Texas Gift Deed Document

The Texas Gift Deed form serves as a crucial legal document for individuals wishing to transfer property ownership without monetary compensation. This form is particularly important in situations where a property owner intends to gift real estate to a family member, friend, or charitable organization. The document outlines essential details such as the names of the donor and recipient, a description of the property being transferred, and any conditions or restrictions that may apply to the gift. Additionally, the Texas Gift Deed must be signed by the donor and typically requires notarization to ensure its validity. By completing this form, individuals can clearly express their intentions and protect their rights, while also providing the recipient with a legally recognized claim to the property. Understanding the components and requirements of the Texas Gift Deed is vital for anyone considering such a transfer, as it helps to prevent disputes and ensures compliance with state laws.

Discover More Gift Deed Forms for Different States

How Much Does It Cost to Transfer Property Deeds? - A Gift Deed can be used for gifts of vehicles, land, or financial assets.

In addition to understanding the basic requirements of the Georgia Trailer Bill of Sale, it is important to educate yourself on the different aspects of trailer ownership and documentation. To assist you in this process, you can find more information and resources at https://georgiapdf.com/trailer-bill-of-sale/, which will guide you through the necessary steps to complete your sale effectively.

Similar forms

-

Warranty Deed: This document transfers ownership of property from one party to another, similar to a Gift Deed. However, a Warranty Deed includes guarantees about the title, ensuring the buyer that the property is free from claims or liens.

-

Quitclaim Deed: Like a Gift Deed, a Quitclaim Deed transfers interest in a property without any warranties. It is often used among family members or in divorce settlements, where one party relinquishes their claim to the property.

- Motorcycle Bill of Sale: Essential for documenting the sale of motorcycles in Ohio, ensuring clear ownership transfer; you can find more details in the All Ohio Forms.

-

Trust Transfer Deed: This document allows property to be transferred into a trust. Similar to a Gift Deed, it can be used to manage assets for beneficiaries, but it may also include specific instructions on how the property should be handled.

-

Sales Contract: A Sales Contract outlines the terms of a sale, including the transfer of property. While a Gift Deed does not involve payment, both documents serve to transfer ownership and define the rights of the parties involved.

