Texas Durable Power of Attorney Document

The Texas Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate a trusted person to make decisions on their behalf, particularly in matters related to financial and healthcare decisions. This form becomes especially important in situations where an individual may become incapacitated and unable to express their wishes. By completing this document, a principal can ensure that their preferences are respected, and their affairs are managed according to their desires. The appointed agent, or attorney-in-fact, is granted the authority to handle a range of responsibilities, from managing bank accounts to making healthcare decisions, depending on the specific powers granted within the form. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal loses the capacity to make decisions. Understanding the nuances of this form, including the necessary signatures and potential limitations on authority, is essential for anyone considering this important step in planning for their future. As individuals navigate the complexities of life, having a durable power of attorney in place can provide peace of mind and clarity for both the principal and their loved ones.

Discover More Durable Power of Attorney Forms for Different States

Durable Financial Power of Attorney California - This form gives you control over who acts on your behalf.

Ny Poa - It reassures your family that someone capable is managing your affairs when the need arises.

When considering the future of your relationship, it is essential to understand the importance of a legal framework like a prenuptial agreement. A Ohio Prenuptial Agreement form is a legal document that couples in Ohio can use before marriage to establish the ownership and division of their current and future assets and debts. It outlines what will happen to each partner's finances and property in the event of a divorce or death. This agreement aims to provide both parties with clarity and security, helping to prevent disputes over financial matters should the marriage end. For those interested in accessing the necessary documents, All Ohio Forms is a valuable resource.

Durable Power of Attorney Pa - A Durable Power of Attorney promotes financial autonomy even in difficult times.

How to Get Power of Attorney in Ohio - Principals should consider their relationships and choose someone who understands their values and wishes well.

Similar forms

- General Power of Attorney: This document allows an individual to appoint someone to make decisions on their behalf, similar to a Durable Power of Attorney. However, it typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form specifically designates an agent to make medical decisions for someone who is unable to do so. Like the Durable Power of Attorney, it remains effective even if the principal becomes incapacitated.

- Living Will: A Living Will outlines an individual’s wishes regarding medical treatment in end-of-life situations. While it does not appoint an agent, it complements the Durable Power of Attorney by providing guidance on healthcare decisions.

-

Lease Agreement: This document serves to protect the rights of both landlords and tenants by clearly establishing responsibilities and rules. For a seamless rental experience, consider filling out the Lease Agreement form by clicking the button below.

- Revocable Trust: This legal arrangement allows an individual to transfer assets into a trust while retaining control over them. Similar to a Durable Power of Attorney, it can help manage assets in the event of incapacity.

- Financial Power of Attorney: This document grants authority to an agent to handle financial matters on behalf of the principal. Like the Durable Power of Attorney, it can remain effective during periods of incapacity, depending on its specific terms.

