexts. Here are five documents that share similarities with the Deed form:

- Bill of Sale: This document transfers ownership of personal property from one party to another. Like a Deed, it provides proof of the transaction and details about the item being sold.

- Lease Agreement: A lease outlines the terms under which one party rents property from another. Similar to a Deed, it establishes rights and responsibilities between the parties involved.

- Trust Agreement: This document creates a trust, allowing one party to hold property for the benefit of another. It is similar to a Deed in that it involves the transfer of property rights, but it also includes terms for managing those rights.

-

Notary Acknowledgement Form: This legal document is crucial for verifying a signer's signature authenticity, ensuring that it was done willingly. For more information, refer to All Ohio Forms.

- Assignment Agreement: This document allows one party to transfer its rights and obligations under a contract to another party. Like a Deed, it formalizes the transfer of interests and ensures all parties are aware of their roles.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters. While it does not transfer property itself, it can authorize someone to execute a Deed on behalf of another, making it functionally similar in certain contexts.

Document Example

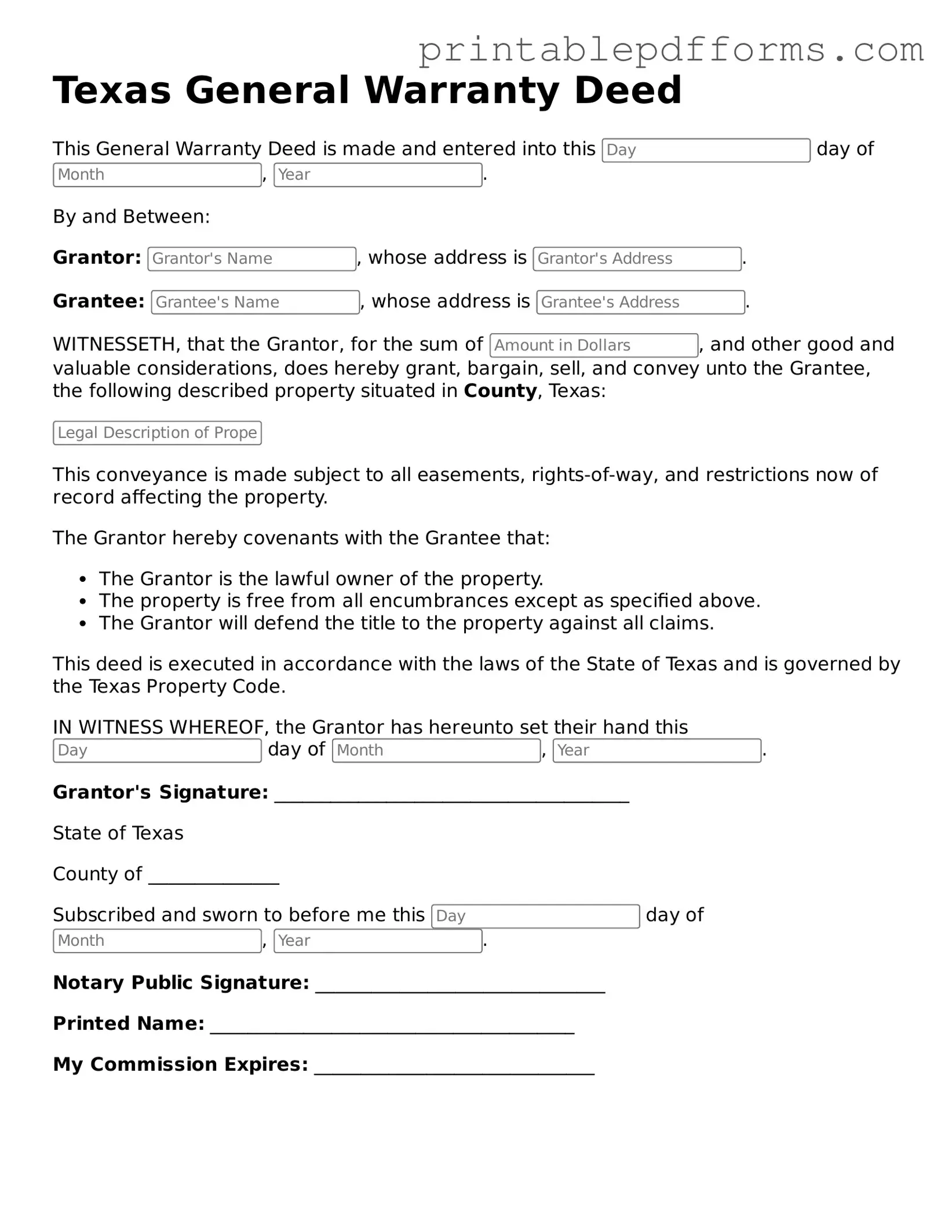

Texas General Warranty Deed

This General Warranty Deed is made and entered into this day of , .

By and Between:

Grantor: , whose address is .

Grantee: , whose address is .

WITNESSETH, that the Grantor, for the sum of , and other good and valuable considerations, does hereby grant, bargain, sell, and convey unto the Grantee, the following described property situated in County, Texas:

This conveyance is made subject to all easements, rights-of-way, and restrictions now of record affecting the property.

