Texas Deed in Lieu of Foreclosure Document

The Texas Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing the prospect of foreclosure. This legal document allows a borrower to voluntarily transfer their property back to the lender in exchange for the cancellation of the mortgage debt. By opting for this route, homeowners can avoid the lengthy and often distressing foreclosure process, which can have lasting impacts on their credit scores and financial futures. The form outlines the rights and responsibilities of both parties, ensuring that the transfer of property occurs smoothly and with clear terms. Additionally, it may include provisions related to the condition of the property and any potential liabilities that may arise post-transfer. Understanding the implications of this form is essential for homeowners seeking to navigate their financial challenges and make informed decisions about their property and credit standing.

Discover More Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Foreclosure Sample - This option helps borrowers protect their credit from the impact of foreclosure.

The Ohio Motor Vehicle Bill of Sale form is a critical document that records the essential details of the sale of a vehicle between two parties in Ohio. It serves as a proof of transaction and establishes the transfer of ownership from the seller to the buyer. The importance of this document cannot be overstated as it is often required for vehicle registration and legal protection. For more information, you can visit All Ohio Forms.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - This form simplifies the process of relinquishing property when facing financial hardship.

Foreclosure Vs Deed in Lieu - It is a strategic choice for those who wish to avoid defaulting on their loan.

Deed in Lieu of Mortgage - This process can be both a relief for the borrower and a practical solution for the lender involved.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, it helps avoid foreclosure by transferring ownership to the buyer, while also relieving the homeowner of the mortgage debt.

- Mortgage Modification Agreement: This agreement modifies the terms of an existing mortgage to make it more manageable for the homeowner. Like a Deed in Lieu of Foreclosure, it aims to prevent foreclosure by allowing the borrower to stay in their home under new, more favorable terms.

- Operating Agreement: The New York Operating Agreement form is essential for LLCs, detailing management structures and member responsibilities. For more information, refer to https://freebusinessforms.org.

- Forebearance Agreement: In this document, the lender agrees to temporarily suspend or reduce mortgage payments. It shares similarities with a Deed in Lieu of Foreclosure in that it provides the homeowner with a way to avoid foreclosure while they regain financial stability.

- Repayment Plan: This plan outlines how a homeowner can repay missed mortgage payments over time. It resembles a Deed in Lieu of Foreclosure by offering a solution to avoid losing the home, but it requires the homeowner to catch up on payments rather than relinquishing the property.

- Quitclaim Deed: This document transfers ownership of property from one party to another without any guarantees. While it is often used in family situations, it is similar to a Deed in Lieu of Foreclosure in that it involves the voluntary transfer of property to resolve financial issues.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to reorganize debts. This document serves a similar purpose to a Deed in Lieu of Foreclosure by offering a legal avenue for homeowners to manage their financial burdens and potentially keep their homes.