Document Example

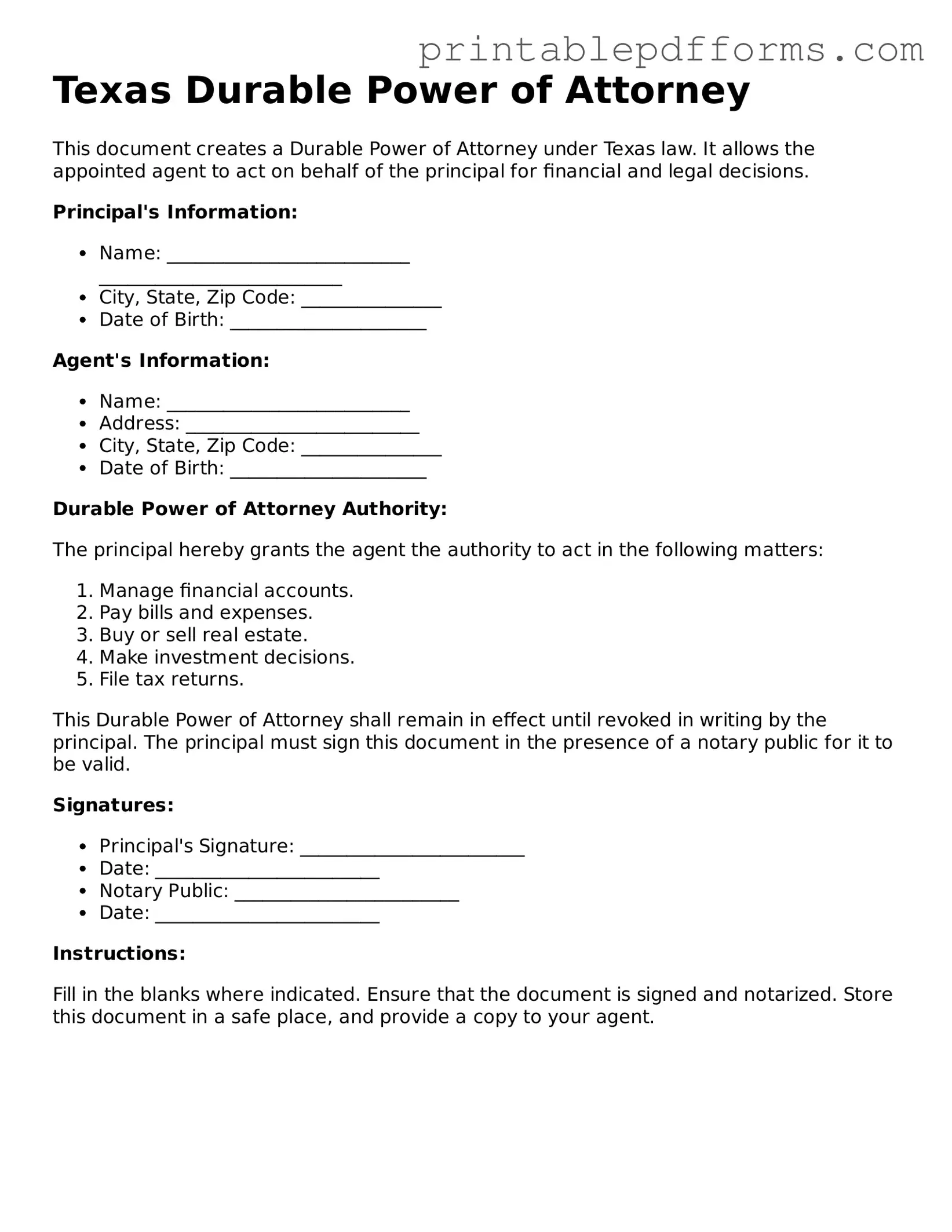

Texas Durable Power of Attorney

This document creates a Durable Power of Attorney under Texas law. It allows the appointed agent to act on behalf of the principal for financial and legal decisions.

Principal's Information:

- Name: __________________________

- City, State, Zip Code: _______________

- Date of Birth: _____________________

Agent's Information:

- Name: __________________________

- Address: _________________________

- City, State, Zip Code: _______________

- Date of Birth: _____________________

Durable Power of Attorney Authority:

The principal hereby grants the agent the authority to act in the following matters:

- Manage financial accounts.

- Pay bills and expenses.

- Buy or sell real estate.

- Make investment decisions.

- File tax returns.

This Durable Power of Attorney shall remain in effect until revoked in writing by the principal. The principal must sign this document in the presence of a notary public for it to be valid.

Signatures:

- Principal's Signature: ________________________

- Date: ________________________

- Notary Public: ________________________

- Date: ________________________

Instructions:

Fill in the blanks where indicated. Ensure that the document is signed and notarized. Store this document in a safe place, and provide a copy to your agent.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Texas Durable Power of Attorney allows you to appoint someone to make financial decisions on your behalf if you become incapacitated. |

| Governing Law | The Texas Durable Power of Attorney is governed by the Texas Estates Code, specifically Title 2, Chapter 752. |

| Durability | This type of power of attorney remains effective even if you become mentally incapacitated, unlike a regular power of attorney. |

| Agent Authority | Your appointed agent can handle various financial matters, such as banking, real estate transactions, and paying bills. |

| Revocation | You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent. |

| Witness Requirements | The document must be signed in the presence of a notary public or two witnesses who are not related to you. |

| Limitations | While your agent has broad authority, they cannot make healthcare decisions unless you include that power in the document. |

Crucial Questions on This Form

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent or attorney-in-fact, to manage their financial and legal affairs. This document remains effective even if the principal becomes incapacitated, ensuring that their affairs can still be handled without interruption.