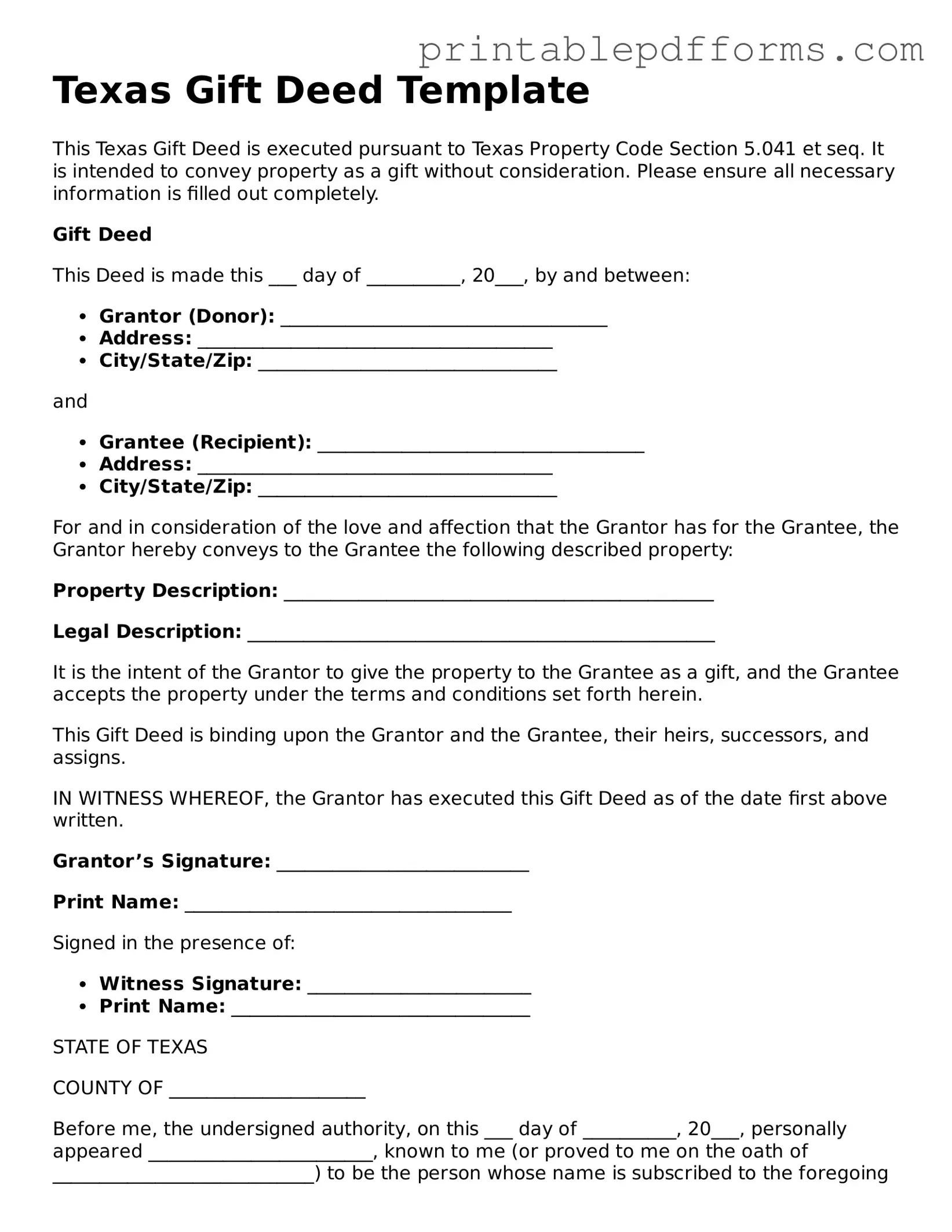

Document Example

Texas Gift Deed Template

This Texas Gift Deed is executed pursuant to Texas Property Code Section 5.041 et seq. It is intended to convey property as a gift without consideration. Please ensure all necessary information is filled out completely.

Gift Deed

This Deed is made this ___ day of __________, 20___, by and between:

- Grantor (Donor): ___________________________________

- Address: ______________________________________

- City/State/Zip: ________________________________

and

- Grantee (Recipient): ___________________________________

- Address: ______________________________________

- City/State/Zip: ________________________________

For and in consideration of the love and affection that the Grantor has for the Grantee, the Grantor hereby conveys to the Grantee the following described property:

Property Description: ______________________________________________

Legal Description: __________________________________________________

It is the intent of the Grantor to give the property to the Grantee as a gift, and the Grantee accepts the property under the terms and conditions set forth herein.

This Gift Deed is binding upon the Grantor and the Grantee, their heirs, successors, and assigns.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the date first above written.

Grantor’s Signature: ___________________________

Print Name: ___________________________________

Signed in the presence of:

- Witness Signature: ________________________

- Print Name: ________________________________

STATE OF TEXAS

COUNTY OF _____________________

Before me, the undersigned authority, on this ___ day of __________, 20___, personally appeared ________________________, known to me (or proved to me on the oath of ____________________________) to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office.

Notary Public Signature: ______________________________

Print Name: ______________________________________

My Commission Expires: _____________________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by Texas Property Code, specifically Section 5.021. |

| Requirements | The deed must be in writing, signed by the donor, and must include a description of the property. |

| Recordation | To be effective against third parties, the deed should be recorded in the county where the property is located. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liabilities, so consulting a tax advisor is recommended. |

Crucial Questions on This Form

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer property ownership from one individual to another without any exchange of money or consideration. This deed serves to formalize the gift of real estate and provides a clear record of the transfer for both parties involved.

Who can create a Gift Deed in Texas?

Any property owner in Texas who wishes to gift their property can create a Gift Deed. The donor, or the person giving the gift, must be of legal age and possess the capacity to make such a transfer. The recipient, or donee, must also be legally capable of receiving the property.

What information is required on a Texas Gift Deed?

A Texas Gift Deed typically includes the following information:

- The names and addresses of both the donor and the donee.

- A legal description of the property being transferred.

- The statement indicating that the transfer is a gift.

- The date of the transfer.

- The signature of the donor, and in some cases, a witness or notary public may be required.

Is a Gift Deed subject to taxes?

While a Gift Deed itself does not incur property taxes, it may have implications for gift tax. The IRS allows individuals to gift up to a certain amount each year without incurring gift tax. However, if the value of the property exceeds this limit, the donor may need to file a gift tax return. It is advisable to consult with a tax professional for specific guidance.