Document Example

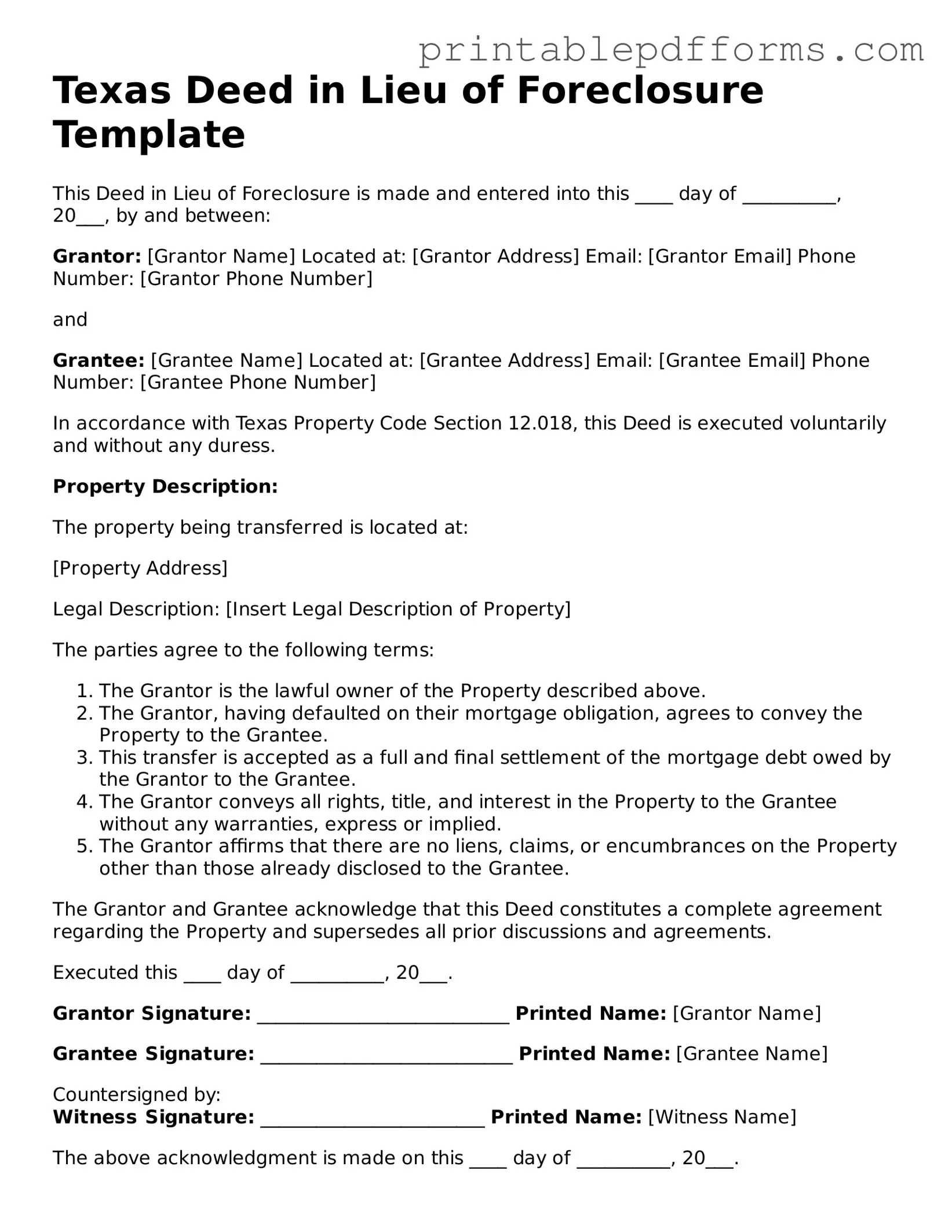

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ____ day of __________, 20___, by and between:

Grantor: [Grantor Name] Located at: [Grantor Address] Email: [Grantor Email] Phone Number: [Grantor Phone Number]

and

Grantee: [Grantee Name] Located at: [Grantee Address] Email: [Grantee Email] Phone Number: [Grantee Phone Number]

In accordance with Texas Property Code Section 12.018, this Deed is executed voluntarily and without any duress.

Property Description:

The property being transferred is located at:

[Property Address]

Legal Description: [Insert Legal Description of Property]

The parties agree to the following terms:

- The Grantor is the lawful owner of the Property described above.

- The Grantor, having defaulted on their mortgage obligation, agrees to convey the Property to the Grantee.

- This transfer is accepted as a full and final settlement of the mortgage debt owed by the Grantor to the Grantee.

- The Grantor conveys all rights, title, and interest in the Property to the Grantee without any warranties, express or implied.

- The Grantor affirms that there are no liens, claims, or encumbrances on the Property other than those already disclosed to the Grantee.

The Grantor and Grantee acknowledge that this Deed constitutes a complete agreement regarding the Property and supersedes all prior discussions and agreements.

Executed this ____ day of __________, 20___.

Grantor Signature: ___________________________ Printed Name: [Grantor Name]

Grantee Signature: ___________________________ Printed Name: [Grantee Name]

Countersigned by:

Witness Signature: ________________________

Printed Name: [Witness Name]

The above acknowledgment is made on this ____ day of __________, 20___.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Texas Property Code, Section 51.001 et seq. |

| Eligibility | Homeowners facing foreclosure may be eligible if they are unable to make mortgage payments and want to avoid the foreclosure process. |

| Process | The borrower must negotiate with the lender to agree on the terms and conditions of the deed transfer. |

| Benefits | This option can help borrowers avoid the negative impact of foreclosure on their credit score. |

| Risks | Borrowers may still be responsible for any deficiency balance if the property sells for less than the mortgage amount. |

| Documentation | Both parties must sign the deed, and it should be recorded with the county clerk to finalize the transfer. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of the mortgage debt. This process can help avoid the lengthy and often stressful foreclosure process. It is typically considered when a homeowner is unable to keep up with mortgage payments and wishes to avoid the negative impact of foreclosure on their credit score.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure generally depends on several factors, including:

- The homeowner must be experiencing financial hardship, such as job loss or medical expenses.