The Grantor hereby covenants with the Grantee that:

- The Grantor is the lawful owner of the property.

- The property is free from all encumbrances except as specified above.

- The Grantor will defend the title to the property against all claims.

This deed is executed in accordance with the laws of the State of Texas and is governed by the Texas Property Code.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this day of , .

Grantor's Signature: ______________________________________

State of Texas

County of ______________

Subscribed and sworn to before me this day of , .

Notary Public Signature: _______________________________

Printed Name: _______________________________________

My Commission Expires: ______________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Texas Deed form is a legal document used to transfer ownership of real property in Texas. |

| Types of Deeds | Common types include General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. |

| Governing Law | The Texas Property Code governs the creation and execution of deed forms in Texas. |

| Requirements | The deed must be in writing, signed by the grantor, and notarized to be valid. |

| Recording | To protect the buyer's interest, the deed should be recorded in the county where the property is located. |

| Transfer Tax | Texas does not impose a state transfer tax on property transfers, but local taxes may apply. |

Crucial Questions on This Form

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real estate in the state of Texas. This form outlines the details of the property being transferred, including its legal description, the names of the parties involved, and any terms or conditions of the transfer. The deed must be signed by the grantor (the person transferring the property) and typically needs to be notarized to be legally binding.

What types of Texas Deeds are available?

There are several types of Texas Deeds, each serving different purposes. The most common include:

- General Warranty Deed: This type provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

- Special Warranty Deed: This deed offers limited warranties, only covering the period during which the seller owned the property.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in the property without any warranties. It is often used between family members or in divorce settlements.

- Deed of Trust: This is used to secure a loan on the property, allowing the lender to take possession if the borrower defaults.

How do I fill out a Texas Deed form?

Filling out a Texas Deed form requires careful attention to detail. Follow these steps:

- Begin with the title of the document, indicating it is a deed.

- Provide the names and addresses of the grantor and grantee.

- Include a legal description of the property. This can often be found on the property’s current deed or tax records.

- State the consideration, or the amount paid for the property, if applicable.

- Sign the document in front of a notary public.

- Record the deed with the county clerk in the county where the property is located.

Do I need an attorney to create a Texas Deed?

While it is not legally required to have an attorney to create a Texas Deed, consulting one can be beneficial. An attorney can help ensure that the deed is filled out correctly and meets all legal requirements. They can also provide guidance on any specific issues related to the property or transaction, such as title issues or potential liabilities. If you are unsure about the process, seeking legal advice is a wise choice.

Documents used along the form

When completing a property transaction in Texas, several documents may accompany the Texas Deed form. These forms help ensure that the transfer of property is clear, legal, and properly recorded. Below is a list of common forms and documents that are often used alongside the Texas Deed.

- Title Commitment: This document outlines the terms under which a title insurance company will issue a title policy. It provides important information about the property's title, including any liens or encumbrances.

- Closing Disclosure: This form details the final terms and costs of the mortgage. It must be provided to the buyer at least three days before closing, allowing them to review the financial aspects of the transaction.

- WC-200A Georgia Form: This form is essential for requesting a change of physician or additional treatment in workers' compensation cases. For more information, visit georgiapdf.com/wc-200a-georgia/.

- Property Survey: A survey shows the boundaries of the property and any structures on it. It helps to identify any easements or encroachments that may affect ownership rights.

- Affidavit of Heirship: This document is used when a property owner passes away without a will. It establishes the heirs of the deceased and helps facilitate the transfer of property to the rightful owners.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community. They are essential for understanding the obligations of ownership.

- Bill of Sale: This document is used to transfer ownership of personal property that may be included in the sale, such as appliances or furniture. It provides proof of the transaction.

Each of these documents plays a vital role in the property transfer process. Ensuring that you have the correct forms can help avoid complications and ensure a smooth transaction. Always consider consulting with a professional if you have questions about any of these documents.

Misconceptions

Understanding the Texas Deed form is crucial for anyone involved in real estate transactions in Texas. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds.

- Only a lawyer can prepare a deed. While it is advisable to consult a lawyer, especially for complex transactions, individuals can prepare a deed themselves if they understand the requirements and format.

- A deed must be notarized to be valid. Notarization is important for many deeds, but not all deeds require it to be legally valid. Some may only need to be signed by the parties involved.

- Verbal agreements are sufficient. Some believe that a verbal agreement is enough to transfer property. However, real estate transactions typically require a written deed to be legally enforceable.

- Once a deed is signed, it cannot be changed. A deed can be amended or revoked, but the process must follow legal guidelines. It is not an irreversible document.

- All deeds must be filed with the county. While it is generally advisable to file a deed with the county clerk to provide public notice, it is not a legal requirement for all types of deeds.

- Property taxes are not affected by the type of deed. The type of deed can influence property tax assessments. For example, transferring property through a gift may have different tax implications than a sale.

- Deeds are only for transferring ownership. Deeds can also serve other purposes, such as establishing easements or rights of way, not just transferring ownership of property.

- All parties must be present to sign the deed. While it is common for all parties to sign in person, remote notarization options may allow for signatures to be gathered without everyone being physically present.

Being aware of these misconceptions can help individuals navigate the complexities of property transactions more effectively.