Why should I create a Durable Power of Attorney?

Creating a Durable Power of Attorney provides several benefits:

- It allows you to choose a trusted person to manage your affairs.

- It can prevent delays in decision-making during times of incapacity.

- It may reduce the need for court intervention or guardianship proceedings.

Who can be appointed as an agent?

In Texas, you can appoint anyone as your agent, as long as they are at least 18 years old and mentally competent. Common choices include family members, friends, or professionals such as attorneys or financial advisors. It is important to choose someone you trust to act in your best interests.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including:

- Managing bank accounts and finances.

- Buying, selling, or managing real estate.

- Handling tax matters.

- Making investment decisions.

- Managing business interests.

You can specify which powers you want to grant or limit certain powers as needed.

How do I create a Durable Power of Attorney in Texas?

To create a Durable Power of Attorney in Texas, follow these steps:

- Obtain the Texas Durable Power of Attorney form.

- Fill out the form, ensuring that all necessary information is included.

- Sign the document in the presence of a notary public.

Make sure to provide copies of the signed document to your agent and any relevant financial institutions or healthcare providers.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you must create a written revocation document and notify your agent and any institutions that have a copy of the original Durable Power of Attorney.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through the court system to obtain guardianship. This process can be time-consuming and costly. Having a Durable Power of Attorney can help avoid these complications and ensure your wishes are respected.

Documents used along the form

When creating a Texas Durable Power of Attorney, it’s essential to consider other documents that can complement this important legal tool. Each of these documents serves a unique purpose and can help ensure that your wishes are honored in various situations. Below are some common forms and documents often used alongside the Durable Power of Attorney.

- Medical Power of Attorney: This document allows you to appoint someone to make healthcare decisions on your behalf if you become unable to do so. It ensures that your medical preferences are respected during critical times.

- Advance Directive: Also known as a living will, this document outlines your wishes regarding medical treatment and end-of-life care. It provides guidance to your loved ones and healthcare providers about your preferences.

- HIPAA Authorization: This form permits designated individuals to access your medical records and health information. It is crucial for ensuring that your appointed agents can make informed decisions about your care.

- Advance Medical Directive: To ensure your healthcare preferences are honored, consider the essential Living Will form resources for effective end-of-life planning.

- Will: A will outlines how your assets should be distributed after your death. It can also name guardians for minor children and serve as a crucial component of your overall estate plan.

- Living Trust: A living trust allows you to place your assets into a trust during your lifetime, which can then be managed by a trustee. This can help avoid probate and ensure a smoother transition of your assets upon your passing.

Considering these documents alongside your Texas Durable Power of Attorney can provide comprehensive protection for your wishes and needs. Each form plays a vital role in ensuring that your preferences are known and respected, both during your lifetime and after.

Misconceptions

When it comes to the Texas Durable Power of Attorney (DPOA), there are several misconceptions that can lead to confusion. Understanding the truth behind these myths is crucial for making informed decisions. Here are five common misconceptions:

- It only applies to financial matters. Many people believe that a Durable Power of Attorney is limited to financial decisions. However, a DPOA can also cover healthcare decisions, depending on how it is drafted. This allows your agent to make medical choices on your behalf if you become unable to do so.

- It becomes invalid if I become incapacitated. A Durable Power of Attorney remains valid even if you become incapacitated. This is what sets it apart from a regular Power of Attorney. The "durable" aspect ensures that your designated agent can act on your behalf when you are no longer able to manage your affairs.

- My agent can do anything they want with my assets. While your agent does have significant authority, their powers are not unlimited. They must act in your best interest and follow the guidelines you set forth in the document. Any misuse of power can lead to legal consequences.

- It’s only necessary for the elderly. Many people think that a Durable Power of Attorney is only for older adults. In reality, anyone can benefit from having a DPOA. Unexpected events can happen at any age, making it wise to plan ahead.

- I can’t change my DPOA once it’s created. Some believe that once a Durable Power of Attorney is established, it cannot be altered. This is not true. You can revoke or modify your DPOA at any time, as long as you are mentally competent to do so.

By clearing up these misconceptions, you can better understand the importance and function of a Texas Durable Power of Attorney. This document can be a valuable tool in ensuring that your wishes are respected and your affairs are managed according to your preferences.