Do I need to record a Gift Deed?

Recording a Gift Deed is not mandatory, but it is highly recommended. By recording the deed with the county clerk's office where the property is located, the transfer becomes a matter of public record. This can help protect the rights of the donee and prevent disputes regarding property ownership in the future.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it is generally considered irrevocable. However, if the donor retains certain rights or conditions related to the property, such as a life estate, they may have the ability to revoke the gift under specific circumstances. Legal advice should be sought if there are concerns about revocation.

What happens if the donor dies after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the property will typically belong to the donee, assuming the deed was properly executed and recorded. The gift is considered complete, and the property will not be included in the donor's estate for probate purposes. However, any conditions or restrictions outlined in the deed should be reviewed.

Where can I obtain a Texas Gift Deed form?

Texas Gift Deed forms can be obtained from various sources, including legal stationery stores, online legal document providers, and some county clerk offices. It is important to ensure that the form complies with Texas law and includes all necessary information for the transfer to be valid.

Documents used along the form

The Texas Gift Deed form is an essential document for transferring property as a gift without consideration. However, several other forms and documents are often used in conjunction with the Gift Deed to ensure a smooth transaction. Below is a list of these related documents, each serving a unique purpose in the property transfer process.

- Property Title Search: This document provides a history of the property ownership and any encumbrances, ensuring that the gift can be transferred free of claims.

- Affidavit of Gift: This sworn statement confirms the intent of the donor to gift the property and may include details about the relationship between the donor and the recipient.

- Gift Tax Return (Form 709): Required by the IRS for reporting gifts over a certain value, this form helps the donor comply with federal tax laws.

- Quitclaim Deed: This document can be used to transfer any remaining interest in the property from the donor to the recipient, ensuring complete ownership transfer.

- Notice of Gift: This document serves to inform interested parties, such as creditors, about the gift transfer, which may protect the recipient from future claims.

- Real Estate Transfer Disclosure Statement: This form provides information about the property's condition and any known issues, ensuring transparency in the transaction.

- Trailer Bill of Sale: Necessary for the sale and transfer of ownership of a trailer, you can access the document here to ensure a smooth transaction.

- Power of Attorney: In some cases, this document allows one person to act on behalf of another in the property transfer process, facilitating the transaction if the donor cannot be present.

- Title Insurance Policy: This policy protects the recipient from potential title issues that may arise after the transfer, providing peace of mind regarding ownership rights.

Using these documents in conjunction with the Texas Gift Deed can help ensure that the property transfer is legally sound and free from complications. Each document plays a critical role in safeguarding the interests of both the donor and the recipient throughout the gifting process.

Misconceptions

When it comes to the Texas Gift Deed form, there are several common misconceptions that can lead to confusion. Understanding the truth behind these myths can help individuals navigate the process more smoothly. Here are five misconceptions about the Texas Gift Deed form:

-

Misconception 1: A Gift Deed is the same as a Sale Deed.

Many people think that a Gift Deed operates just like a Sale Deed. However, a Gift Deed transfers property without any exchange of money or consideration. In contrast, a Sale Deed involves a buyer and seller, with a financial transaction taking place.

-

Misconception 2: A Gift Deed can be revoked at any time.

Some believe that once a Gift Deed is executed, it can be easily revoked. In reality, a Gift Deed is typically irrevocable once it is delivered and accepted by the recipient. This means that the giver cannot simply change their mind after the deed is completed.

-

Misconception 3: No formalities are required for a Gift Deed.

While it may seem straightforward, a Gift Deed must follow specific legal requirements to be valid. This includes being in writing, signed by the donor, and often notarized. Failing to meet these requirements can render the deed invalid.

-

Misconception 4: A Gift Deed does not require a title search.

Some individuals think that a title search is unnecessary for a Gift Deed. However, conducting a title search is a prudent step to ensure that the property is free from liens or other claims that could affect the transfer.

-

Misconception 5: Gift Deeds are only for family members.

While many people associate Gift Deeds with family transfers, they can be used between friends or even charitable organizations. The key factor is the intent to give the property as a gift, regardless of the relationship between the parties.

By understanding these misconceptions, individuals can approach the Texas Gift Deed process with greater confidence and clarity. Always consider consulting with a professional to ensure that all aspects are handled correctly.