- The property must be in good condition, without significant liens or other encumbrances.

- The homeowner must have tried to work out a loan modification or other alternatives with the lender before pursuing this option.

What are the benefits of a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several advantages:

- It can help homeowners avoid the lengthy foreclosure process.

- It typically results in less damage to the homeowner’s credit score compared to a foreclosure.

- Homeowners may be able to negotiate a cash incentive from the lender to help with relocation costs.

What are the potential drawbacks?

While a Deed in Lieu of Foreclosure has benefits, it also has some potential downsides:

- Homeowners may still face tax implications, as forgiven debt can be considered taxable income.

- It may not fully relieve the homeowner of all liabilities associated with the property, especially if there are junior liens.

- The homeowner loses ownership of the property and may not be able to recover it later.

How does the process work?

The process typically involves several steps:

- The homeowner contacts the lender to express interest in a Deed in Lieu of Foreclosure.

- The lender will review the homeowner's financial situation and the property’s condition.

- If approved, both parties will sign the Deed in Lieu of Foreclosure document.

- The lender will then take possession of the property and cancel the mortgage debt.

What should homeowners consider before proceeding?

Before moving forward with a Deed in Lieu of Foreclosure, homeowners should consider the following:

- Consulting with a legal or financial advisor to understand the implications.

- Exploring all alternatives, such as loan modifications or short sales.

- Understanding the potential impact on credit and taxes.

Can a Deed in Lieu of Foreclosure be reversed?

Once a Deed in Lieu of Foreclosure is executed, it is generally irreversible. The homeowner relinquishes ownership of the property, and the lender takes control. This makes it essential for homeowners to be fully informed and certain about their decision before proceeding.

Is a Deed in Lieu of Foreclosure the same as a short sale?

No, a Deed in Lieu of Foreclosure is not the same as a short sale. In a short sale, the property is sold for less than the amount owed on the mortgage, and the lender agrees to accept that amount as full payment. In contrast, a Deed in Lieu of Foreclosure involves the homeowner transferring the property back to the lender without a sale, effectively surrendering the property and debt.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Texas, several other documents may be necessary to ensure a smooth transition and to protect the rights of all parties involved. Each of these documents serves a specific purpose in the process, helping to clarify obligations and facilitate the transfer of property. Below is a list of commonly used forms and documents that accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the terms under which the lender agrees to modify the original loan. It may include changes to the interest rate, payment schedule, or loan balance, providing a potential alternative to foreclosure.

- Property Inspection Report: This report provides an assessment of the property's condition. It is often required by lenders to evaluate any repairs or maintenance that may be necessary before accepting a deed in lieu.

- Tractor Bill of Sale: A vital form for the transfer of tractor ownership in Georgia, ensuring all details are clearly documented, available at georgiapdf.com/tractor-bill-of-sale.

- Release of Liability: This document releases the borrower from any further obligations under the loan after the deed is executed. It ensures that the borrower will not be pursued for any remaining debt related to the property.

- Affidavit of Title: This sworn statement confirms the borrower’s ownership of the property and that there are no undisclosed liens or claims against it. This affidavit is critical in assuring the lender of a clear title transfer.

Understanding these documents can help individuals navigate the complexities of the foreclosure process more effectively. Each plays a vital role in ensuring that both borrowers and lenders are protected during the transfer of property ownership.

Misconceptions

Many homeowners facing foreclosure may consider a Texas Deed in Lieu of Foreclosure as an option. However, several misconceptions can cloud their understanding of this process. Here are seven common misconceptions:

- It eliminates all debt obligations. A Deed in Lieu of Foreclosure does not automatically erase all debts. Homeowners may still be responsible for other loans or liens against the property.

- It guarantees a quick resolution. While a Deed in Lieu can speed up the process compared to foreclosure, it still requires the lender's approval and can take time to finalize.

- It is a simple process. Although it may seem straightforward, the process involves legal paperwork and negotiations with the lender, which can be complex.

- It negatively affects credit less than foreclosure. Both a Deed in Lieu and foreclosure can significantly impact credit scores. The difference in impact may not be as pronounced as some believe.

- It is available to all homeowners. Not every homeowner qualifies for a Deed in Lieu. Lenders typically require specific criteria to be met before approving this option.

- It releases homeowners from all liabilities. Homeowners may still face potential tax liabilities or other legal responsibilities even after transferring the property.

- It is the only alternative to foreclosure. There are other options available, such as loan modifications or short sales, that may be more suitable depending on individual circumstances.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.